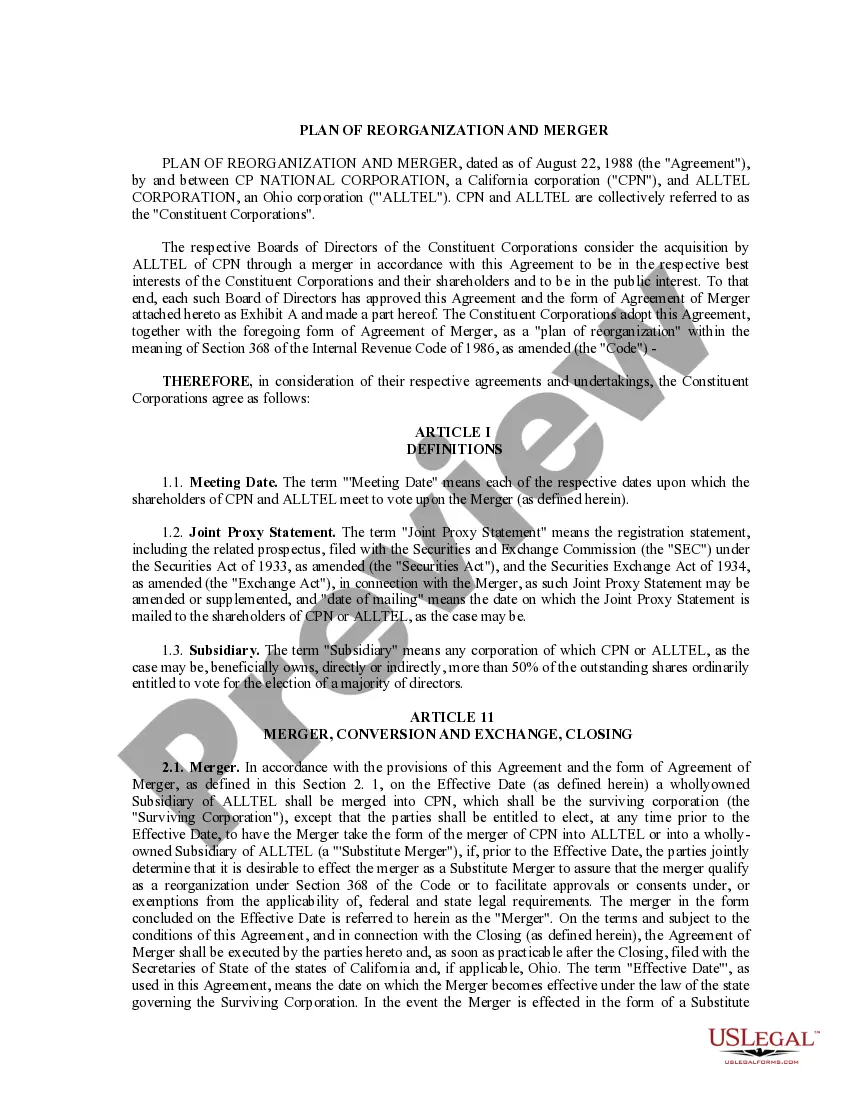

The Montgomery Maryland Plan of Reorganization and Merger between CP National Corp. and All tel Corp. refers to a specific agreement and strategic move involving these two companies. This plan, which includes various types or stages, entails merging, reorganizing, and restructuring the operations, assets, and management of CP National Corp. and All tel Corp. within the Montgomery, Maryland area. Key aspects of the Montgomery Maryland Plan of Reorganization and Merger may include an extensive analysis of both companies' financials, market share, and competitive positioning. By conducting a thorough evaluation, the plan aims to identify and capitalize on potential synergies between CP National Corp. and All tel Corp. One type of reorganization within this plan might involve combining the administrative, finance, and human resources departments of both companies. This consolidation seeks to streamline operations and reduce redundancies while maximizing efficiency and cost savings. Additionally, marketing and sales teams may be integrated to leverage each company's strengths and expand their market presence. In terms of assets and infrastructure, the plan may call for a review and optimization of physical locations, such as offices, warehouses, and data centers. This could lead to relocating operations to more strategic locations or consolidating facilities to improve cost-effectiveness. The Montgomery Maryland Plan of Reorganization and Merger also encompasses a financial restructuring component. It may involve evaluating debt, equity, and capital structures, seeking opportunities for refinancing or debt consolidation. The plan may also outline strategies to optimize cash flow, streamline investments, and enhance shareholder value. Throughout the implementation of the plan, effective communication and change management strategies are crucial. Regular updates, town hall meetings, and employee training programs ensure stakeholders understand the objectives, benefits, and potential impact of the merger and reorganization. Furthermore, these initiatives encourage employee engagement and align the workforce with the newly integrated company's vision and values. By leveraging relevant keywords such as Montgomery Maryland, Plan of Reorganization, Merger, CP National Corp., and All tel Corp., this description provides a detailed overview of the plan's essential elements and objectives.

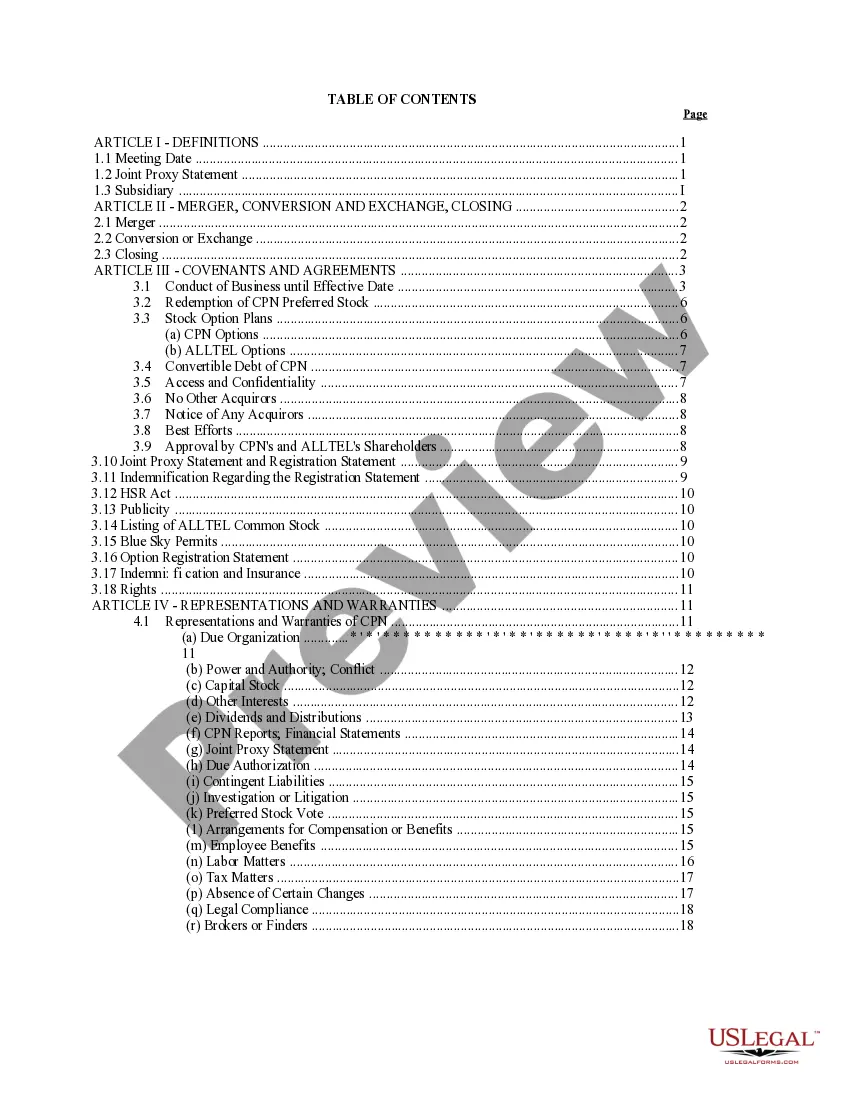

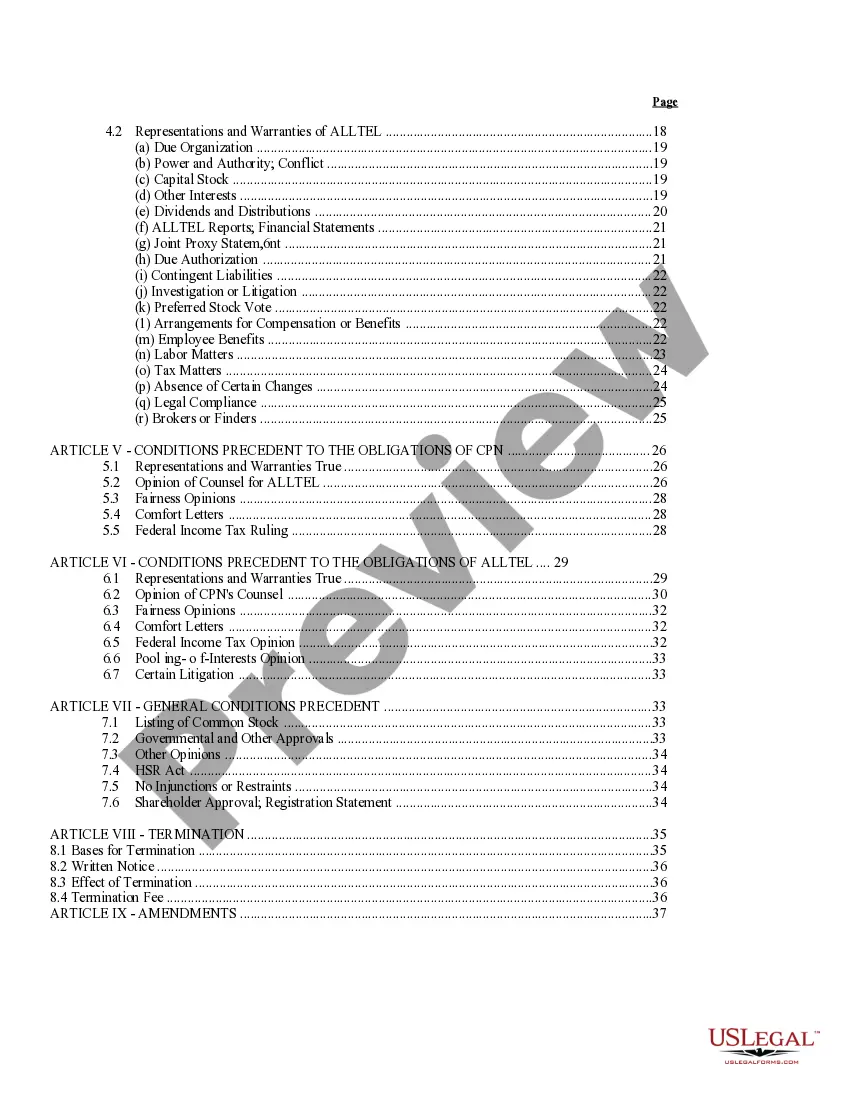

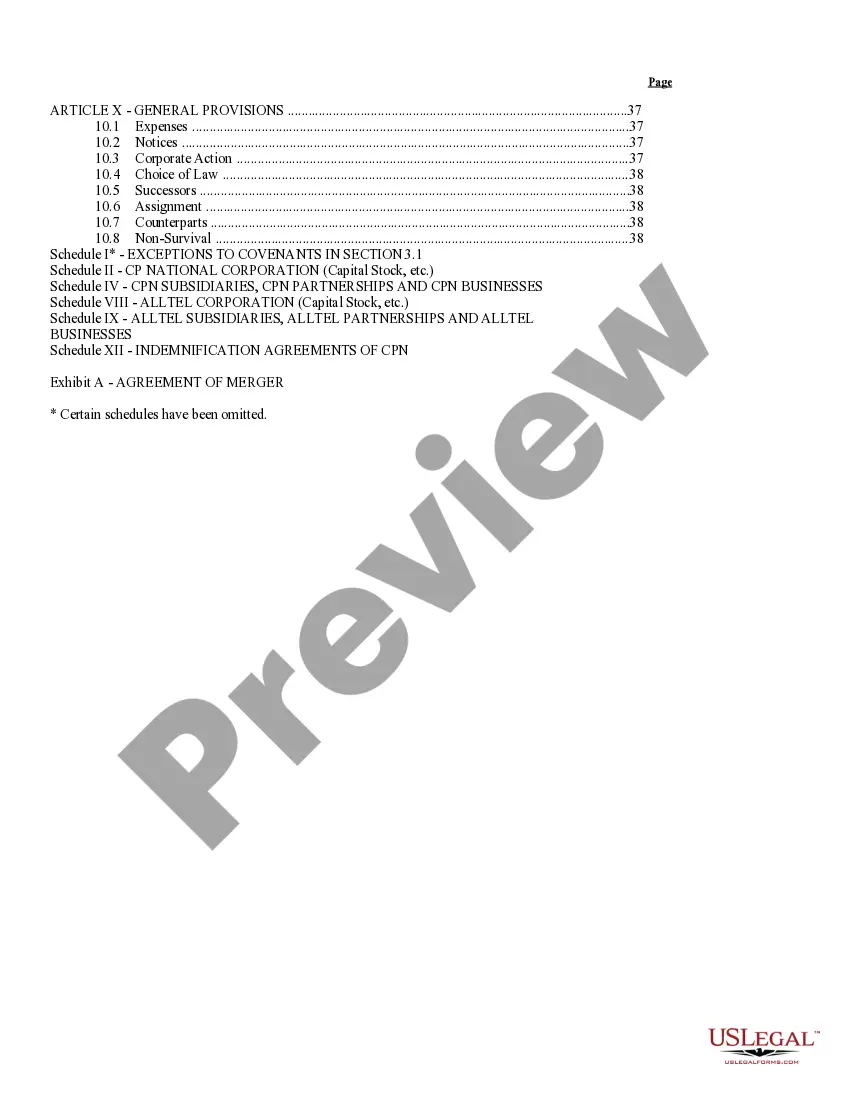

Montgomery Maryland Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.

Description

How to fill out Montgomery Maryland Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Montgomery Plan of Reorganization and Merger between CP National Corp. and Alltel Corp., you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Montgomery Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Montgomery Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A company merger is when two companies combine to form a new company. Companies merge to expand their market share, diversify products, reduce risk and competition, and increase profits.

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. 1.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

More info

In June 2005, as part of a plan of reorganization. Sun Com was merged with American Family Insurance. In September 2005, Sun Com was reclassified to a private company, Sun Com was reclassified to a privately held company, the remaining assets of the reorganized business continued to be available for issuance preferred shares, and American Family Insurance was dissolved. The Sun Com Trust Agreement provides for an optional dissolution of the Sun Com Trust in order to facilitate the reorganization. AMERICAN FAMILY INSURANCE. American Family Insurance was a subsidiary of The American Family Assurance Company, LLC (“ADAC”), which owns a controlling interest in AAC. American Family Insurance was principally engaged in the business of mortgage reinsurance. AAC is a subsidiary of the American Family Assurance Company.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.