The Kings New York Investment Management Agreement between Fund, Asia Management, and CICAM is a comprehensive financial contract that outlines the terms and conditions governing the investment management services provided by Kings New York. This agreement serves as a legal and contractual framework between the three entities, ensuring a mutual understanding of roles, responsibilities, and expectations. It enables efficient collaboration to maximize investment opportunities and achieve the desired financial outcomes. Some key components of the Kings New York Investment Management Agreement include: 1. Parties involved: The agreement details the names and roles of all parties involved, which typically include the investment fund, Asia Management representing the fund, and CICAM as the investment management firm. 2. Objective and scope: The agreement defines the primary investment objectives, goals, and strategies agreed upon by all parties. It outlines the specific investment markets, sectors, or regions that will be targeted and managed by Kings New York. 3. Duties and responsibilities: This section outlines the respective duties and responsibilities of each party. It includes the obligations of Kings New York as the investment manager, such as conducting research, due diligence, and investment decision-making. It also establishes the responsibilities of Asia Management and CICAM in terms of providing necessary information, documentation, and oversight. 4. Fee structure: The agreement specifies the fee structure and compensation arrangements for Kings New York's services. This includes management fees, performance-based incentives, and any other relevant charges or expenses associated with the investment management. 5. Reporting and communication: The agreement establishes reporting requirements, outlining the frequency, format, and content of investment reports to be provided by Kings New York. It also defines the communication channels and frequency of meetings between the parties to discuss investment performance, strategy updates, and any other relevant matters. 6. Duration and termination: The agreement includes provisions related to the duration of the engagement, specifying the initial term and any renewal terms. It also outlines the conditions and procedures for termination by either party, including notice periods and potential exit fees if applicable. It's important to note that there might be different types of Kings New York Investment Management Agreements, tailored to specific investment strategies or asset classes. Some variations could include agreements for fixed-income investments, equity investments, real estate investments, or alternative investment strategies, each with its own unique terms and conditions. These agreements are designed to protect the interests of all parties involved, ensuring transparency, accountability, and legal compliance throughout the investment management process. They serve as a crucial document to establish a solid foundation of trust and understanding between the investment fund, Asia Management, and CICAM, promoting successful collaboration and pursuit of common financial goals.

Kings New York Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Kings New York Investment Management Agreement Between Fund, Asia Management And NICAM?

Drafting paperwork for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Kings Investment Management Agreement between Fund, Asia Management and NICAM without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Kings Investment Management Agreement between Fund, Asia Management and NICAM on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Kings Investment Management Agreement between Fund, Asia Management and NICAM:

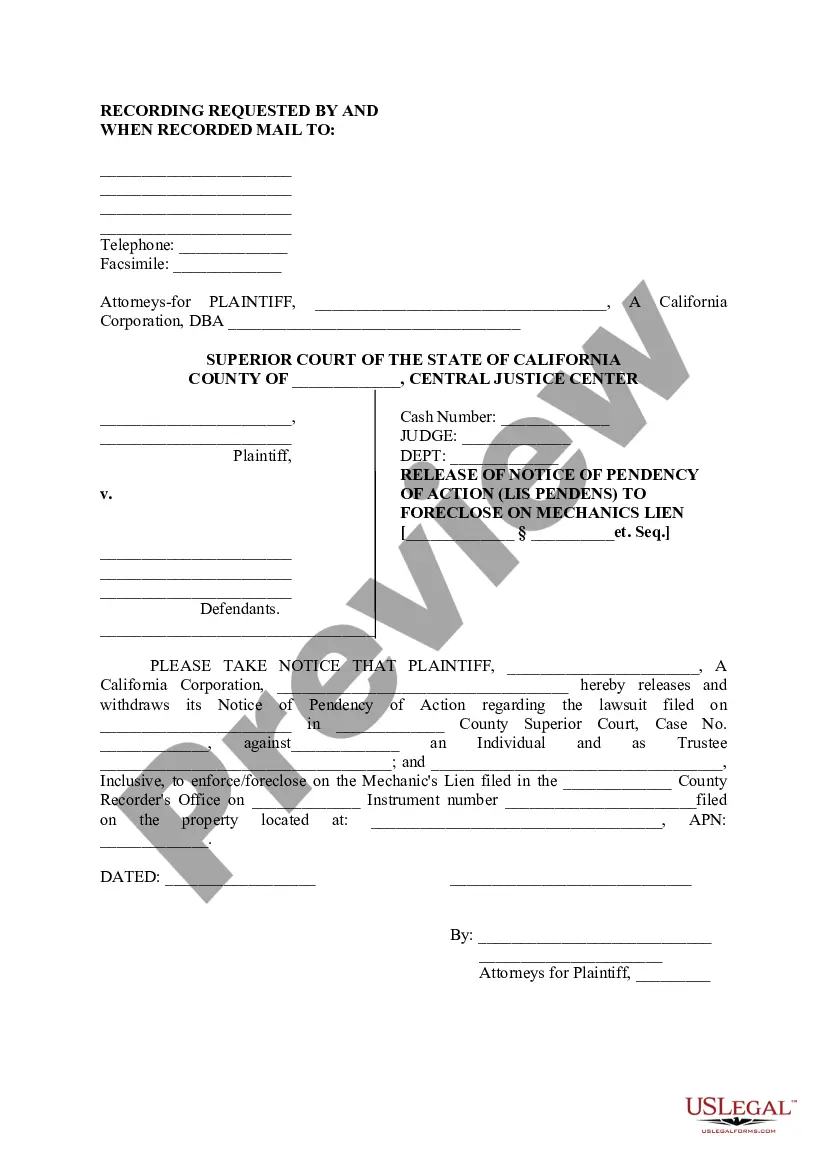

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!