The Maricopa Arizona Agreement and Plan of Merger is a significant legal document outlining the terms and conditions for the merger between The News Corporation Ltd, HMC Acquisition, and Heritage Media. This merger is expected to have far-reaching implications and is of great significance in the media and entertainment industry. The Maricopa Arizona Agreement and Plan of Merger represent the consolidation of resources, assets, and operations of these three prominent entities. The agreement aims to outline the specifics of the merger, including the exchange ratio for the stockholders, the composition of the new company's board of directors, and other vital procedural and financial aspects of the merger. Key stakeholders will be interested in this agreement as it contains crucial information about the future direction of the involved companies. Investors, employees, shareholders, and consumers will closely scrutinize the document to understand the potential impact on their interests, financial positions, and market value. This merger agreement may also encompass different types of mergers, such as horizontal, vertical, or conglomerate mergers, depending on the nature of the businesses involved. Each type of merger may have unique provisions that reflect the specific needs and goals of the entities merging. For example, a horizontal merger between The News Corporation Ltd, HMC Acquisition, and Heritage Media would bring together companies operating in the same industry or market segment. This consolidation may lead to increased market dominance, economies of scale, and enhanced competitiveness, offering benefits to the merging entities and potentially altering the competitive landscape of the media industry. Alternatively, a vertical merger may involve the integration of companies operating at different stages of the media production and distribution process. Such a merger could lead to enhanced efficiencies, improved supply chain management, and increased value creation for the merged entity. Lastly, a conglomerate merger might involve the merging of companies from unrelated industries, potentially expanding the scope and diversification of the new company's operations. In summary, the Maricopa Arizona Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media is a complex and comprehensive legal document which outlines the terms and conditions for the merger of these significant entities. It provides crucial information for stakeholders and may encompass different types of mergers, depending on the specific nature and objectives of the companies involved.

Maricopa Arizona Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media

Description

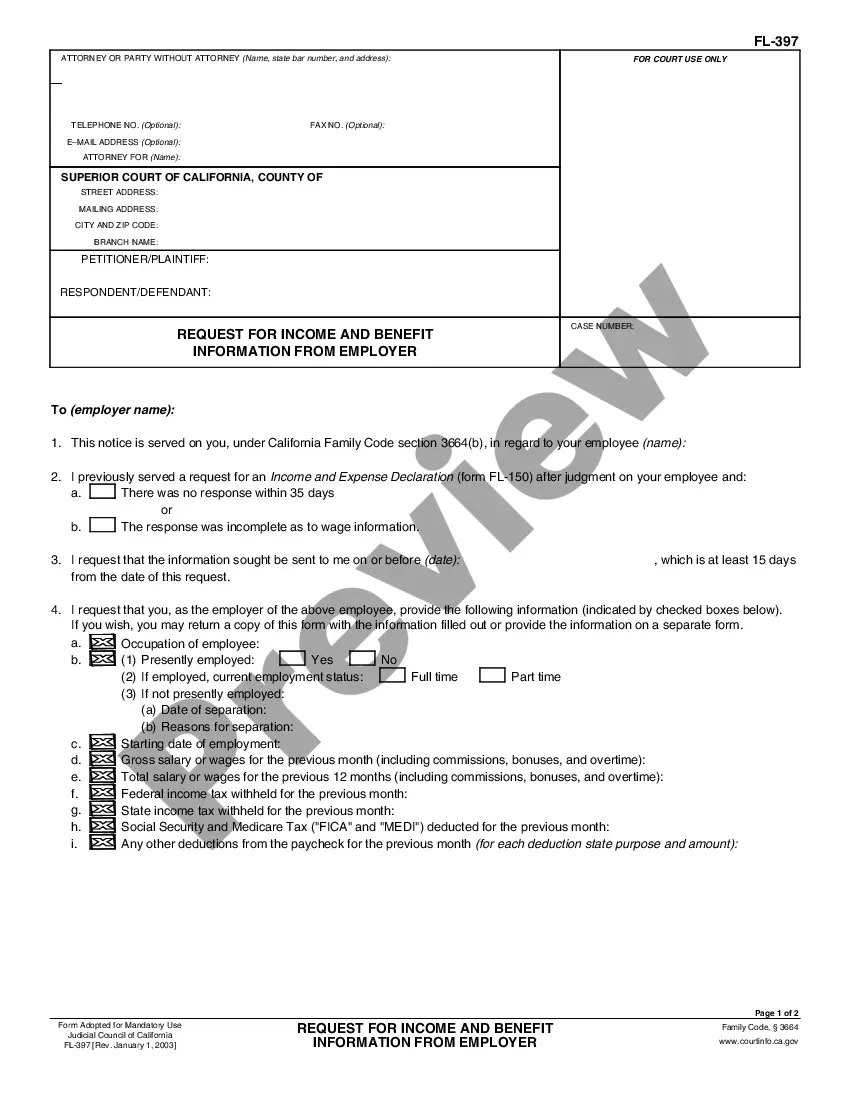

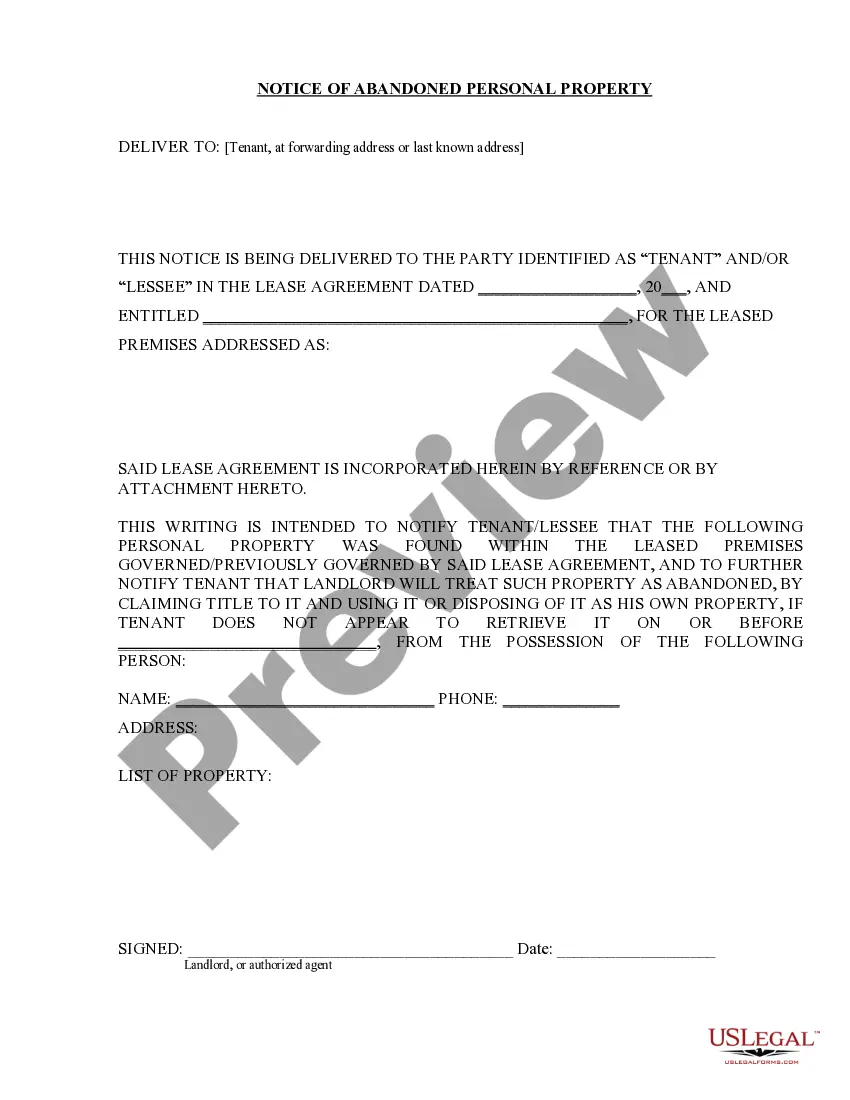

How to fill out Maricopa Arizona Agreement And Plan Of Merger By The News Corporation Ltd, HMC Acquisition, And Heritage Media?

Do you need to quickly create a legally-binding Maricopa Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media or maybe any other document to take control of your personal or business matters? You can go with two options: hire a legal advisor to write a valid document for you or create it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant document templates, including Maricopa Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Maricopa Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Maricopa Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The vote for a merger is typically a vote requiring the approval of either a majority or two-thirds of all shares issued and outstanding for the company.

Market estimates place a merger's timeframe for completion between six months to several years. In some instances, it may take only a few months to finalize the entire merger process. However, if there is a broad range of variables and approval hurdles, the merger process can be elongated to a much longer period.

In a stock sale, the agreement is often called the merger agreement, while in an asset sale, it's often called an asset purchase agreement. The agreement lays out the terms of the deal in more detail. For example, the LinkedIn merger agreement details: Conditions that would trigger the break-up fee.

8 Step in the Mergers and Acquisitions (M&A) Process #1 Developing Strategy.#2 Identifying and Contacting Targets.#3 Information Exchange.#4 Valuation and Synergies.#5 Offer and Negotiation.#6 Due Diligence.#7 Purchase Agreement.#8 Deal Closure and Integration.

Merger transactions typically require approval of the boards of directors of the constituent companies and a vote of the shareholders of the constituent companies.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. Negotiating a Merger Agreement. Price and Consideration. Holdback or Escrow. Representations and Warranties.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

How to Prepare for and Handle a Merger or Acquisition Step 1: Meet with the Executive Board to Set Goals.Step 2: Nominate Members of a "Transition Team"Step 3: Conduct Due Diligence or "Cultural Compatibility Assessment"Step 4: Report Findings to the Executive Board.Step 5: Prevent Loss of Productivity.