Houston Texas Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. is a significant corporate agreement that involves the merging of multiple oil and gas companies. This merger aims to consolidate resources, optimize operations, and enhance overall market competitiveness within the energy sector. The Houston Texas Agreement of Merger signifies that VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. have reached an understanding uniting their respective organizations. This merger will create a stronger and more diversified company, capable of leveraging their combined expertise, assets, and financial strength to unlock growth opportunities and deliver value to their shareholders. As a result of this agreement, the newly merged entity will be equipped to navigate the volatile energy market, sustain long-term profitability, and maximize value creation for all stakeholders. By pooling their resources and sharing best practices, the companies aim to achieve cost savings, operational efficiencies, and technological advancements in exploration, production, and distribution of oil and gas products. The Houston Texas Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. demonstrates their commitment to strategic growth and their vision to become a dominant player in the energy industry. This merger is expected to enhance the companies' collective capabilities in research and development, environmental stewardship, and community engagement. The specialized types of Houston Texas Agreement of Merger that can arise in this context include horizontal mergers, vertical mergers, and conglomerate mergers. Horizontal mergers involve the combination of companies operating within the same industry and at the same stage of the production process. Vertical mergers occur when companies operating at different stages of the production process merge together. Conglomerate mergers involve the merger of companies operating in unrelated industries. In conclusion, the Houston Texas Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. is a significant strategic move aimed at strengthening the energy industry's footprint. Through this merger, the companies seek to create a more competitive, sustainable, and resilient organization, capable of driving innovation and delivering long-term value to its stakeholders.

Houston Texas Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.

Description

How to fill out Houston Texas Agreement Of Merger By VP Oil, Inc., VP Acquisition Corp., Big Piney Oil And Gas Co., Big Piney Acquisition Corp., And National Energy Group, Inc.?

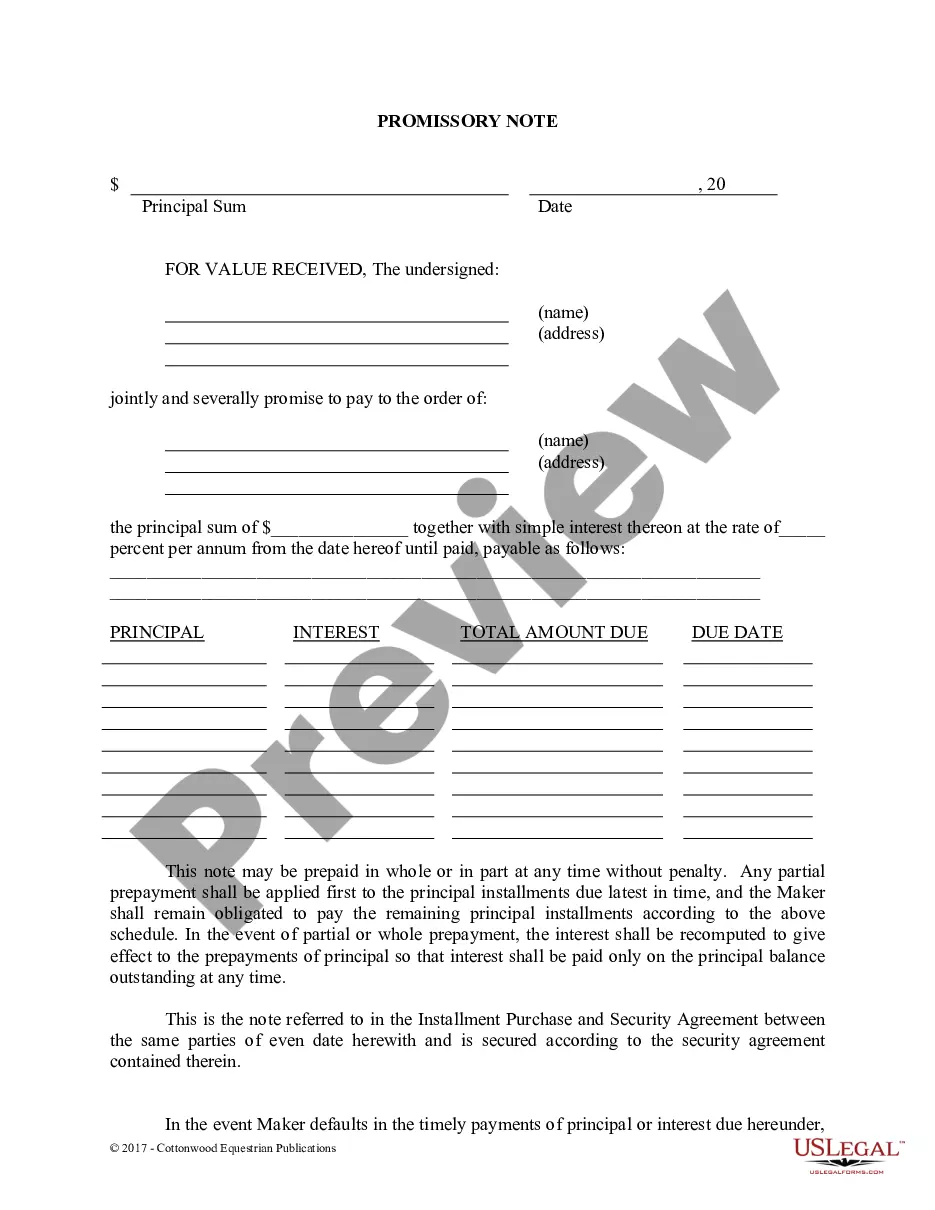

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Houston Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any tasks associated with document completion straightforward.

Here's how you can find and download Houston Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc..

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the similar document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Houston Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc..

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Houston Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc., log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you need to deal with an extremely challenging case, we recommend using the services of an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!