Middlesex Massachusetts Opinion of Lehman Brothers

Description

How to fill out Opinion Of Lehman Brothers?

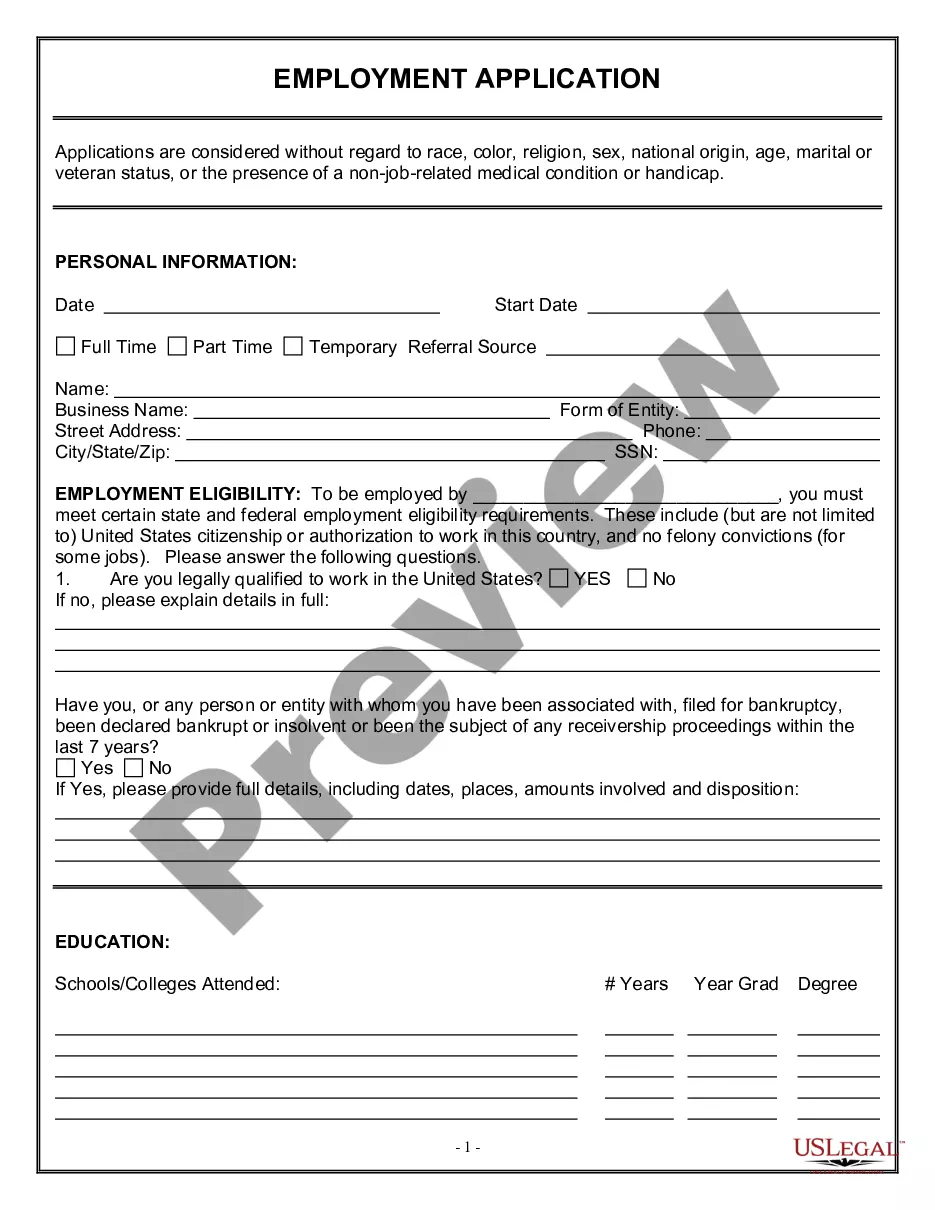

Whether you intend to launch your enterprise, engage in a contract, request your identification update, or handle family-related legal matters, it is essential to prepare certain documentation that complies with your regional laws and regulations.

Locating the appropriate documents may require considerable time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 professionally created and verified legal templates for any personal or business situation. All documents are categorized by state and area of use, making it fast and easy to select a copy like the Middlesex Opinion of Lehman Brothers.

The forms available on our site are multi-use. With an active subscription, you can access all of your previously obtained documentation at any time in the My documents section of your profile. Stop spending time on an endless search for current official documents. Join the US Legal Forms platform and organize your paperwork with the most extensive online form collection!

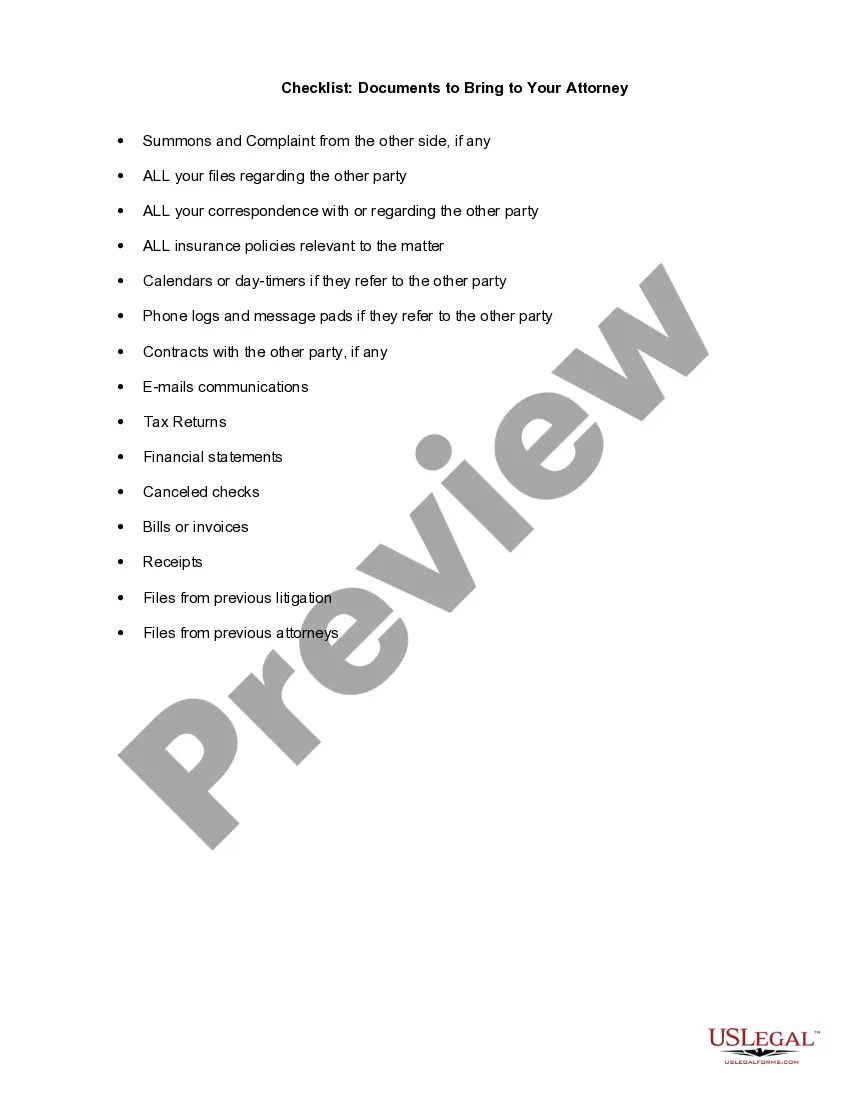

- Ensure the sample meets your individual needs and state legal requirements.

- Review the form description and examine the Preview if one is available on the page.

- Utilize the search tab provided for your state above to discover another template.

- Click Buy Now to acquire the document when you identify the correct option.

- Select the subscription plan that fits you best to proceed.

- Log in to your account and remit the service fee using a credit card or PayPal.

- Download the Middlesex Opinion of Lehman Brothers in your preferred file format.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Form popularity

FAQ

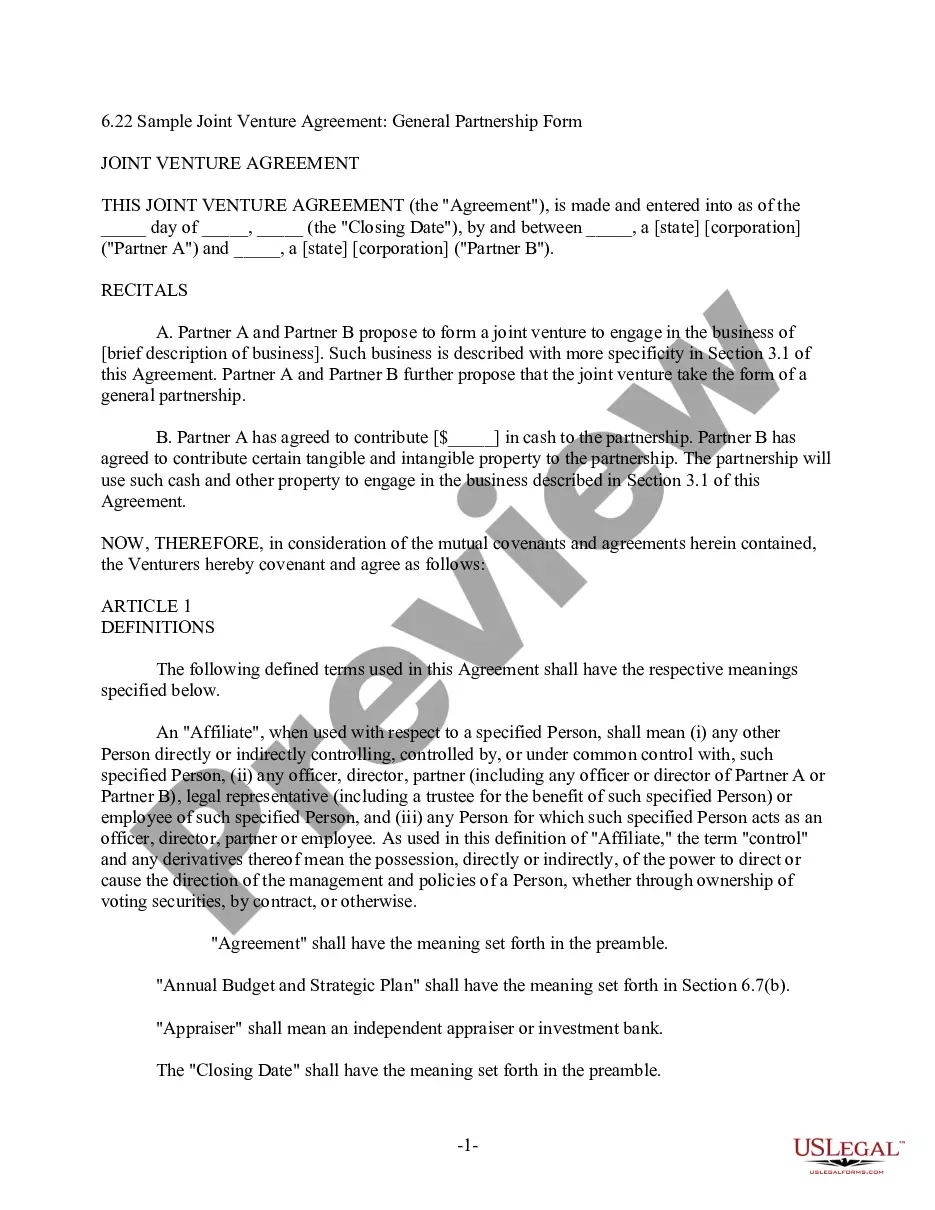

The refusal to bail out Lehman Brothers marked a significant shift in U.S. financial policy, prioritizing market discipline over intervention. Officials aimed to avoid moral hazard, where companies engage in risky behavior expecting government rescues. As reflected in the Middlesex Massachusetts Opinion of Lehman Brothers, this approach forced a reconsideration of the balance between market freedom and the need for regulation.

So how did Lehman meet its demise after being at the top of its game just one year before? While there were several factors contributing to its collapse, many experts seem to agree that it was in large part due to a lack of trust, over-leveraging, poor long-term investments, and shaky funding.

But a source familiar with the liquidation process confirmed that Lehman still manages an equity portfolio primarily to maximize value to pay back creditorsas the bank's ultimate mission (and reason for continued existence) is to repay its debts.

The firm survived many challenges but was eventually brought down by the collapse of the subprime mortgage market. Lehman first got into mortgage-backed securities in the early 2000s before acquiring five mortgage lenders. The firm posted multiple, consecutive losses and its share price dropped.

Lehman Brothers was forced to file for bankruptcy, an act that sent the company's stock plummeting a final 93%. When it was all over, Lehman Brothers with its $619 billion in debts was the largest corporate bankruptcy filing in U.S. history.

Lehman Brothers was a global financial services firm whose bankruptcy in 2008 was largely caused byand acceleratedthe subprime mortgage crisis.

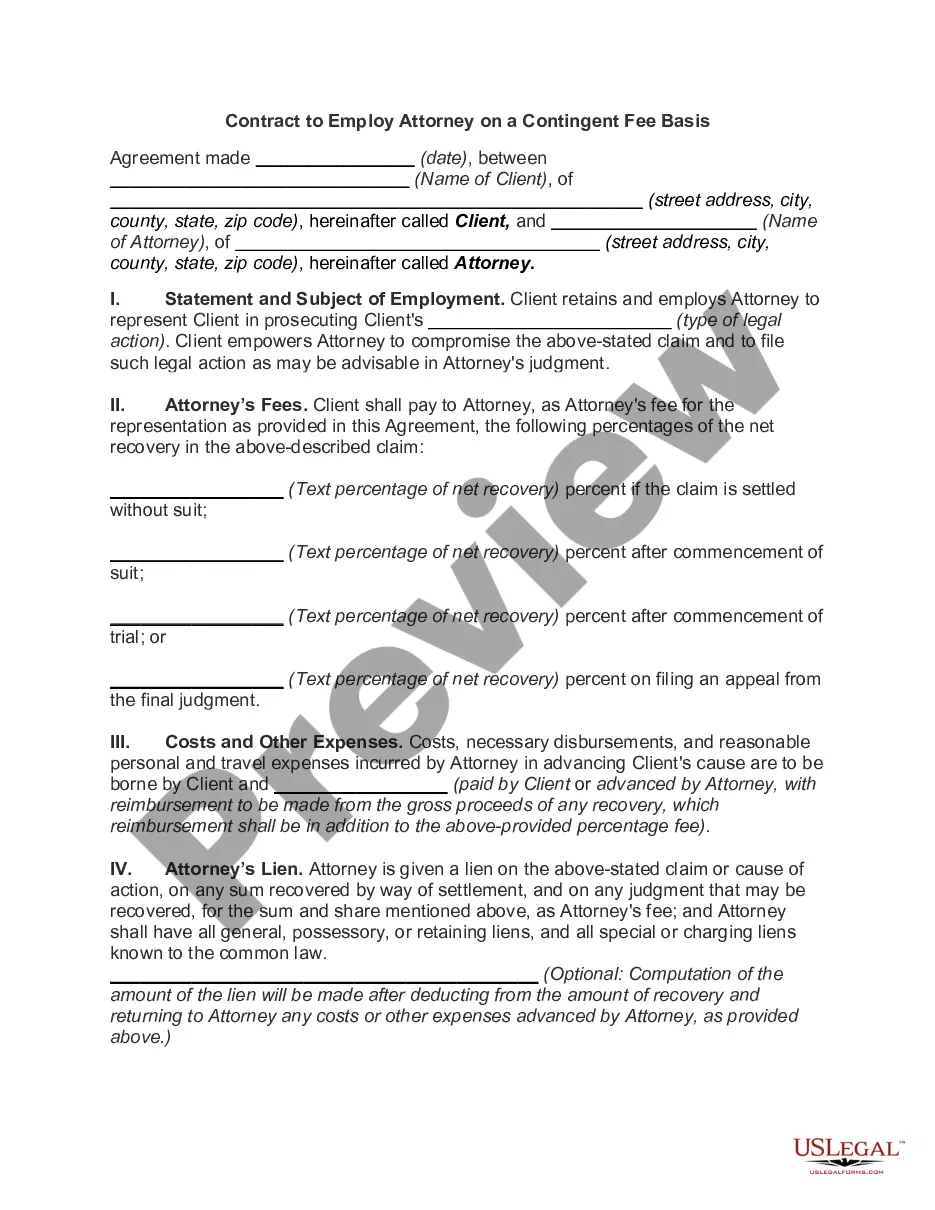

7fefffeff On Monday, September 15, Lehman declared bankruptcy, resulting in the stock plunging 93% from its previous close on September 12. Lehman stock plunged 93% between the close of trading on September 12, 2008, and the day it declared bankruptcy.

This was caused by rising energy prices on global markets, leading to an increase in the rate of global inflation. This development squeezed borrowers, many of whom struggled to repay mortgages. Property prices now started to fall, leading to a collapse in the values of the assets held by many financial institutions.

When Lehman Brothers Collapsed, it was the triggering of cataclysmic financial consequences in both the US and the UK. At am in the UK, HBoss the largest mortgage lender in the UK slumped 34% in its share value and was saved by Lloyds. Panic engulfed the market, and the FTSE fell by almost 400 points.

The firm survived many challenges but was eventually brought down by the collapse of the subprime mortgage market. Lehman first got into mortgage-backed securities in the early 2000s before acquiring five mortgage lenders. The firm posted multiple, consecutive losses and its share price dropped.