Chicago Illinois Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc. is a legal document that outlines the terms and conditions of a merger between CP National Corp., All tel Corp., and All tel California, Inc. The agreement is designed to facilitate the consolidation of these companies, ensuring the smooth transition of assets, liabilities, and business operations. Key terms and provisions included in the Chicago Illinois Agreement of Merger include: 1. Parties involved: CP National Corp., All tel Corp., and All tel California, Inc. are the main participants in the merger. 2. Purpose: The agreement sets forth the intentions and objectives of the merger, such as combining resources, expanding market reach, and increasing efficiency. 3. Effective date: The agreement specifies the date on which the merger becomes legally effective. 4. Assets and liabilities: It outlines the transfer of assets and liabilities from the merging parties to the new entity resulting from the merger. 5. Stock exchange: If the merger involves the exchange of stock, the agreement will detail the exchange ratio and the type of stock to be issued. 6. Management and governance: The agreement addresses the composition of the new entity's board of directors, executive management, and their respective roles and responsibilities. 7. Employee matters: The agreement covers the treatment of employees of the merging companies, such as their rights, benefits, and potential reassignment or termination. 8. Intellectual property: Any intellectual property owned by the merging parties, including patents, trademarks, and copyrights, will be addressed in the agreement. 9. Regulatory approvals: The agreement acknowledges that the merger may be subject to various regulatory approvals, such as those from government agencies, shareholders, and industry-specific bodies. 10. Termination clause: The agreement may include provisions for terminating the merger under certain conditions, such as the failure to obtain necessary approvals or breaches of representations and warranties. As for different types of Chicago Illinois Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc., it should be noted that the specific terms and conditions can vary depending on the nature of the merger, the industry involved, and other factors. Some potential variations may include vertical mergers, where two companies operating in different stages of the supply chain merge, or horizontal mergers, where two companies in the same industry and market combine. However, without specific details about the merger in question, it is not possible to provide a comprehensive list of different types.

Chicago Illinois Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.

Description

How to fill out Chicago Illinois Agreement Of Merger By CP National Corp., Alltel Corp., And Alltel California, Inc.?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Chicago Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Chicago Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Chicago Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.:

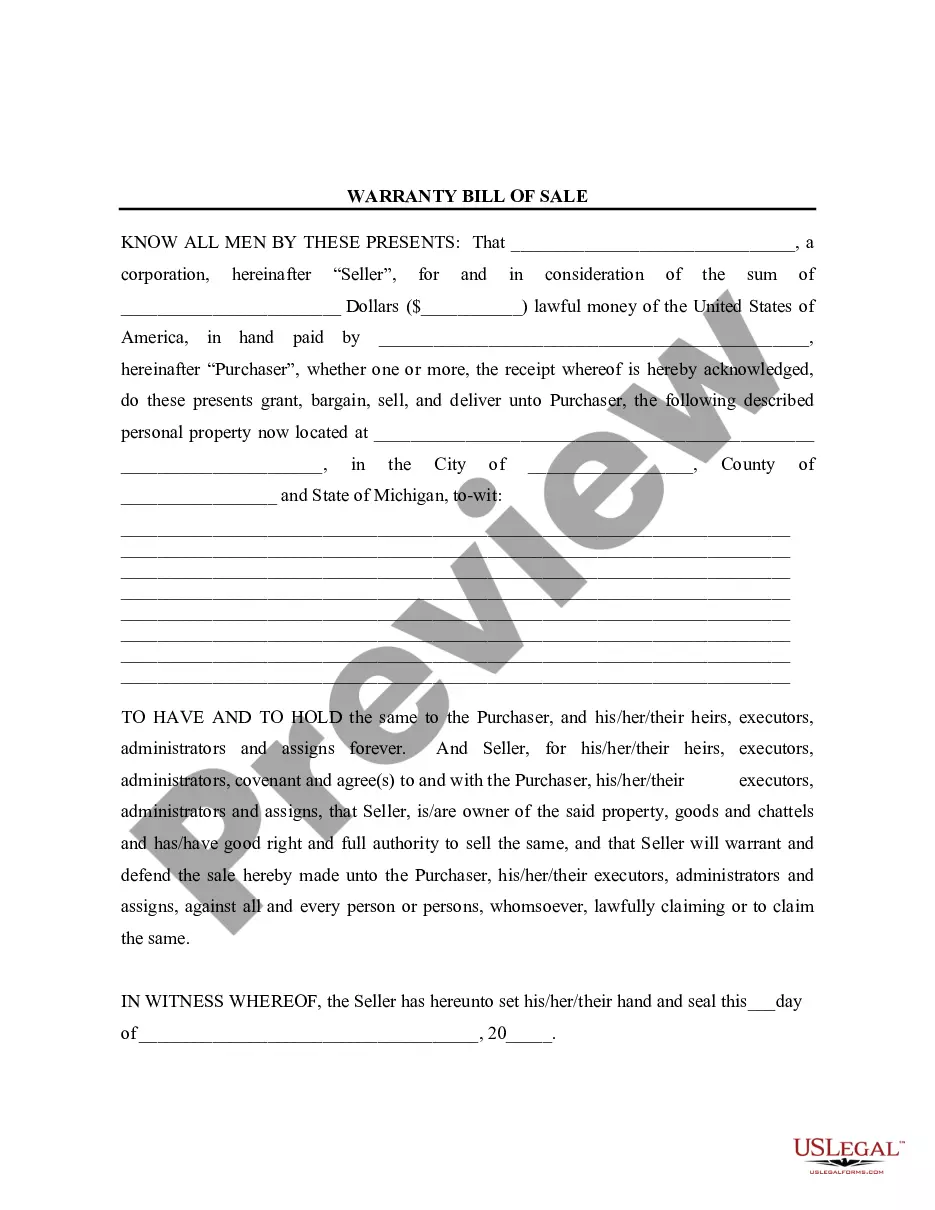

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!