Title: Cook Illinois Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders — Detailed Overview Introduction: In this detailed description, we will explore the Cook Illinois Amended Stock Exchange Agreement involving SJW Corp, Roscoe Moss Co, and RMC Shareholders. This agreement holds substantial importance in the financial landscape, warranting an in-depth analysis of its implications and key components. 1. Definition and Purpose: The Cook Illinois Amended Stock Exchange Agreement is a legally binding contract that outlines the terms for the exchange of stocks between SJW Corp, Roscoe Moss Co, and RMC Shareholders. The purpose of this agreement is to facilitate a mutually beneficial transaction, enabling the parties to pool their resources and enhance their market presence. 2. Key Parties Involved: a. SJW Corp: SJW Corp is one of the key stakeholders in the Cook Illinois Amended Stock Exchange Agreement. They are a leading water utility company, publicly traded on a stock exchange, and actively involved in water supply and related services. b. Roscoe Moss Co: Roscoe Moss Co, another significant player in the agreement, specializes in manufacturing and distributing water well screens and casing systems. c. RMC Shareholders: RMC Shareholders represent the collective group of shareholders associated with Roscoe Moss Co. 3. Background and Rationale: The Cook Illinois Amended Stock Exchange Agreement arises from the strategic decision made by SJW Corp to expand its business operations. Recognizing the synergies between water utility services and well screen manufacturing, SJW Corp sought a partnership with Roscoe Moss Co to capitalize on its expertise. To accomplish this, SJW Corp negotiated the agreement with RMC Shareholders, allowing for stock exchange. 4. Stock Exchange Terms: a. Share Ratio: The agreement establishes a predetermined share ratio that dictates the number of Roscoe Moss Co shares exchanged for SJW Corp shares and vice versa. b. Valuation Mechanism: A mutually agreed-upon valuation mechanism is implemented to determine the fair value of the shares involved. c. Premiums: The agreement may outline any premiums or adjustments to be made based on specific circumstances, such as extraordinary events or market fluctuations. 5. Amendment Provisions: The Cook Illinois Amended Stock Exchange Agreement may contain provisions allowing for subsequent amendments. These provisions facilitate the modification of terms in the agreement to adapt to changing circumstances, ensuring fairness and continued alignment of interests among the parties involved. 6. Regulatory and Shareholder Approvals: Compliance with applicable laws and obtaining necessary regulatory approvals, such as those from federal or state agencies, may be a vital prerequisite for executing the agreement. Additionally, the consent and approval of shareholders from both SJW Corp and Roscoe Moss Co are typically required. Conclusion: The Cook Illinois Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders represents a strategic partnership aiming to leverage the strengths of each party involved. By conducting a detailed analysis of this agreement, one can better understand the motivations, terms, and potential outcomes that will drive the development of these companies in the future.

Cook Illinois Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

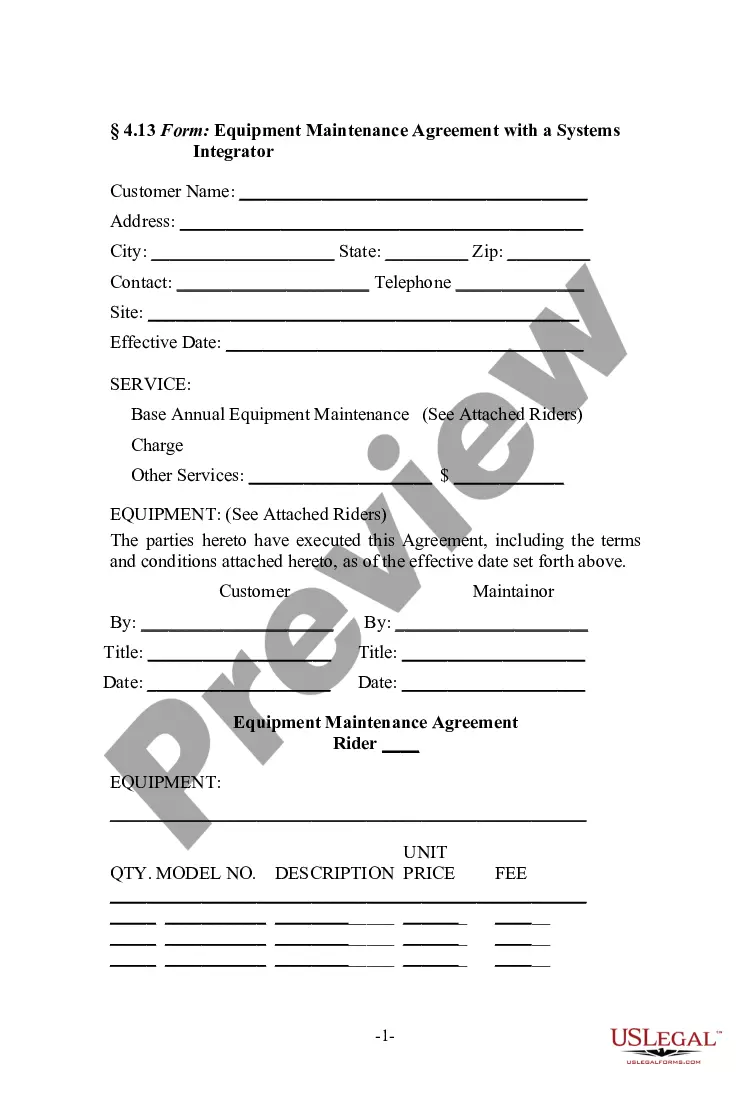

How to fill out Cook Illinois Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Cook Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Cook Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Cook Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!