The Hennepin Minnesota Agreement of Merger is a significant legal document that outlines the merger between VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. This agreement serves as a definitive agreement for the consolidation of these companies, aiming to optimize their collective resources, expertise, and market presence. The Hennepin Minnesota Agreement of Merger establishes the terms and conditions under which VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. will combine their operations to form a stronger and more competitive entity. This merger is expected to generate synergies, increase operational efficiency, expand market reach, and deliver enhanced value to shareholders, customers, and stakeholders. This agreement encompasses various key aspects to ensure a smooth merger process. It includes provisions related to the allocation of shares, assets, and liabilities, as well as the governance structure of the merged entity. Additionally, it outlines the procedures for the integration of employees, the transfer of contracts, and the consolidation of operations. Compliance with applicable laws, regulatory approvals, and the protection of intellectual property rights are also addressed in this document. The Hennepin Minnesota Agreement of Merger may also have different types, depending on the specific nature and scope of the merger. These variations can include horizontal mergers, where companies operating in the same industry or sector merge to achieve economies of scale and expand market share. Vertical mergers can also be formed, involving companies from different stages of the same supply chain, aiming to streamline operations and improve efficiency. Other possibilities include conglomerate mergers, where unrelated companies merge to diversify their operations and minimize risk. Keyword: Hennepin Minnesota Agreement of Merger, VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., National Energy Group, Inc., merger, consolidation, synergies, operational efficiency, market reach, shareholders, customers, stakeholders, allocation of shares, assets, liabilities, governance structure, employee integration, contract transfer, compliance, regulatory approvals, intellectual property rights, horizontal merger, vertical merger, conglomerate merger.

Hennepin Minnesota Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.

Description

How to fill out Hennepin Minnesota Agreement Of Merger By VP Oil, Inc., VP Acquisition Corp., Big Piney Oil And Gas Co., Big Piney Acquisition Corp., And National Energy Group, Inc.?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so helpful.

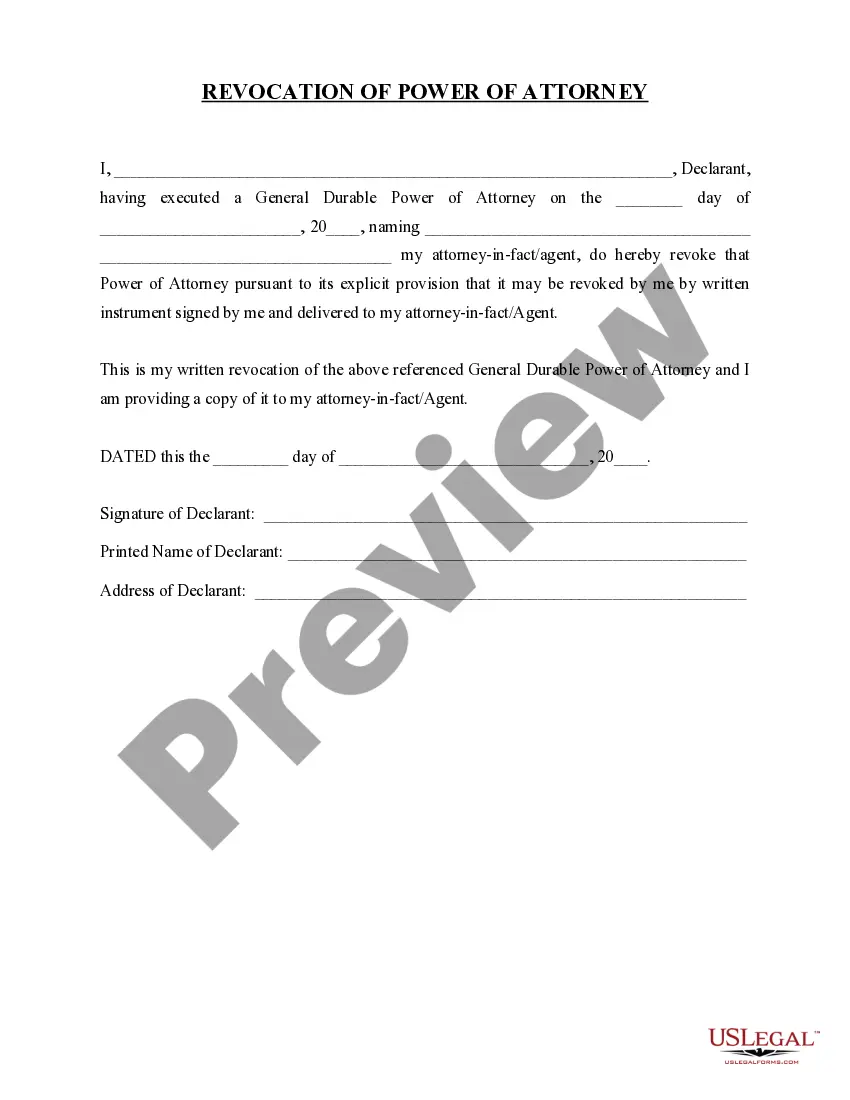

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Hennepin Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc..

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Hennepin Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Hennepin Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Hennepin Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!