The San Diego California Exchange Agreement is a significant legal arrangement entered into by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders. This comprehensive agreement outlines the terms, conditions, and objectives agreed upon by the parties involved in relation to a specific exchange of assets, shares, or interests within the San Diego region of California. One type of San Diego California Exchange Agreement executed by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders could involve the exchange of shares or stocks held by each party. In this scenario, the agreement would detail the number of shares, the valuation, and the allocation process, ensuring a fair and equitable exchange. Furthermore, another variation of the San Diego California Exchange Agreement could be centered around the exchange of certain assets or property holdings within the region. This type of agreement may encompass real estate properties, intellectual property rights, or any other tangible or intangible assets that are subject to exchange. When drafting the San Diego California Exchange Agreement, Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders would specifically designate the roles and responsibilities of each party involved, ensuring clarity and alignment in the execution of the agreement. This includes defining the conditions for the exchange, such as any necessary approvals or consents, timelines for completion, and any potential contingencies that need to be considered. Additionally, the agreement may outline the financial considerations associated with the exchange, such as the method of payment or the determination of fair market value for the assets or shares being exchanged. It may also address any potential tax implications or regulatory requirements that need to be adhered to as a result of the exchange. Overall, the San Diego California Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders represents a legally binding agreement that aims to facilitate a seamless exchange of assets, shares, or interests within the San Diego region of California. This agreement ensures that all parties involved have a comprehensive understanding of their rights, obligations, and expectations, safeguarding the interests of each entity and promoting a mutually beneficial outcome.

San Diego California Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

How to fill out San Diego California Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the San Diego Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the San Diego Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders:

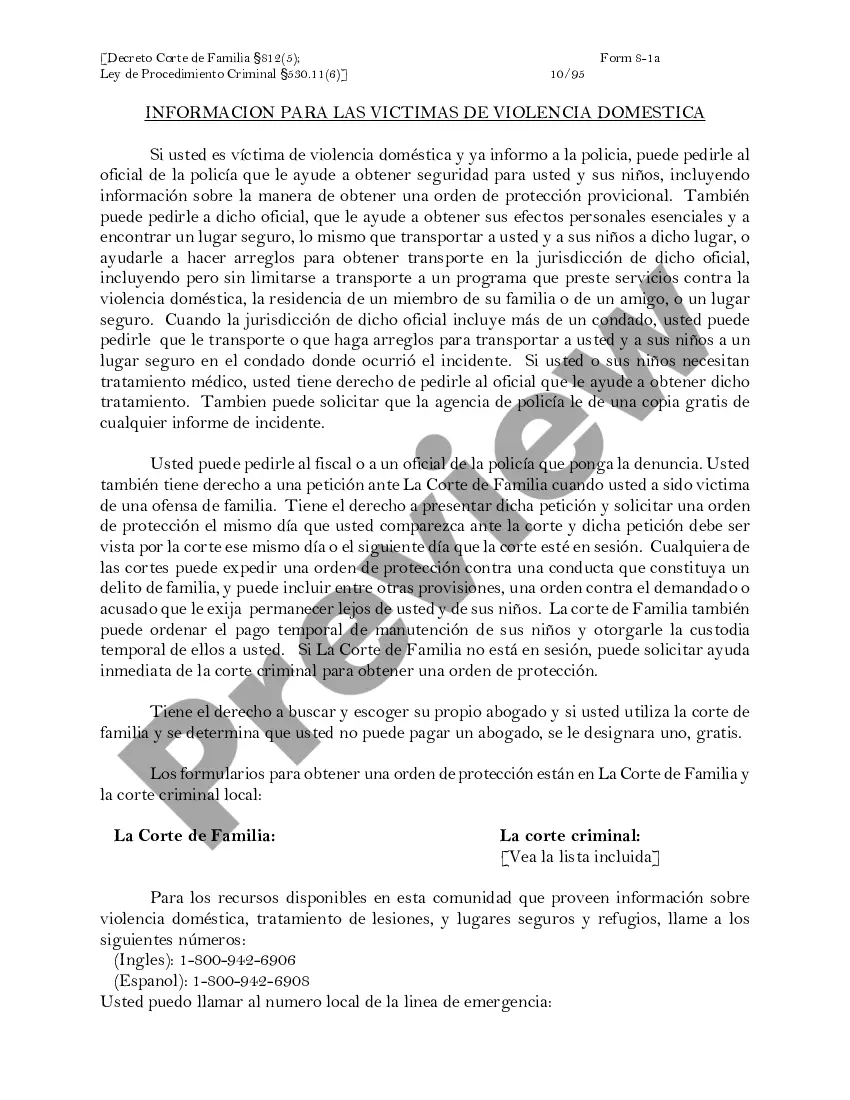

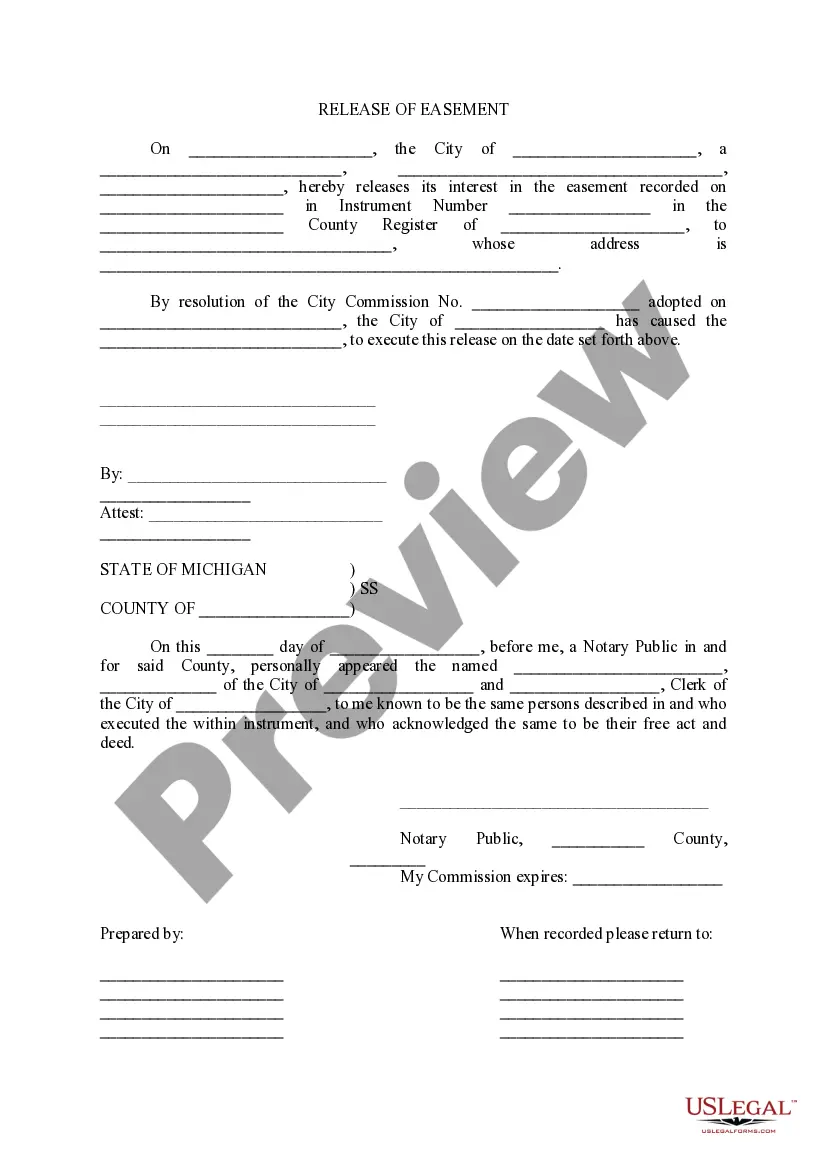

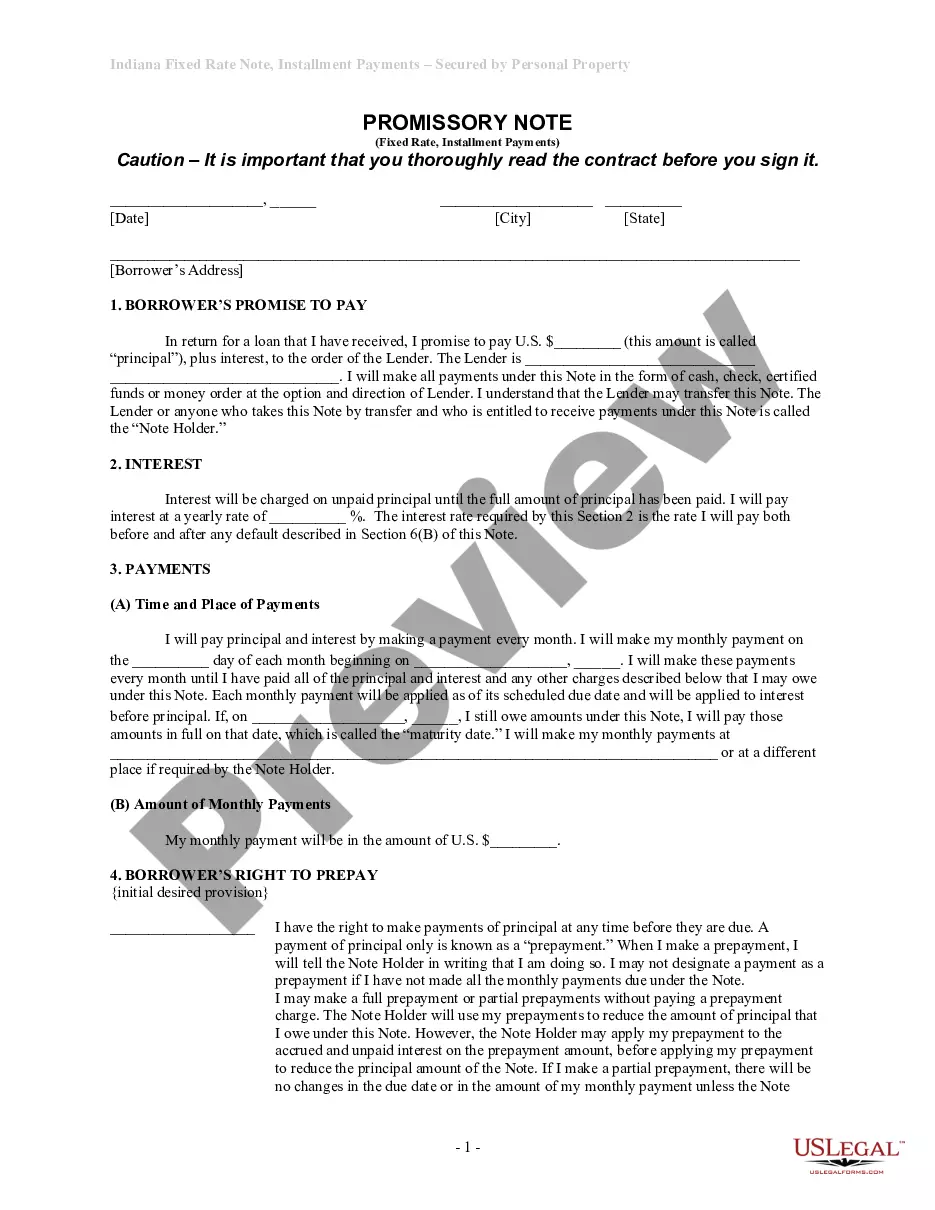

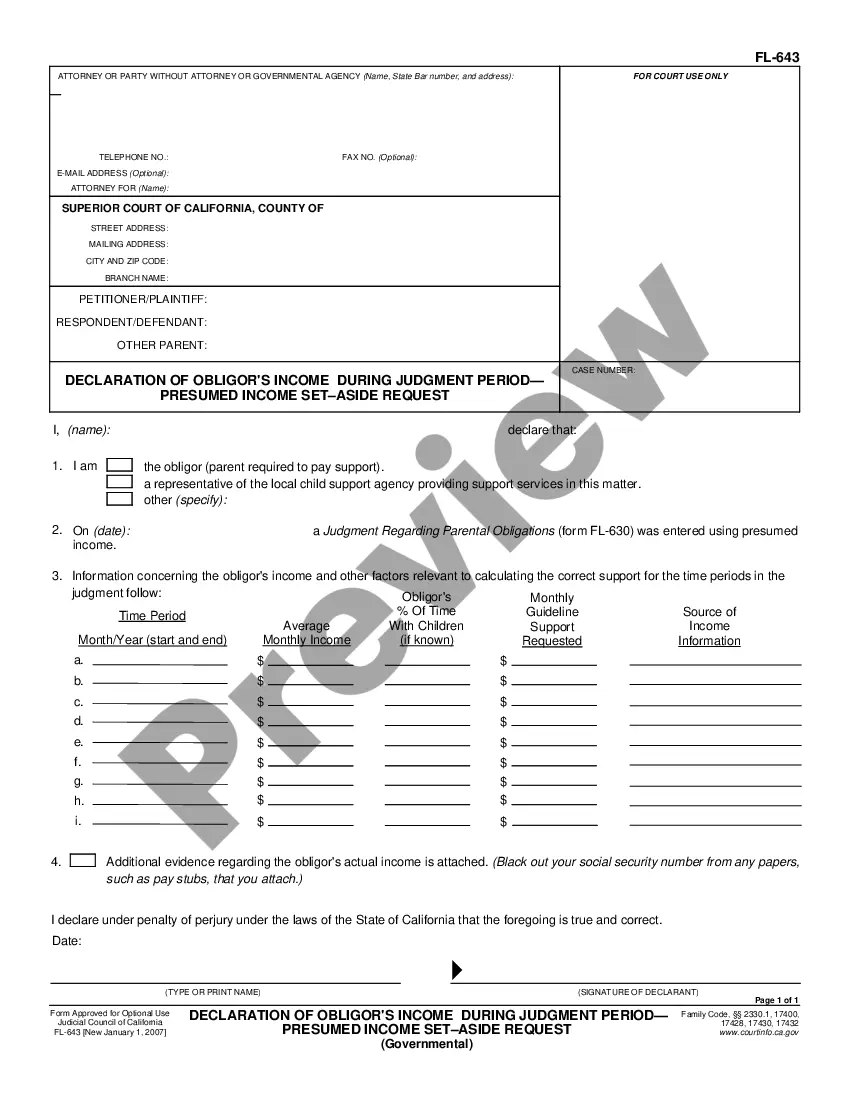

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!