The Harris Texas Management Agreement is a legal document that outlines the terms and conditions for a trust and a corporation to collaborate and manage assets in Harris County, Texas. This agreement serves as a foundation for the effective management of investments, properties, and other assets held by the trust. One type of Harris Texas Management Agreement between a Trust and a Corporation is the Investment Management Agreement. This agreement focuses on the management of financial assets and investments within the trust. It sets forth the scope of the corporation's authority to make investment decisions, including buying, selling, and holding various securities. The agreement also outlines the corporation's responsibilities in monitoring and reporting the performance of the trust's investments. Another type of Harris Texas Management Agreement is the Property Management Agreement. In this arrangement, the corporation is entrusted with the responsibility of managing and maintaining the trust's real estate properties located in Harris County, Texas. The agreement outlines the corporation's duties, such as rent collection, property maintenance, tenant relations, and lease negotiation. Additionally, it specifies the compensation and any expenses the corporation may incur in carrying out their obligations. The Harris Texas Management Agreement also includes provisions related to the fiduciary duties of the corporation acting on behalf of the trust. The corporation must act in the best interests of the trust and exercise a high standard of care and skill in managing the trust's assets. Furthermore, the agreement may address any limitations or restrictions imposed on the corporation's decision-making authority. The agreement also covers aspects such as duration, termination, amendment, and dispute resolution procedures. It stipulates the length of time the agreement will be in effect and provides conditions under which either party can terminate the agreement. Additionally, it outlines the process for making amendments to the agreement and resolving any disputes that may arise between the trust and the corporation. In conclusion, the Harris Texas Management Agreement between a Trust and a Corporation serves as a comprehensive roadmap for the effective management and administration of assets held by the trust in Harris County, Texas. By clearly defining the roles, responsibilities, and limitations of the corporation, the agreement ensures transparency, accountability, and the protection of the trust's interests.

Harris Texas Management Agreement between a Trust and a Corporation

Description

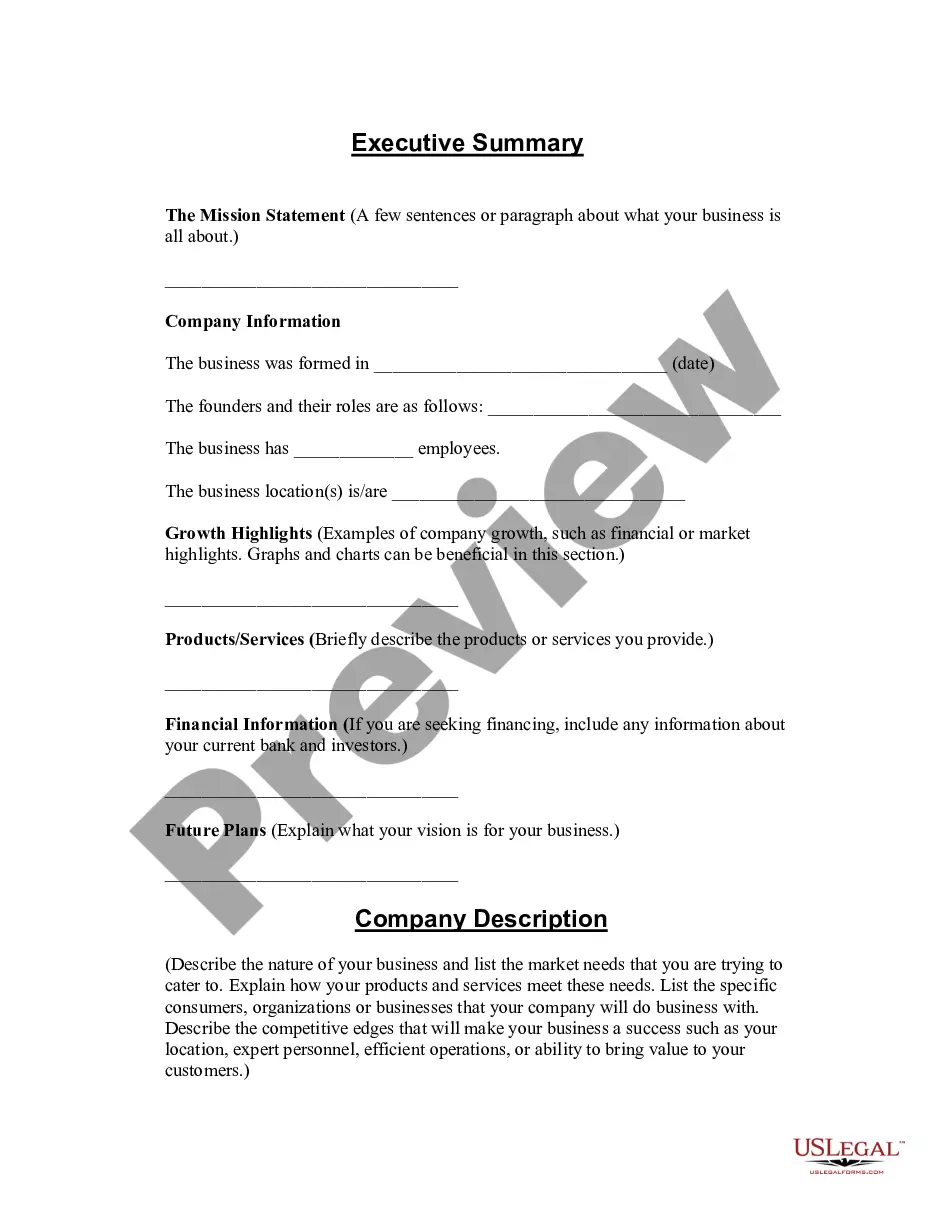

How to fill out Harris Texas Management Agreement Between A Trust And A Corporation?

Drafting documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Harris Management Agreement between a Trust and a Corporation without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Management Agreement between a Trust and a Corporation on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Harris Management Agreement between a Trust and a Corporation:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

Trust corporation means the Public Trustee or a corporation either appointed by the court in any particular case to be a trustee or entitled by rules made under subsection (3) of section four of the Public Trustee Act, 1906, to act as custodian trustee; Sample 1.

Typically, irrevocable trusts are used to reduce or avoid estate taxes. They also are used to meet other goals, such as to protect assets from being wasted or misused or to protect assets of an individual with a disability.

A trust is a legal agreement that transfers legal title of an asset to a trustee, who then manages the asset for the benefit of the grantor or another beneficiary. The trustee will hold, manage, and distribute the assets to a beneficiary as directed by the trust agreement.

A corporate trustee is an Australian company. Typically, a corporate trustee is a shell company with only an ACN, no filing obligations and no assets. A corporate trustee must have a shareholder or shareholders and appoint directors to manage the trust and the distribution of assets to beneficiaries.

Bank trust corporations are usually part of a group structure and are generally trading. They normally charge for their services and have their own separate terms of business setting out the trust corporation's charges to carry out the work.

A trustee has a fiduciary duty to act in the best interests of both current and future beneficiaries of the trust and can be held personally liable for any breach of that duty.

A fiduciary is a person or organization that acts on behalf of another person or persons, putting their clients' interests ahead of their own, with a duty to preserve good faith and trust. Being a fiduciary thus requires being bound both legally and ethically to act in the other's best interests.

Trust advantages and disadvantages limited liability is possible if a corporate trustee is appointed. the structure provides more privacy than a company. there can be flexibility in distributions among beneficiaries. trust income is generally taxed as income of an individual.

With an irrevocable trust, you must get written consent from all involved parties to switch the trustee. That means having the trustmaker (the person who created the trust), the current trustee and all listed beneficiaries sign an amendment to remove the trustee and replace him or her with a new one.

A trustee is personally liable for a breach of his or her fiduciary duties. The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties. The duty of loyalty requires that the trustee administer the trust solely in the interest of the beneficiaries.