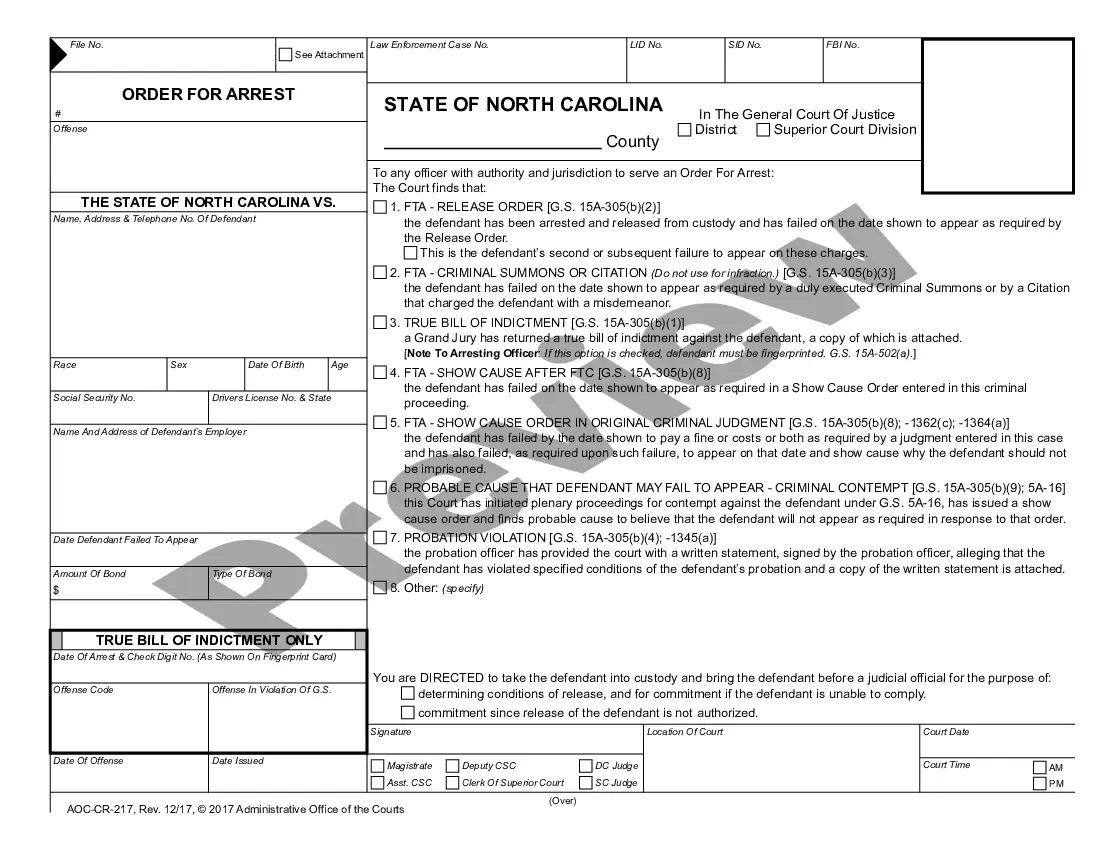

Sacramento, California is the capital city of the state of California, located in the northern-central part of the state. It is known for its rich history, cultural diversity, and vibrant economy. Sacramento offers a unique blend of urban amenities and natural beauty, making it an attractive destination for residents, tourists, and businesses alike. In terms of the Texas Business Corporation Act, Articles 5.11, 5.12, and 5.13 govern various aspects of corporations operating within the state. These articles outline specific regulations and requirements for different types of corporations, ensuring transparency, fairness, and legal compliance in corporate affairs. The first type of corporation covered by Article 5.11 is the "For-Profit Corporation." This refers to a business entity formed with the purpose of generating profits for its shareholders or owners. Article 5.11 establishes guidelines for the formation, structure, and governance of for-profit corporations, including provisions on shareholders' rights, director duties, and corporate governance. The second type of corporation addressed by Article 5.12 is the "Nonprofit Corporation." This category includes organizations formed for charitable, educational, religious, or other philanthropic purposes. Article 5.12 outlines the specific rules and regulations that govern the formation, operation, and dissolution of nonprofit corporations in Texas. It covers aspects such as the formation process, board composition, tax-exempt status, and fundraising activities. Lastly, Article 5.13 pertains to the "Professional Corporation." A professional corporation is a specific type of corporation that is typically formed by individuals belonging to certain professional fields, such as lawyers, doctors, accountants, or engineers. Article 5.13 sets forth the unique requirements, restrictions, and regulations that govern professional corporations to ensure compliance with professional licensing laws and maintain a high level of professional standards. In summary, Articles 5.11, 5.12, and 5.13 of the Texas Business Corporation Act provide comprehensive guidelines for different types of corporations operating within the state. While Article 5.11 focuses on for-profit corporations, Article 5.12 covers nonprofit corporations, and Article 5.13 applies specifically to professional corporations. Each article specifies the legal framework and obligations for corporations in their respective categories, serving as essential references for businesses within the State of Texas.

Sacramento California Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act

Description

How to fill out Sacramento California Articles 5.11, 5.12 And 5.13 Of Texas Business Corporation Act?

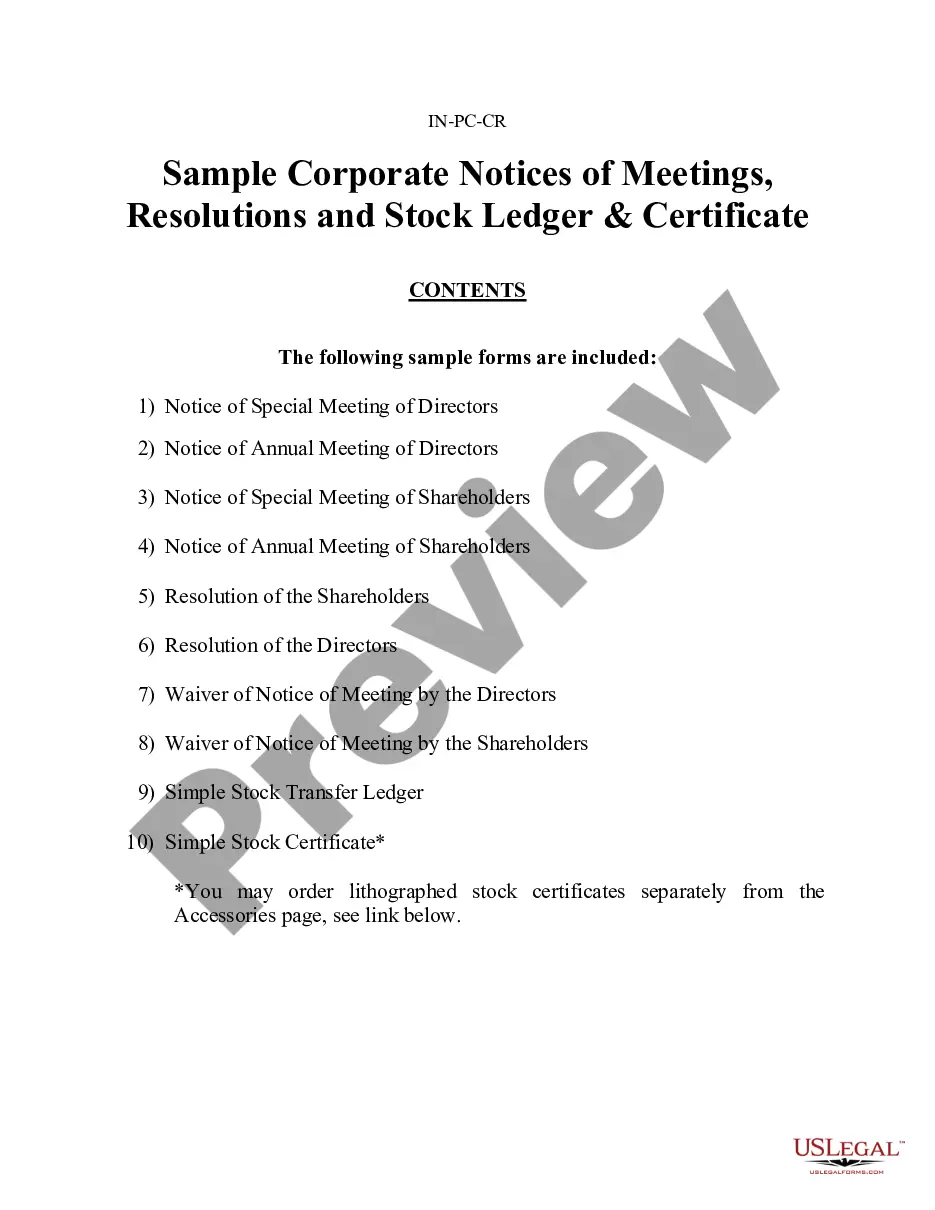

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Sacramento Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any activities associated with document execution simple.

Here's how you can purchase and download Sacramento Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Examine the similar document templates or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase Sacramento Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Sacramento Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to cope with an extremely complicated situation, we recommend using the services of an attorney to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!