Mecklenburg North Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation The Mecklenburg North Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation is a legally-binding document that outlines the terms and conditions of a merger between two entities. This agreement aims to merge Barber Oil Corporation and Stock Transfer Restriction Corporation into a single entity, thus combining their resources, expertise, and market presence. By merging, both companies seek to leverage their respective strengths and achieve greater efficiency, profitability, and competitiveness in the market. The Mecklenburg North Carolina Agreement of Merger outlines the steps, procedures, and legal requirements necessary for the merger to take place successfully. Key terms and clauses included in the agreement may cover the following aspects: 1. Purpose: The purpose section of the agreement highlights the intent behind the merger, emphasizing the potential synergies, growth opportunities, and added value it will bring to both companies. 2. Definitions: This part of the agreement offers clear definitions of terms used throughout the document to ensure mutual understanding and avoid ambiguity. 3. Merger Consideration: The agreement describes the consideration given by each party involved in the merger, such as stock shares, cash, or other assets, to determine the value of the merger. 4. Management and Governance: This section lays out the structure of the merged entity's management team, defining the roles, responsibilities, and decision-making processes. It may also outline any changes to the board of directors or executive leadership. 5. Intellectual Property and Assets: The agreement specifies how intellectual property rights, proprietary information, patents, trademarks, and existing assets will be transferred and protected post-merger. 6. Employee Matters: This section addresses how the merger affects the employees of both merging entities. It may cover issues such as severance packages, retention bonuses, relocation assistance, and new employment terms. 7. Stock Transfer Restrictions: If applicable, the agreement may include provisions regarding restrictions on the transfer of stock shares in the merged entity. This can help to maintain stability and control over ownership and voting rights. 8. Termination and Amendments: The agreement may outline the circumstances under which the merger can be terminated or modified, as well as the associated procedures and penalties. It is worth noting that although the Mecklenburg North Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation is a hypothetical example, similar merger agreements under the laws of Mecklenburg, North Carolina, might exist in practice. The specific types of such agreements could vary based on the unique circumstances, nature of the merging entities, and specific legal requirements.

Mecklenburg North Carolina Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

How to fill out Mecklenburg North Carolina Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Mecklenburg Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Mecklenburg Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Mecklenburg Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation:

- Ensure you have opened the proper page with your local form.

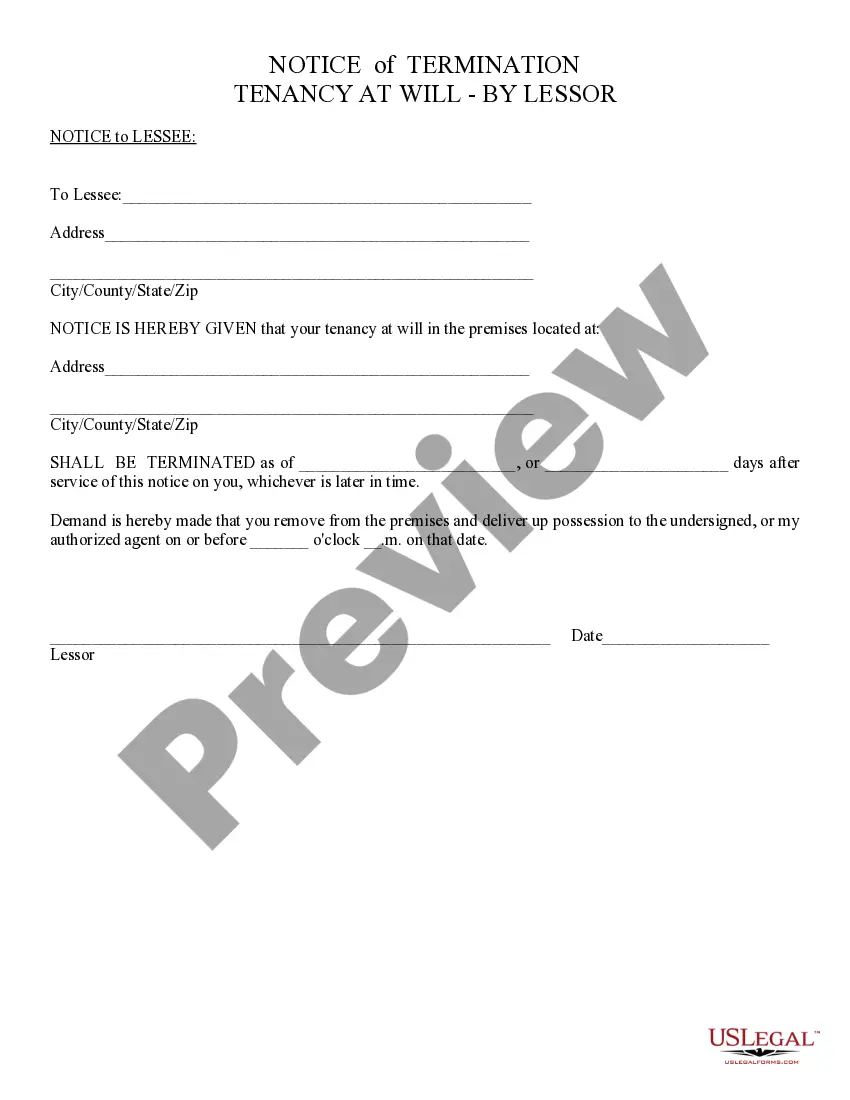

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Mecklenburg Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!