The Chicago Illinois Exchange Agreement, executed by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders, is a legally binding contract that outlines the terms and conditions for the exchange of assets and shares between these entities. This agreement is of immense importance in the financial and insurance sectors, and the involvement of these prominent organizations adds further significance to it. The Chicago Illinois Exchange Agreement is anticipated to function as a catalyst for strategic business partnerships, capitalizing on the strengths and synergies of the parties involved. This collaboration aims to optimize resource allocation, enhance operational efficiency, and foster growth in an increasingly competitive market landscape. Under this agreement, different types of exchanges can take place, such as: 1. Asset Exchange: The agreement facilitates the exchange of specific assets, allowing each party to acquire or divest assets that align with their respective business strategies. This can involve the transfer of physical assets, intellectual property, or any other form of valuable asset. 2. Share Exchange: This agreement also enables the exchange of shares among the involved entities. Shareholders of CCP, Danielson Holding Corp., and Mission American Insurance Co. may exchange their shares in a mutually beneficial manner, potentially resulting in increased ownership percentages or realignment of ownership structure. 3. Capital Exchange: The agreement may also include provisions for the exchange of capital or financial resources. This could involve the infusion of additional funds into one of the entities, allowing for expansion, investment, or diversification of business activities. 4. Risk Mitigation: The Chicago Illinois Exchange Agreement may encompass clauses related to risk-sharing and risk mitigation strategies. Entities can leverage the expertise and capabilities of one another to manage and mitigate potential risks, ensuring the stability and longevity of their respective businesses. It is important to note that the specifics, variations, and additional types of exchanges under the Chicago Illinois Exchange Agreement will depend on the individual intentions, goals, and needs of the involved organizations. The agreement serves as a contractual framework within which the parties can mutually negotiate and define the terms of their exchanges, outlining their respective rights, responsibilities, and obligations. Overall, the Chicago Illinois Exchange Agreement executed by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders represents a significant step towards collaborative growth, synergy-driven partnerships, and efficient resource allocation within the financial and insurance sectors.

Chicago Illinois Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

How to fill out Chicago Illinois Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Chicago Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Chicago Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Chicago Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders:

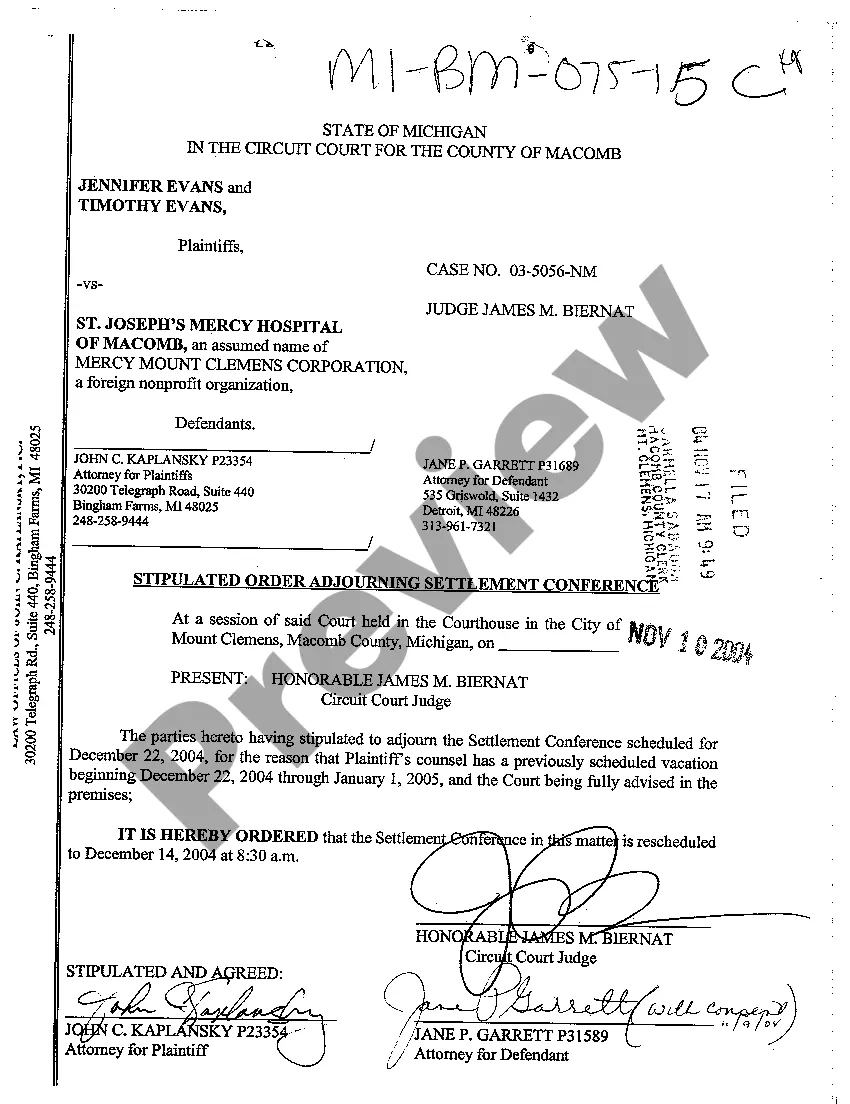

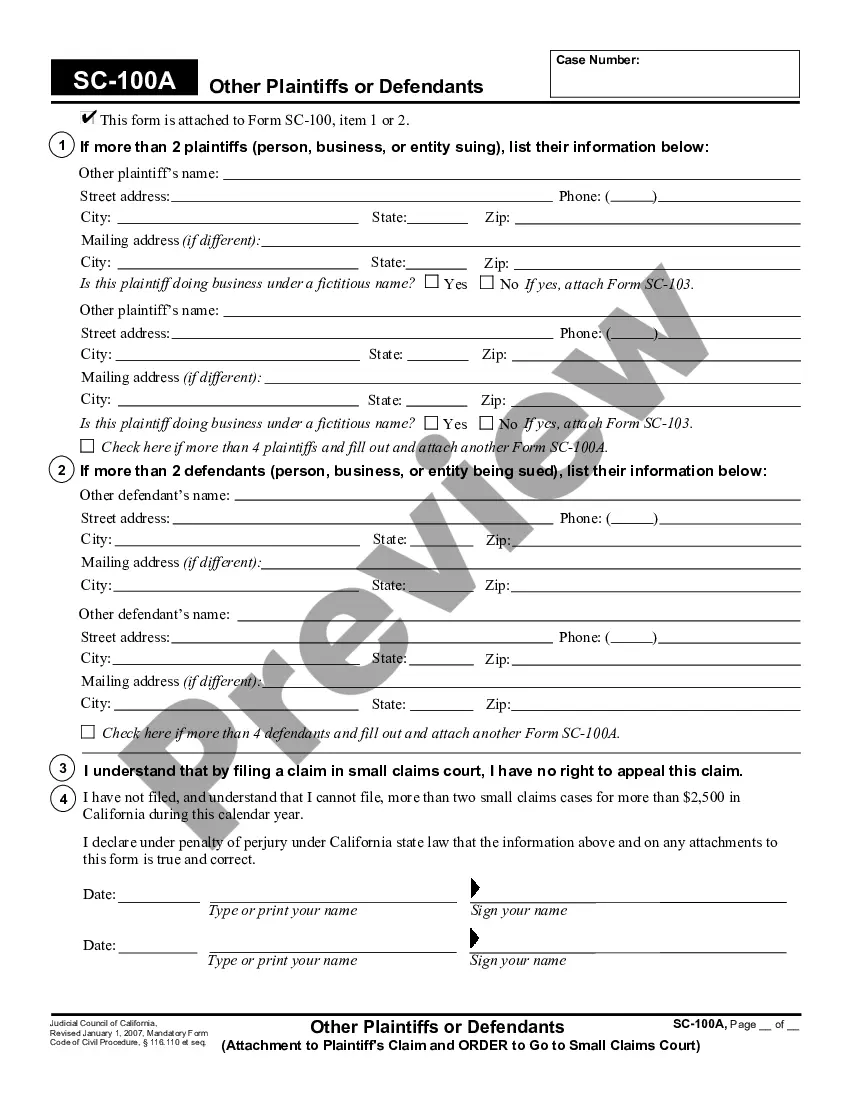

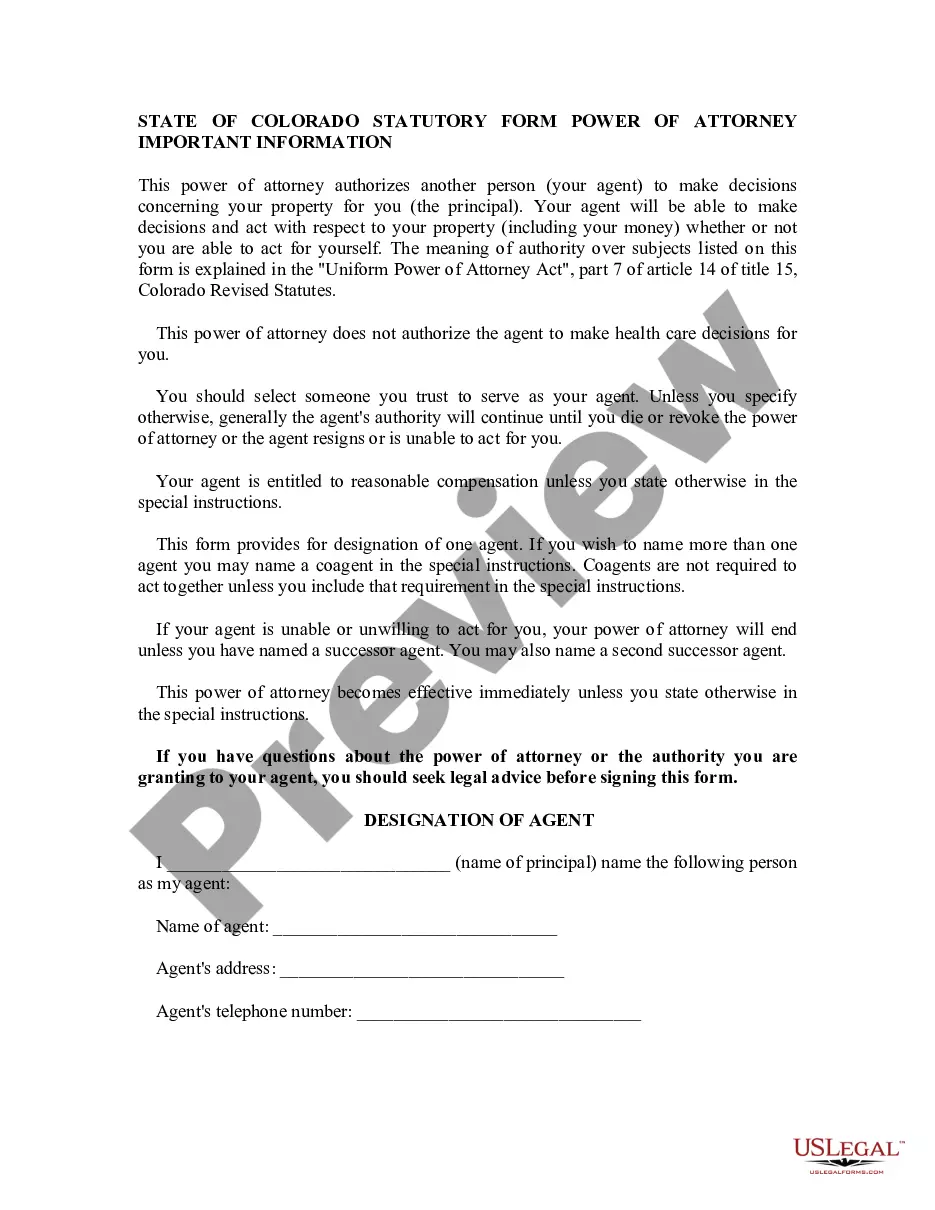

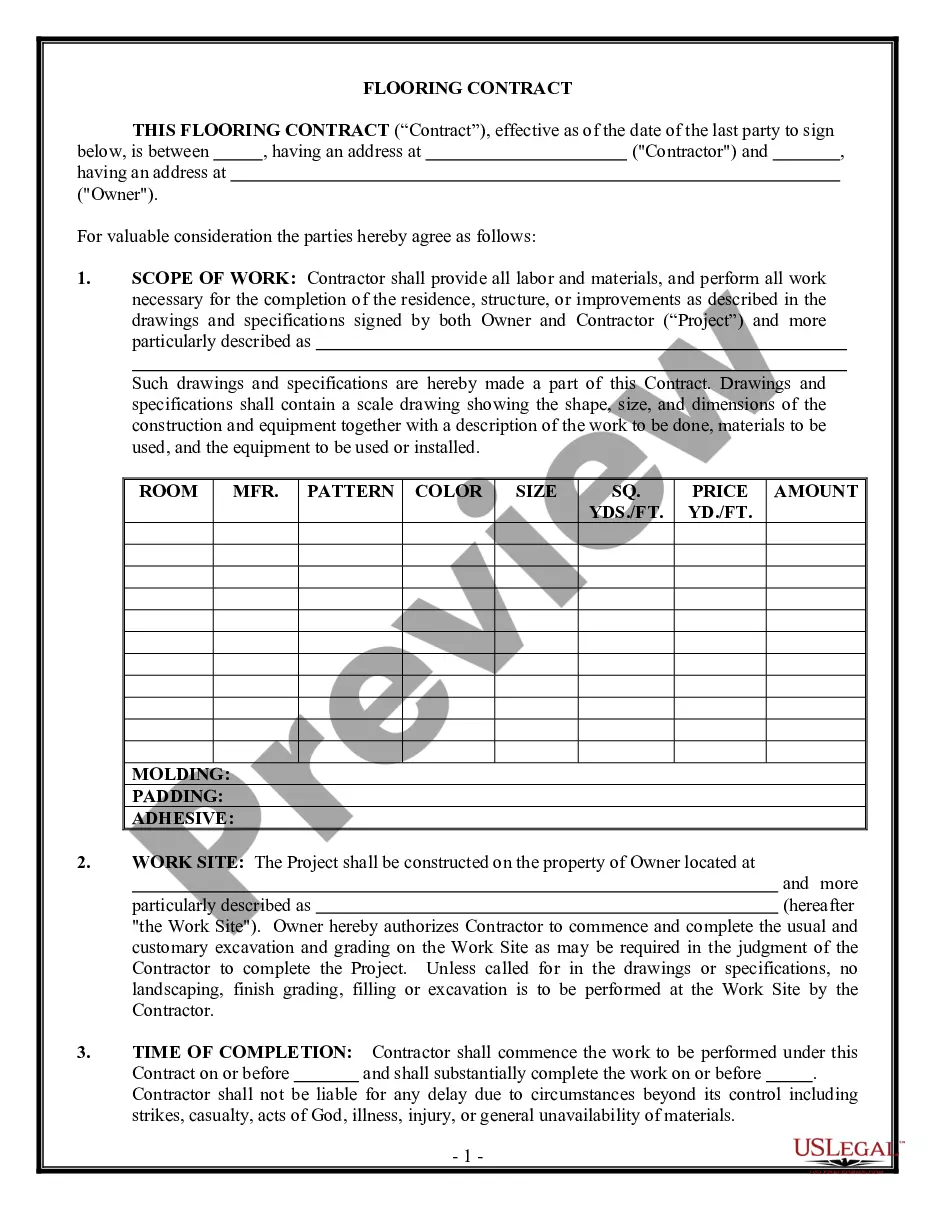

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!