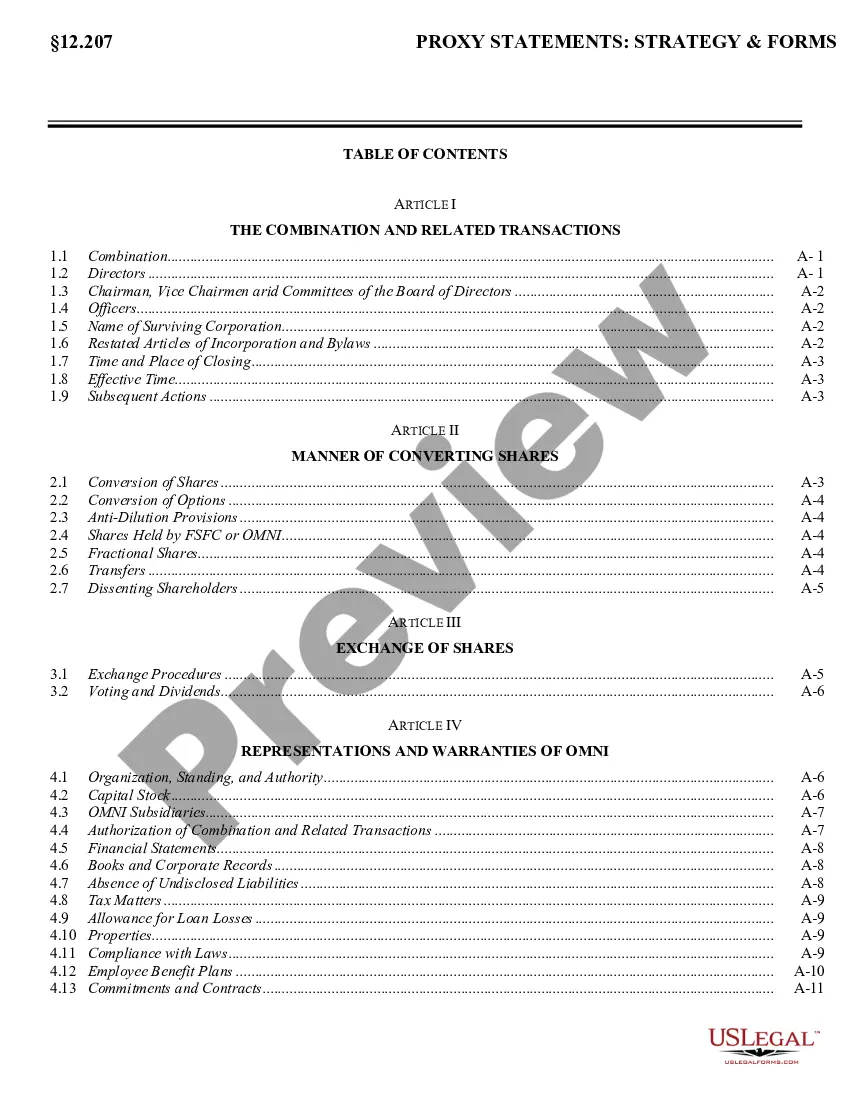

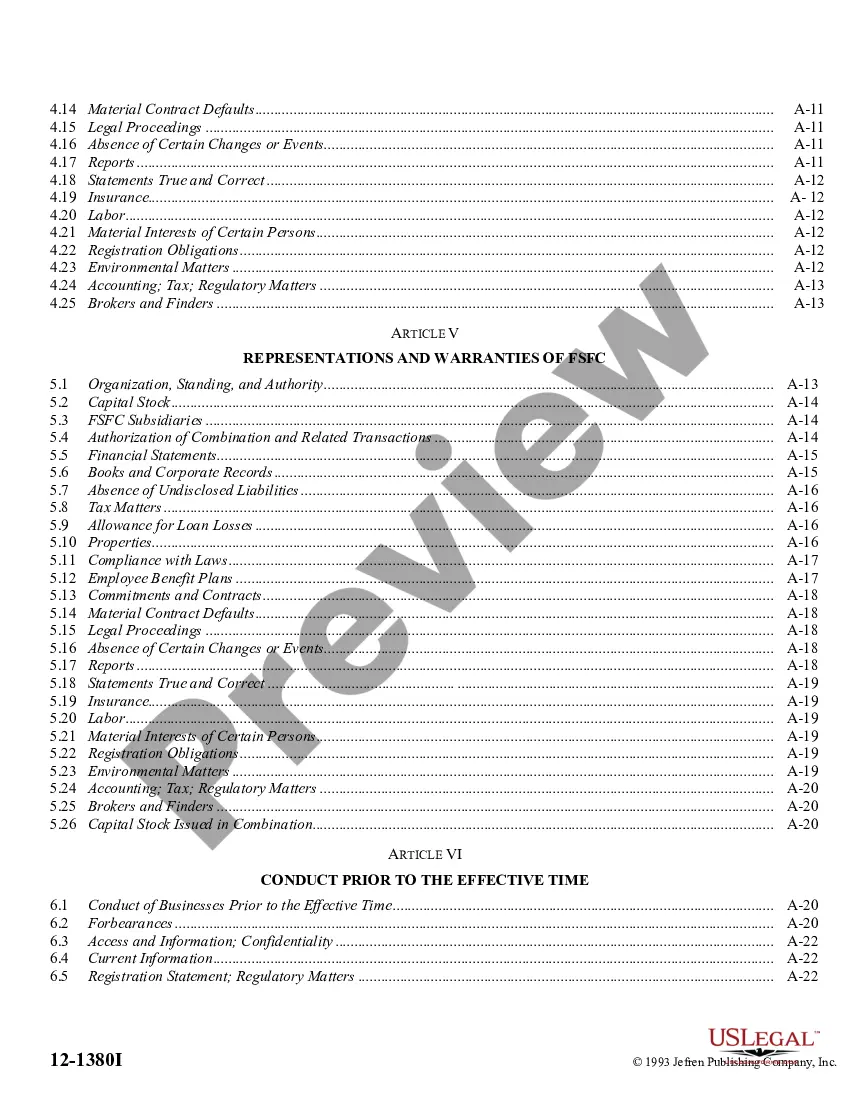

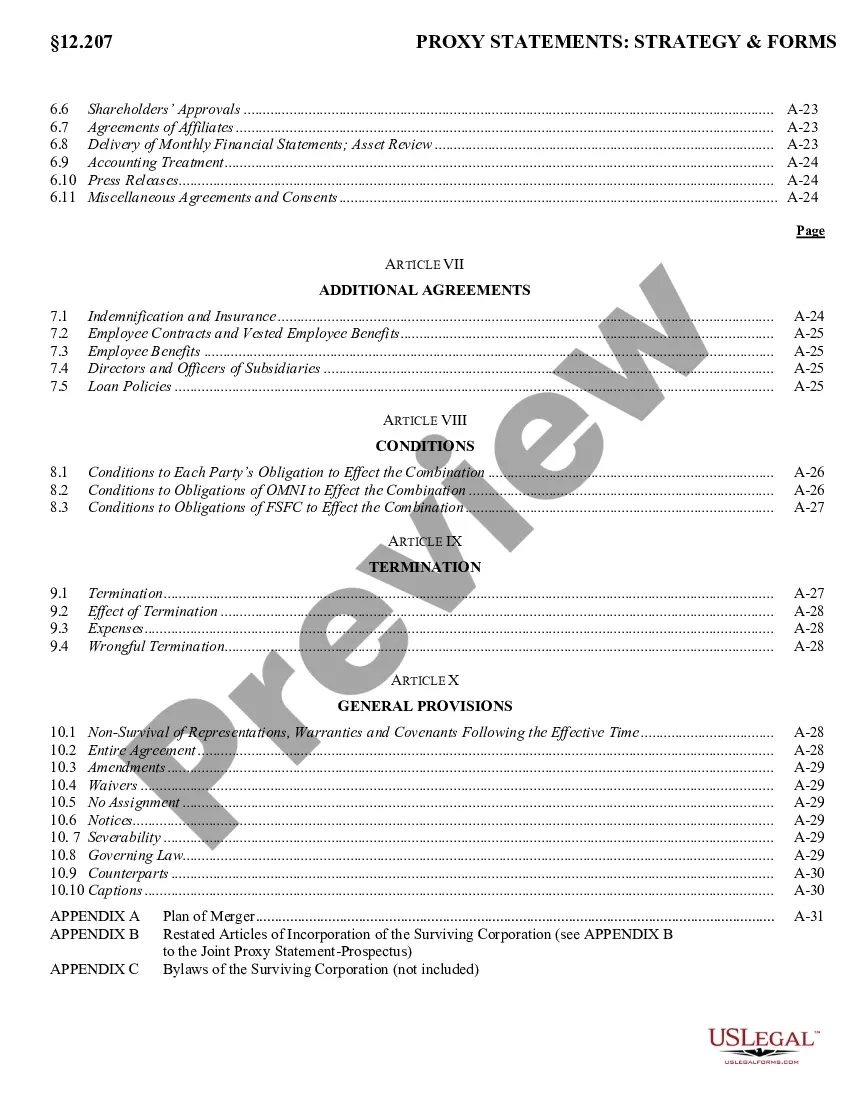

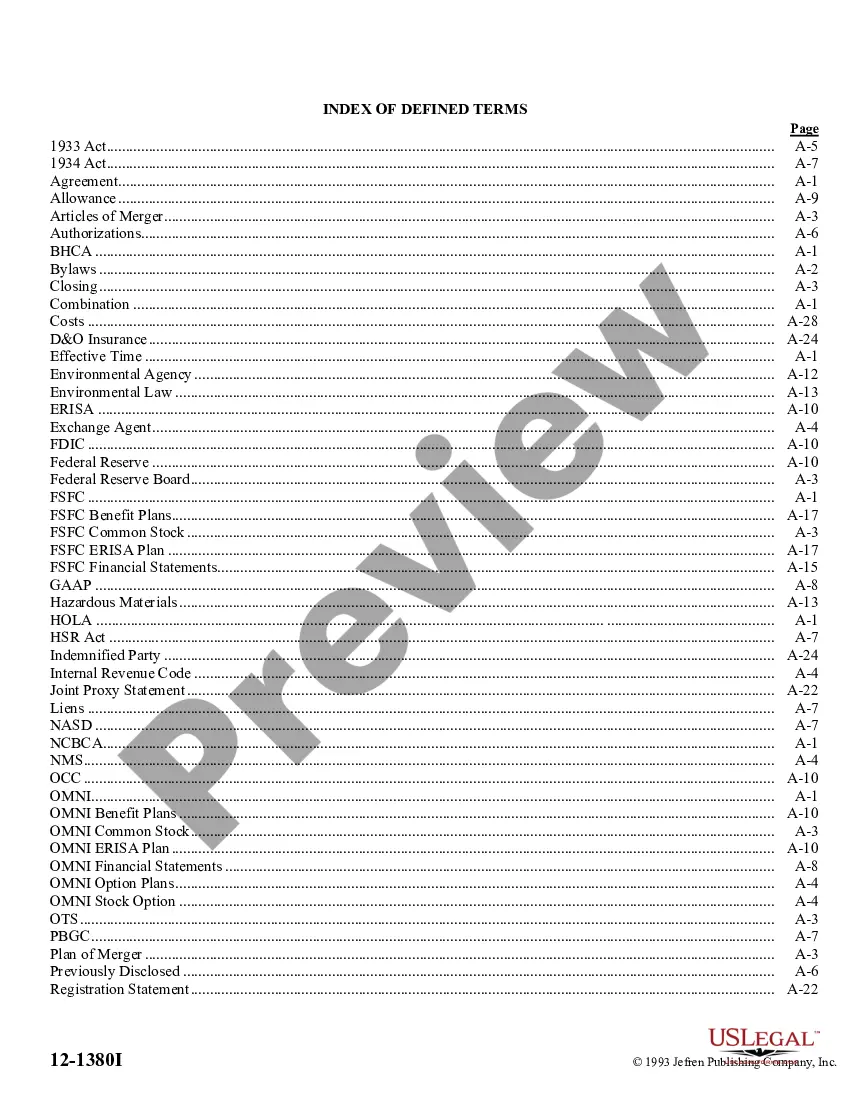

The Philadelphia Pennsylvania Agreement of Combination is a legal document that establishes the terms and conditions for combining or merging multiple entities or organizations in the city of Philadelphia, Pennsylvania. This agreement ensures that the consolidation process is carried out in a transparent and lawful manner, protecting the rights and interests of all parties involved. The Agreement of Combination can be categorized into two main types: public and private. Public Agreements of Combination involve government or municipal entities, such as merging of different city departments or agencies to streamline operations and improve efficiency. Private Agreements of Combination, on the other hand, pertain to the consolidation of private businesses, nonprofit organizations, or other types of entities operating within Philadelphia. The Philadelphia Pennsylvania Agreement of Combination outlines specific elements and provisions that need to be addressed during the merger process. These may include the identification and description of the entities involved, the purpose and objectives of the combination, the distribution of assets and liabilities, employee considerations, and governance structure of the newly formed entity. Key keywords related to the Philadelphia Pennsylvania Agreement of Combination are merger, consolidation, entity, organization, legal document, terms and conditions, transparency, protection of rights, interests, public sector, private sector, government, municipality, efficiency, streamlining operations, private businesses, nonprofit organizations, merger process, assets, liabilities, employees, governance structure. In conclusion, the Philadelphia Pennsylvania Agreement of Combination is a vital legal framework that facilitates the merging or consolidation of entities in Philadelphia. By providing specific guidelines and regulations, it ensures a smooth and lawful integration process, benefiting both the participating entities and the community at large.

Philadelphia Pennsylvania Agreement of Combination

Description

How to fill out Philadelphia Pennsylvania Agreement Of Combination?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Philadelphia Agreement of Combination.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Philadelphia Agreement of Combination will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Philadelphia Agreement of Combination:

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Philadelphia Agreement of Combination on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

Sign the return, enclose W-2 forms, PA Schedule SP (if applicable) and mail to: Philadelphia Department of Revenue, P.O. Box 1648, Philadelphia, PA 19105-1648.

The tax applies to payments that a person receives from an employer in return for work or services. All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

How to file City taxes Filing returns online. All Philadelphia taxes can be filed online.Filing returns through Modernized e-Filing (MeF) You can use the IRS Modernized e-Filing program to file some City of Philadelphia taxes.Filing paper returns.

1. What is Annual Reconciliation? In addition to filing wage withholding returns and making payments throughout the year, employers or entities that issue income payments to individuals must also submit an annual withholding reconciliation with the Department of Revenue.

You can file BIRT returns and make payments through the Philadelphia Tax Center. Starting with payments due in April 2018 for Tax Year 2017, taxpayers who owe $5,000 or more for the Business Income and Receipts Tax are required to pay those taxes electronically.

Sign the return, enclose W-2 forms, PA Schedule SP (if applicable) and mail to: Philadelphia Department of Revenue, P.O. Box 1648, Philadelphia, PA 19105-1648.

How to pay File a return by mail. Mail your return to: Philadelphia Dept. of Revenue. P.O. Box 1660.Pay by mail. Mail all payments with a payment coupon to: Philadelphia Dept. of Revenue. P.O. Box 1393.Request a refund by email. Mail your return and refund request to: Philadelphia Dept. of Revenue. P.O. Box 1137.