Houston Texas Restructuring Agreement is a legally binding agreement that outlines the terms and conditions for a reorganization or restructuring plan in Houston, Texas. This agreement is particularly significant when a business or organization is facing financial difficulties and needs to undergo a financial makeover to continue its operations. The Houston Texas Restructuring Agreement involves the negotiation and formalization of a plan between the debtor (the party in financial distress) and the creditors (those owed money). It aims to provide a framework for the restructuring process, focusing on debt repayment, asset liquidation, and potential changes in the company's ownership structure. Key components included in a Houston Texas Restructuring Agreement may comprise: 1. Debt restructuring: This entails renegotiating the terms of existing debts, such as extending repayment periods, reducing interest rates, or even writing off a portion of the outstanding debt to alleviate the debtor's financial burden. 2. Asset disposal: To generate funds for debt repayment, some assets may need to be liquidated. The Houston Texas Restructuring Agreement clarifies the process of valuing, marketing, and selling these assets. 3. Equity exchange or conversion: In some cases, creditors may convert their debt into equity ownership in the company, resulting in a change in ownership structure. This may involve issuing new shares or changing the ownership percentages of existing shareholders. 4. Operational changes: The agreement may require the debtor to implement certain operational changes, such as cost-cutting measures, management restructuring, or streamlining business processes to improve the company's financial health. 5. Governance and control: If ownership changes occur, the restructuring agreement may define the new governance structure, including the composition of the board of directors or the appointment of new management personnel. 6. Covenants and warranties: The agreement may include various covenants and warranties to ensure compliance with the terms agreed upon. These may cover subjects like financial reporting requirements, restrictions on incurring new debt, or limitations on certain business activities. Different types of Houston Texas Restructuring Agreements may vary based on the specific needs and circumstances of the debtor and creditors involved. Some notable variations could include Pre-packaged restructuring agreements, where a restructuring plan is agreed upon before the formal insolvency process occurs, or Chapter 11 restructuring agreements under the U.S. Bankruptcy Code, which provide protection from creditors while the debtor reorganizes its operations. Overall, Houston Texas Restructuring Agreements play a pivotal role in assisting financially distressed entities in regaining stability and continuing their operations.

Houston Texas Restructuring Agreement

Description

How to fill out Houston Texas Restructuring Agreement?

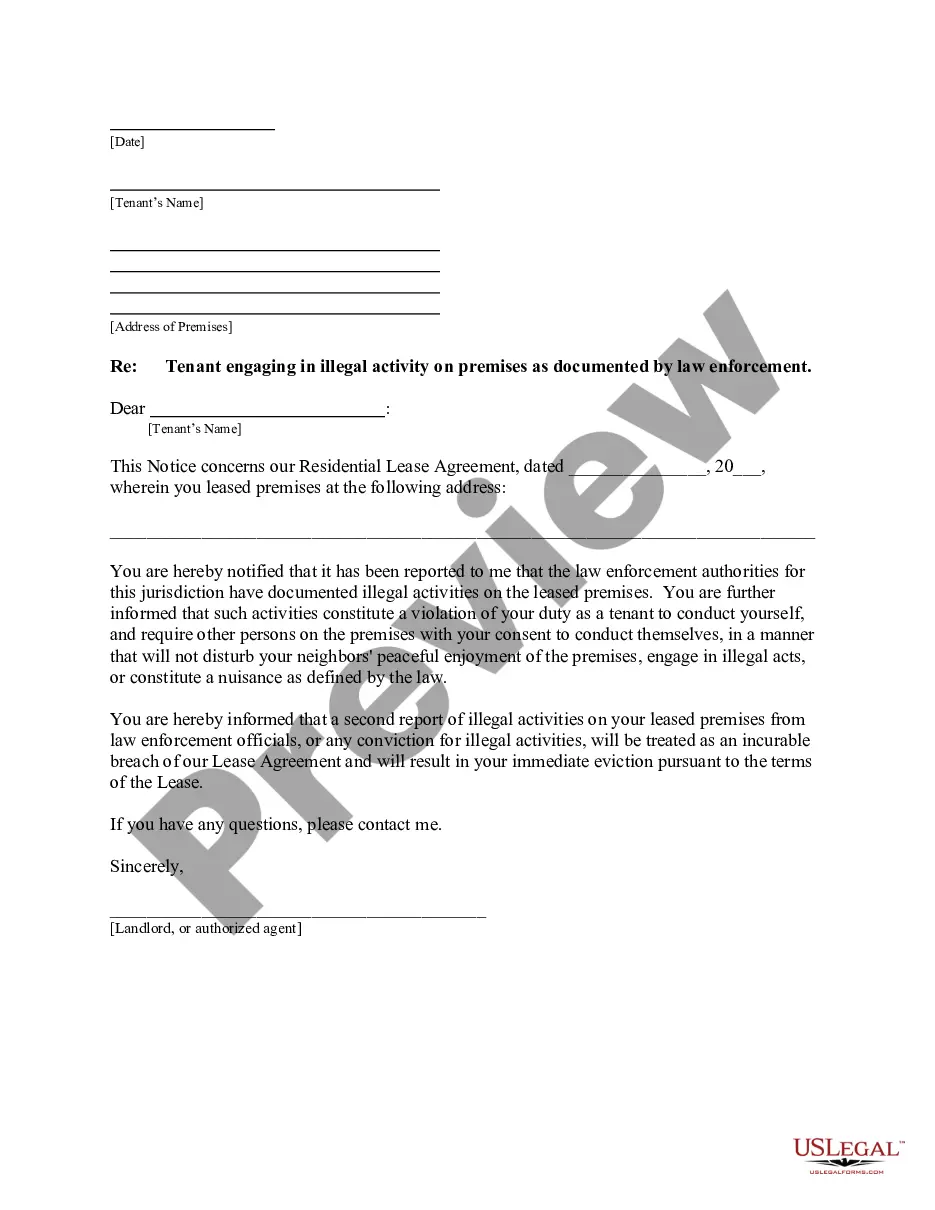

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Houston Restructuring Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how you can find and download Houston Restructuring Agreement.

- Go over the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

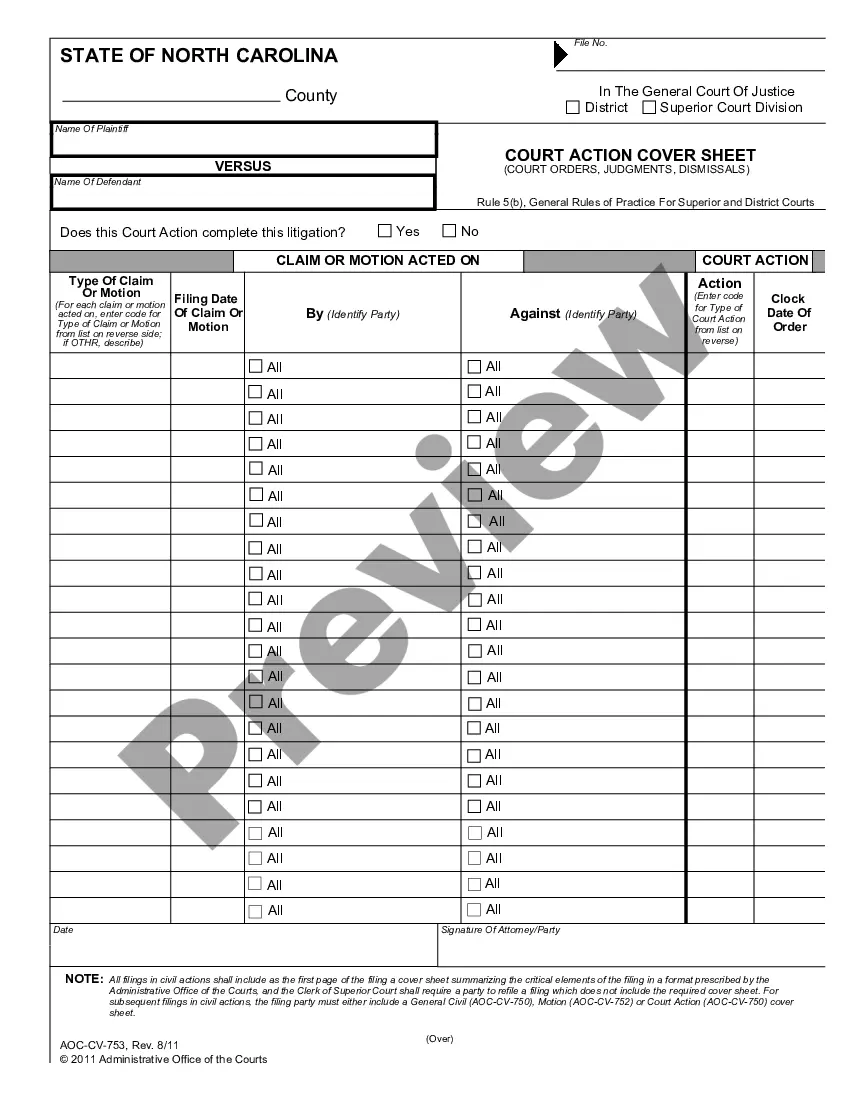

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Houston Restructuring Agreement.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Houston Restructuring Agreement, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you need to deal with an extremely difficult situation, we recommend using the services of an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!