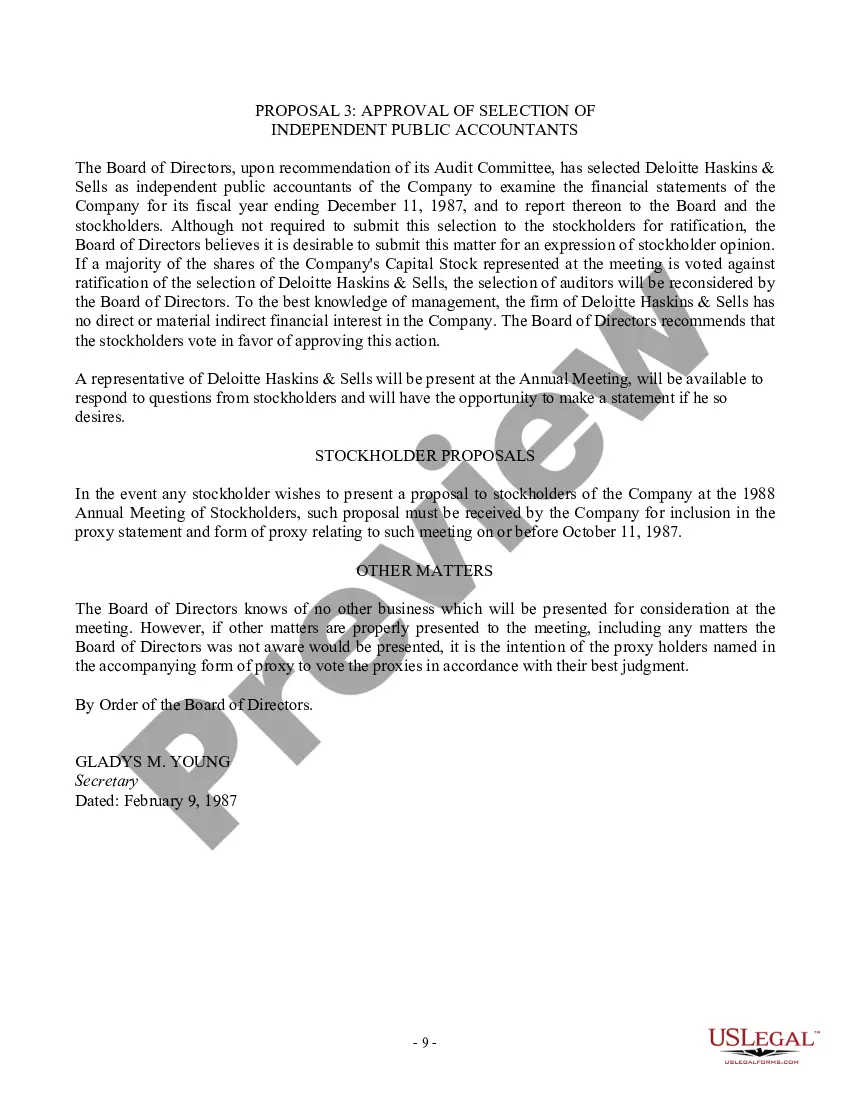

Middlesex Massachusetts Proxy Statement — Hatteras Income Securities, Inc. is a legal document that contains important information for shareholders of Hatteras Income Securities, Inc., a financial investment company operating in Middlesex County, Massachusetts. This proxy statement provides shareholders with details regarding upcoming corporate matters and proposals. The Middlesex Massachusetts Proxy Statement includes a copy of the advisory agreement between Hatteras Income Securities, Inc. and its advisory firm. This agreement outlines the terms and conditions of the professional relationship between the company and the advisory firm, including the scope of services provided, compensation structure, and other relevant details. This proxy statement is crucial for shareholders as it enables them to make informed decisions on various matters that may affect their investment. Shareholders are typically asked to vote on matters such as electing new board members, approving executive compensation, and authorizing certain corporate actions. The proxy statement provides in-depth information about these proposals to help shareholders understand the potential impact on their investment. In terms of different types of Middlesex Massachusetts Proxy Statement — Hatteras Income Securities, Inc. with a copy of advisory agreement, they may include: 1. Annual Proxy Statement: This is the most common type of proxy statement, typically released annually before the company's annual shareholders' meeting. It outlines key proposals and matters to be voted upon and provides shareholders with details to help them cast their votes effectively. 2. Special Proxy Statement: This is issued when there are specific events or proposals that require shareholder approval outside the regular annual meeting. These events could include mergers, acquisitions, or major corporate restructuring. In conclusion, the Middlesex Massachusetts Proxy Statement — Hatteras Income Securities, Inc. with a copy of the advisory agreement is a vital document for shareholders. It informs them of important corporate matters and proposals, helping them exercise their voting rights and make informed decisions about their investment in the company.

Middlesex Massachusetts Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out Middlesex Massachusetts Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Middlesex Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the current version of the Middlesex Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Middlesex Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!