Kings New York Option to Purchase Common Stock refers to a financial instrument that grants an individual or entity the right, but not the obligation, to purchase shares of common stock in the company Kings New York. This option allows investors to acquire ownership in the company by buying its common stock at a predetermined price within a specified period. The Kings New York Option to Purchase Common Stock offers investors flexibility and potential profit, as they can benefit from the future rise in the stock price if it exceeds the predetermined price. It is an attractive investment tool for those who believe in the long-term growth prospects of Kings New York. There may be different types of Kings New York Option to Purchase Common Stock. These variations can include different exercise prices, expiration dates, and terms and conditions. Each type of option may have its own set of advantages and risks, catering to the specific needs of investors. Investors interested in Kings New York Option to Purchase Common Stock should carefully consider the terms and conditions of the option agreement, including the exercise price, expiration date, and any additional provisions. It is important to assess the potential risks associated with the investment, such as market volatility and the performance of Kings New York. With the Kings New York Option to Purchase Common Stock, investors can participate in the company's growth and potentially benefit from a rise in its stock price. However, it is essential to conduct thorough research and analysis to make informed investment decisions. Consulting with a financial advisor can also provide valuable guidance to understand the potential benefits and risks associated with this type of investment. In summary, Kings New York Option to Purchase Common Stock is a financial instrument that grants the right to buy common stock in Kings New York at a predetermined price within a specified period. It offers investors the opportunity to participate in the company's growth and potentially profit from a rise in the stock price. Different types of options may be available, each with its own terms and conditions. Careful consideration of the option agreement and potential risks is crucial before making any investment decisions.

Kings New York Option to Purchase Common Stock

Description

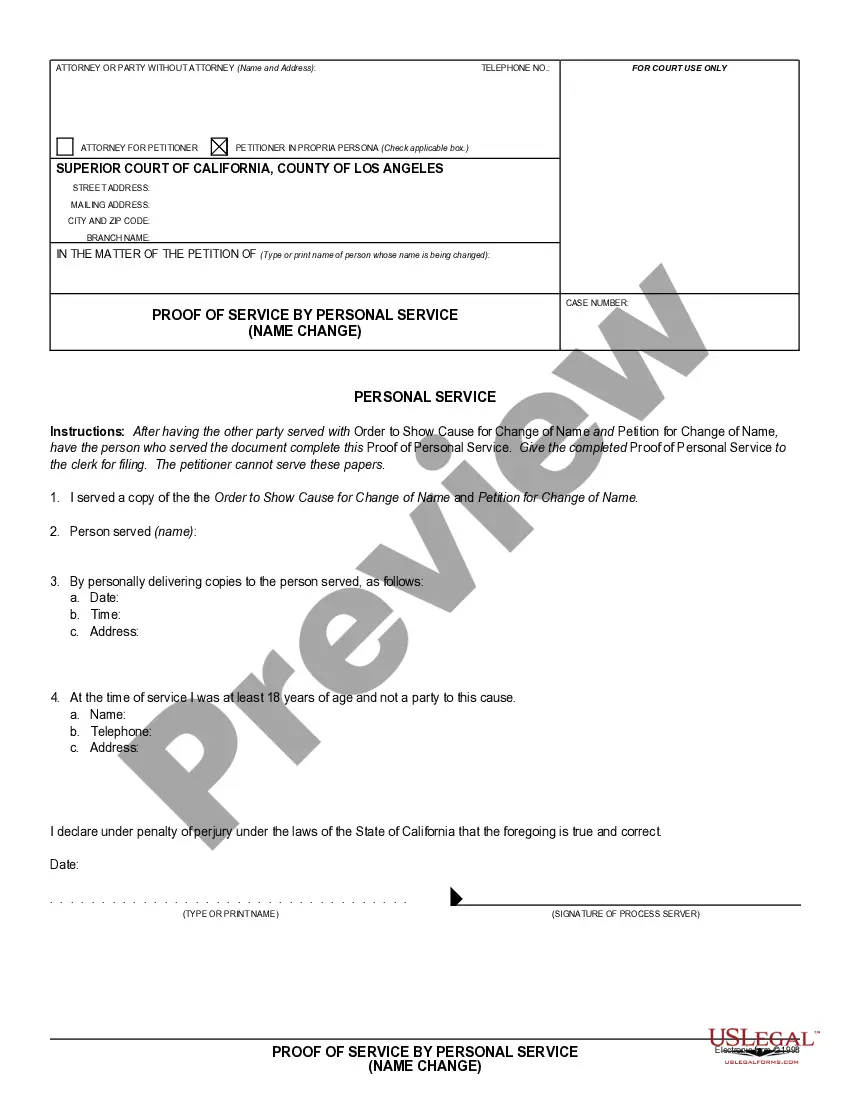

How to fill out Kings New York Option To Purchase Common Stock?

Drafting papers for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Kings Option to Purchase Common Stock without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Kings Option to Purchase Common Stock by yourself, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Kings Option to Purchase Common Stock:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

Income Tax Act S. When your options are treated as capital gains, their disposition is reported on Schedule 3 Part 3, where publicly traded shares are reported. Gains or losses realized by a writer (seller) of naked (uncovered) options are normally treated as income.

Key Takeaways Purchase rights might allow shareholders to buy at a below-market price. Options contracts are traded on exchanges and give holders the right, but not the obligation, to buy or sell a security.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the exercise or strike price. You take actual ownership of granted options over a fixed period of time called the vesting period. When options vest, it means you've earned them, though you still need to

Your W-2 includes income from any other compensation sources you may have, such as stock options, restricted stock, restricted stock units, employee stock purchase plans, and cash bonuses.

Common stock options are merely options to purchase stock at a later date in time. Specifically, options are those sold by one party to another party that allow the potential purchaser to exercise the right to buy the options at a previously agreed price.

Background. Under the employee stock option rules in the Income Tax Act, employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid. Provided certain conditions are met, an employee can claim an offsetting deduction equal to 50% of the taxable benefit.

Open market options When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040.

Shares give the holder immediate ownership of a stake in the company. Options are the promise of ownership of a stake in the company at a fixed point in the future, at a fixed price. Option holders only become shareholders when their options are exercised and have converted into shares.

A stock option is the contractual right to purchase shares of a company's stock at a specified price during a specified period. An option is granted with a vesting schedule (typically 4 years) and an exercise price that is generally equal to the fair market value of the stock at the time of the grant.

After you exercise an option or receive free stocks, your employer should note the value of the benefits you received, and he should report that amount in box 14 of your T4 slip.