The Harris Texas Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust is a crucial legal document that outlines the process of reorganization and liquidation undertaken by the two entities. This agreement serves as a guide for the systematic and structured dissolution of assets, liabilities, and operations. The Harris Texas Agreement and Plan of Reorganization and Liquidation is designed to ensure the efficient handling of the reorganization and liquidation process, maximizing the value of assets while minimizing risks and liabilities. This plan is meticulously crafted to adhere to both federal and state laws, providing a solid framework for the smooth transition of affairs. Key elements included in the agreement typically encompass the following: 1. Objective and Purpose: The document lays out the primary goal and purpose of the reorganization and liquidation, emphasizing the intention to safeguard shareholder interests and optimize financial outcomes. 2. Asset Evaluation: An extensive evaluation of assets, both tangible and intangible, is conducted to determine their fair market value. This analysis plays a significant role in establishing the foundation for subsequent transactions and determining distribution priorities. 3. Debt and Liability Assessment: The plan investigates and assesses all outstanding debts, obligations, and liabilities to ensure proper identification and allocation. This step is vital to prevent any undue burden on the involved parties and to prioritize creditor settlements. 4. Distribution Strategy: The Harris Texas Agreement and Plan of Reorganization and Liquidation outlines a comprehensive strategy for the distribution of assets and liabilities among various stakeholders. It articulates the hierarchy of payment priority and the method of distribution to respective parties involved. 5. Tax Implications: Tax implications are a crucial aspect considered during the reorganization and liquidation process. The agreement addresses tax-related issues to ensure compliance with applicable tax laws and regulations. 6. Timeline and Milestones: The plan sets forth a timeline that outlines the critical milestones and key dates for the reorganization and liquidation process. This ensures that all activities are coordinated and executed within a specified timeframe. While there may not be different types of Harris Texas Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust, variations in the content may occur based on the unique circumstances and objectives of each agreement. Nevertheless, the overarching purpose remains consistent — to facilitate the organized and efficient dissolution of assets and liabilities, ultimately safeguarding the interests of all parties involved.

Harris Texas Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust

Description

How to fill out Harris Texas Agreement And Plan Of Reorganization And Liquidation By Niagara Share Corp. And Scudder Investment Trust?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Harris Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Harris Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

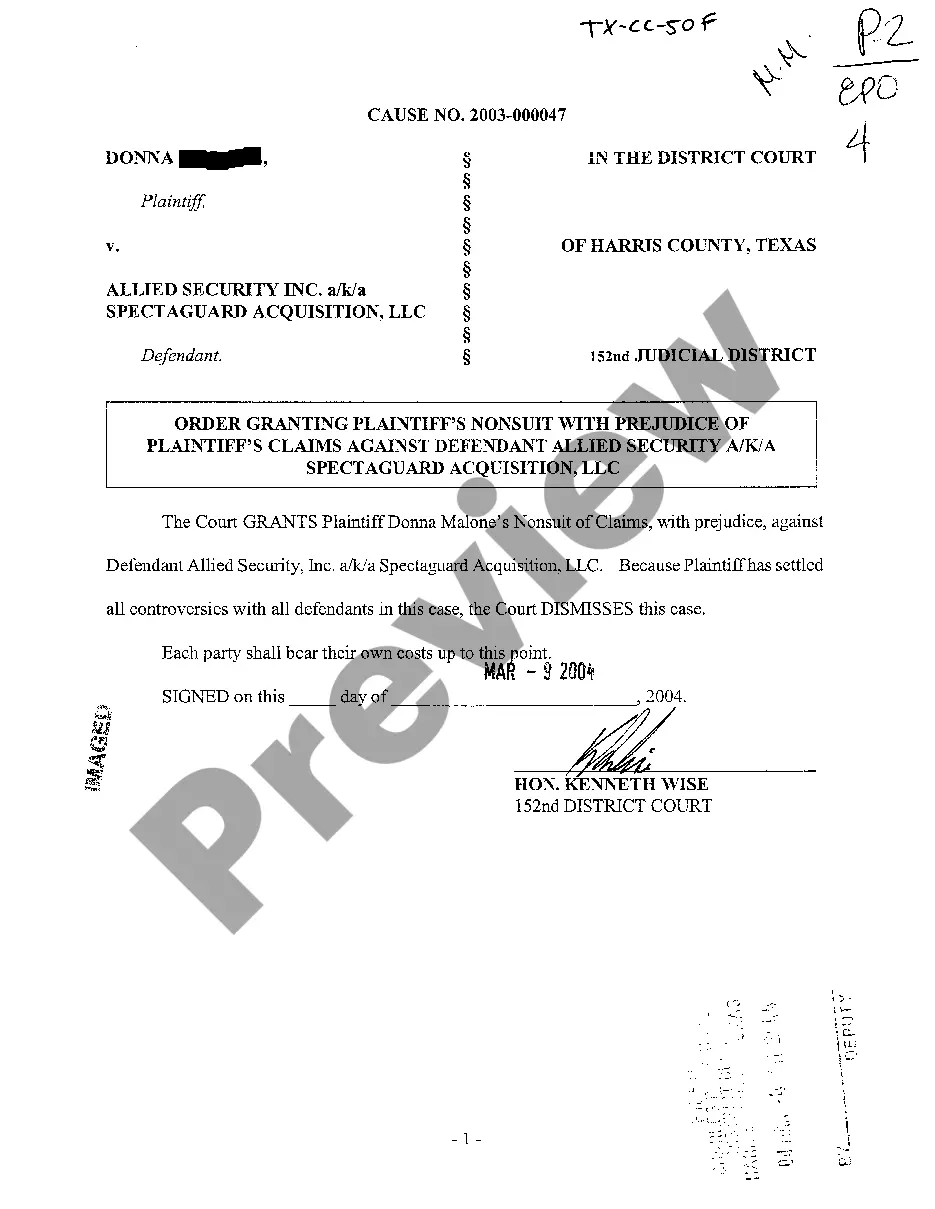

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!