The Kings New York Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank is a significant legal document that outlines the terms and conditions of a merger between these financial institutions. This merger aims to consolidate their resources and expertise, thereby creating a stronger entity that can better serve their customers and gain a competitive advantage in the market. Here are some key details about the Kings New York Agreement and Plan of Merger: 1. Purpose: The main objective of this agreement is to merge Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank into a single entity. The merger is intended to streamline operations, enhance financial stability, and maximize shareholder value. 2. Merger Structure: The document provides a detailed description of the structure and mechanics of the merger. It outlines the exchange ratio and other financial terms, illustrates the treatment of shares, and addresses any potential adjustments or contingencies. 3. Legal and Regulatory Compliance: The agreement emphasizes compliance with applicable laws, regulations, and governmental approvals required for the merger. It ensures that all necessary legal procedures are followed, and the merger is executed in accordance with local and federal regulations. 4. Governance and Management: The merger plan defines the governance structure of the newly formed entity. It establishes the composition of the board of directors, outlines any changes to executive positions, and determines how key decisions will be made during the period of transition. 5. Employee Matters: The agreement addresses employee-related matters, including the treatment of employee benefits, retention programs, and potential redundancies. It aims to minimize disruption to employees and facilitate a seamless integration process. 6. Financial Considerations: The financial aspects of the merger, such as the valuation of assets and liabilities, are thoroughly outlined in the agreement. It also addresses any potential tax implications and provides guidance on accounting treatment. Other types of King New York Agreements and Plan of Mergers by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank may include variations specific to different mergers or acquisitions they undertake in the future. The specific terms and conditions of each merger agreement may differ, depending on the entities involved, market conditions, and strategic goals.

Kings New York Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

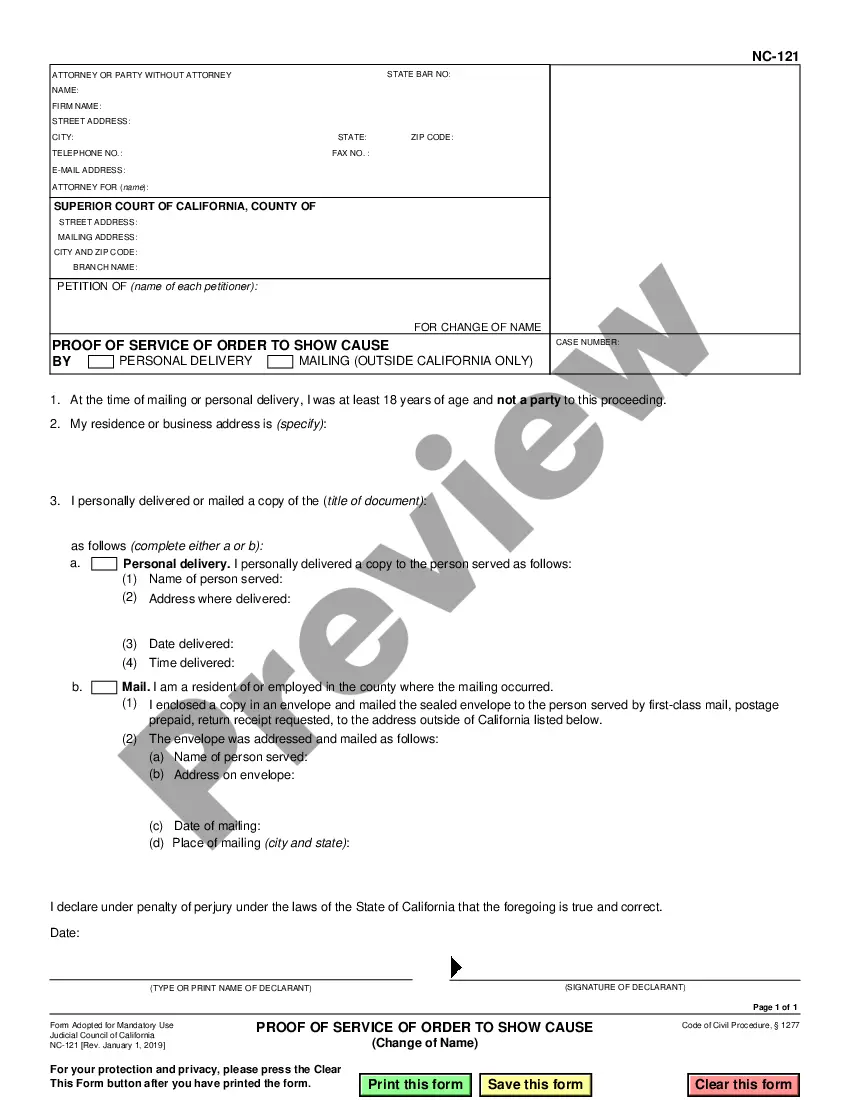

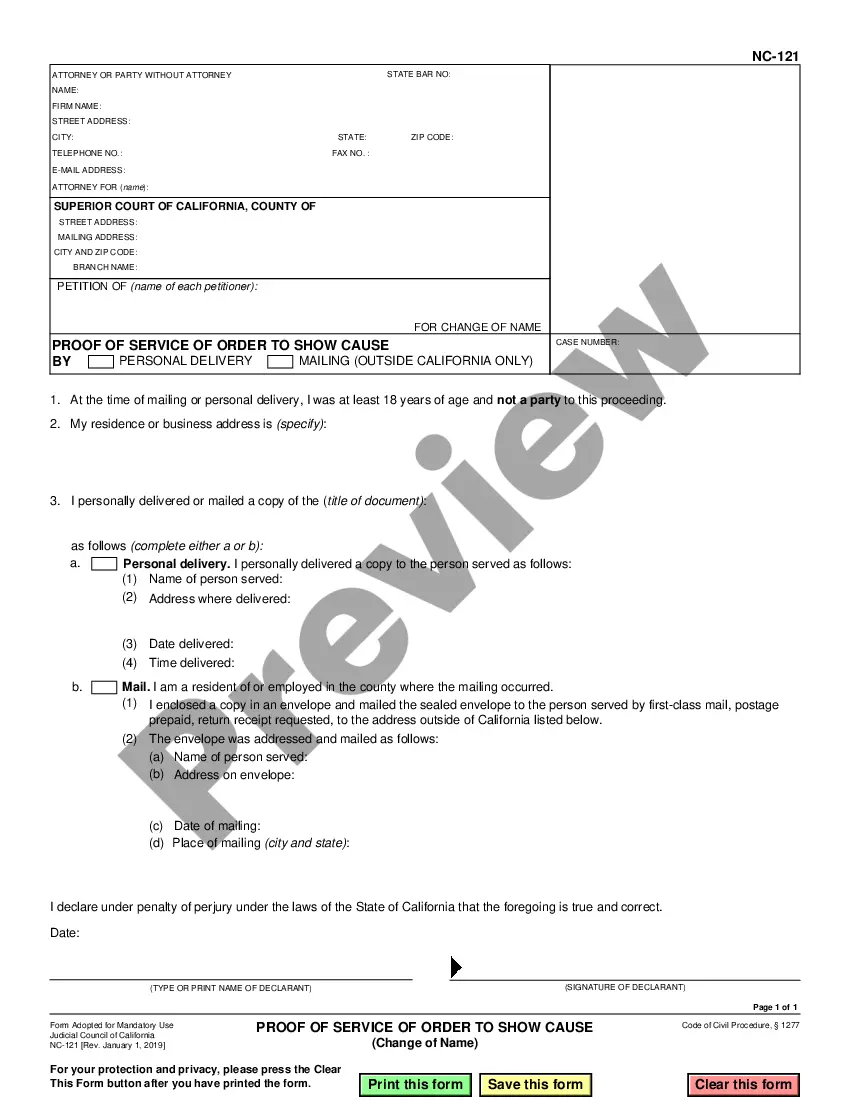

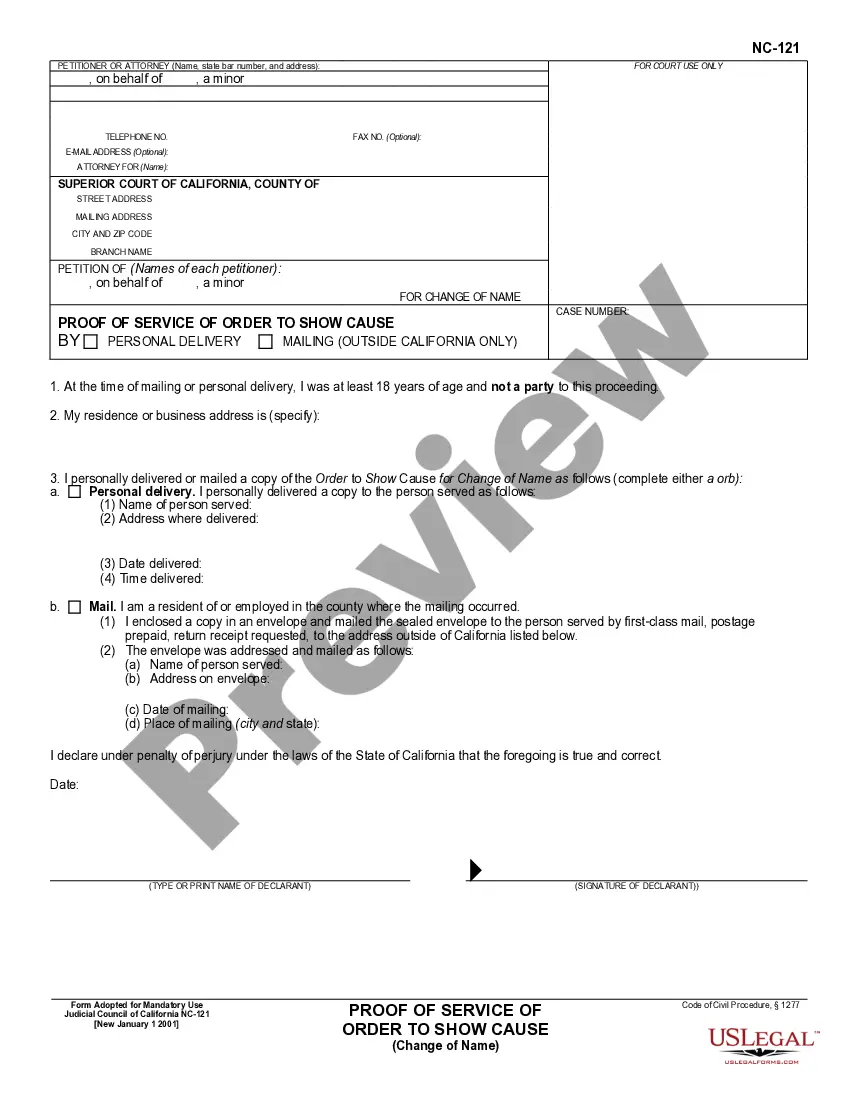

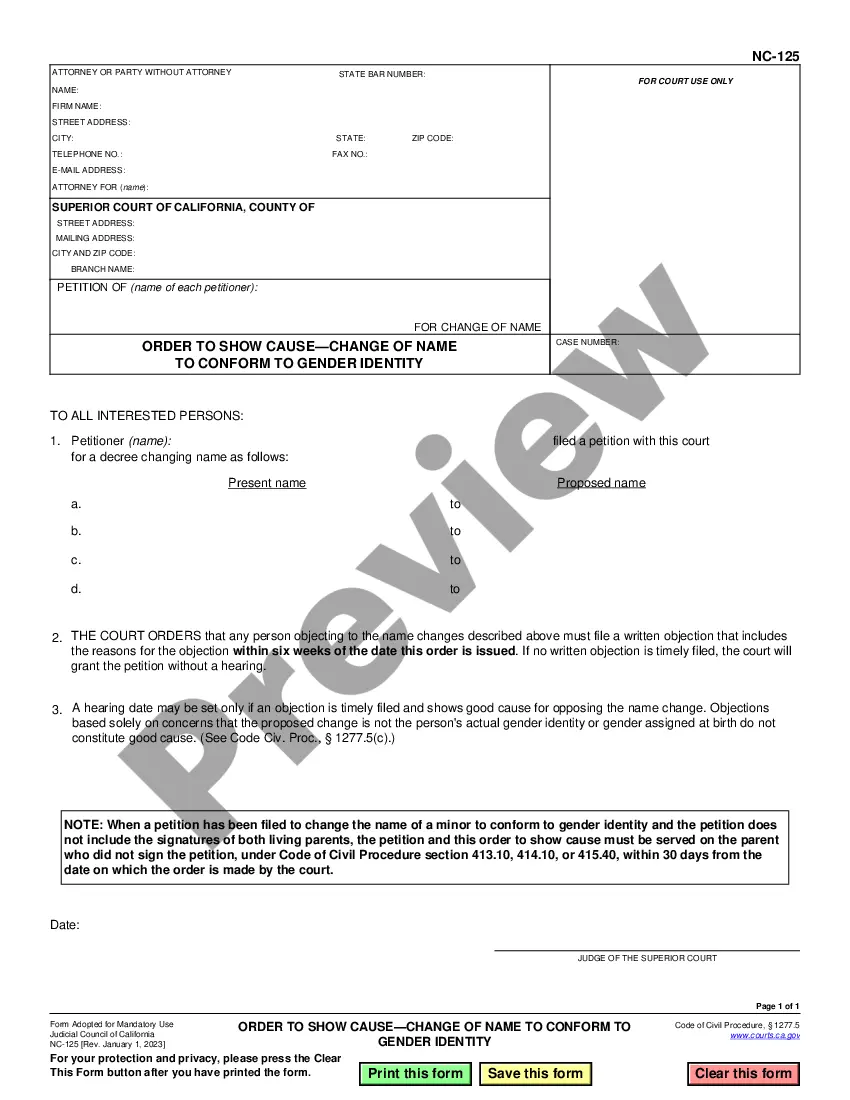

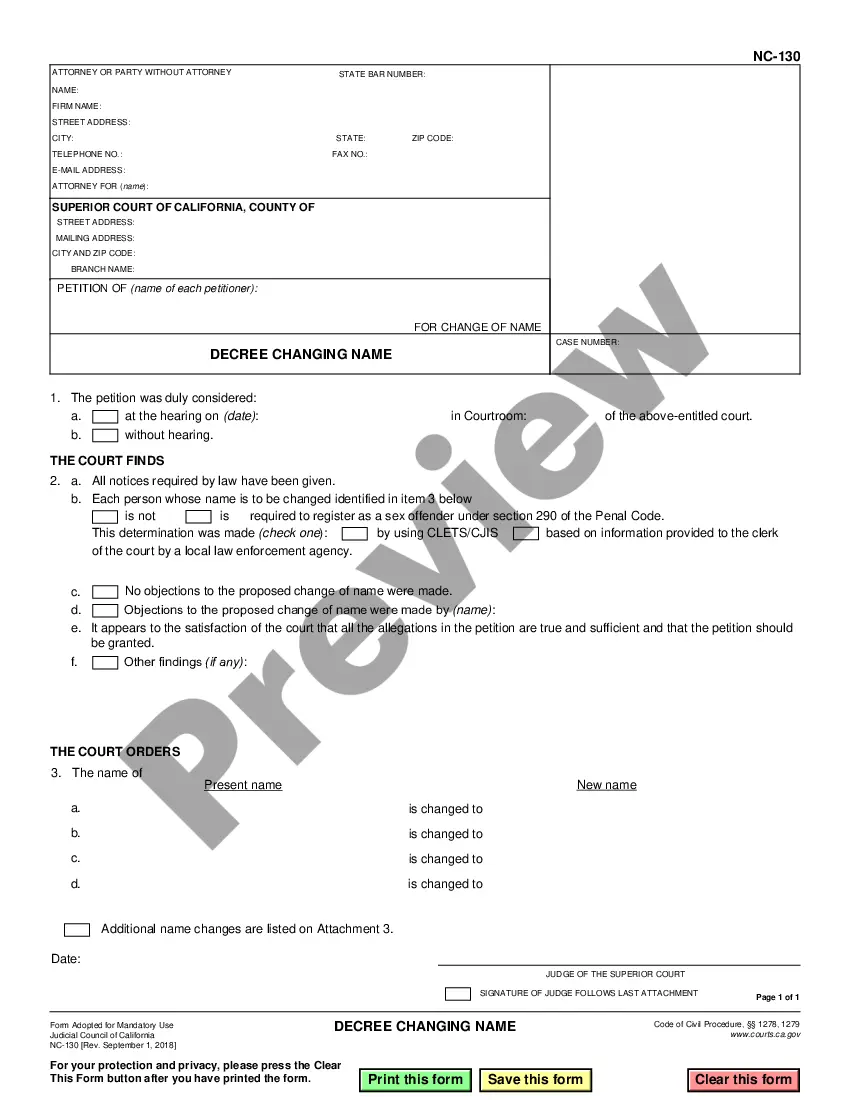

How to fill out Kings New York Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

Are you looking to quickly create a legally-binding Kings Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank or maybe any other document to take control of your personal or business matters? You can select one of the two options: contact a legal advisor to draft a valid paper for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Kings Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Kings Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank is adapted to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Kings Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the documents we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!