A Maricopa Arizona Management Agreement between a Trust and a Corporation is a legal document that outlines the terms and conditions of the management relationship between a trust and a corporation in the town of Maricopa, Arizona. This agreement is vital for ensuring a clear understanding of roles, responsibilities, and obligations between the two parties involved. The Maricopa Arizona Management Agreement is designed to protect the interests of both the trust and the corporation involved in the management arrangement. It establishes the framework for how the trust's assets and affairs will be managed by the corporation and provides guidelines for decision-making, financial reporting, and communication. Some key elements typically included in a Maricopa Arizona Management Agreement between a Trust and a Corporation are: 1. Parties involved: The agreement will clearly identify the trust and the corporation entering into the management relationship. It will outline their legal names, addresses, and contact information. 2. Purpose and scope: The agreement will define the purpose of the management relationship and outline the specific areas of management responsibility. This may include financial management, investment decisions, property maintenance, and any other aspects relevant to the trust's assets. 3. Term and termination: The agreement will specify the duration of the management arrangement and any provisions for termination. This may include termination by mutual agreement, breach of contract, or other agreed-upon circumstances. 4. Duties and responsibilities: The agreement will outline the duties and responsibilities of both the trust and the corporation. This may include financial reporting, record-keeping, tax compliance, and maintaining accurate documentation of all transactions related to the trust's assets. 5. Compensation and fees: The agreement will establish the compensation structure for the corporation's management services. This may include a fixed fee, a percentage of assets under management, or performance-based incentives. 6. Confidentiality and non-disclosure: The agreement may include provisions to protect the confidentiality of sensitive information and prevent unauthorized disclosure of the trust's affairs. Types of Maricopa Arizona Management Agreements between a Trust and a Corporation may vary based on specific circumstances. Examples could include Specialized Asset Management Agreement, Property Management Agreement, or Financial Management Agreement. These agreements may have specific details or variations relevant to the type of assets being managed or the goals of the trust. In summary, a Maricopa Arizona Management Agreement between a Trust and a Corporation is a crucial document that defines the terms and conditions of the management relationship. It ensures a clear understanding of roles, responsibilities, and expectations, protecting the interests of both the trust and the corporation.

Maricopa Arizona Management Agreement between a Trust and a Corporation

Description

How to fill out Maricopa Arizona Management Agreement Between A Trust And A Corporation?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Maricopa Management Agreement between a Trust and a Corporation without expert assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Maricopa Management Agreement between a Trust and a Corporation by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Maricopa Management Agreement between a Trust and a Corporation:

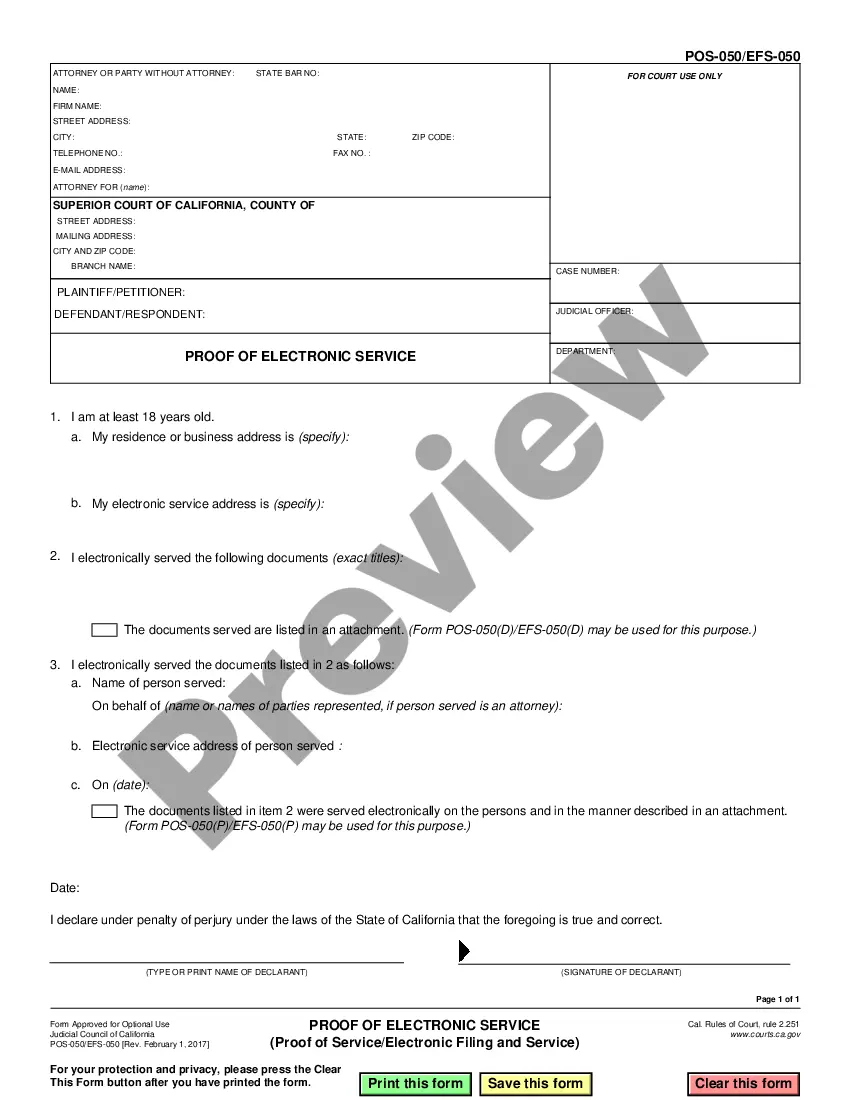

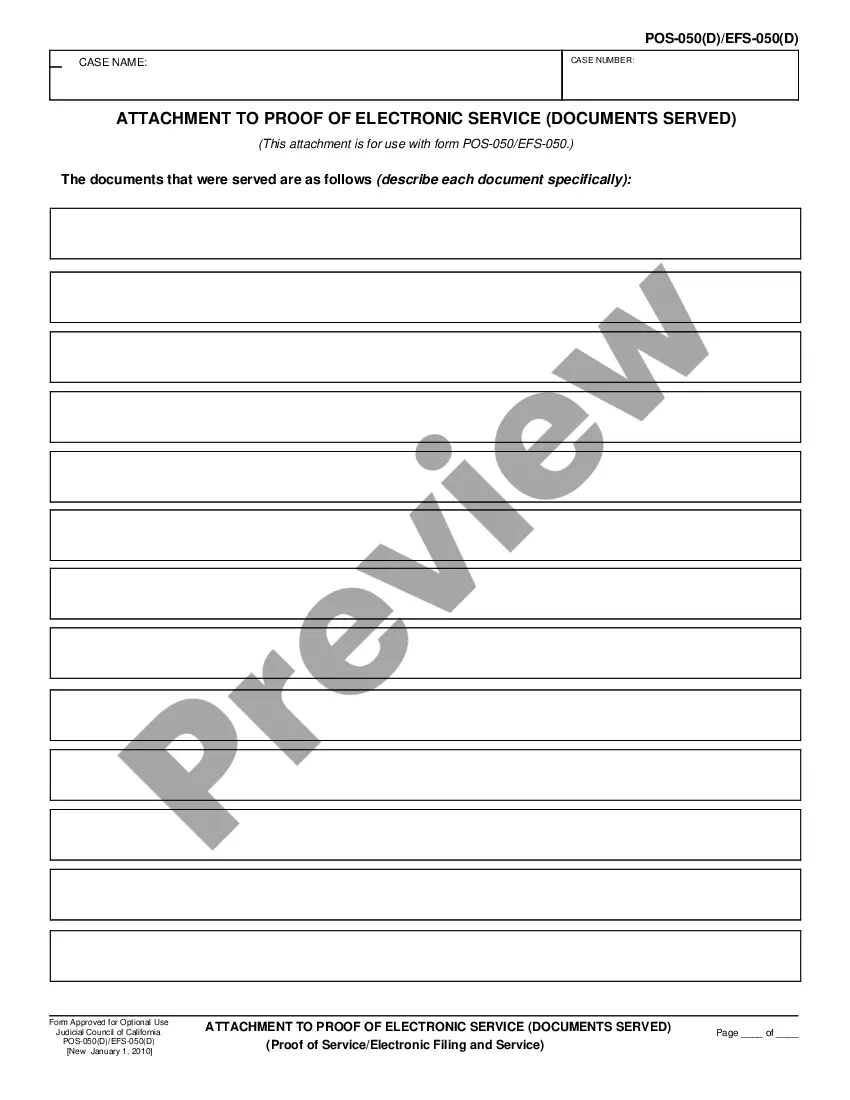

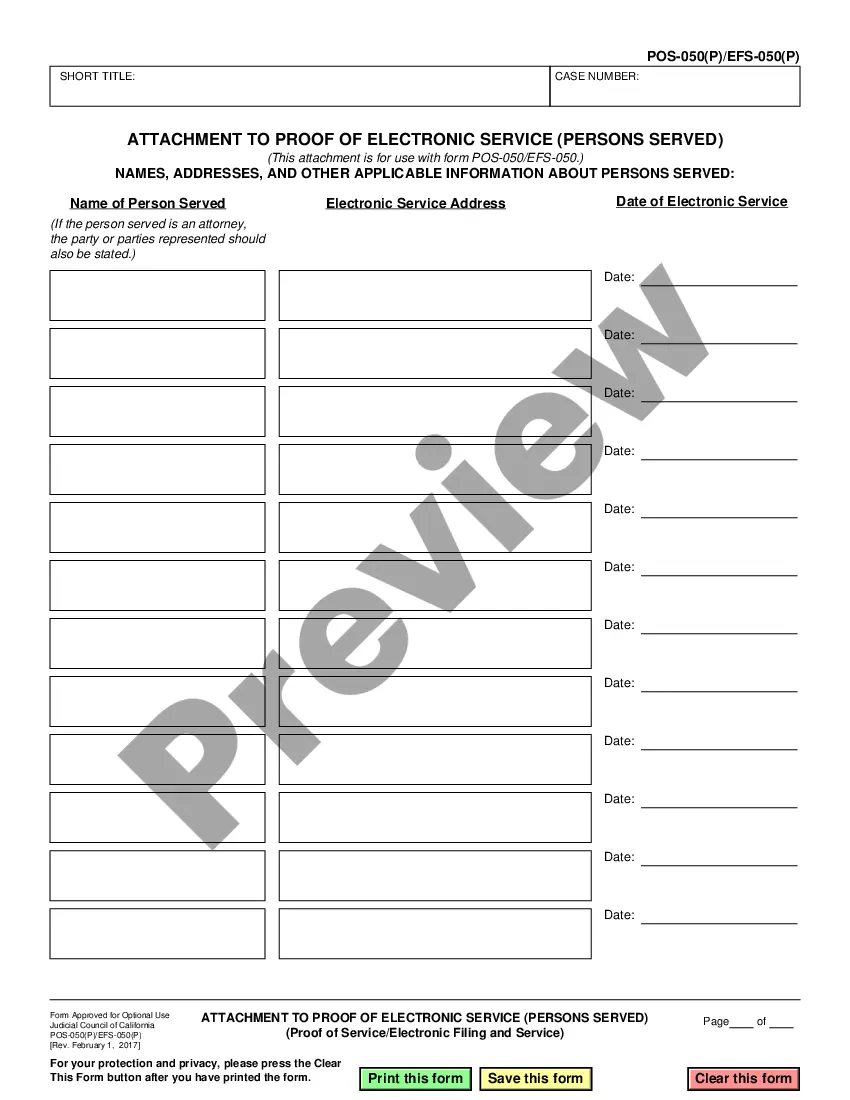

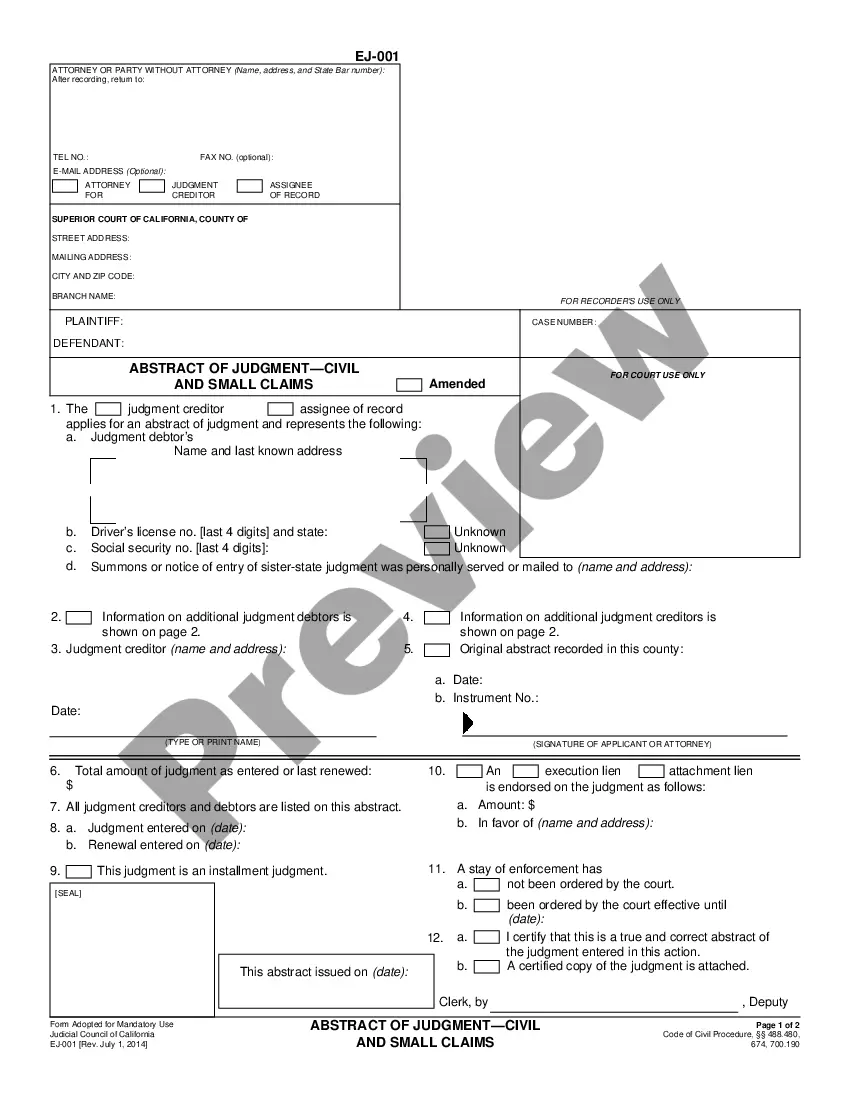

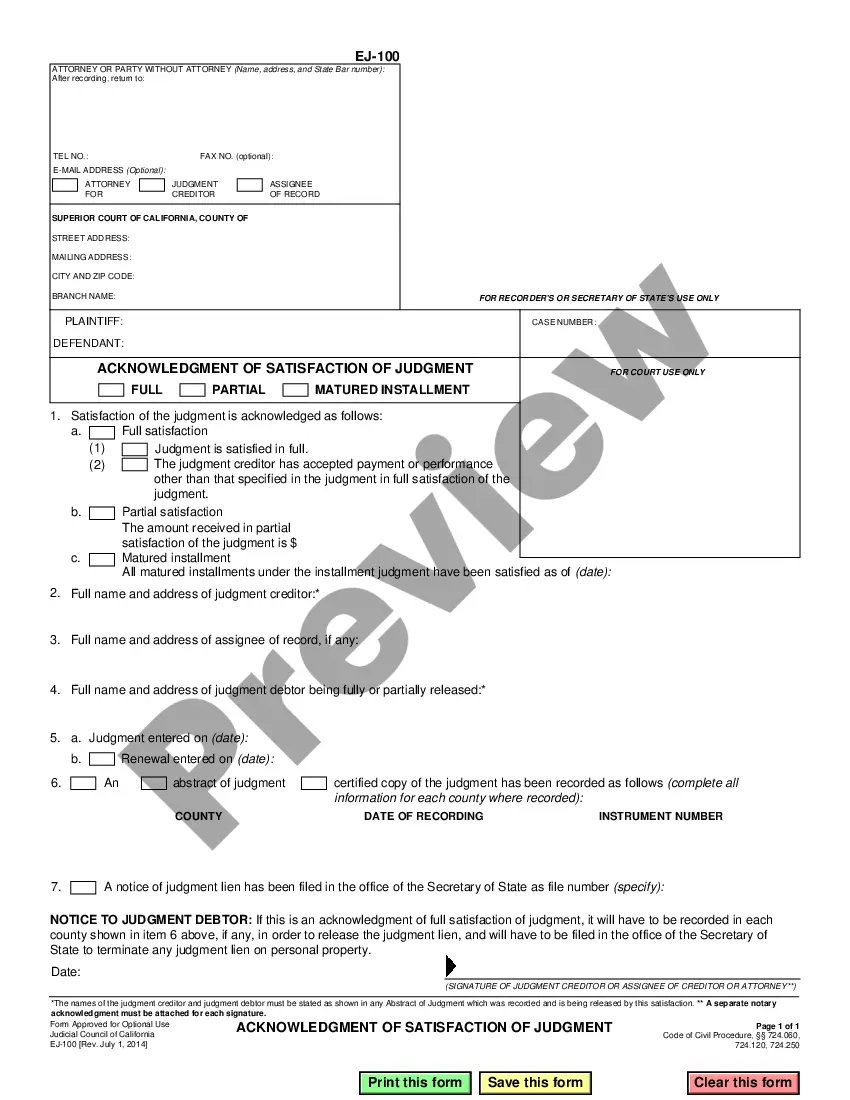

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!