The Hennepin Minnesota Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders is a significant legal document that outlines the terms, provisions, and obligations of the stock exchange agreement between these parties. This detailed agreement aims to facilitate the acquisition and exchange of shares between SJW Corp, Roscoe Moss Co, and RMC Shareholders, enabling them to consolidate operations and enhance shareholder value. The Hennepin Minnesota Amended Stock Exchange Agreement encompasses various crucial aspects, ensuring a comprehensive framework for the establishment and execution of the stock exchange process. It includes detailed clauses related to the share valuation mechanism, transaction timeline, regulatory compliance, and post-merger integration strategies. This agreement aims to provide a clear roadmap and mechanism to govern the exchange of securities and other assets involved in the transaction. By engaging in this Amended Stock Exchange Agreement, the parties involved seek to leverage their respective strengths, synergies, and resources to create a more robust and competitive business entity. They also aspire to maximize operational efficiencies, minimize duplicative costs, and streamline processes through this consolidation. The Hennepin Minnesota Amended Stock Exchange Agreement may have different types depending on the specific terms, conditions, and arrangements agreed upon by SJW Corp, Roscoe Moss Co, and RMC Shareholders. These variations may include modifications in the exchange ratio, transfer of specific assets or subsidiaries, capital structure adjustments, or other additional provisions relevant to the unique circumstances of the parties involved. Overall, the Hennepin Minnesota Amended Stock Exchange Agreement represents a milestone in the business strategies of SJW Corp, Roscoe Moss Co, and RMC Shareholders. Through this agreement, they aim to unlock synergies, enhance competitiveness, and ultimately create long-term value for their shareholders and stakeholders alike.

Hennepin Minnesota Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

How to fill out Hennepin Minnesota Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Hennepin Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Hennepin Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed from the My Forms tab.

For new users, it's necessary to make several more steps to get the Hennepin Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed:

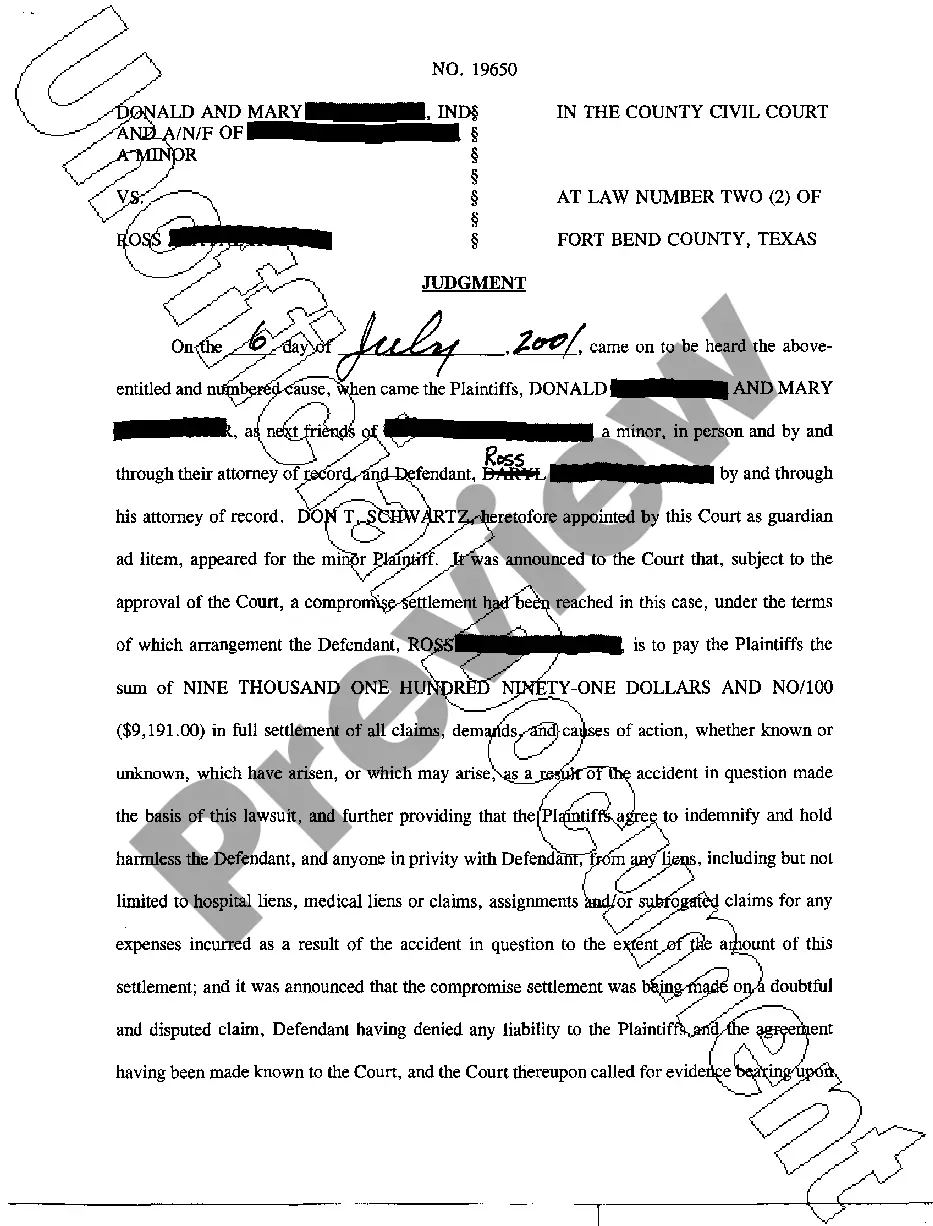

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!