Travis Texas Exchange Agreement refers to a legal contract entered into by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders, outlining the terms of a mutual business transaction. This agreement aims to facilitate the exchange of assets, shares, or interests among the parties involved. The primary type of Travis Texas Exchange Agreement between these entities encompasses a comprehensive transfer of ownership rights, assets, or securities. Under this agreement, Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders agree to exchange their respective assets, shares, or interests based on pre-determined conditions and terms of the contract. Keywords: Travis Texas Exchange Agreement, Danielson Holding Corp., Mission American Insurance Co., CCP Shareholders, mutual business transaction, exchange of assets, shares, interests, transfer of ownership rights, securities. However, it is crucial to note that there might be variations or subcategories of the Travis Texas Exchange Agreement, depending on the specific nature of the transaction. These variations can include: 1. Asset Exchange Agreement: This type of Travis Texas Exchange Agreement specifically focuses on transferring physical or non-physical assets between the entities involved. It outlines the terms of the exchange, including the valuation, condition, and transfer process of the assets. 2. Stock Exchange Agreement: In this subcategory, the Travis Texas Exchange Agreement revolves around the exchange of shares or stocks between Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders. It outlines the number of shares being exchanged, the valuation method, and any necessary approvals or regulatory compliance. 3. Ownership Interest Exchange Agreement: This type of Travis Texas Exchange Agreement primarily concerns the exchange of ownership interests, such as partnership interests, membership units, or joint ventures. It lays out the terms, conditions, and valuation methodology for transferring these ownership rights among the involved parties. 4. Merger or Acquisition Agreement: If the Travis Texas Exchange Agreement involves a merger or acquisition, it will encompass specific terms related to the consolidation or takeover of one entity by another. This agreement would detail aspects such as purchase price, integration plans, post-transaction roles and responsibilities, and any regulatory or shareholder approvals required. Keywords: asset exchange agreement, stock exchange agreement, ownership interest exchange agreement, merger, acquisition, consolidation, takeover, transfer process, valuation methodology, integration plans, regulatory compliance. Overall, the Travis Texas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders serves as a legally binding contract that facilitates the exchange of assets, shares, or interests between the involved parties. The specific type of agreement may vary based on the nature of the transaction, such as asset exchange, stock exchange, ownership interest exchange, or merger/acquisition. However, all variations aim to outline the terms, conditions, and procedures for a successful exchange of assets or interests among the parties.

Travis Texas Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

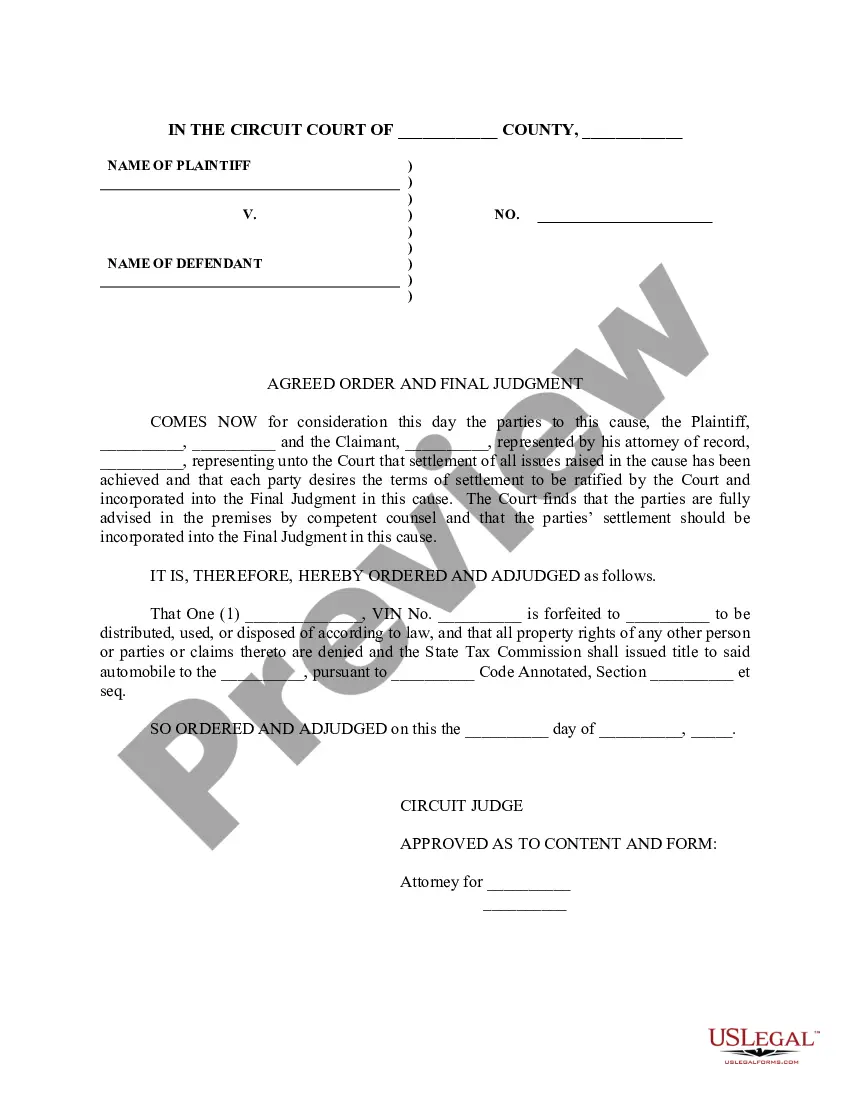

How to fill out Travis Texas Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Preparing papers for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Travis Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Travis Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Travis Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!