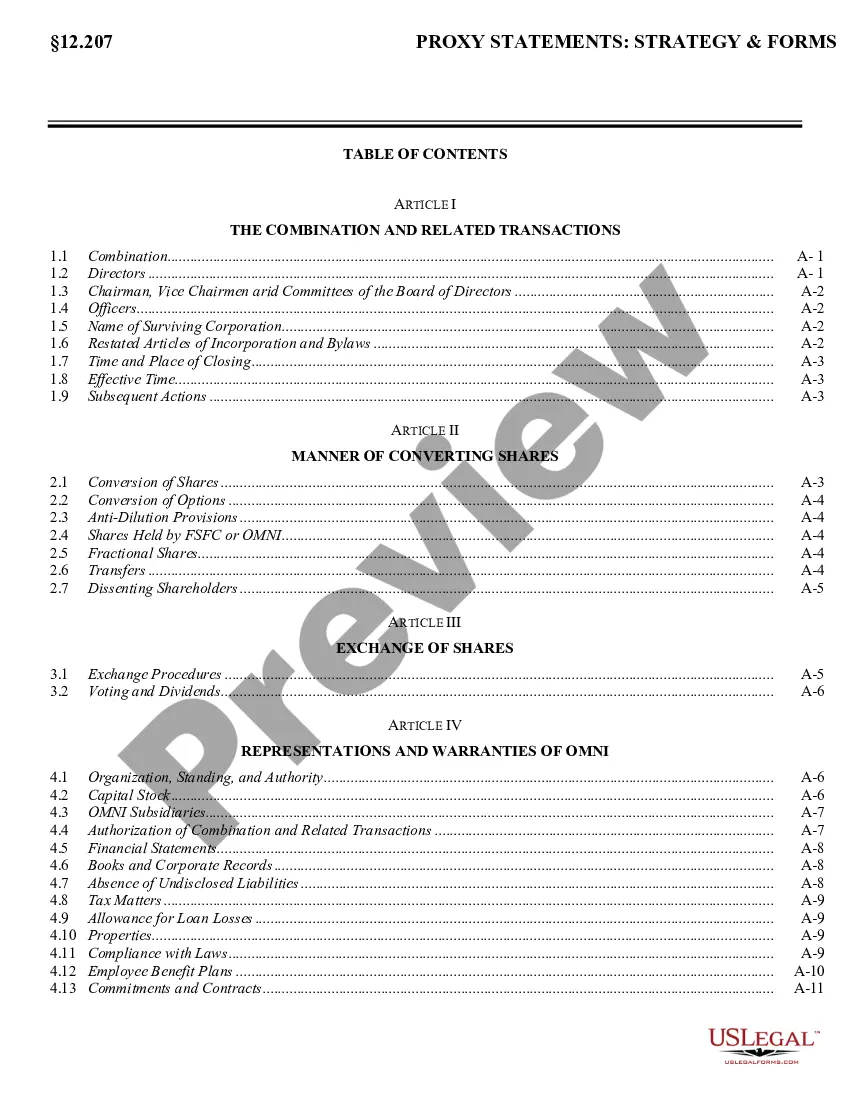

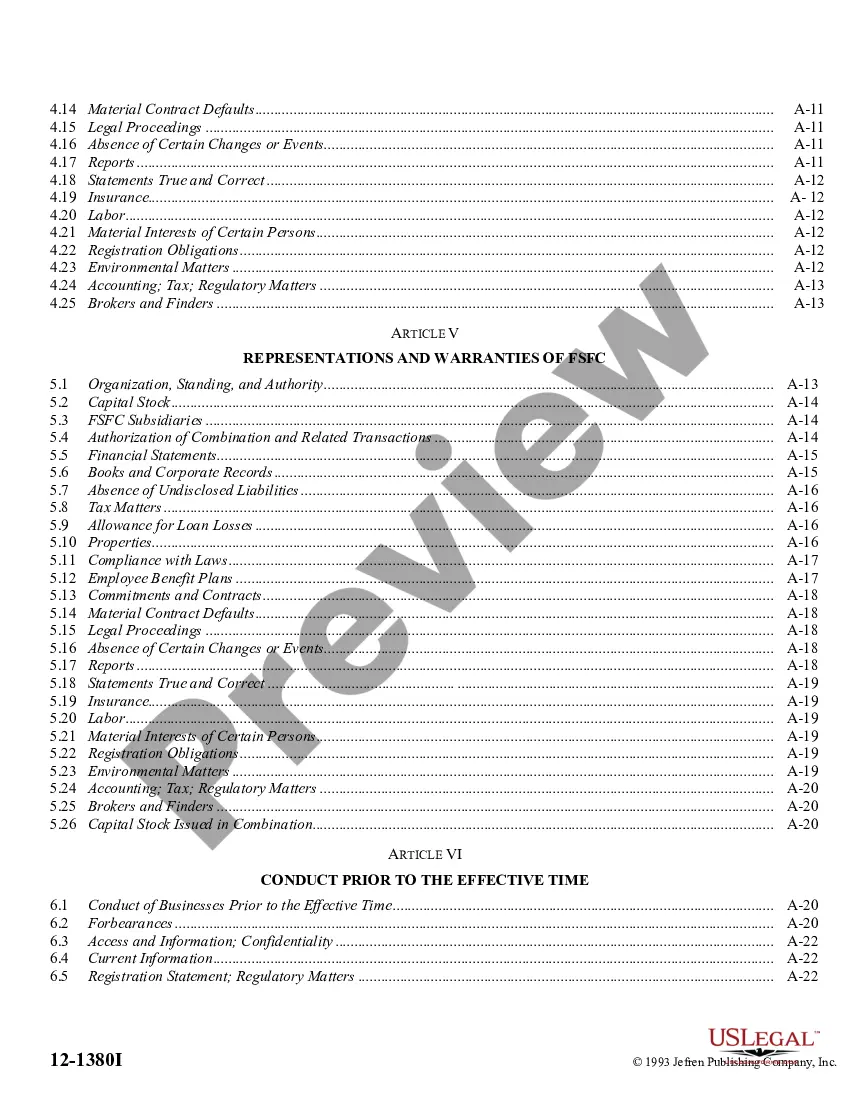

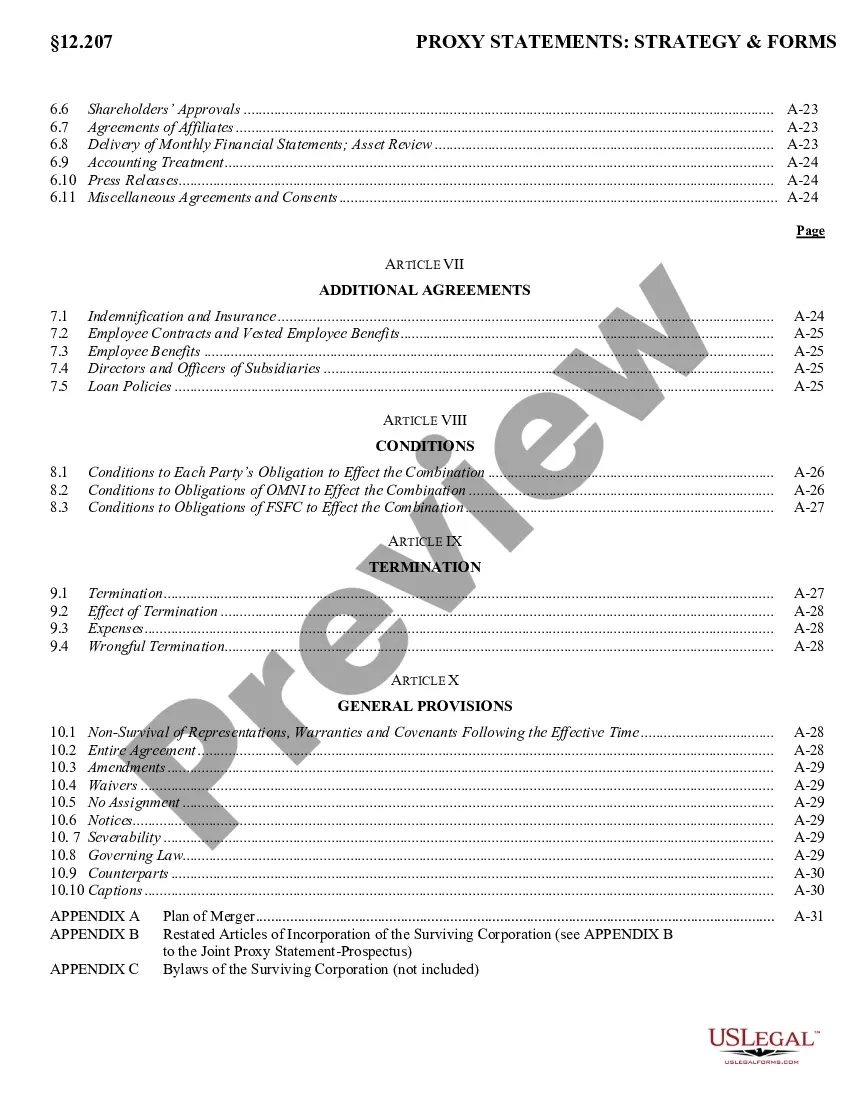

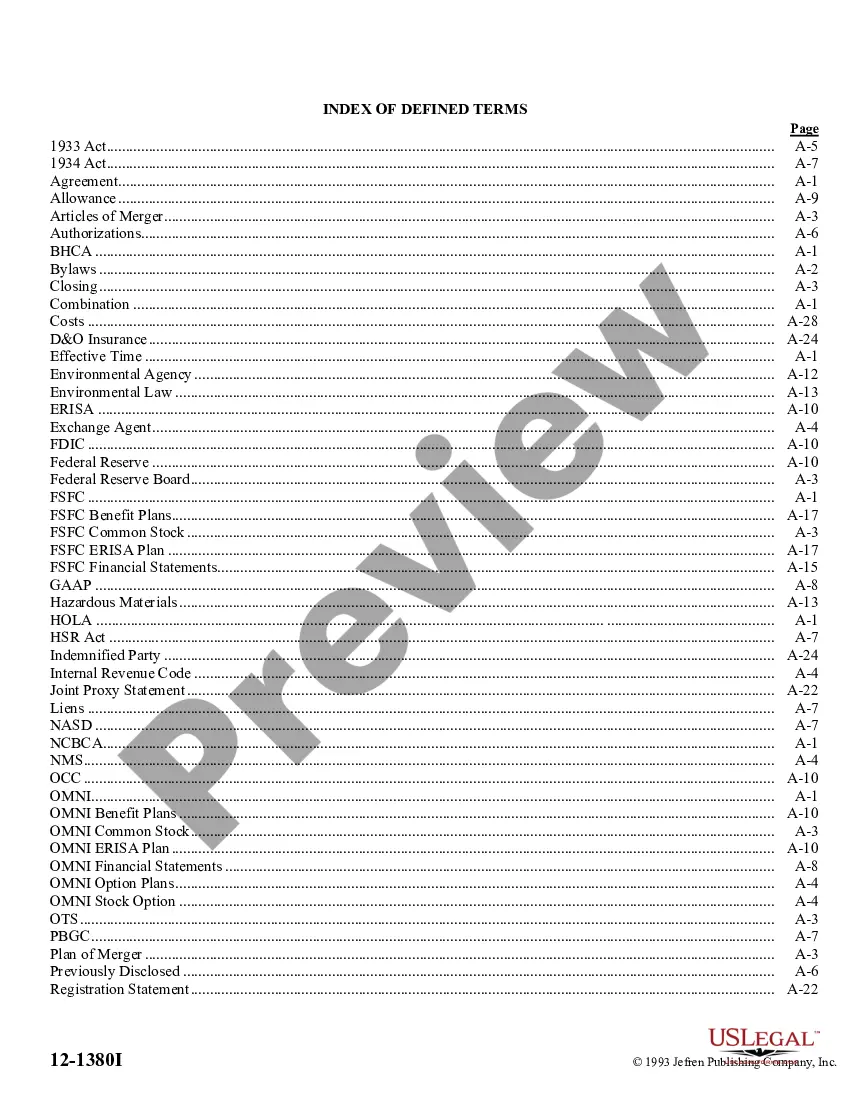

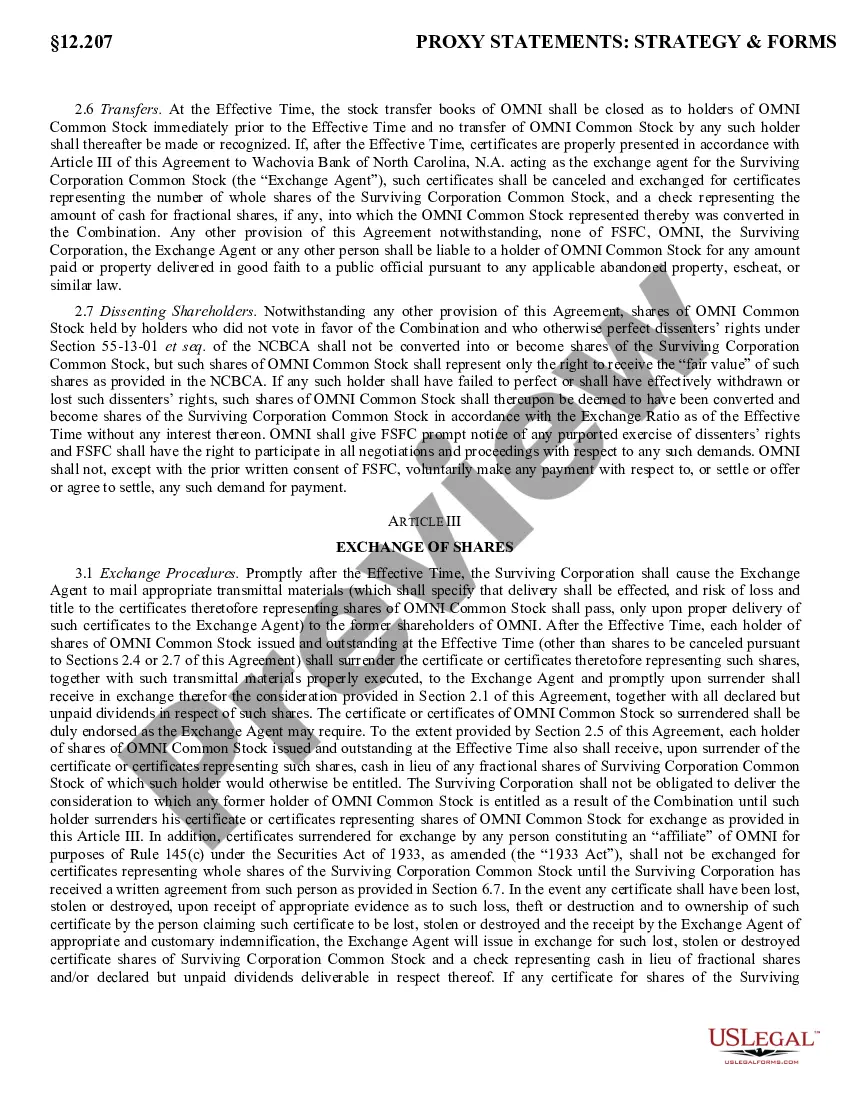

Dallas Texas Agreement of Combination, also known as a merger agreement, is a legal document that outlines the terms and conditions under which two or more entities come together to form a single entity. The agreement serves as a binding contract between the parties involved and ensures the smooth transition and integration of their operations, assets, and liabilities. In Dallas, Texas, there are several types of Agreement of Combination, each catering to different business scenarios and objectives. These types include: 1. All-Stock Merger: This type of Agreement of Combination involves the exchange of shares between the merging entities. It allows for a seamless transition of ownership in which the shareholders of both companies become shareholders of the newly formed entity. 2. Asset Acquisition: In this type of Agreement of Combination, one entity acquires the assets, including machinery, equipment, intellectual property, and contracts, of another entity. The acquiring party assumes the liabilities associated with the acquired assets and takes over the business operations. 3. Stock-for-Asset Swap: This Agreement of Combination involves the exchange of stock for assets. One entity provides shares to the other entity in exchange for its assets. This type of combination allows for the acquiring entity to expand its operations and diversify its asset base. 4. Vertical Merger: A vertical merger occurs when two companies operating at different stages of the supply chain, such as a manufacturer and a distributor, come together to form a single entity. This type of Agreement of Combination aims to streamline operations, improve efficiency, and capture a larger share of the market. 5. Horizontal Merger: In a horizontal merger, two or more entities operating in the same industry and offering similar products or services merge to create a stronger market presence. By combining resources, expertise, and customer bases, the merged entity can achieve economies of scale and gain a competitive advantage. 6. Conglomerate Merger: This Agreement of Combination involves entities from completely unrelated industries merging to form a diversified conglomerate. Such mergers allow for increased market reach, risk diversification, and synergy creation across various sectors. Regardless of the type, the Dallas Texas Agreement of Combination typically includes provisions for the allocation of assets and liabilities, the exchange ratio or purchase price, governance structure of the merged entity, employee retention or termination, and any other specific terms agreed upon by the parties involved. It is crucial for all stakeholders to consult legal professionals to ensure the agreement adheres to local and federal laws, safeguarding the interests of all parties involved.

Dallas Texas Agreement of Combination

Description

How to fill out Dallas Texas Agreement Of Combination?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Dallas Agreement of Combination, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Dallas Agreement of Combination, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Dallas Agreement of Combination:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Dallas Agreement of Combination and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

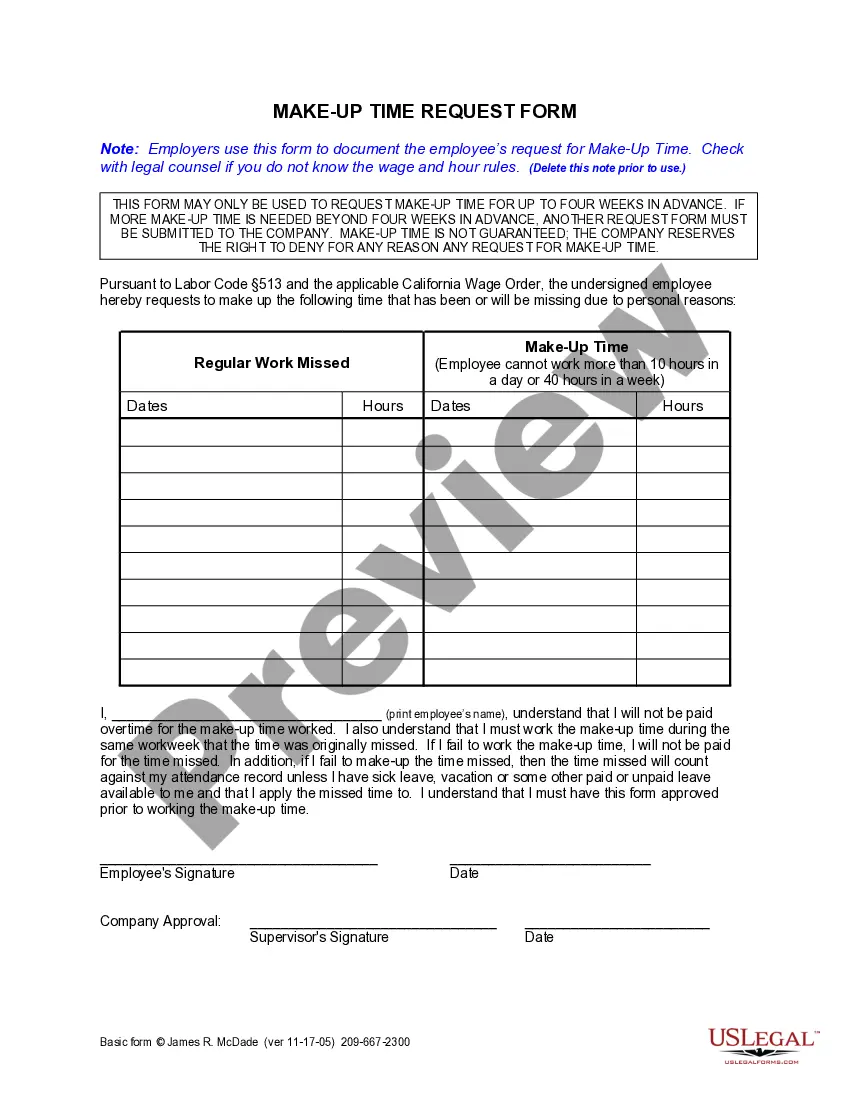

Ten Tips for Making Solid Business Agreements and Contracts Get it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.

Most verbal agreements are legally binding in Texas. A handshake can be legally binding in Texas if the agreement is otherwise a valid contract. However, certain agreements must be in writing by law before they become binding.

A business combination agreement is a legal document for when companies merge that determines who has voting power for specific issue, such as amendments to the company's bylaws and mergers with other companies. Unfortunately, many business owners are unaware of the importance of a business combination agreement.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

The Elements of a Legally Enforceable Contract in Texas There Must Be an Offer. There Must Be Acceptance. There Must Be Mutual Consideration. The Parties Must Be Capable of Forming a Contract. The Purpose of the Contract Must Be Legal. The Contract Should Be in Writing.

It isn't illegal to write a contract without an attorney. A contract can be simple or complex and is an agreement between two or more parties. It can be a written or oral agreement. A contract doesn't have to be on a preprinted or standardized form: It can be written on a napkin and still be legitimate.

A merger agreement (or definitive merger agreement) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

There are three elements that must be present for a contract to exist: offer, acceptance, and consideration.

The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality. In some states, element of consideration can be satisfied by a valid substitute.

There are four elements of a contract, in order to have a valid contract, all four must be present: fffdOffer. This is the first step towards a contract.Acceptance. The party to whom the offer was made must now agree to the terms of the original offer.Consideration.fffdCapacity.