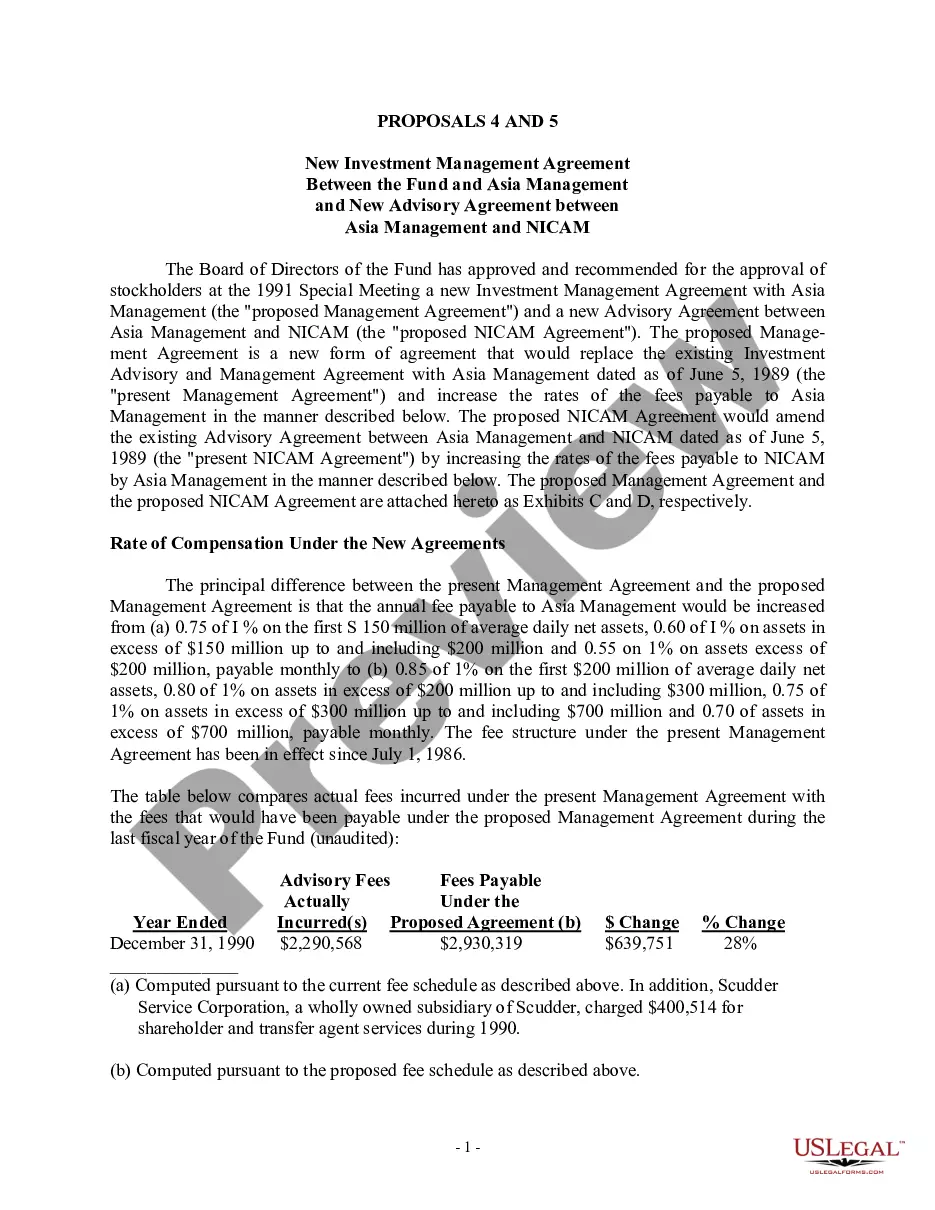

Title: Cook Illinois Investment Management Agreement: Exploring the Partnership between Fund, Asia Management, and CICAM Introduction: The Cook Illinois Investment Management Agreement represents a significant collaboration between Fund, Asia Management, and CICAM. This detailed description aims to clarify the key aspects of this partnership and shed light on the various types of agreements that can be formed within this framework. 1. Overview: The Cook Illinois Investment Management Agreement acts as a legally binding contract between Fund, Asia Management, and CICAM. It outlines the rights, responsibilities, and obligations of all parties involved in managing investment funds to ensure clarity and transparency throughout the partnership. 2. Parties Involved: a. Fund: The "Fund" refers to the entity that provides the financial resources to be managed. It might be a private equity firm, a pension fund, or any other organization or individual looking to invest their assets. b. Asia Management: "Asia Management" denotes the investment management firm based in Asia that takes charge of managing and allocating the Fund's investment portfolio. c. CICAM: "CICAM" represents a respected financial institution, such as a bank or insurance company, that acts as custodian or trustee for the Fund's assets, ensuring their safekeeping. 3. Key Components of the Agreement: a. Investment Strategy and Objectives: The agreement defines the Fund's investment objectives, risk tolerance, desired returns, and any specific criteria for asset allocation. It serves as a roadmap for Asia Management in structuring the investment approach accordingly. b. Roles and Responsibilities: The agreement outlines the duties of each party, including the fund manager (Asia Management), the custodian (CICAM), and any other relevant stakeholders. c. Reporting and Communication: Detailed reporting and communication requirements are established to ensure regular updates on the performance of the investments, adherence to regulations, and compliance with agreed-upon reporting standards. d. Compensation and Fees: This section defines the remuneration structure for Asia Management, including management fees, performance-based bonuses, and any other compensation arrangements. Additionally, it highlights the custodian's fee structure (CICAM) for their services. e. Termination and Dispute Resolution: The processes for terminating the agreement and resolving any potential conflicts or disputes between the parties are clearly stated to ensure a smooth and fair resolution. 4. Types of Cook Illinois Investment Management Agreements: a. General Investment Management Agreement: This is the standard agreement that outlines the rights, obligations, and expectations of all parties involved. It covers the basic elements mentioned above. b. Exclusive or Non-Exclusive Agreement: The parties may choose to enter into an exclusive agreement, limiting the Fund's engagement with other investment managers, or a non-exclusive agreement, allowing the Fund to diversify its investment management across different firms. c. Performance-Based Fee Agreement: In some cases, the agreement may incorporate a performance-based fee structure that rewards the Asia Management firm based on their ability to achieve certain predefined investment goals or benchmarks. Conclusion: The Cook Illinois Investment Management Agreement serves as the foundation for a collaborative partnership between Fund, Asia Management, and CICAM. By addressing various aspects, including investment strategy, roles and responsibilities, reporting, compensation, and dispute resolution, this agreement lays the groundwork for a successful and transparent investment management relationship.

Cook Illinois Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Cook Illinois Investment Management Agreement Between Fund, Asia Management And NICAM?

If you need to find a trustworthy legal paperwork supplier to get the Cook Investment Management Agreement between Fund, Asia Management and NICAM, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to find and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Cook Investment Management Agreement between Fund, Asia Management and NICAM, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Cook Investment Management Agreement between Fund, Asia Management and NICAM template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Cook Investment Management Agreement between Fund, Asia Management and NICAM - all from the convenience of your home.

Join US Legal Forms now!