The Mecklenburg North Carolina Investment Management Agreement is a comprehensive contract that outlines the terms and conditions between Fund, Asia Management, and CICAM (North Carolina Investment Corporation for Asset Management). This agreement establishes a solid framework for the management and investment of assets held by Fund, with the assistance of Asia Management and CICAM. Under this agreement, Fund entrusts Asia Management and CICAM with the responsibility of managing its investment portfolio, aiming to maximize returns while minimizing risks. The agreement details the various responsibilities, obligations, and limitations of each party involved. The agreement includes provisions related to investment strategies, risk management, asset allocation, and reporting requirements. It identifies the investment objectives and specific guidelines within which Asia Management and CICAM must operate. These guidelines may include information regarding acceptable asset classes, target allocations, and performance benchmarks. Furthermore, the Mecklenburg North Carolina Investment Management Agreement outlines the fee structure and compensation arrangements for Asia Management and CICAM. This section may describe management fees, performance-based incentives, or any other costs associated with investment management services. The agreement may also classify different types of Mecklenburg North Carolina Investment Management Agreements between the parties involved, depending on the specific nature of the investment mandate. For instance, there could be separate agreements for pension fund management, endowment management, or private equity fund management. Each agreement would have distinct terms and conditions tailored to the specific investment objectives and strategies. In conclusion, the Mecklenburg North Carolina Investment Management Agreement is a crucial legal document that serves as the foundation for a successful and efficient investment management relationship between Fund, Asia Management, and CICAM. It fosters transparency, provides clear expectations, and protects the interests of all parties involved in the investment management process.

Mecklenburg North Carolina Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Mecklenburg North Carolina Investment Management Agreement Between Fund, Asia Management And NICAM?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Mecklenburg Investment Management Agreement between Fund, Asia Management and NICAM suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Apart from the Mecklenburg Investment Management Agreement between Fund, Asia Management and NICAM, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Mecklenburg Investment Management Agreement between Fund, Asia Management and NICAM:

- Examine the content of the page you’re on.

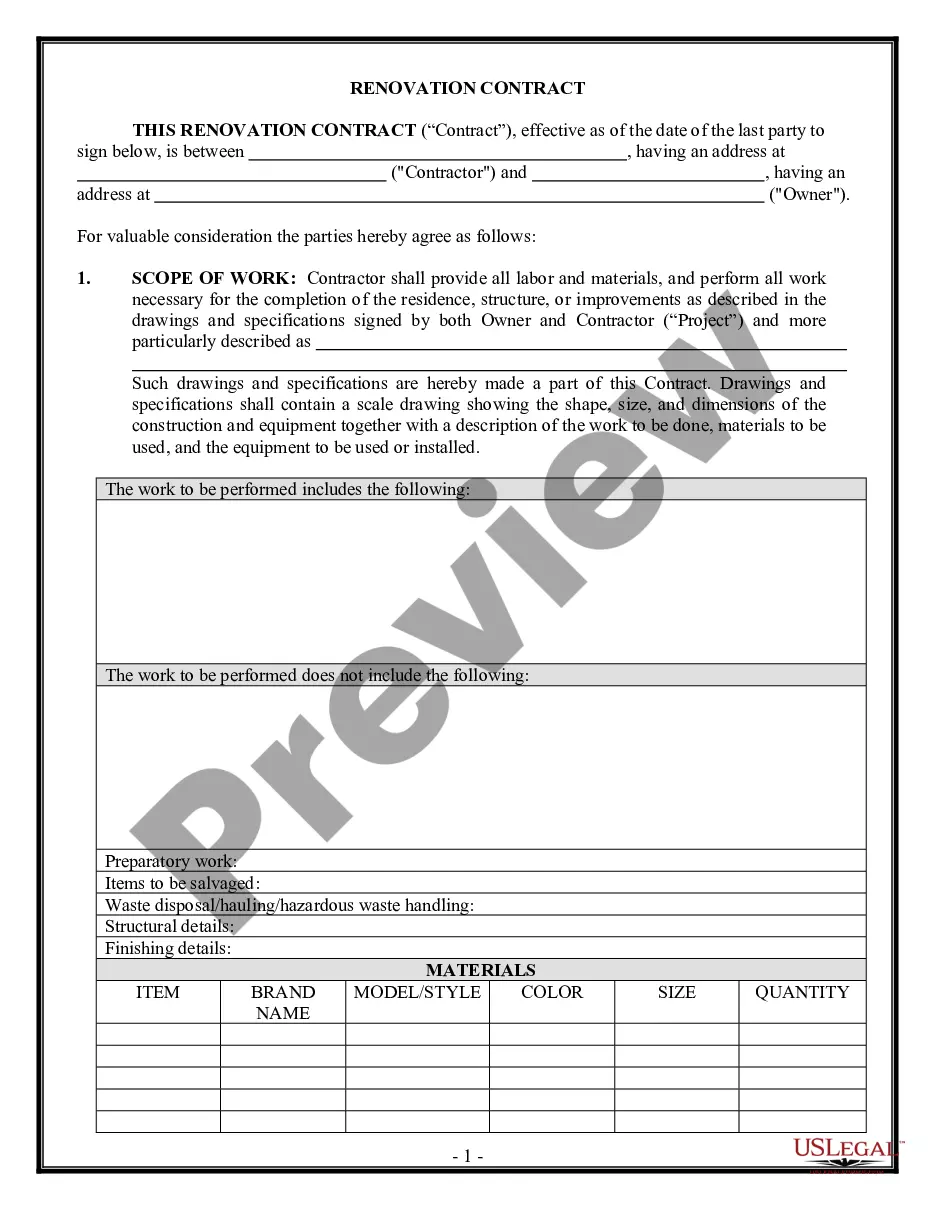

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Mecklenburg Investment Management Agreement between Fund, Asia Management and NICAM.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!