Nassau New York Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders — Detailed The Nassau New York Amended Stock Exchange Agreement is a significant agreement entered into by SJW Corp, Roscoe Moss Co, and RMC Shareholders. This detailed description aims to provide comprehensive information about the agreement, its purpose, and potential implications, using relevant keywords. 1. Background: The agreement was made between SJW Corp, a prominent water utility company, Roscoe Moss Co, a leading groundwater infrastructure provider, and RMC Shareholders, the shareholders of Roscoe Moss Co. The parties involved sought to amend the original stock exchange agreement in order to address specific issues and optimize the merger process. 2. Objectives: The primary objectives of the Nassau New York Amended Stock Exchange Agreement are to enhance cooperation, streamline operations, and maximize the efficiency of the merger between SJW Corp and Roscoe Moss Co. The agreement aims to facilitate a successful integration of the two entities, leading to improved services and enhanced shareholder value. 3. Key Provisions: — Stock Exchange Ratio: The agreement specifies the exchange ratio at which RMC Shareholders will receive SJW Corp common stock in exchange for their Roscoe Moss Co shares. — Financing: It outlines the terms and conditions for financing the transaction, including potential cash consideration. — Management and Governance: The agreement addresses the composition of the board of directors and executive management roles in the combined entity. — Employee Matters: It details the treatment of employees, including compensation, benefits, and potential restructuring plans. — Regulatory Approvals: The agreement identifies the necessary approvals from regulatory bodies and outlines the necessary steps to obtain them. — Representations and Warranties: It includes representations and warranties made by both SJW Corp and Roscoe Moss Co regarding the accuracy of financial statements, compliance with laws, and absence of undisclosed liabilities. 4. Benefits: By amending the initial stock exchange agreement, the parties involved aim to unlock several benefits, including: — Synergy Creation: The combined strengths of SJW Corp and Roscoe Moss Co are expected to result in increased operational efficiency and cost savings. — Diversification: The merger enables SJW Corp to expand its market reach and diversify its revenue streams, thereby reducing dependence on specific regions or market segments. — Enhanced Capabilities: By leveraging Roscoe Moss Co's expertise in groundwater infrastructure, SJW Corp can offer a broader range of services to its customers. — Shareholder Value: The agreement aims to create long-term value for SJW Corp and Roscoe Moss Co shareholders by capitalizing on combined resources and business opportunities. 5. Potential Variations: While the detailed description above encompasses the general aspects of the Nassau New York Amended Stock Exchange Agreement, it is important to note that specific variations or additional terms may exist, such as: — Timeframe: Different versions of the agreement may have varying timelines for completing the transaction and integration process. — Earn-Outs: Depending on the agreement, certain shareholders of Roscoe Moss Co may be eligible for earn-outs based on achieving predetermined performance targets. — Other Agreements: In some cases, additional agreements related to intellectual property rights, licenses, lease agreements, or supply contracts may be attached or referenced within the main agreement. In conclusion, the Nassau New York Amended Stock Exchange Agreement between SJW Corp, Roscoe Moss Co, and RMC Shareholders represents a strategic collaboration aimed at creating a stronger, more diversified entity in the water utility and groundwater infrastructure sectors. The agreement, with its provisions and objectives, lays the foundation for a smooth merger process, potential synergies, and improved shareholder value.

Nassau New York Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

How to fill out Nassau New York Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

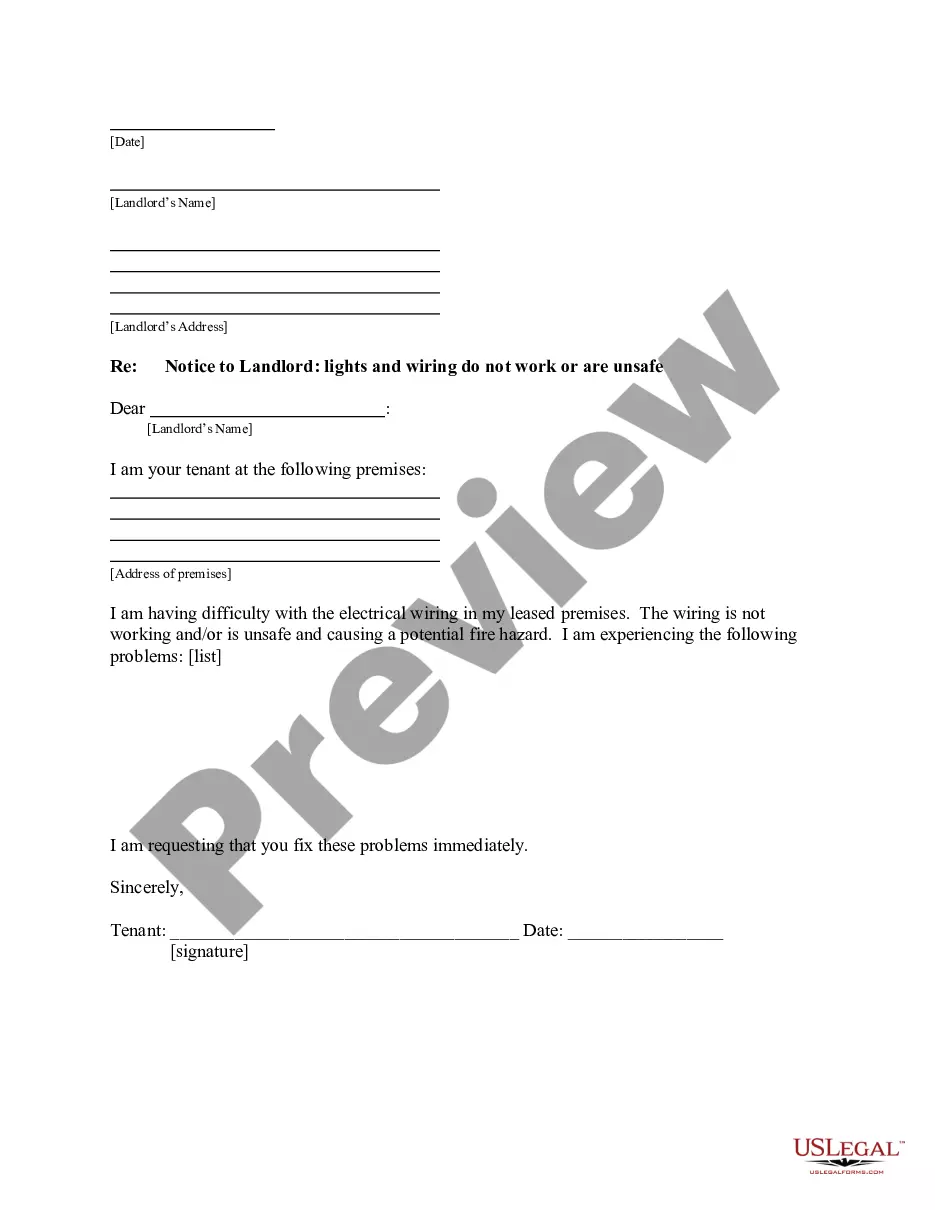

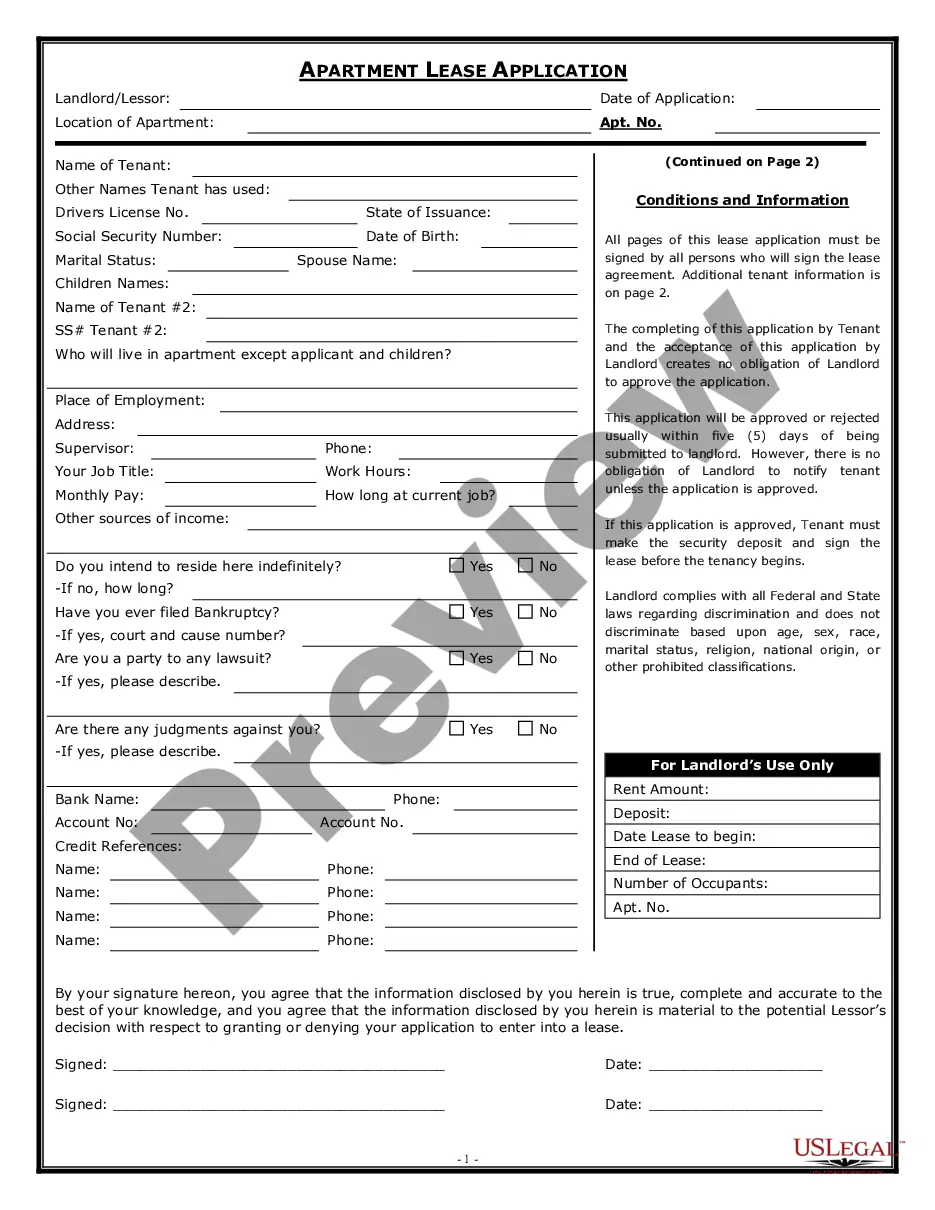

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Nassau Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Apart from the Nassau Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Nassau Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!