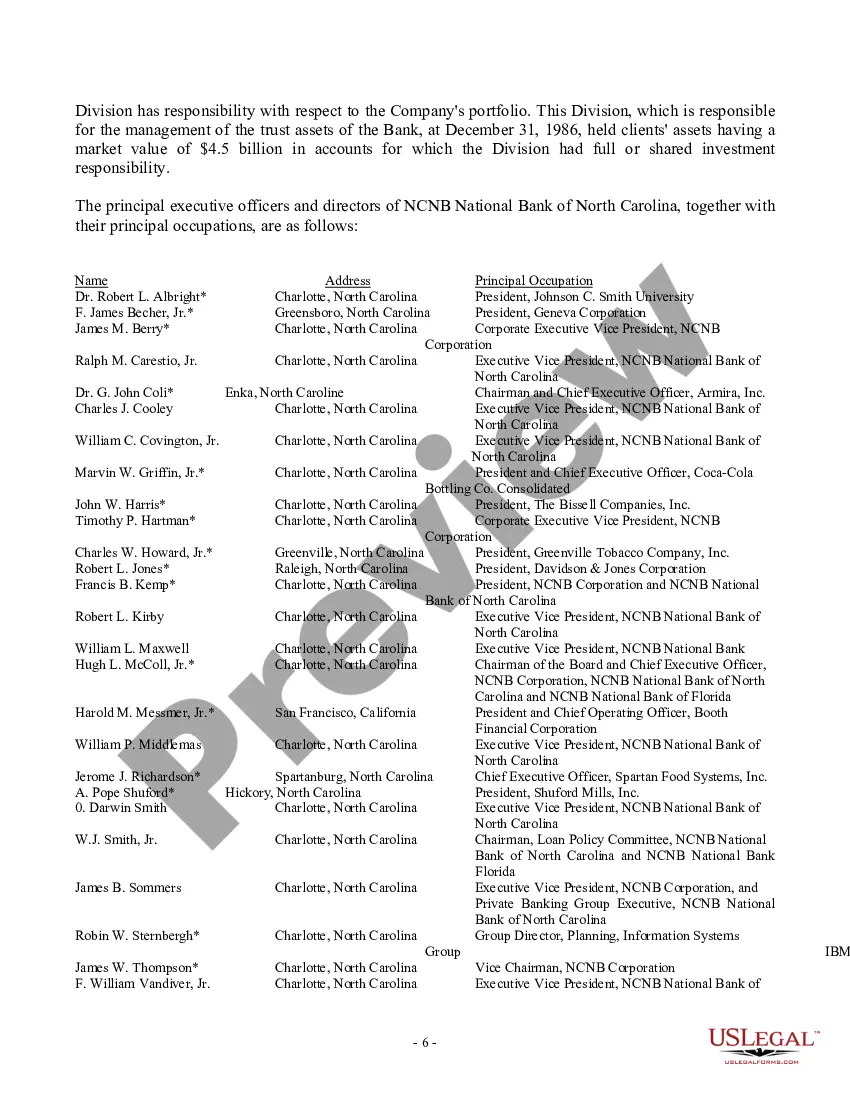

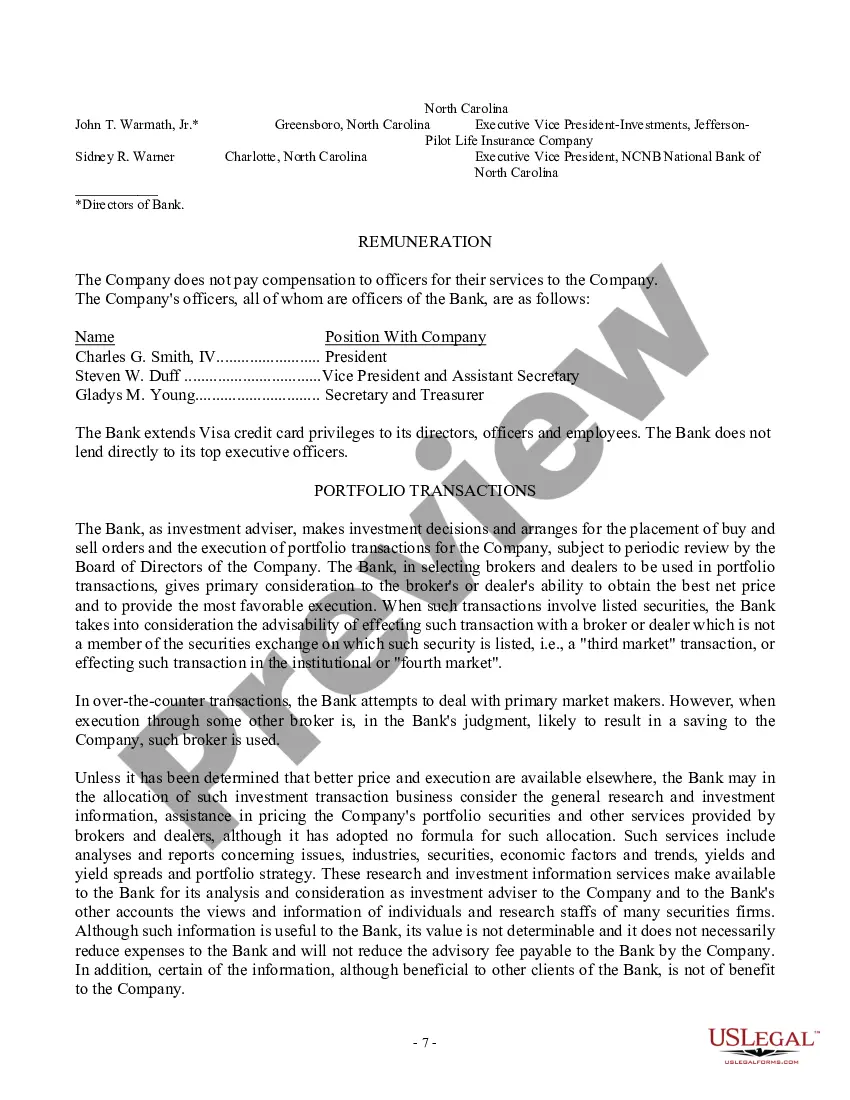

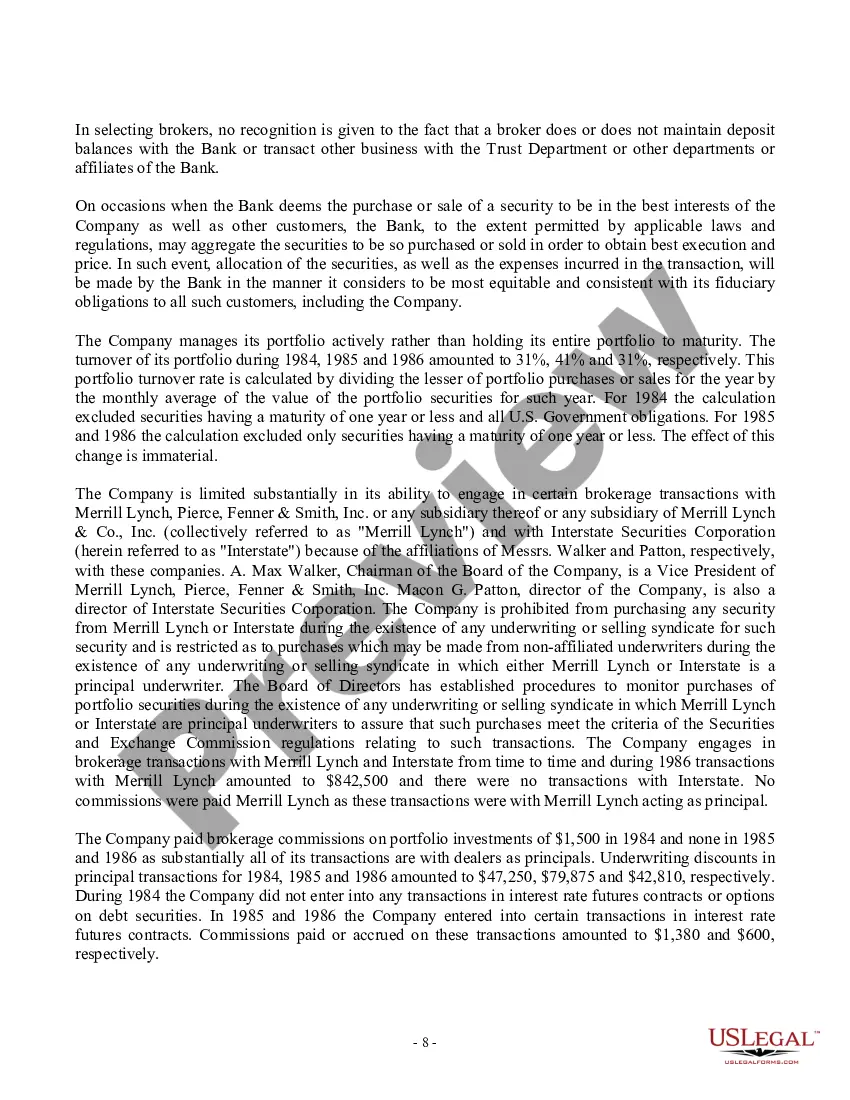

San Diego California Proxy Statement — Hatteras Income Securities, Inc. with Copy of Advisory Agreement: The San Diego California Proxy Statement for Hatteras Income Securities, Inc. is an important document that provides shareholders with detailed information regarding the company's operations, governance, and voting matters. This statement is prepared and distributed by the company to shareholders in advance of an annual or special meeting, allowing them to make informed decisions and cast their votes. The Proxy Statement includes various sections that cover crucial aspects of Hatteras Income Securities, Inc., giving shareholders an insight into the company's financial health, management team, and overall performance. One of the vital components of the Proxy Statement is the copy of the advisory agreement, which outlines the terms and conditions of the agreement between the company and its advisory firm. The advisory agreement is a legally binding contract between Hatteras Income Securities, Inc. and their chosen advisory firm, which provides guidance and support in regard to investment decisions and portfolio management. By including a copy of this agreement in the Proxy Statement, shareholders can review the terms and conditions under which the advisory firm operates and ensure that their interests align with those of the company. The Proxy Statement also contains information about the board of directors, including their qualifications, experience, and specialties. It outlines the procedures for electing directors and describes the process by which shareholders can nominate candidates for the board. This section allows shareholders to evaluate the competencies of the board members and make informed decisions when voting. Furthermore, the Proxy Statement provides detailed financial information such as the company's annual financial statements, auditor's report, and any proposed changes to the capital structure. Shareholders can assess the company's financial performance, identify any potential risks, and make informed decisions in line with their investment objectives. Different types of San Diego California Proxy Statements for Hatteras Income Securities, Inc. may include: 1. Annual Proxy Statement: This statement is released each year and covers all essential matters that require shareholder votes, such as electing directors, approving auditors, and voting on other important issues. 2. Special Meeting Proxy Statement: This type of proxy statement is released when there is a need for an unscheduled or extraordinary meeting. It addresses specific and time-sensitive matters that require shareholder input and decision-making. Overall, the San Diego California Proxy Statement for Hatteras Income Securities, Inc. is a comprehensive document that enables shareholders to understand the company's operations, governance, and financial performance. It provides crucial information to facilitate informed decision-making and allows shareholders to exercise their voting rights effectively.

San Diego California Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out San Diego California Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Diego Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the San Diego Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!