Houston, Texas Sample Noncom petition Agreement — Stock Sale: A Sample Noncom petition Agreement for Stock Sale is a legally binding contract commonly used in Houston, Texas, to safeguard the interests of companies engaging in stock sales. This agreement protects the selling company by preventing the departing stockholder from competing directly or indirectly with the company after the sale. This agreement serves as a crucial tool for businesses in Houston, Texas, as it safeguards their trade secrets, confidential information, customer base, and goodwill, which are integral to their success. By signing this document, the stockholder agrees not to engage in any activities that would harm the business's competitive advantage. The Houston, Texas Sample Noncom petition Agreement — Stock Sale typically includes various clauses tailored to address specific needs. These clauses may differ depending on the nature of the business, industry, and specific requirements of the stock sale. Some common variations of this agreement may include: 1. Buy-Sell Noncom petition Agreement: This type of agreement applies when the stockholder wants to sell their stocks to another party. It outlines the terms and conditions of the sale, along with the noncom petition obligations of the departing stockholder. 2. Merger Noncom petition Agreement: In the case of a merger between two companies, this agreement outlines the noncom petition obligations of both parties involved. It ensures that each company cannot provide a competitive advantage to other entities during or after the merger. 3. Stock Option Noncom petition Agreement: This type of agreement is applicable when stock options are granted to employees or key stakeholders. It stipulates that the individuals with stock options cannot compete with the company if they choose not to exercise their options. 4. Asset Purchase Noncom petition Agreement: When a business wishes to purchase specific assets rather than stocks, this agreement ensures that the selling party does not use these assets or compete with the purchasing company after the sale. It is important to consult legal professionals to draft a Houston, Texas Sample Noncom petition Agreement — Stock Sale that adheres to state laws and regulations. State-specific clauses and considerations may need to be incorporated to ensure the validity and enforceability of the agreement. In conclusion, the Houston, Texas Sample Noncom petition Agreement — Stock Sale is a crucial legal document for businesses involved in stock sales. It aims to protect businesses from potential harm caused by departing stockholders and ensures that trade secrets and confidential information remain secure. By utilizing this agreement, companies can confidently engage in stock sales while safeguarding their competitive advantage in the Houston, Texas market.

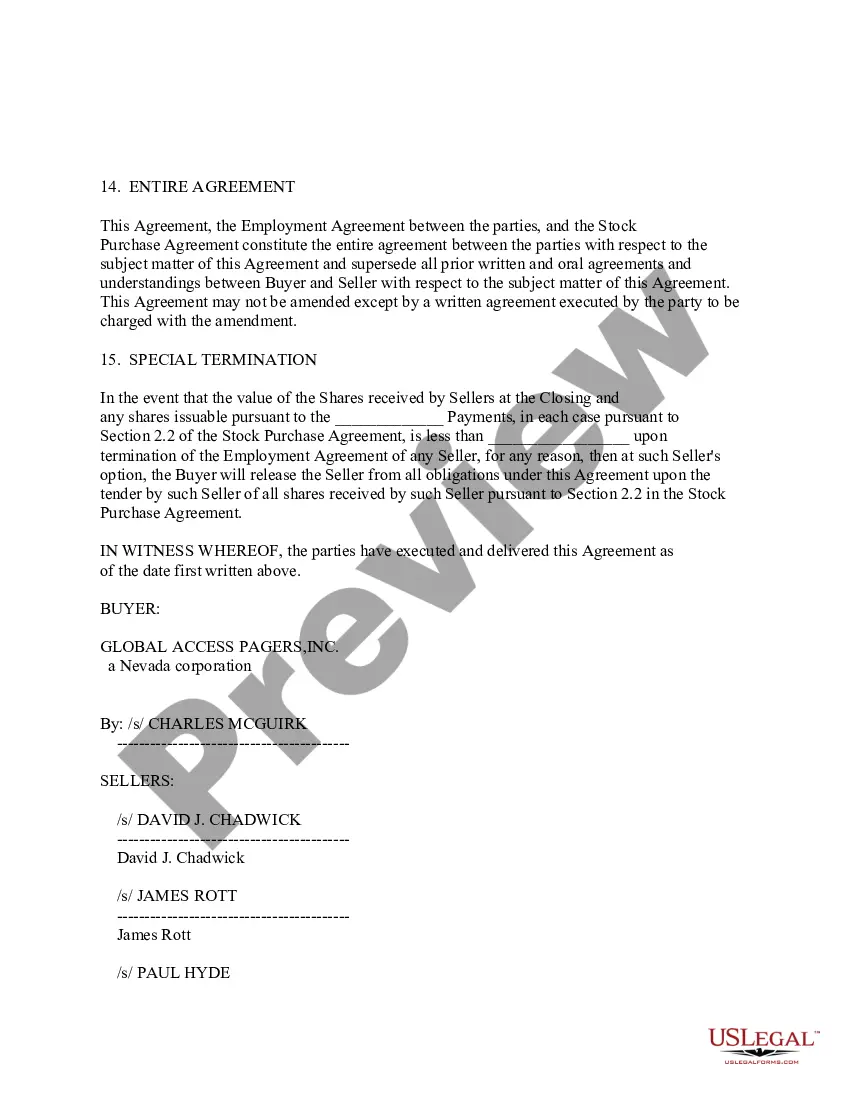

Houston Texas Sample Noncompetition Agreement - Stock Sale

Description

How to fill out Houston Texas Sample Noncompetition Agreement - Stock Sale?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Houston Sample Noncompetition Agreement - Stock Sale is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Houston Sample Noncompetition Agreement - Stock Sale. Follow the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Sample Noncompetition Agreement - Stock Sale in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!