San Diego California Stock Option and Award Plan is a comprehensive employee benefit program that enables companies located in San Diego, California, to offer stock options and various awards to their employees as a form of compensation and incentive. This plan provides employees with the opportunity to acquire company stock at a predetermined price, known as the exercise price, within a specific time frame. The San Diego California Stock Option and Award Plan are designed to attract and retain highly skilled employees, align employee interests with company growth, and foster a sense of ownership and loyalty. These plans are regulated by the Securities and Exchange Commission (SEC) and must comply with specific legal and accounting requirements. There are several types of stock option and award plans available in San Diego, California. Some commonly used ones include: 1. Stock Options: This type of plan allows employees to purchase company stock at a predetermined price for a set period. There are two main types of stock options: Incentive Stock Options (SOS) and Non-Qualified Stock Options (Nests). SOS offer tax advantages, while Nests do not qualify for favorable tax treatment. 2. Restricted Stock Units (RSS): RSS are awards that grant employees the right to receive company stock at a future date, subject to certain conditions. These conditions often include a vesting period or specific performance targets that must be met. 3. Employee Stock Purchase Plans (ESPN): ESPN enable employees to purchase company stock at a discounted price, typically through payroll deductions. These plans encourage employee participation and provide an opportunity for long-term wealth creation. 4. Performance-Based Stock Awards: Companies may provide employees with stock awards that are dependent on the achievement of predetermined performance goals. These awards aim to incentivize employees to drive company growth and reach specific milestones. 5. Stock Appreciation Rights (SARS): SARS provide employees with the opportunity to benefit from the increase in the company's stock price without having to purchase it directly. Employees receive a cash payout equal to the difference between the stock price at the time of grant and exercise. San Diego California Stock Option and Award Plans are customizable to meet the unique needs of each company and its employees. They play a crucial role in attracting top talent, motivating employees, and aligning their interests with the company's success. Companies in San Diego, California, utilize these plans to establish a competitive advantage in the job market and foster a culture of innovation and growth.

San Diego California Stock Option and Award Plan

Description

How to fill out San Diego California Stock Option And Award Plan?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including San Diego Stock Option and Award Plan, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to locate and download San Diego Stock Option and Award Plan.

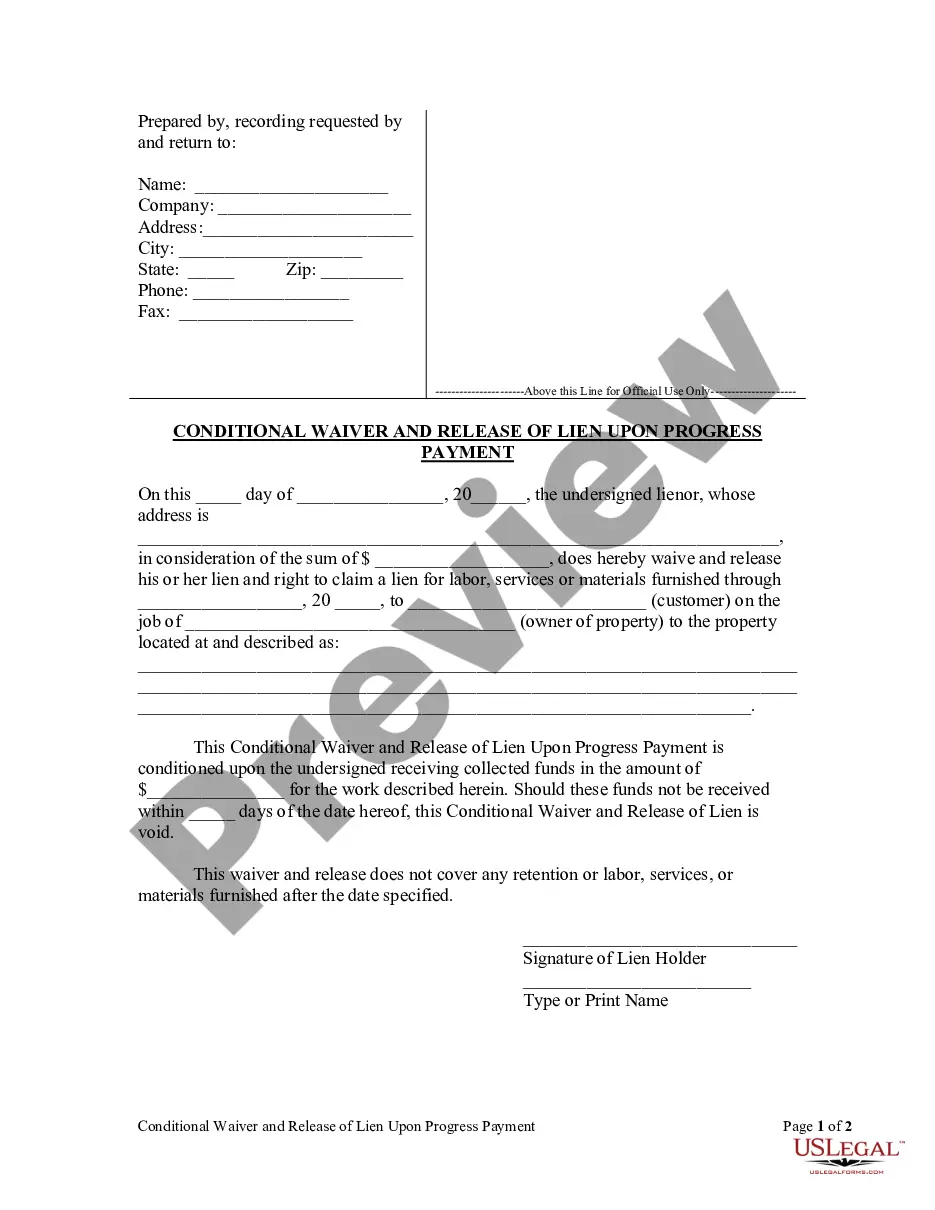

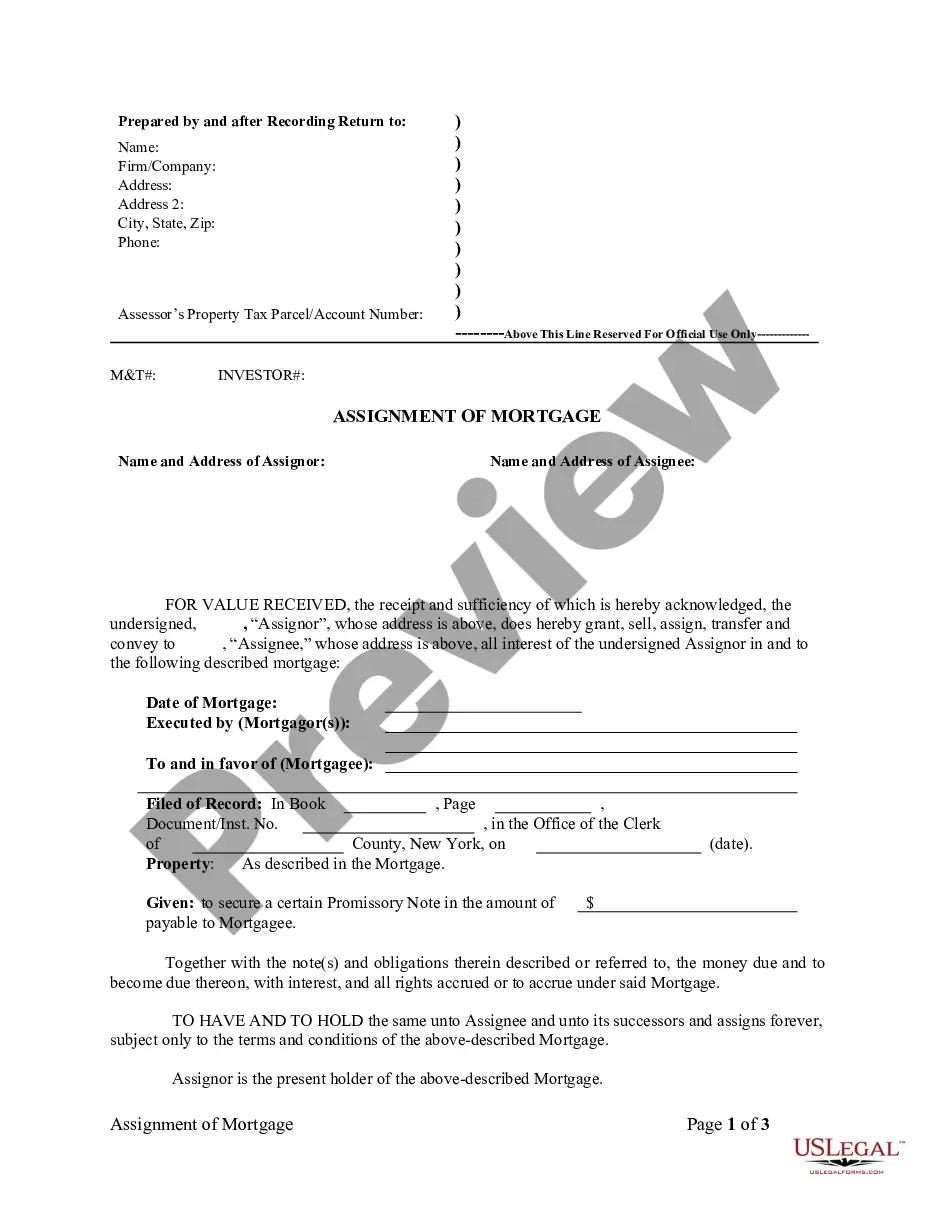

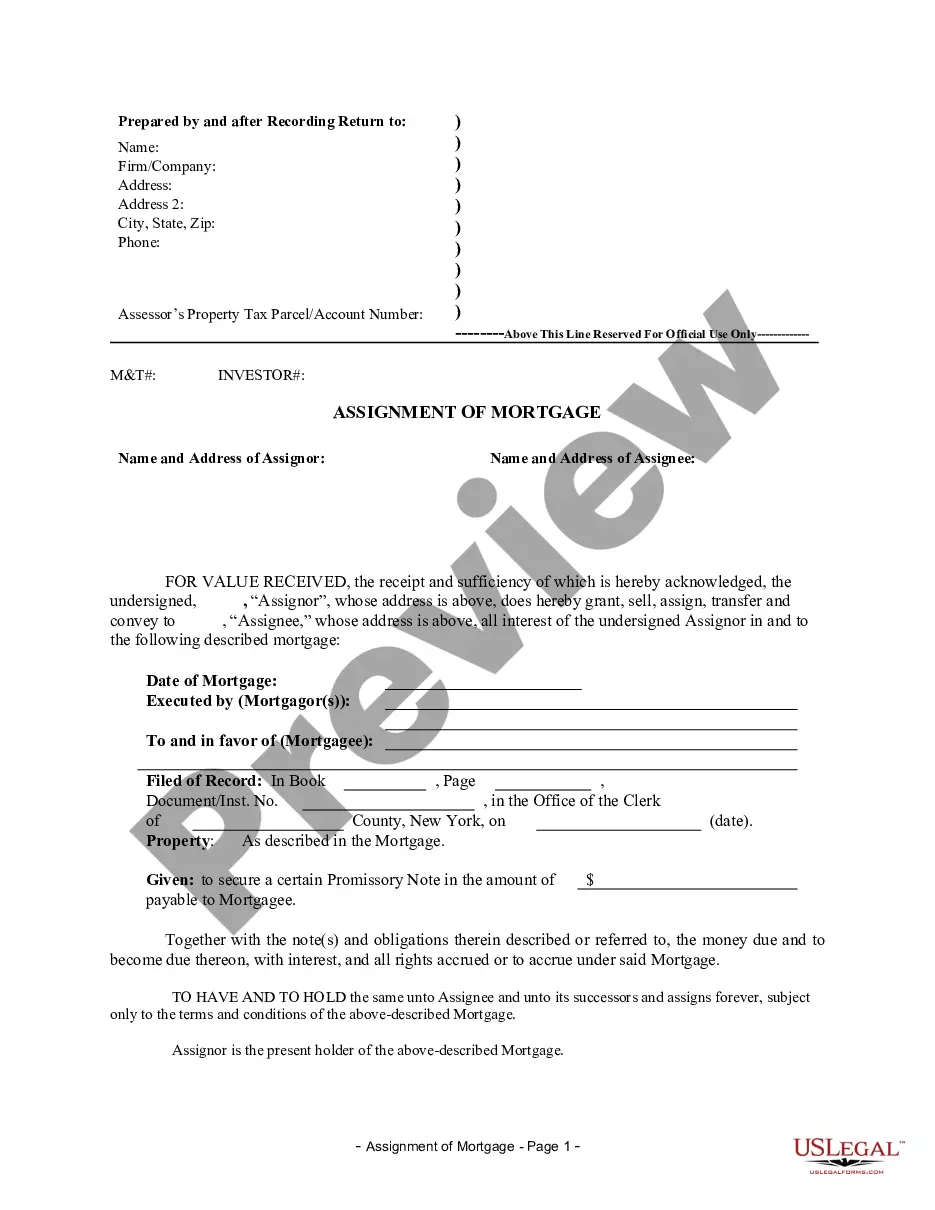

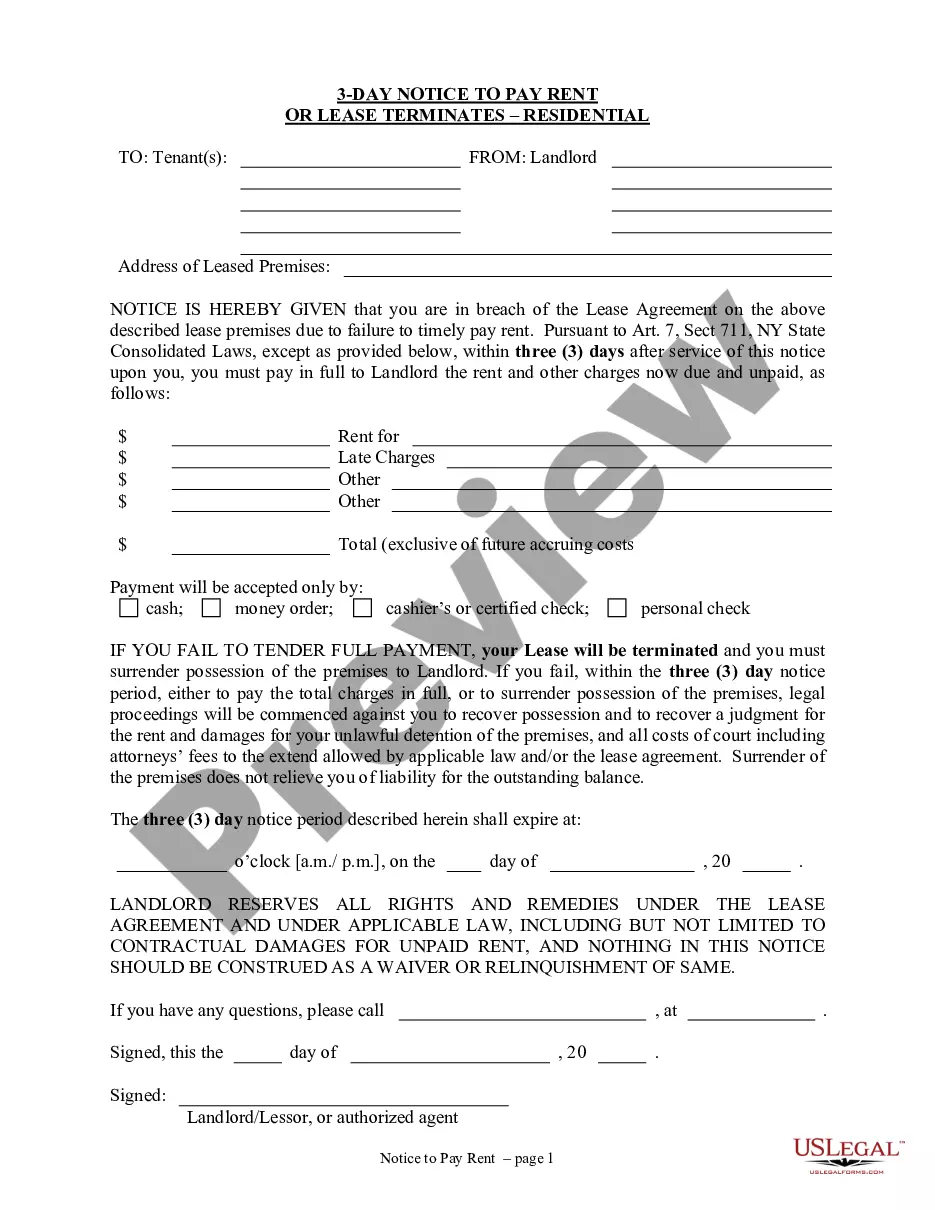

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy San Diego Stock Option and Award Plan.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Stock Option and Award Plan, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to cope with an extremely difficult case, we recommend getting a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!