The Dallas Texas Exchange Agreement between Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders is a contract that outlines the terms and conditions of a strategic partnership between these entities. This agreement focuses on facilitating the exchange of crucial resources, knowledge, and expertise to enhance their respective operations and ultimately achieve mutual growth. Danielson Holding Corp., a leading provider of financial services, enters into this agreement with Mission American Insurance Co., a prominent insurance company, and the CCP Shareholders, who are the major stakeholders of CCP, a renowned investment firm. The collaboration aims to leverage the unique strengths and capabilities of each organization to pursue profitable opportunities and create value in the Dallas Texas market. Through this exchange agreement, the parties establish a framework for cooperation in various areas such as investment strategies, risk management, marketing, and technological advancements. By pooling their expertise, resources, and market insights, they aim to maximize their competitive advantages and improve their overall performance. Different types of Dallas Texas Exchange Agreements facilitated by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders may include: 1. Investment Exchange Agreement: This type of agreement allows the parties to exchange investment opportunities, share market intelligence, and collaborate on joint investment projects in the Dallas Texas region. It aims to diversify their investment portfolios and capitalize on emerging market trends. 2. Risk Management Exchange Agreement: This agreement focuses on sharing risk management strategies, tools, and techniques to mitigate financial risks and ensure regulatory compliance. It enhances the parties' ability to assess and manage risks associated with their operations in Dallas Texas. 3. Marketing Partnership Agreement: This type of agreement enables the parties to jointly develop and execute marketing campaigns, promotional activities, and customer acquisition initiatives in the Dallas Texas market. It leverages their combined brand reputation and customer reach to expand their market share. 4. Technological Collaboration Agreement: This agreement pertains to the exchange of technological know-how, innovative solutions, and research and development efforts. It facilitates the adoption of advanced technologies, such as artificial intelligence and blockchain, to drive operational efficiency and create cutting-edge products and services. Overall, the Dallas Texas Exchange Agreement between Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders signifies a strategic alliance aimed at capitalizing on the vast potential of the Dallas Texas market. Through collaborative efforts, they intend to enhance their business operations, deliver superior value to stakeholders, and reinforce their position as industry leaders.

Dallas Texas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

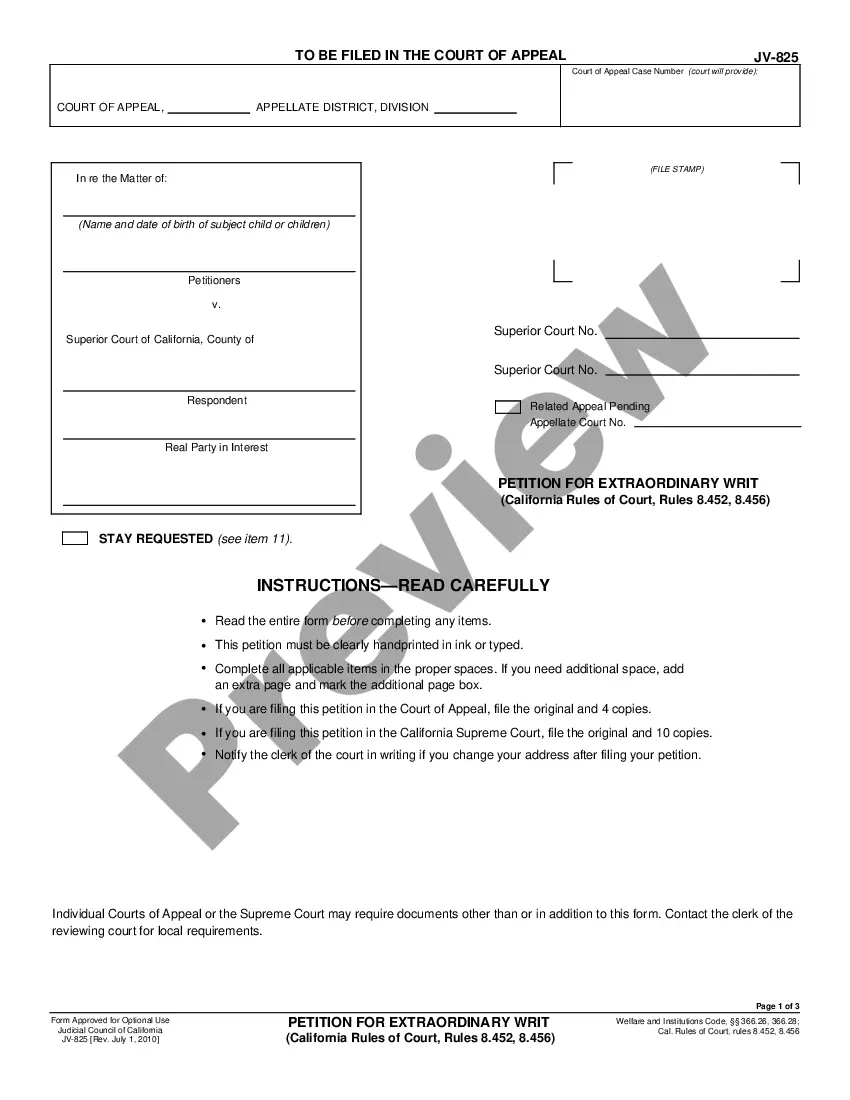

How to fill out Dallas Texas Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Do you need to quickly create a legally-binding Dallas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders or probably any other document to take control of your own or corporate matters? You can select one of the two options: hire a legal advisor to draft a valid document for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Dallas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Dallas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders is adapted to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by using the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Dallas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

Interesting Questions

More info

If a company is in default, the insurance companies sell the underlying portfolio and other assets to the defaulting insurer. The default insurer sells the assets to a secondary purchaser and pays the secondary purchaser the premiums and accrued interest. The remaining funds are sent back to the primary insurance company. The primary insurer purchases the assets back from an issuer or third party and makes a claim on the insurance company. The issuer will have paid the initial premium when the primary insurer receives the investment portfolio back, and it has incurred the accrued interest. The secondary insurer will get the assets back from the secondary insurer when the primary insurer pays the claims. A portfolio of non-life insurance companies and reinsurance policies could be a lucrative venture for an entrepreneur.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.