The Riverside California Investment Advisory Agreement of Equity Strategies Fund, Inc. and EPSF Advisors, Inc. is a comprehensive legal document that outlines the terms and conditions between the two parties involved in the investment advisory services. Keywords: Riverside California, Investment Advisory Agreement, Equity Strategies Fund, Inc., EPSF Advisors, Inc. This agreement serves as a binding contract between Equity Strategies Fund, Inc. (ESF) and EPSF Advisors, Inc. (EPSF) in establishing a client-advisor relationship. In this agreement, ESF appoints EPSF as its investment advisor, entrusting them with the responsibility of managing and providing investment advice for the funds held by ESF. The Investment Advisory Agreement delineates the roles, responsibilities, and compensation structure of both parties involved. It highlights the various investment strategies and services that EPSF will provide to ESF, including portfolio management, investment research, risk assessment, and asset allocation, among others. These services are tailored to meet the specific investment goals and objectives of ESF. Furthermore, the agreement also outlines the investment restrictions, guidelines, and limitations that EPSF must adhere to while managing ESF's funds. These risk parameters help to ensure that the investment strategies implemented align with the overall risk tolerance and investment objectives of ESF. In addition to the standard Investment Advisory Agreement, there may be different types or variations based on the specific needs and requirements of ESF. These variations could include specialized agreements for particular asset classes or investment styles, such as equity-focused strategies, fixed-income strategies, alternative investments, or socially responsible investing. The agreement also includes provisions related to termination, dispute resolution, confidentiality, and regulatory compliance. It addresses issues such as the grounds for termination of the agreement, the process for resolving disputes, the protection of confidential information, and adherence to applicable laws and regulations governing investment advisory services. In conclusion, the Riverside California Investment Advisory Agreement of Equity Strategies Fund, Inc. and EPSF Advisors, Inc. is a vital legal document that establishes the contractual relationship and defines the terms and conditions under which EPSF will provide investment advisory services to ESF. The agreement helps ensure transparency, clarity, and alignment of interests between the two parties involved, ultimately working towards achieving ESF's investment objectives while mitigating risks.

Riverside California Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc.

Description

How to fill out Riverside California Investment Advisory Agreement Of Equity Strategies Fund, Inc. And EQSF Advisors, Inc.?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Riverside Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc., it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the recent version of the Riverside Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Riverside Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc.:

- Look through the page and verify there is a sample for your region.

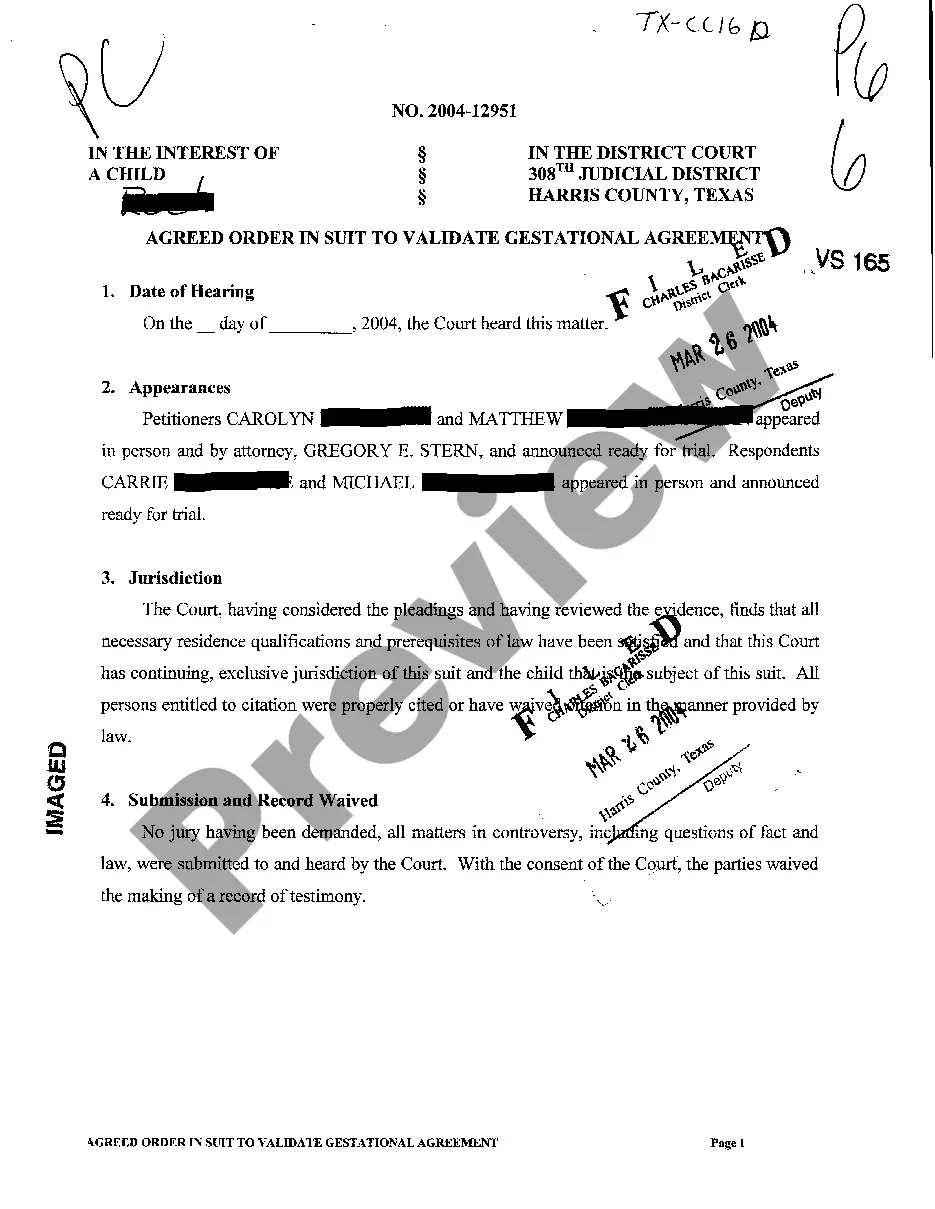

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Riverside Investment Advisory Agreement of Equity Strategies Fund, Inc. and EQSF Advisors, Inc. and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!