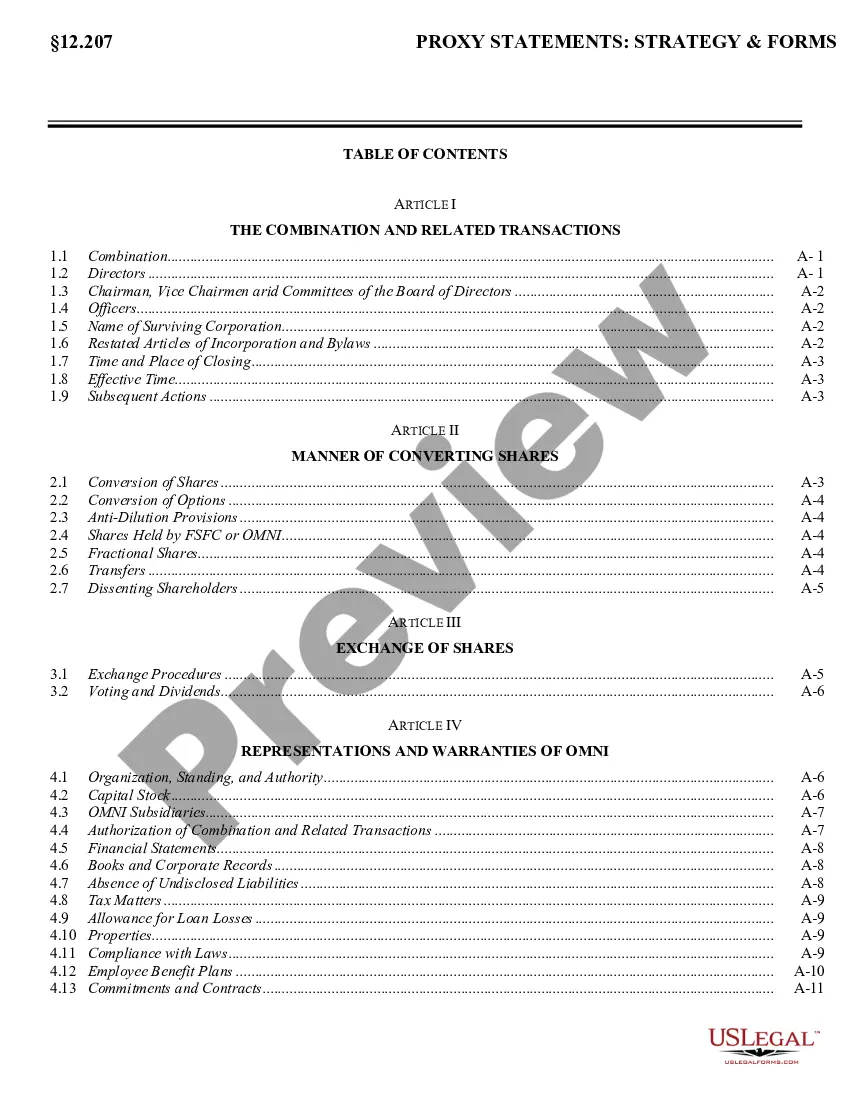

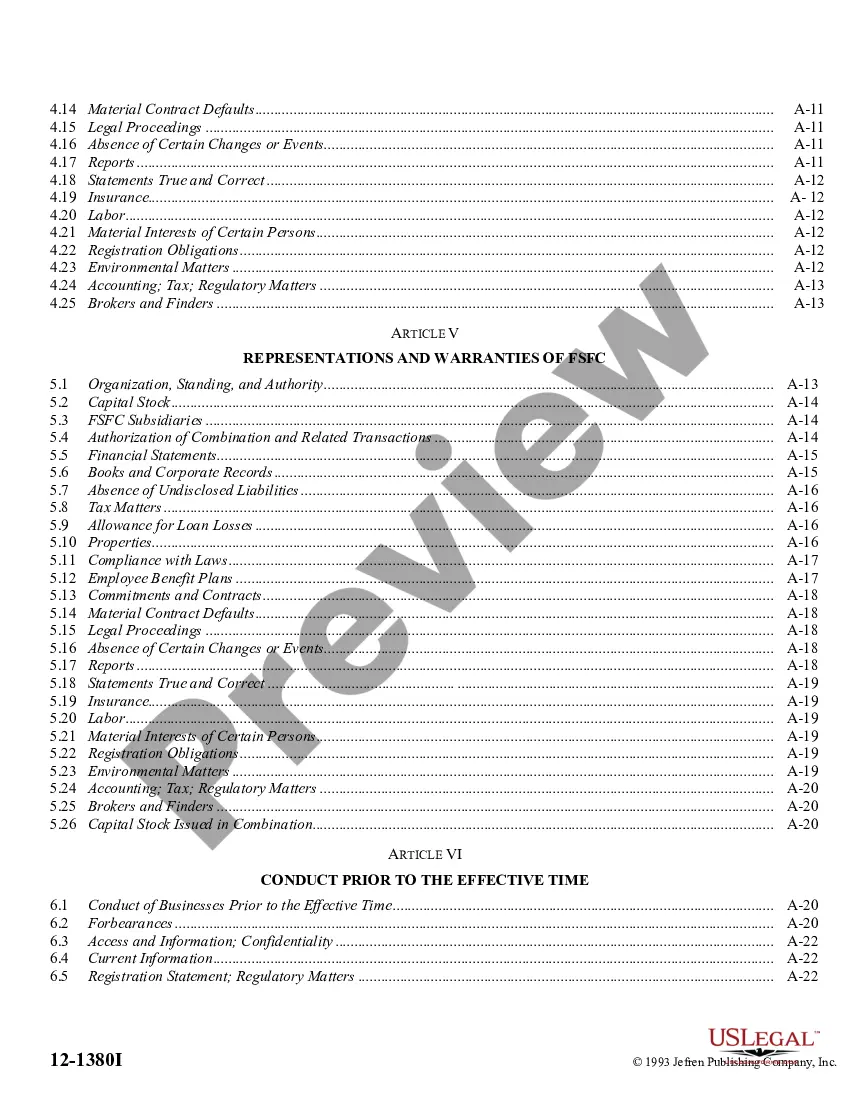

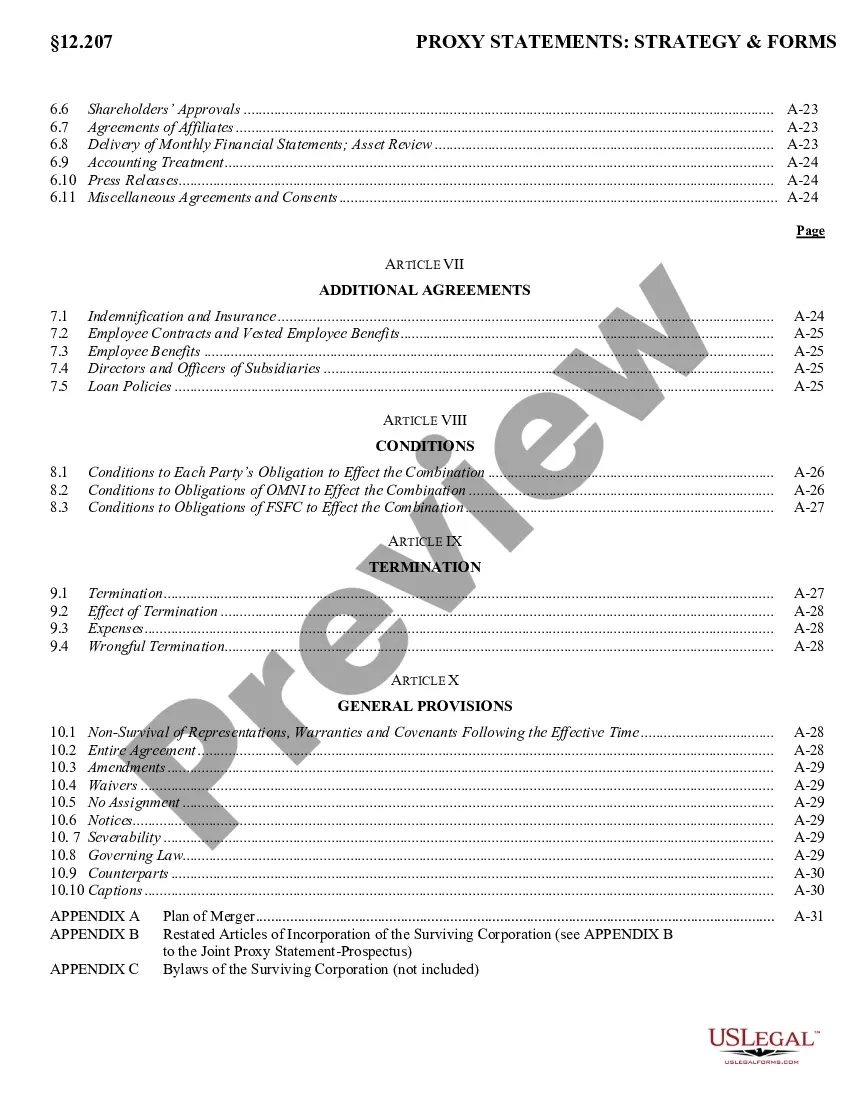

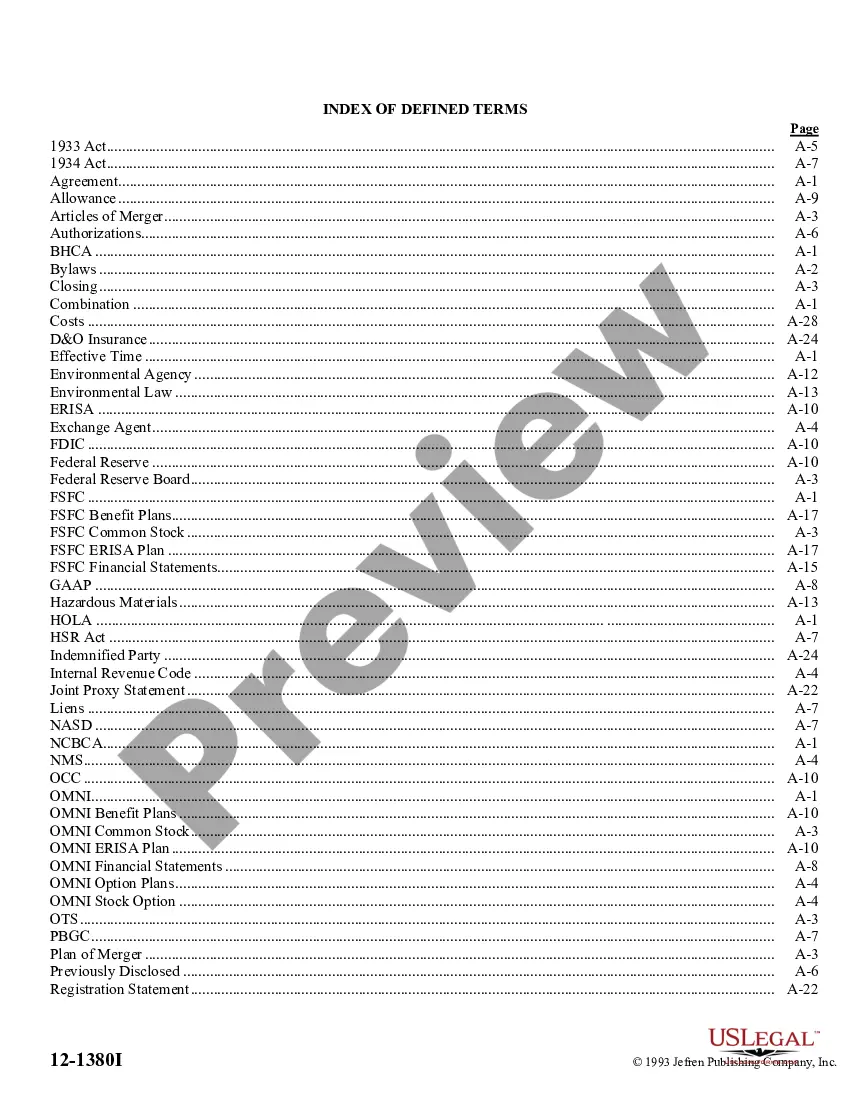

The Allegheny Pennsylvania Agreement of Combination is a historic agreement that has significant importance in the realm of corporate mergers and acquisitions. It is a legal document that outlines the terms and conditions of the consolidation of multiple organizations into one entity within the Allegheny, Pennsylvania region. This agreement brings together businesses to create a stronger and more efficient combined entity, leveraging their resources, expertise, and market presence. The Allegheny Pennsylvania Agreement of Combination serves as a comprehensive roadmap, addressing crucial aspects such as financial arrangements, asset allocation, governance structure, employee matters, intellectual property rights, and other key components necessary for a successful merger. This agreement plays a vital role in ensuring a seamless and harmonious transition for the merging entities, fostering growth and synergy. There are various types of Allegheny Pennsylvania Agreement of Combination, tailored to the specific requirements and nature of the merging organizations. Some notable types include: 1. Horizontal Combination: This type of agreement occurs when two or more companies operating in the same industry, offering similar products or services, join forces. The purpose is often to gain a larger market share, increase economies of scale, and eliminate duplications. 2. Vertical Combination: In this scenario, companies operating at different stages of the supply chain or in related industries merge. For instance, a manufacturing company might combine with a supplier of raw materials or a distributor to ensure a more streamlined production and distribution process. 3. Conglomerate Combination: Unlike horizontal or vertical combinations, conglomerate combinations involve businesses that operate in unrelated industries. This type of agreement aims to diversify the merged entity's portfolio and reduce risk by entering new markets or expanding into different sectors. 4. Joint Venture: Although not strictly considered a merger, a joint venture involves two or more companies collaborating on a specific project or business opportunity. The Allegheny Pennsylvania Agreement of Combination for a joint venture defines the goals, roles, and responsibilities of each participant, promoting cooperation and resource sharing. The Allegheny Pennsylvania Agreement of Combination is a crucial legal and strategic tool that plays a pivotal role in shaping the business landscape of the region. With its ability to facilitate mergers and acquisitions effectively, this agreement continues to be a driving force behind the growth, innovation, and consolidation of businesses in Allegheny, Pennsylvania.

Allegheny Pennsylvania Agreement of Combination

Description

How to fill out Allegheny Pennsylvania Agreement Of Combination?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Allegheny Agreement of Combination is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Allegheny Agreement of Combination. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Agreement of Combination in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!