Los Angeles California Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank is an important legal document outlining the terms and conditions of a merger between the mentioned financial institutions. This agreement serves as a blueprint for the consolidation process and helps streamline the transition. The Los Angeles California Agreement and Plan of Merger is designed to ensure a smooth transition of assets, liabilities, and operations from the merging entities. It sets out various provisions such as the exchange ratio for shares, governance structure of the newly merged entity, treatment of employees, and regulatory approvals required. Under this agreement, Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank come together to form a stronger and more robust financial institution. The merger aims to enhance their collective capabilities, expand market reach, and create synergies that will benefit both customers and shareholders. By merging, the institutions consolidate their financial resources, expertise, and customer base. This union enables them to leverage economies of scale, reduce operational redundancies, and optimize their offerings to better serve the Los Angeles community. The Los Angeles California Agreement and Plan of Merger may encompass different types based on the specific details and objectives of the merging banks. Some potential variations could include: 1. Merger for Market Expansion: In this type of agreement, the banks aim to expand their footprint in the Los Angeles market by combining their resources and customer bases. This merger allows them to tap into new segments and gain a competitive advantage. 2. Merger for Diversification: Here, the merging banks seek to diversify their product offerings and customer base. They may have complementary strengths in different areas such as commercial banking, retail banking, or wealth management. By merging, they can combine these strengths to provide a more comprehensive range of services to their existing and potential customers. 3. Merger for Increased Financial Stability: This type of agreement focuses on enhancing financial stability and resilience in the face of economic uncertainties. Through the merger, the banks aim to strengthen their capital base, improve risk management practices, and achieve a more sustainable financial position. The Los Angeles California Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank represents a strategic move towards growth, innovation, and increased competitiveness in the financial services industry. The merging entities endeavor to create a stronger institution capable of meeting the evolving needs of the Los Angeles community while delivering enhanced value to their stakeholders.

Los Angeles California Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

How to fill out Los Angeles California Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Los Angeles Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Los Angeles Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank from the My Forms tab.

For new users, it's necessary to make some more steps to get the Los Angeles Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank:

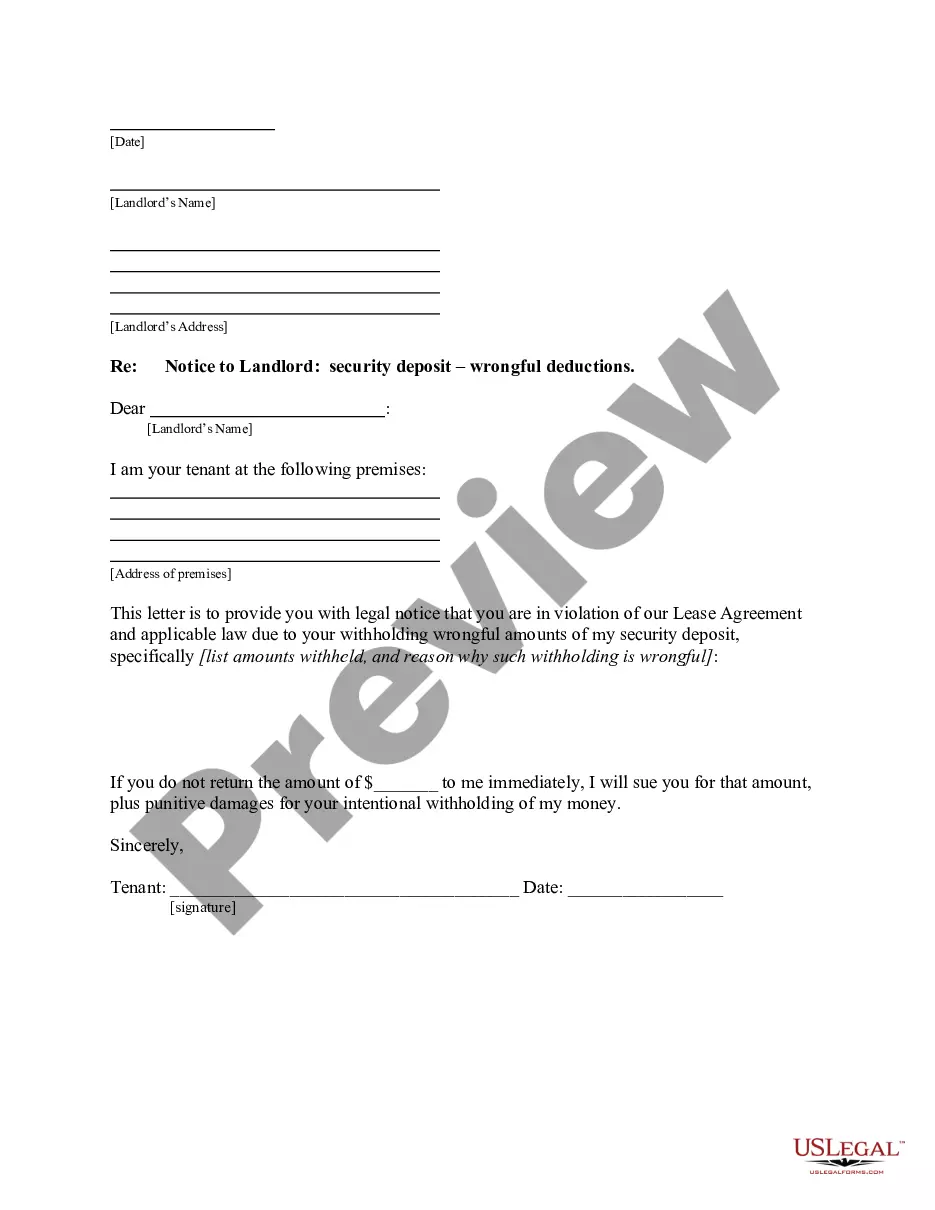

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!