The Allegheny Pennsylvania Agreement of Merger, led by CP National Corp., All tel Corp., and All tel California, Inc., represents a significant milestone in the corporate landscape. This agreement stands as a legal contract that outlines the terms and conditions surrounding the merger between CP National Corp., All tel Corp., and All tel California, Inc. This detailed description will shed light on the nature of this merger, its significance, and highlight different types of Allegheny Pennsylvania Agreements of Merger that may exist. The Allegheny Pennsylvania Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc., signifies a strategic consolidation of resources and assets. This merger enables the parties involved to align their expertise, market presence, and financial capabilities to foster growth and enhance competitiveness. The agreement establishes a framework for combining respective operations, capitalizing on synergies, and creating value for stakeholders. Keywords: Allegheny Pennsylvania Agreement of Merger, CP National Corp., All tel Corp., All tel California, Inc., merger, legal contract, terms and conditions, consolidation, resources, assets, strategic, expertise, market presence, financial capabilities, growth, competitiveness, framework, operations, synergies, value, stakeholders. Different types of Allegheny Pennsylvania Agreements of Merger may exist depending on various factors, including the participating entities or industries. For instance, there could be an Allegheny Pennsylvania Agreement of Merger involving companies from the telecommunications' industry, where CP National Corp., All tel Corp., and All tel California, Inc. merge to pool their networks, customer bases, and technological advancements. Similarly, another type of Allegheny Pennsylvania Agreement of Merger might involve entities from the energy sector. In this scenario, CP National Corp., All tel Corp., and All tel California, Inc. could come together to combine their renewable energy portfolios, access to infrastructure, and research and development capabilities, focusing on a more sustainable future. These are just examples to illustrate the potential diversity of Allegheny Pennsylvania Agreements of Merger. The exact characteristics and terms of these agreements would vary depending on the specific companies, industries, and strategic objectives. Keywords: Allegheny Pennsylvania Agreement of Merger, telecommunications industry, energy sector, networks, customer bases, technological advancements, renewable energy, infrastructure, research and development, sustainable future, strategic objectives. In conclusion, the Allegheny Pennsylvania Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc. represents a significant undertaking to combine forces and create a stronger, more competitive entity. This legal contract outlines the terms and conditions for the merger, detailing how resources, operations, and capabilities will be interwoven to achieve growth and value creation. Different types of Allegheny Pennsylvania Agreements of Merger can exist, depending on the industries and strategic goals involved, showcasing the versatility and adaptability of such mergers in today's dynamic business environment. Keywords: Allegheny Pennsylvania Agreement of Merger, CP National Corp., All tel Corp., All tel California, Inc., merger, legal contract, terms and conditions, resources, operations, capabilities, growth, value creation, industries, strategic goals, adaptability, business environment.

Allegheny Pennsylvania Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.

Description

How to fill out Allegheny Pennsylvania Agreement Of Merger By CP National Corp., Alltel Corp., And Alltel California, Inc.?

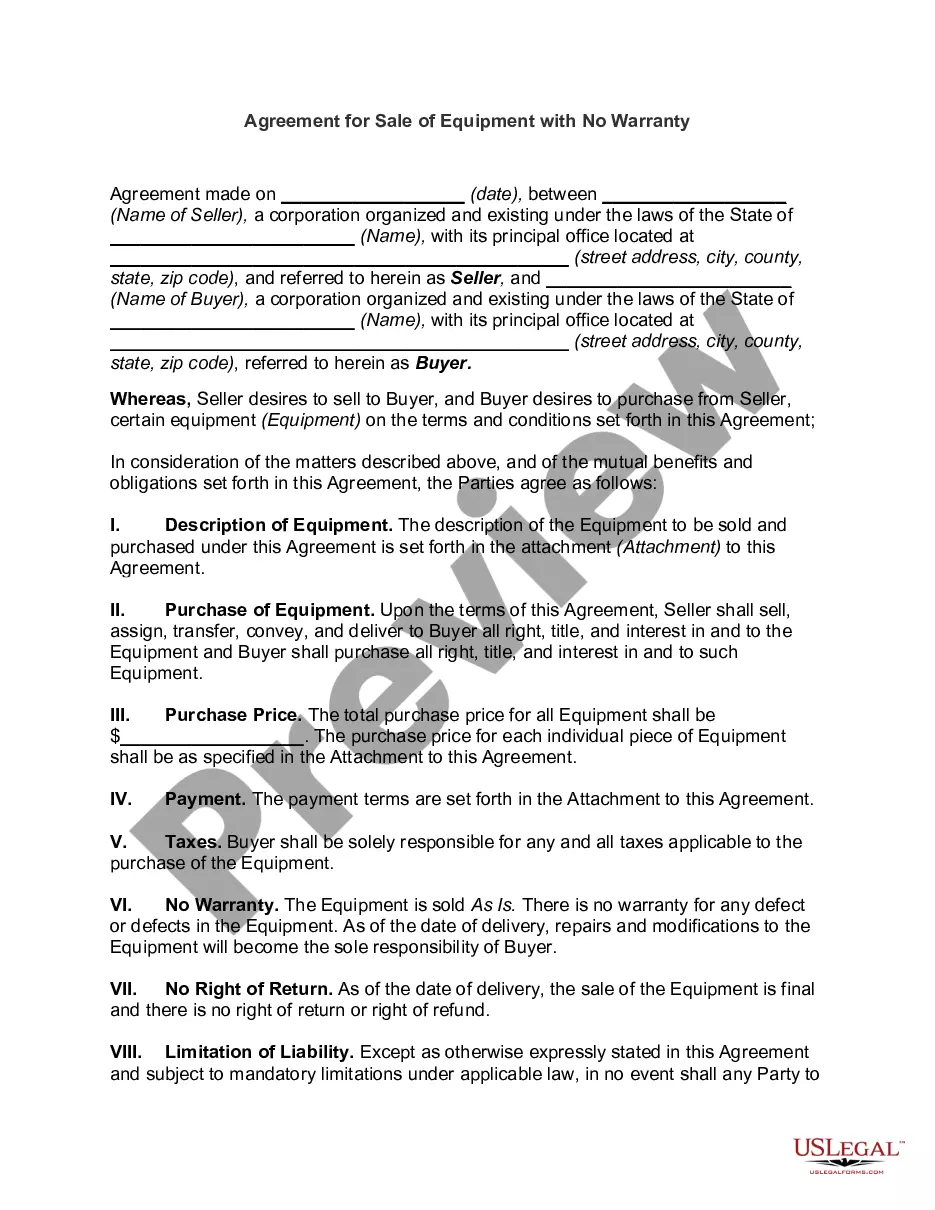

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Allegheny Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with document execution simple.

Here's how to find and download Allegheny Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc..

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

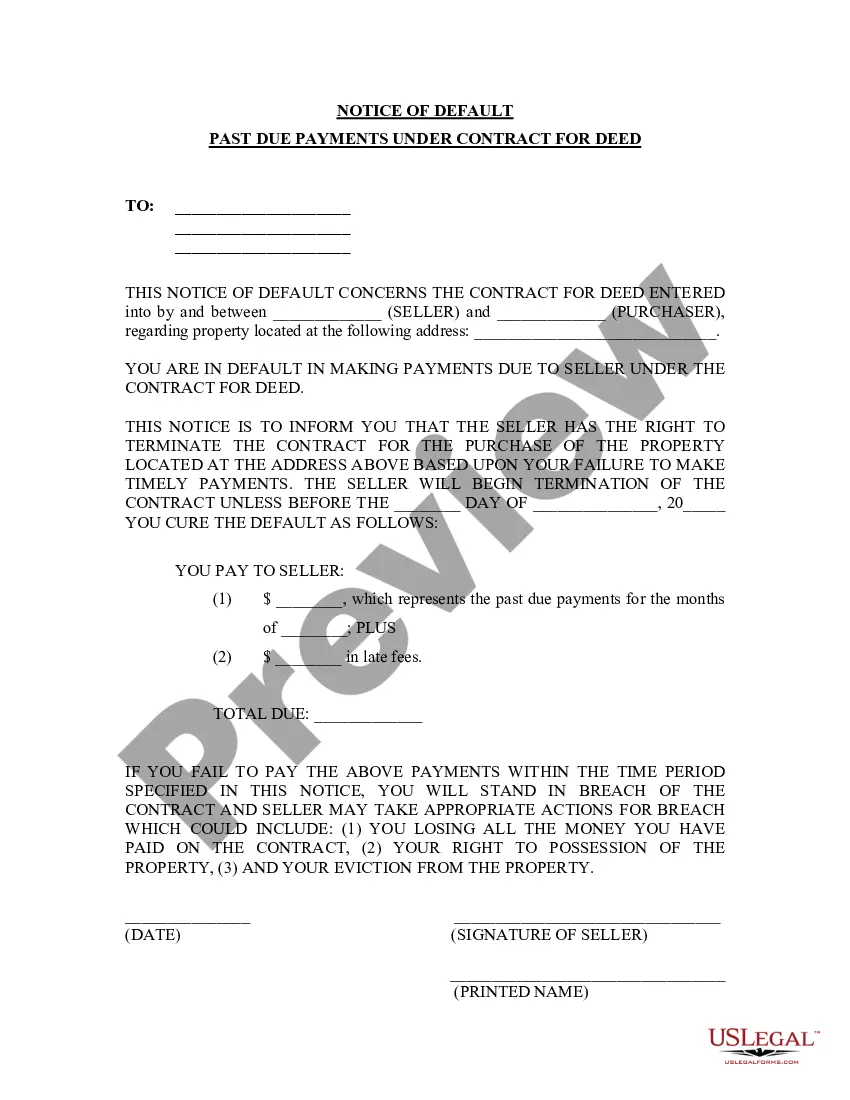

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar forms or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Allegheny Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc..

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Allegheny Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you have to deal with an exceptionally difficult case, we recommend getting a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific documents with ease!