The Kings New York Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders — Detailed is a significant contractual agreement that has far-reaching implications in the business world. This agreement outlines the specific terms and conditions governing the stock exchange between the three entities involved, SJW Corp, Roscoe Moss Co, and RMC Shareholders. The main purpose of this detailed agreement is to modify the existing stock exchange arrangement between the parties, bringing about certain amendments that address various aspects related to the transaction. Through this agreement, the parties aim to establish a clear and concise framework for the exchange of stocks, ensuring transparency, fairness, and legal compliance throughout the process. One type of amendment that may be outlined in the Kings New York Amended Stock Exchange Agreement is the revision of the share exchange ratio. This ratio determines how many shares of the acquiring company (SJW Corp) will be issued in exchange for each share of the target company (Roscoe Moss Co and RMC Shareholders). This ratio is crucial as it determines the ownership percentage of the shareholders in the new entity, post-merger or acquisition. Another key aspect that may be covered in this detailed agreement is the modification of board composition and governance structure. It may involve defining the number of directors from each company that will be appointed to the newly formed entity's board of directors. These changes aim to ensure effective decision-making, representation, and alignment of interests between SJW Corp, Roscoe Moss Co, and RMC Shareholders. Furthermore, the detailed agreement may also address issues related to the treatment of minority shareholders, protections for existing employees, and any conditions or obligations that need to be fulfilled before the completion of the stock exchange. These provisions aim to safeguard the interests of all parties involved and provide a comprehensive framework for the smooth execution of the transaction. In conclusion, the Kings New York Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders — Detailed encompasses various crucial aspects of the stock exchange between the parties. It focuses on modifying the existing arrangement and ensures fair treatment and clear guidelines for all stakeholders. Through this comprehensive agreement, SJW Corp, Roscoe Moss Co, and RMC Shareholders aim to achieve a successful and mutually beneficial stock exchange, leading to enhanced shareholder value and strengthened market presence.

Kings New York Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

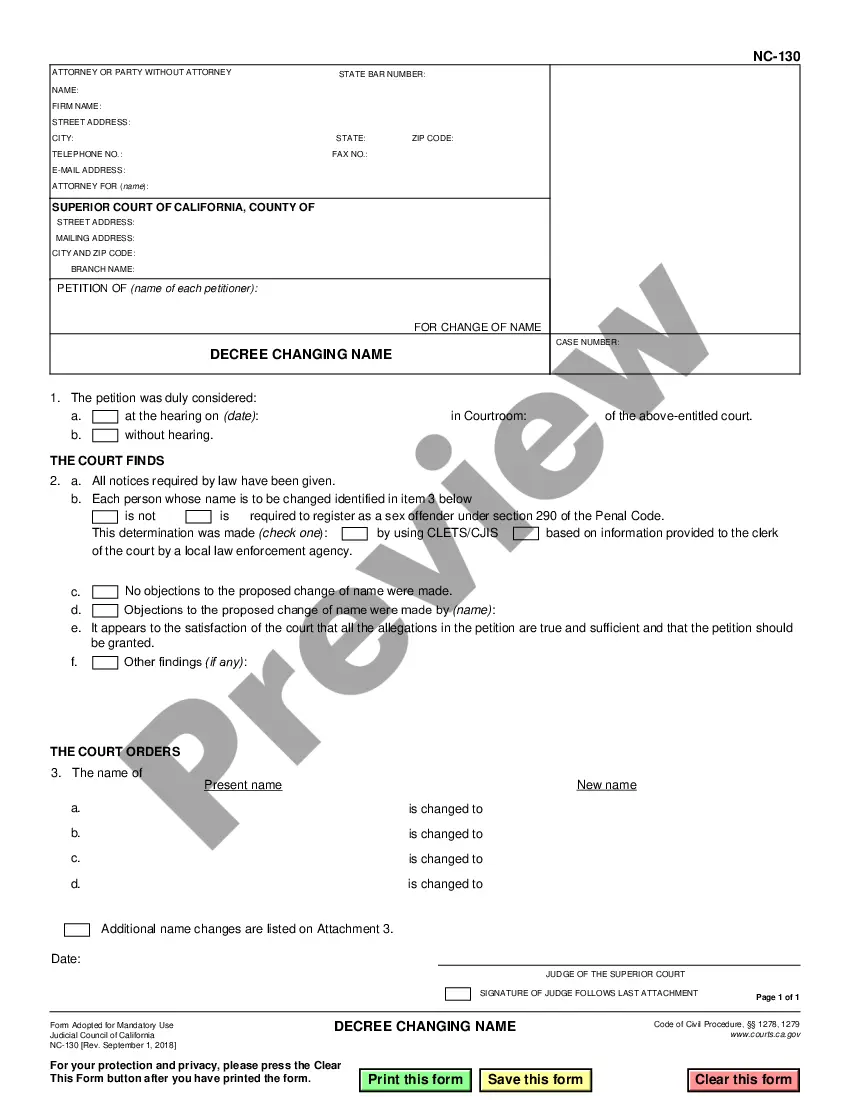

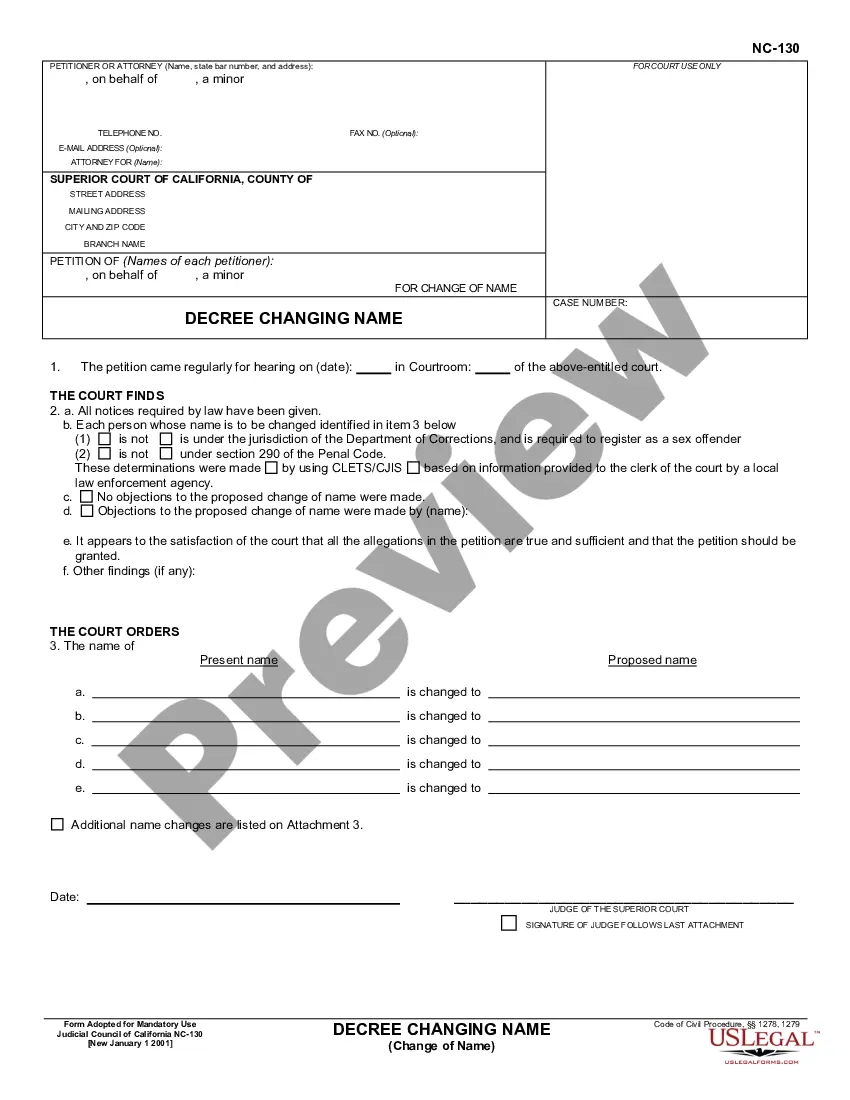

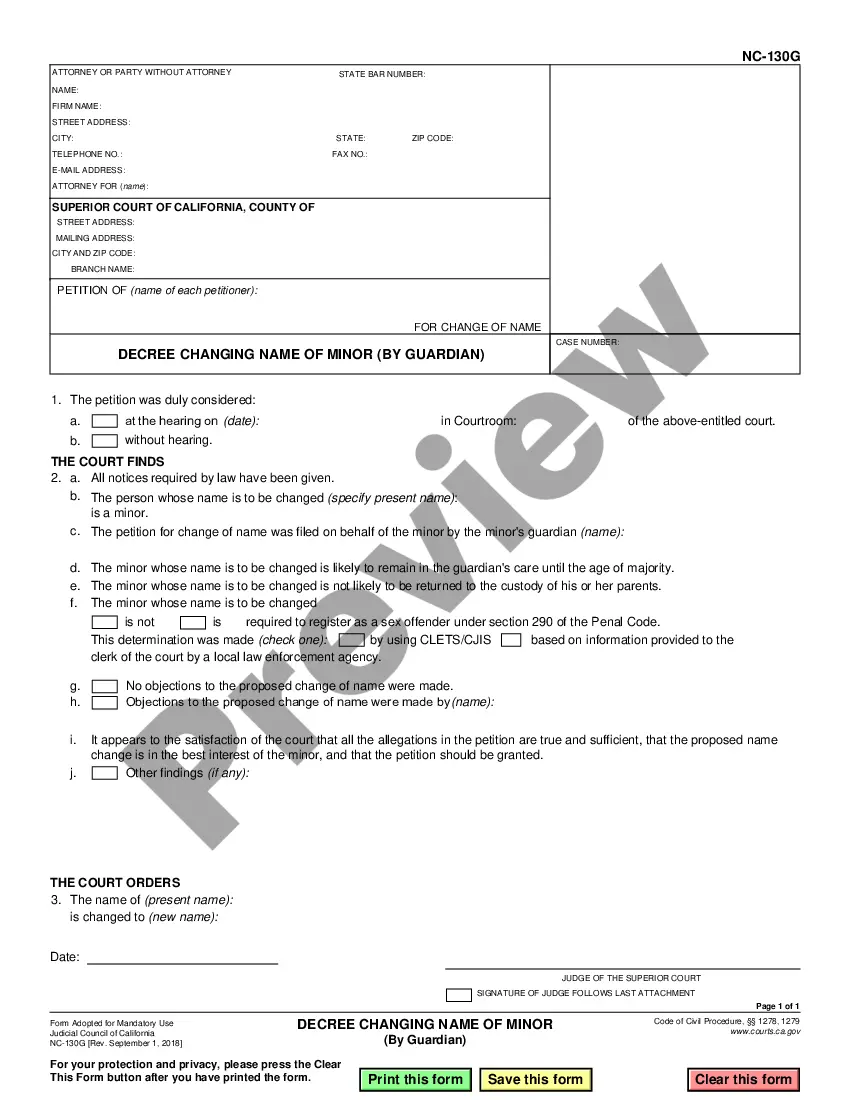

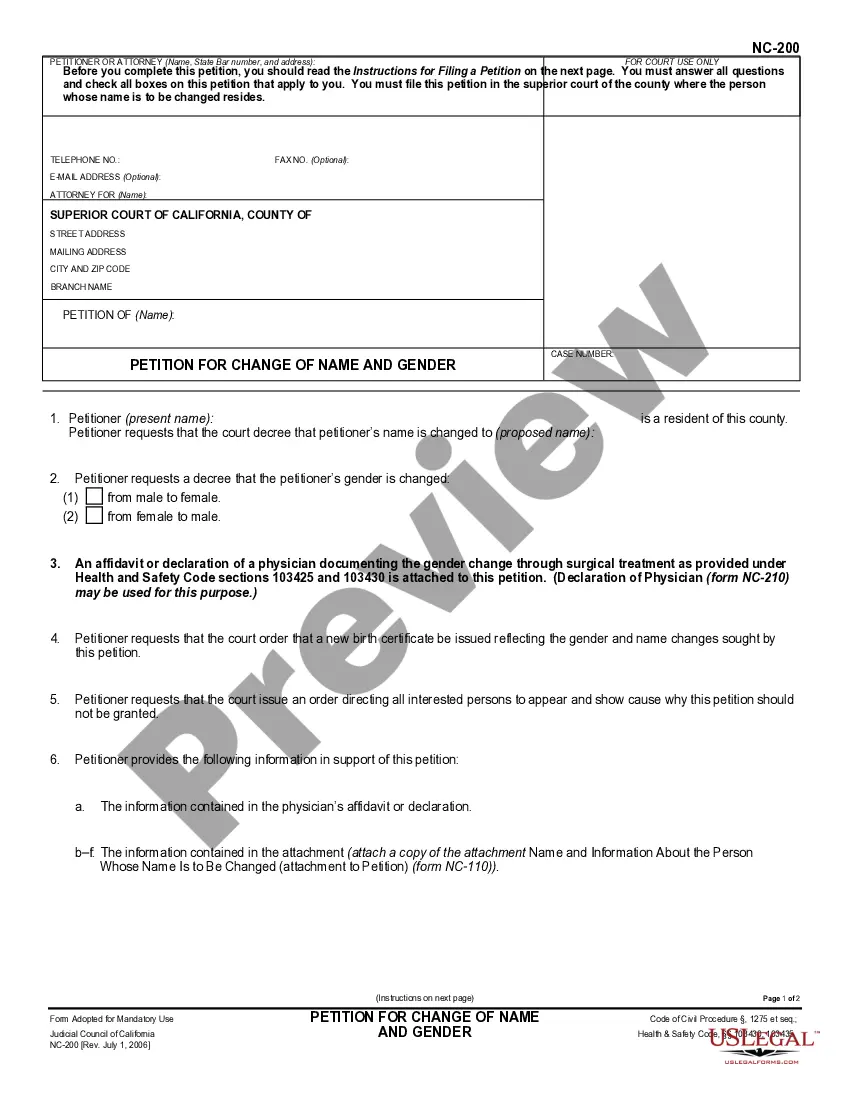

How to fill out Kings New York Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Kings Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Kings Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!