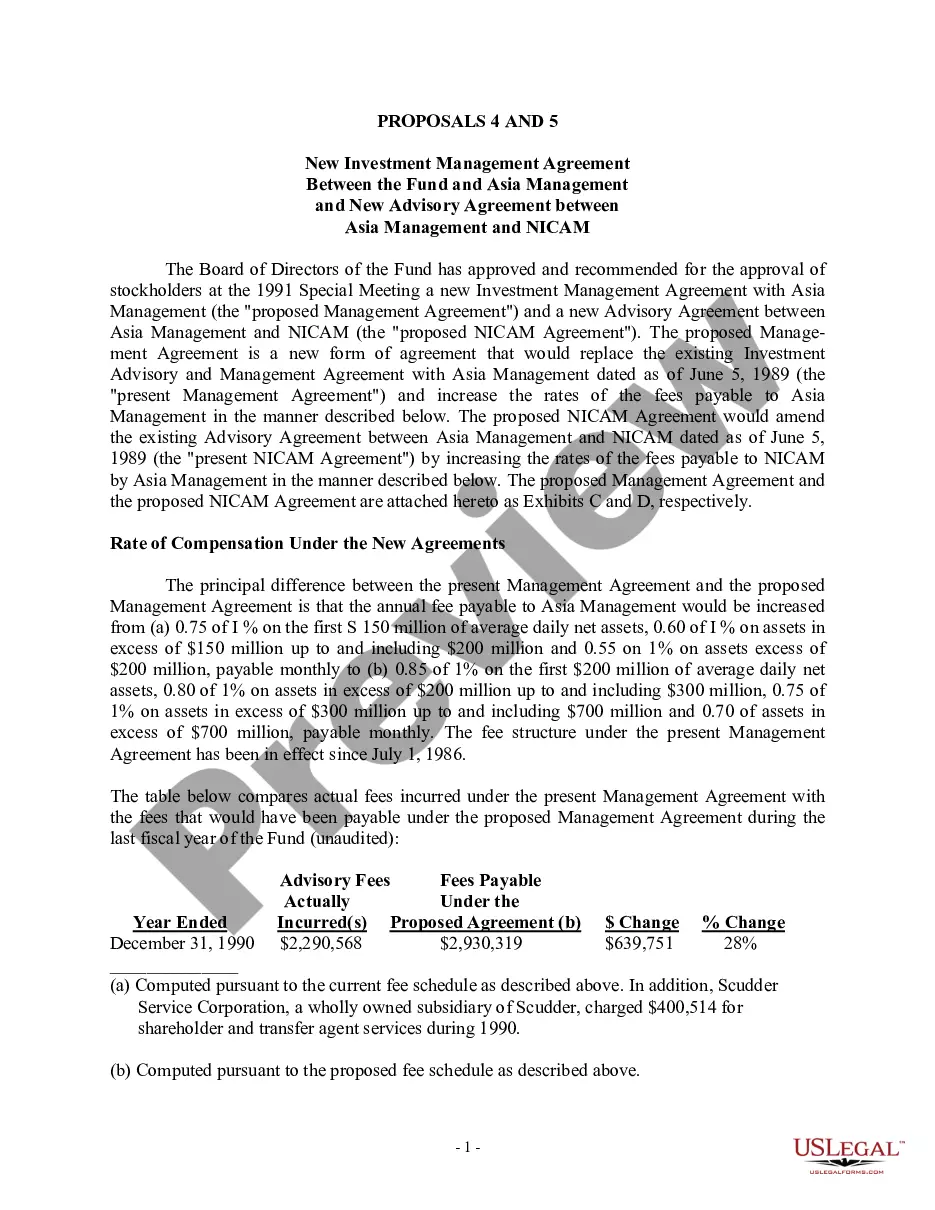

Phoenix Arizona Investment Management Agreement between Fund, Asia Management, and CICAM: The Phoenix Arizona Investment Management Agreement brings together Fund, Asia Management, and CICAM (Name of Institution/Company). This legal document outlines the terms and conditions for managing investment assets located in Phoenix, Arizona. This agreement serves as a binding contract that establishes the roles, responsibilities, and rights of all parties involved. The primary objective is to ensure efficient investment management and maximize returns while adhering to legal and regulatory requirements. Key Terms and Components of the Phoenix Arizona Investment Management Agreement: 1. Parties involved: The agreement identifies the parties involved in the investment management partnership. These include the Fund, Asia Management, and CICAM, clearly specifying their respective roles and responsibilities. 2. Scope of the agreement: This section defines the scope and boundaries of the investment management agreement. It specifies the types of assets to be managed in Phoenix, Arizona, which may include stocks, bonds, real estate, private equity, and other financial instruments. 3. Investment objectives and strategies: The agreement outlines the investment objectives and strategies to be pursued. It may mention targets for risk-adjusted returns, asset allocation, diversification, and other relevant investment parameters. 4. Service fees and compensation: This section covers the fees and compensation structure for the services provided by Asia Management and CICAM. It may include a combination of management fees, performance-based fees, and other charges associated with investment activities. 5. Reporting and communication: The agreement sets guidelines for regular reporting on investment performance, including the frequency and format of reports. It also specifies the channels and frequency of communication between the parties involved. 6. Risk management and compliance: The agreement addresses risk management and compliance protocols to safeguard the investment assets. It may include risk assessment methods, risk mitigation strategies, and compliance with applicable laws and regulations. Different Types of Phoenix Arizona Investment Management Agreements: 1. Fixed-term agreement: This type of agreement has a predefined duration, and the parties commit to working together for a specific period. At the end of the term, the agreement may be renewed or terminated, subject to individual preferences. 2. Open-ended agreement: Unlike a fixed-term agreement, an open-ended investment management agreement continues until either party provides notice of termination. This flexibility allows for a more indefinite partnership, subject to periodic performance evaluations and reviews. 3. Specialized investment agreement: In some cases, the agreement may be tailored to a specific investment niche or asset class, such as real estate investment, private equity investment, or socially responsible investment. These specialized agreements outline additional considerations unique to the chosen investment area. Overall, the Phoenix Arizona Investment Management Agreement is a comprehensive legal contract that provides a framework for effective investment management. Whether utilizing a fixed-term or open-ended structure, this agreement serves as a crucial tool to establish collaboration, define expectations, and ensure the prudent management of investment assets in Phoenix, Arizona.

Phoenix Arizona Investment Management Agreement between Fund, Asia Management and NICAM

Description

How to fill out Phoenix Arizona Investment Management Agreement Between Fund, Asia Management And NICAM?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Phoenix Investment Management Agreement between Fund, Asia Management and NICAM, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Phoenix Investment Management Agreement between Fund, Asia Management and NICAM.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the legality of some records.

- Check the related document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Phoenix Investment Management Agreement between Fund, Asia Management and NICAM.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Investment Management Agreement between Fund, Asia Management and NICAM, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to cope with an extremely challenging situation, we recommend using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!