Nassau New York Advisory Agreement between Real Estate Investment Trust and Corporation: A Comprehensive Guide In Nassau, New York, an Advisory Agreement between a Real Estate Investment Trust (REIT) and a corporation is a crucial legal document that establishes a partnership for the management and advisory services related to real estate investments. This agreement outlines the terms and conditions under which the REIT and the corporation will work together, ensuring a mutually beneficial relationship. To provide you with a deeper understanding, this article will discuss the key elements of a Nassau New York Advisory Agreement, while highlighting different types of such agreements. 1. Purpose: The primary objective of the Advisory Agreement is to formalize the arrangement between the REIT and the corporation, defining the scope of services to be provided. This may include strategic planning, property management, financial analysis, risk assessment, and other relevant aspects related to the corporation's real estate investments. 2. Parties: The agreement identifies the parties involved, specifically naming the REIT and the corporation. It also acknowledges the capacity of each party, distinguishing between the REIT acting as the advisor and the corporation as the client. 3. Duration: The agreement sets out the duration of the partnership between the REIT and the corporation. It may be for a specific term, such as one year, or for an indefinite period of time subject to termination clauses. 4. Compensation: The Advisory Agreement addresses the fees and compensation structure for the advisory services provided by the REIT. It outlines how and when the fees will be paid, such as a fixed monthly retainer, a percentage of assets under management, or a performance-based incentive. 5. Duties and Responsibilities: This section of the agreement details the specific duties and responsibilities of the REIT as the advisor. It may include conducting market research, property valuation, lease negotiations, financial reporting, and recommending investment strategies, among others. The corporation also has certain obligations outlined within the agreement, such as providing necessary financial information and promptly notifying the REIT of any significant changes in the business or investment objectives. 6. Liability and Indemnification: To protect both parties, the Advisory Agreement discusses the allocation of liability and indemnification provisions. It establishes limitations on liability for the advisor in the case of errors, omissions, or negligence, and may require the corporation to carry appropriate insurance coverage. 7. Termination: The agreement specifies the circumstances under which either party can terminate the advisory relationship. This includes events of breach, non-performance, changes in ownership, or the overall satisfaction of the parties involved. Termination clauses also address the notice period required and any associated penalties or monetary obligations. Types of Nassau New York Advisory Agreements: 1. General Advisory Agreement: This type of agreement encompasses a broad range of advisory services, allowing the REIT to provide comprehensive guidance on various aspects of real estate investments. 2. Property-Specific Advisory Agreement: In some cases, the corporation may require advisory services specific to a particular property or real estate project. A property-specific advisory agreement focuses solely on the management and advisory services related to that specific asset. 3. Specialized Advisory Agreement: This agreement caters to unique situations where the corporation seeks specialized expertise or advice, such as tax planning, environmental risk assessment, or regulatory compliance. The Nassau New York Advisory Agreement between a Real Estate Investment Trust and a corporation is a vital legal tool that fosters a successful partnership and ensures effective management of real estate investments. It is crucial for both parties to thoroughly review and negotiate the terms before entering into this agreement. To ensure compliance with local regulations and industry best practices, consulting legal professionals experienced in real estate advisory agreements is highly recommended.

Nassau New York Advisory Agreement between Real Estate Investment Trust and corporation

Description

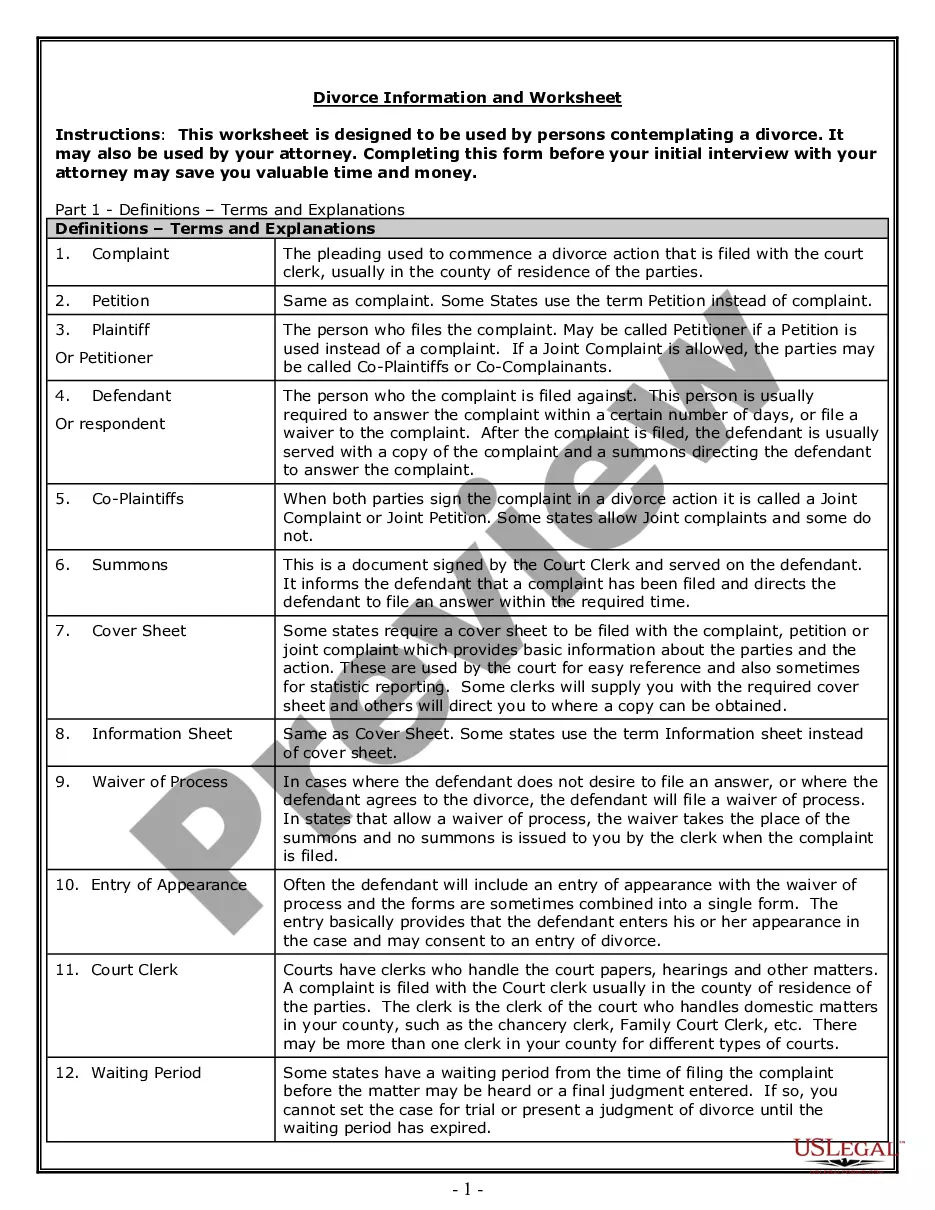

How to fill out Nassau New York Advisory Agreement Between Real Estate Investment Trust And Corporation?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Nassau Advisory Agreement between Real Estate Investment Trust and corporation.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Nassau Advisory Agreement between Real Estate Investment Trust and corporation will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Nassau Advisory Agreement between Real Estate Investment Trust and corporation:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Nassau Advisory Agreement between Real Estate Investment Trust and corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!