Dallas Texas Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc. is a legal document that outlines the terms and conditions of a merger between these three entities. This merger agreement aims to combine the resources, expertise, and market presence of CP National Corp., All tel Corp., and All tel California, Inc. to create a more robust and competitive entity in the telecommunications' industry. The Dallas Texas Agreement of Merger is structured to ensure a smooth transition and integration of the operations, assets, and liabilities of the involved companies. It encompasses various aspects such as the exchange of shares, appointment of new board members, corporate governance structure, and financial considerations. The agreement highlights the key objectives of the merger, which may include enhancing operational efficiency, increasing market share, expanding service offerings, and capitalizing on economies of scale. The document also defines the post-merger entity's name, organizational structure, and headquarters location. Keywords: Dallas Texas, Agreement of Merger, CP National Corp., All tel Corp., All tel California, Inc., legal document, terms and conditions, merger agreement, resources, expertise, market presence, telecommunications industry, smooth transition, integration, operations, assets, liabilities, exchange of shares, board members, corporate governance structure, financial considerations, key objectives, operational efficiency, market share, service offerings, economies of scale, post-merger entity, organizational structure, headquarters location. Types of Dallas Texas Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc. may include: 1. Complete Merger Agreement: This type of agreement encompasses all aspects of the merger, including the legal, financial, and operational details of combining the entities into a single, unified organization. 2. Partial Merger Agreement: In some cases, the merger may involve only specific divisions or assets of the involved companies. A partial merger agreement would outline the terms and conditions specific to the partial merger, focusing on the transferred divisions or assets. 3. Cross-Border Merger Agreement: If one or more of the merging entities are international or have operations in multiple countries, a cross-border merger agreement would be necessary. This agreement would address the legal and regulatory aspects of merging entities from different jurisdictions. 4. Holding Company Merger Agreement: In certain cases, the merger may involve the creation of a holding company that will oversee the operations of the merged entities. A holding company merger agreement would outline the structure and governance of this new entity. Keywords: Complete Merger Agreement, Partial Merger Agreement, Cross-Border Merger Agreement, Holding Company Merger Agreement, legal, financial, operational details, single organization, specific divisions, assets, transferred, Cross-Border, jurisdictions, holding company, structure, governance.

Dallas Texas Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.

Description

How to fill out Dallas Texas Agreement Of Merger By CP National Corp., Alltel Corp., And Alltel California, Inc.?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Dallas Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Dallas Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Dallas Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.:

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

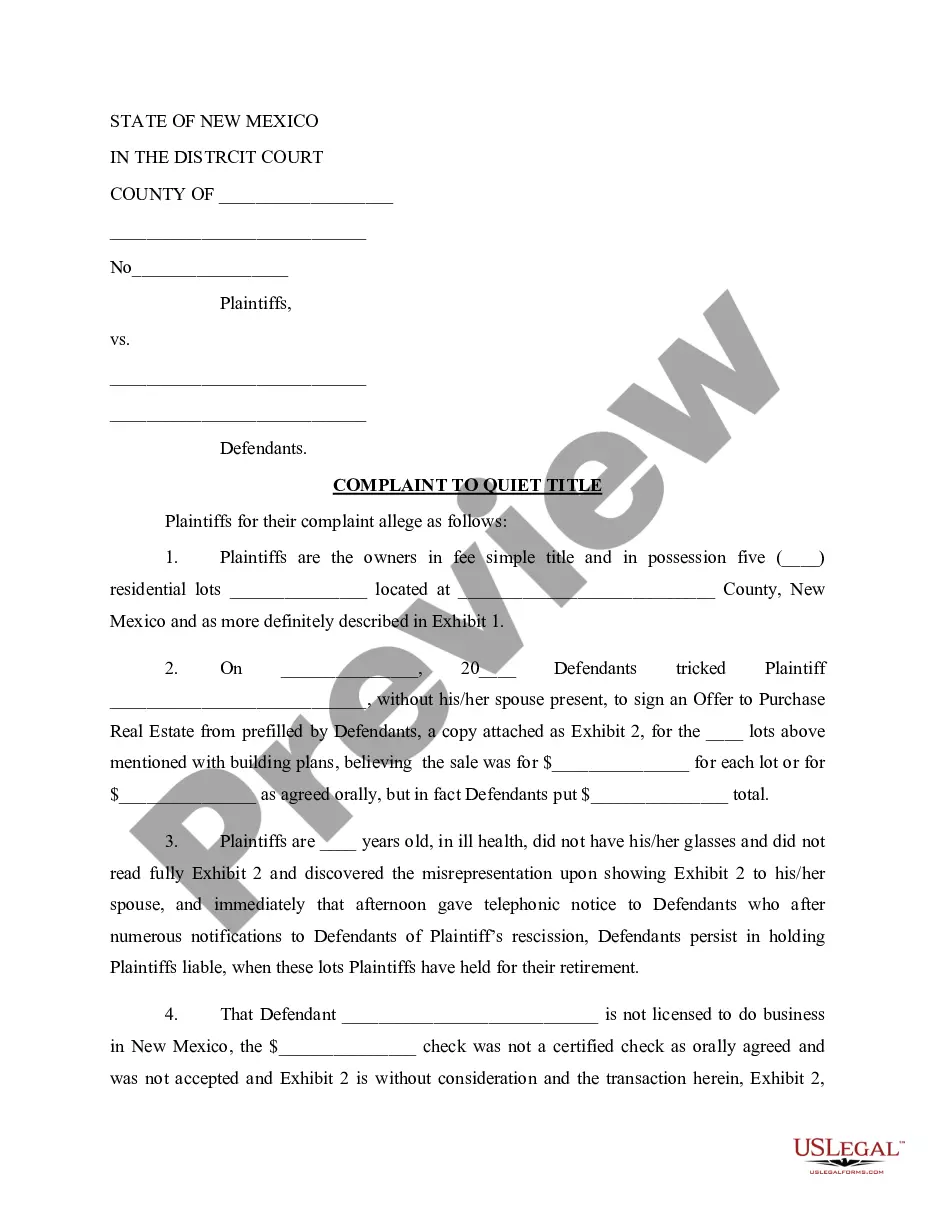

A certificate of merger, also known as an articles of merger, is a document that provides evidence of the merger between two or more entities into one entity.

Since Verizon Wireless and Alltel use the same technology platform, the vast majority of customers will be able to use their current handset after the transition to Verizon Wireless. Additional information for customers is available at .

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

Alltel Wireless was a wireless service provider, primarily based in the United States. Before acquisitions by Verizon Wireless and AT&T, it served 34 states and had approximately 13 million subscribers....Alltel. TypePrivateFounderAllen SchafferDefunct2016FateDissolved by AT&TSuccessorVerizon Wireless AT&T Mobility7 more rows

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. 1.

7. A statement that the Agreement of Merger will be provided to any stockholder of any constituent corporation or any partner of any constituent limited partnerships. Execution Block - The document must be signed by an Authorized Officer of the surviving Delaware corporation.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

The stocks of both companies in a merger are surrendered, and new equity shares are issued for the combined entity. An acquisition is when one company takes over another company, and the acquiring company becomes the owner of the target company.