The Maricopa Arizona Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank is a legal document that outlines the terms and conditions of the merger between these financial entities. This merger is a significant step towards consolidation in the banking and financial services industry in Maricopa, Arizona, benefiting both the involved companies and their customers. The agreement aims to combine the expertise, resources, and customer bases of Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank to create a stronger and more competitive financial institution. This merger will result in the formation of a new entity, which is expected to provide enhanced banking services, increased access to financial products, and improved customer experiences. The Maricopa Arizona Agreement and Plan of Merger details important aspects such as the exchange ratio of shares, the governance structure of the new entity, the composition of the board of directors, and the integration of operations and systems. It also addresses any potential legal or regulatory hurdles that might arise during the merger process, ensuring compliance with all applicable laws and regulations. Additionally, the agreement may include provisions catering to the interests of shareholders, employees, and customers of the merging entities. These provisions aim to protect the rights and welfare of stakeholders by addressing matters related to shareholding, employee retention, customer accounts, and service continuity. They also outline the financial terms of the merger, including any cash components, dividend payouts, or stock options. It is important to note that there may be different types or versions of the Maricopa Arizona Agreement and Plan of Merger, as these documents can be customized based on the specific requirements and circumstances of each merger. Some examples of these variations could include agreements that cater to cross-border mergers, mergers involving subsidiary companies, or mergers with specific sector-focused institutions such as insurance companies or investment firms. In conclusion, the Maricopa Arizona Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank represents a strategic consolidation of resources and expertise in the financial industry. This merger aims to create a stronger financial institution capable of delivering improved banking services and greater value to its customers in Maricopa, Arizona, and potentially beyond.

Maricopa Arizona Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

How to fill out Maricopa Arizona Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Maricopa Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Maricopa Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Maricopa Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank:

- Check the content of the page you’re on.

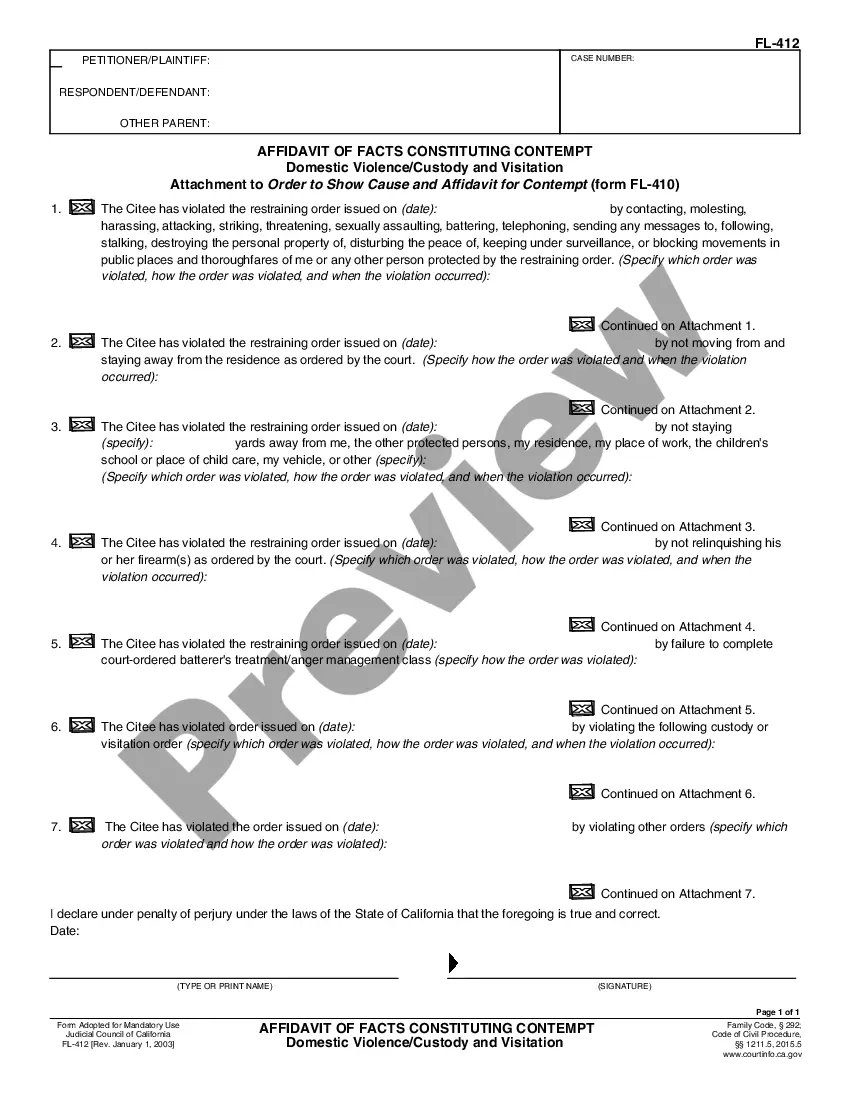

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Maricopa Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!