The San Diego California Agreement of Merger, involving CP National Corp., All tel Corp., and All tel California, Inc., is a pivotal legal document that outlines the terms and conditions surrounding the merger between the three entities. This agreement is essential in ensuring a smooth transition and consolidation of resources, operations, and interests. Key terms and keywords related to the San Diego California Agreement of Merger may include: 1. Merger: The agreement describes the merger process, where two or more companies combine to form a single entity. 2. CP National Corp.: CP National Corp. is one of the merging parties involved in the agreement. It is a company based in San Diego, California, active in a specific industry. 3. All tel Corp.: All tel Corp. is another merging party based somewhere other than San Diego, California. The agreement will encompass the merger between All tel Corp. and CP National Corp. 4. All tel California, Inc.: All tel California, Inc., is the specific entity based in California that is a part of this merger agreement. It could be a subsidiary or a distinct division of All tel Corp., specifically catering to the California market. 5. Entity consolidation: The agreement outlines the process of consolidating the assets, resources, and operations of the merging entities into a single entity. 6. Shareholders' interests: It delineates the protection and treatment of shareholders' interests and rights in the merged entity. 7. Asset transfer: The agreement details the transfer of assets, including intellectual property, trademarks, licenses, contracts, and physical properties, from the merging parties to the new entity. 8. Operations and management: It establishes the protocol and structure for ongoing operations, management, and decision-making processes in the merged entity. 9. Legal compliance: The agreement ensures compliance with legal and regulatory requirements during the merger process. 10. Financial considerations: It covers financial aspects such as the exchange of stocks, merger costs, dividends, tax implications, and any cash or stock payments made to the stakeholders. While this description primarily pertains to a general San Diego California Agreement of Merger by CP National Corp., All tel Corp., and All tel California, Inc., it is worth noting that specific types or variations of agreements within this context could exist based on the individual circumstances of each merger or acquisition process.

San Diego California Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.

Description

How to fill out San Diego California Agreement Of Merger By CP National Corp., Alltel Corp., And Alltel California, Inc.?

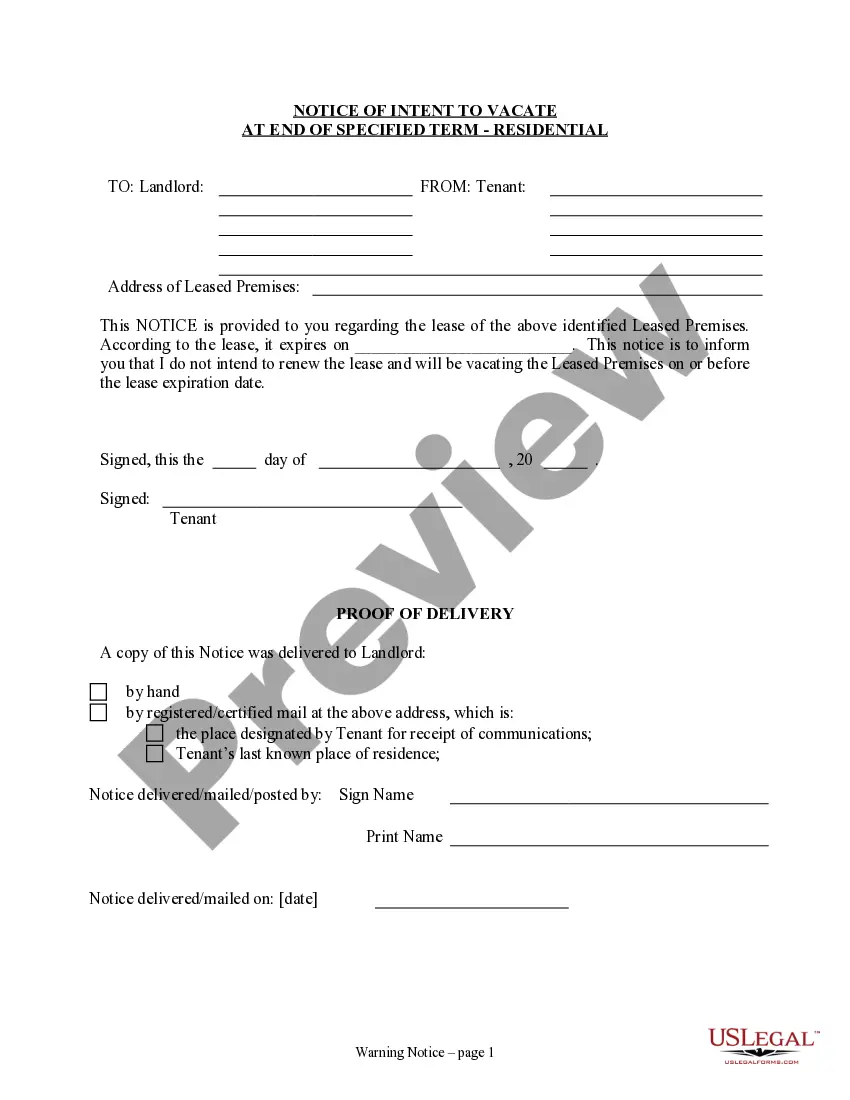

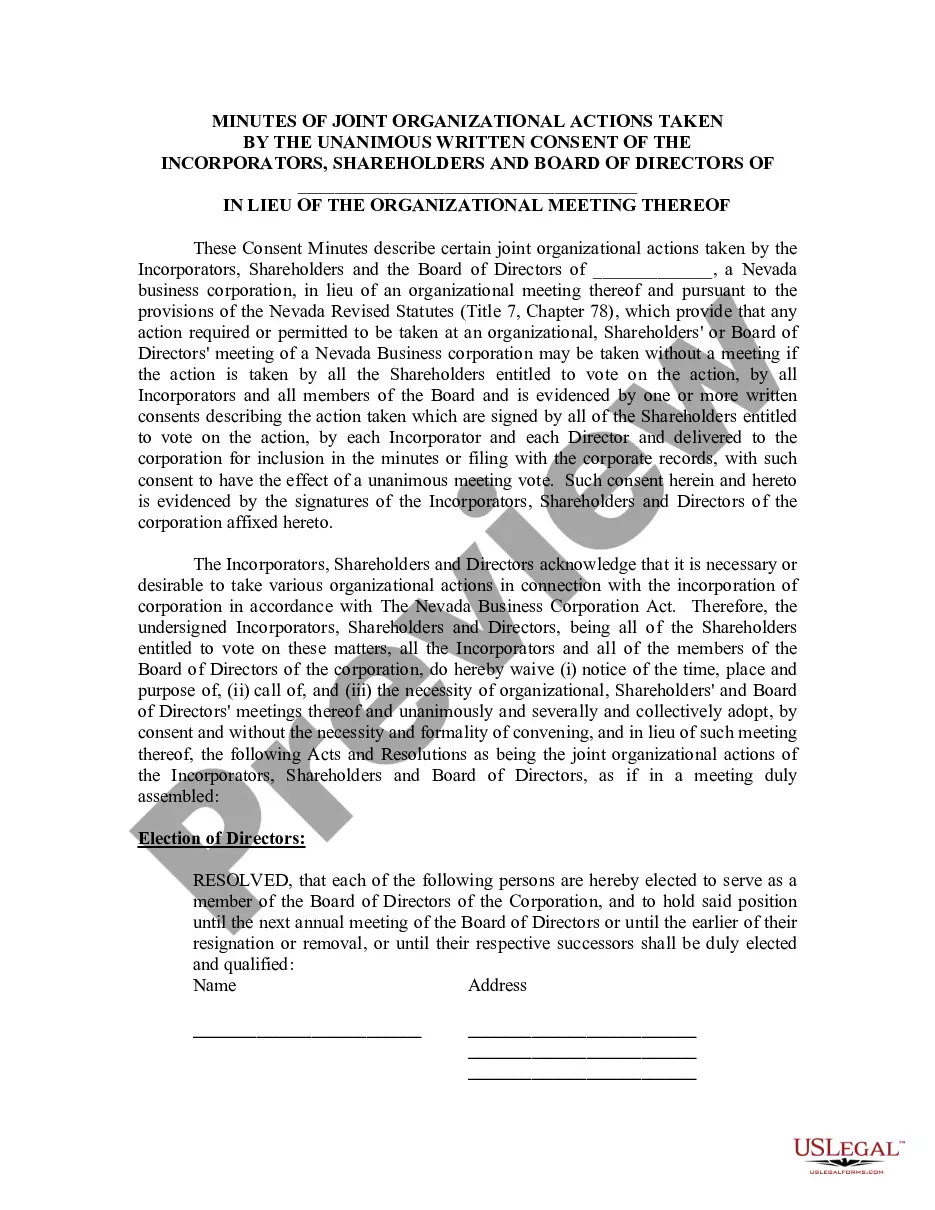

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the current version of the San Diego Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your San Diego Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc. and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!