Maricopa, Arizona Article 13 — Dissenters' Rights: A Comprehensive Overview Maricopa, Arizona, is a bustling city located in the US state of Arizona, known for its rich history and legal framework. Among its various legal provisions, Article 13 — Dissenters' Rights has significant importance for shareholders in Maricopa. Dissenters' Rights, also known as appraisal rights, provide minority shareholders with certain protections and options when they disagree with certain corporate actions taken by the majority shareholders or the company itself. These rights aim to ensure fairness and maintain the value of the minority shareholders' investment, even when their voting opinions differ. Under Maricopa's Article 13 — Dissenters' Rights, minority shareholders are granted the ability to dissent from specific corporate actions and receive a fair value for their shares, above and beyond the market value or predetermined purchase price. The legislation grants dissenter shareholders the opportunity to exercise their rights and claim a reasonable appraised value for their shares within a specified timeframe. The primary types of actions that can trigger Dissenters' Rights include mergers, consolidations, reclassification, conversions, transfers of assets, or amendments to the company's articles of incorporation or other governing documents. When such actions occur, dissenting shareholders can actively voice their disagreement and request a fair appraisal of their shares. In cases where they choose to exercise their Dissenters' Rights, shareholders must typically follow a specific protocol. This may include filing written notice of their objection within a defined period, indicating the number of shares held, and their intent to demand the appraised value for those shares. Failure to adhere to the procedural requirements might result in the loss of Dissenters' Rights and reduced bargaining power. Once the objection is filed, an independent appraiser or a court will evaluate the fair value of the dissenting shareholders' shares based on various factors such as the company's financial statements, market conditions, future prospects, and other relevant information. The appraisal's purpose is to determine a fair value that adequately reflects the shareholders' investment in the company. Maricopa, Arizona, ensures that Dissenters' Rights are protected and enforced, putting controls in place to prevent the majority shareholders from manipulating valuation to the disadvantage of dissenting shareholders. The legislation seeks to strike a balance between the rights of the majority and minority shareholders, maintaining fairness and equity in corporate decision-making. In conclusion, Maricopa, Arizona's Article 13 — Dissenters' Rights serves as a crucial mechanism to safeguard the interests of minority shareholders. By providing a transparent and fair appraisal process, this legislation ensures that dissenting shareholders receive an equitable value for their shares when disagreeing with major corporate actions.

Maricopa Arizona Article 13 - Dissenters' Rights

Description

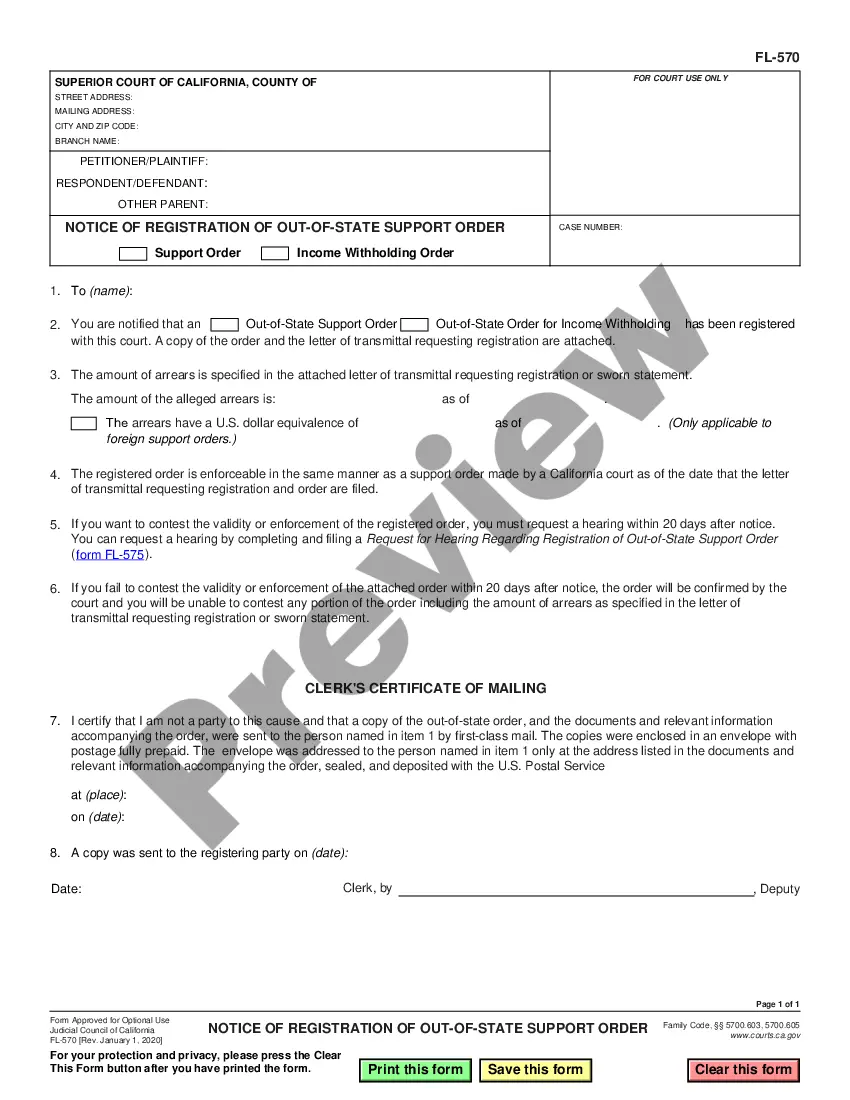

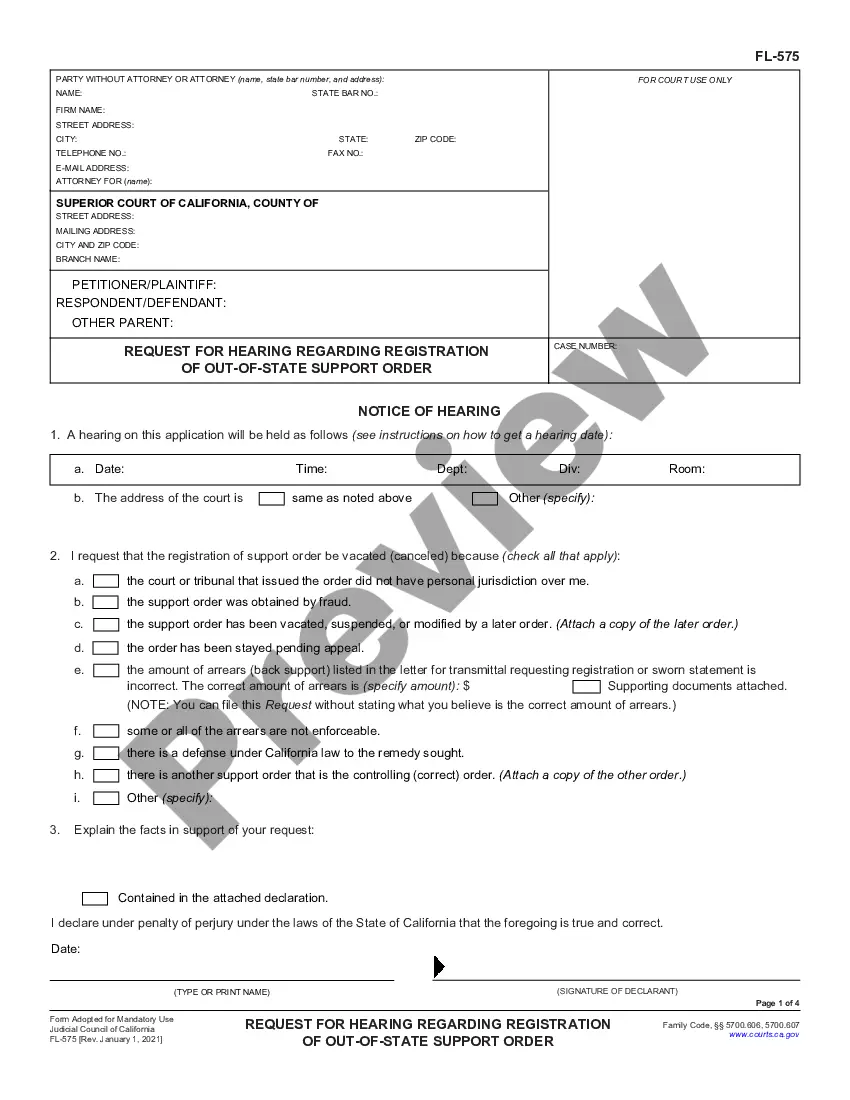

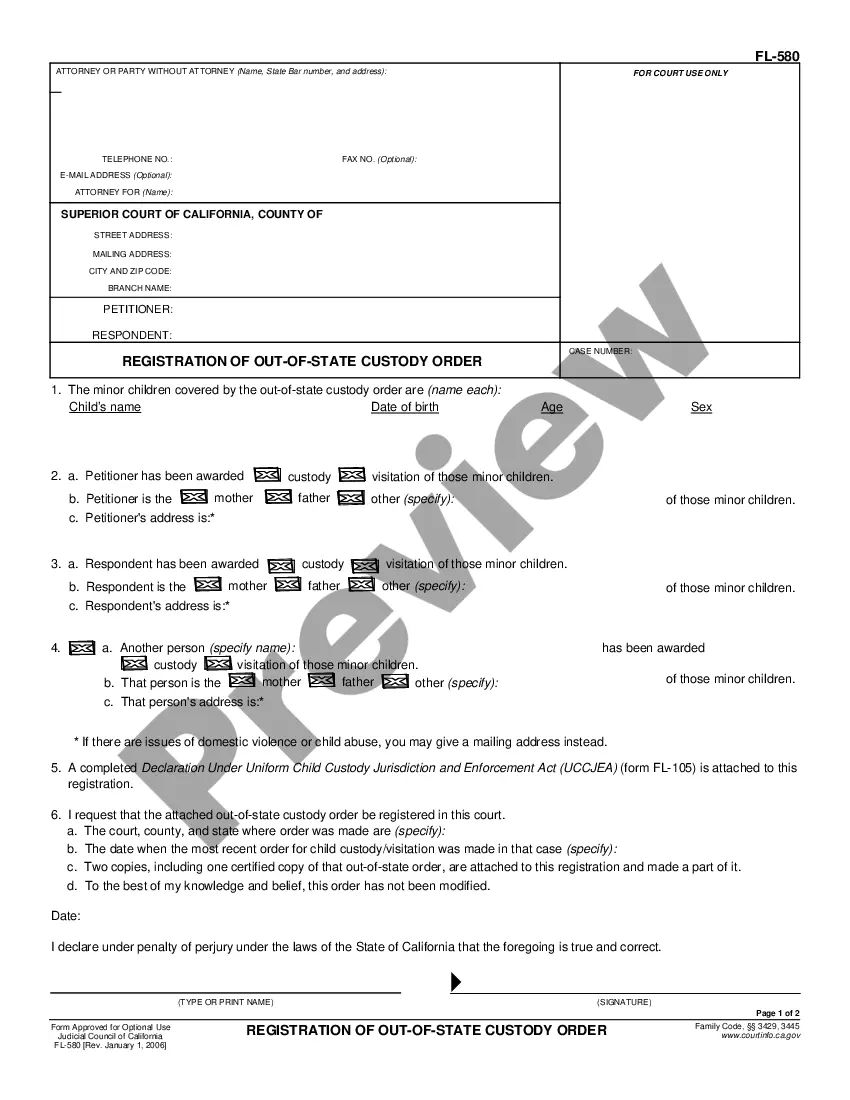

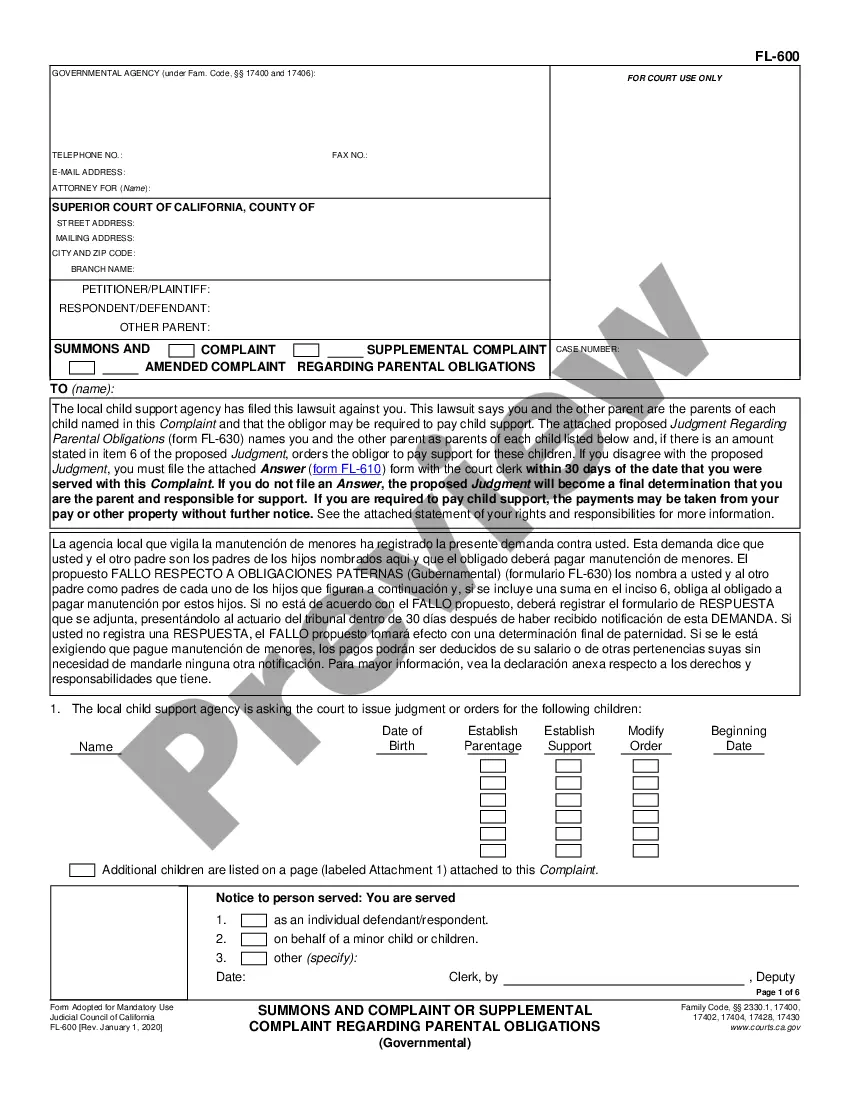

How to fill out Maricopa Arizona Article 13 - Dissenters' Rights?

Do you need to quickly create a legally-binding Maricopa Article 13 - Dissenters' Rights or probably any other form to manage your own or business affairs? You can go with two options: hire a legal advisor to write a valid document for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Maricopa Article 13 - Dissenters' Rights and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- First and foremost, double-check if the Maricopa Article 13 - Dissenters' Rights is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's intended for.

- Start the search again if the document isn’t what you were seeking by using the search box in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Maricopa Article 13 - Dissenters' Rights template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!