A King Washington Sample Asset Purchase Agreement is a legally binding document that outlines the terms and conditions of an asset purchase transaction between a seller, which is a third-tier subsidiary of a corporation, and a buyer, which is a second-tier subsidiary of an unrelated corporation. This agreement is of utmost importance as it governs the transfer of assets, rights, and liabilities from the seller to the buyer. The King Washington Sample Asset Purchase Agreement typically includes various crucial components to ensure a smooth and transparent transaction. These components may vary depending on the specific type of agreement being used, but some common sections may include: 1. Introduction: This section specifies the date of the agreement, names and addresses of both the seller and the buyer, and provides a brief background of the transaction. 2. Asset Transfer: The agreement details the assets being transferred, which may include tangible assets like machinery, equipment, real estate, inventory, and intellectual property such as patents, trademarks, copyrights, etc. It also identifies any excluded assets or liabilities that will not be part of the transaction. 3. Purchase Price: The agreement establishes the purchase price or the consideration that the buyer will pay to acquire the assets. It outlines the payment terms, such as the method and timing of payment. 4. Representations and Warranties: This section outlines the seller's guarantees regarding the assets being sold. It ensures that the seller has the right to sell the assets, that the assets are in good condition, and that they are free from any encumbrances or legal disputes. The buyer relies on these representations to make an informed decision about the purchase. 5. Assumption and Allocation of Liabilities: If the buyer agrees to assume certain liabilities of the seller, such as outstanding debts, contractual obligations, or pending legal claims, this section of the agreement details the responsibilities and terms of the assumption. 6. Closing Conditions: The agreement specifies the conditions that must be met before the transaction can be considered closed, such as obtaining necessary regulatory approvals or consents from third parties. 7. Governing Law and Jurisdiction: This section determines the governing law of the agreement and the jurisdiction where any disputes arising from the agreement will be resolved. Different types of King Washington Sample Asset Purchase Agreements may arise depending on the specific circumstances or industry involved. For instance, there could be agreements tailored for technology-related assets, real estate assets, or even specific industries like healthcare, manufacturing, or energy. In conclusion, the King Washington Sample Asset Purchase Agreement provides a comprehensive framework for a successful asset transfer between a third-tier subsidiary of a corporation (the seller) and a second-tier subsidiary of an unrelated corporation (the buyer). It ensures that all parties involved are protected and that the transaction is conducted in a fair and transparent manner.

King Washington Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer)

Description

How to fill out King Washington Sample Asset Purchase Agreement Between Third Tier Subsidiary Of Corporation (Seller) And Second Tier Subsidiary Of Unrelated Corporation (Buyer)?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft King Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid King Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the King Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer):

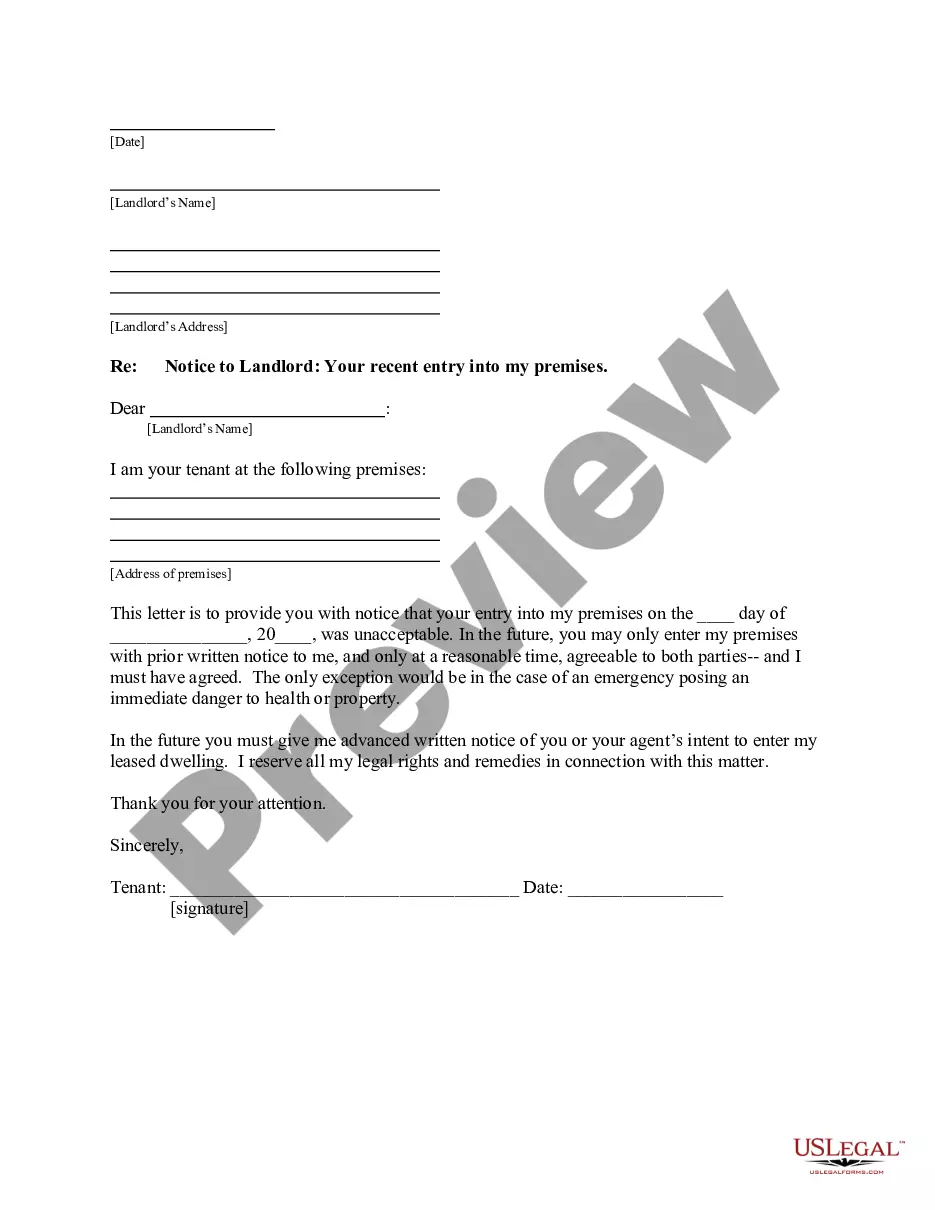

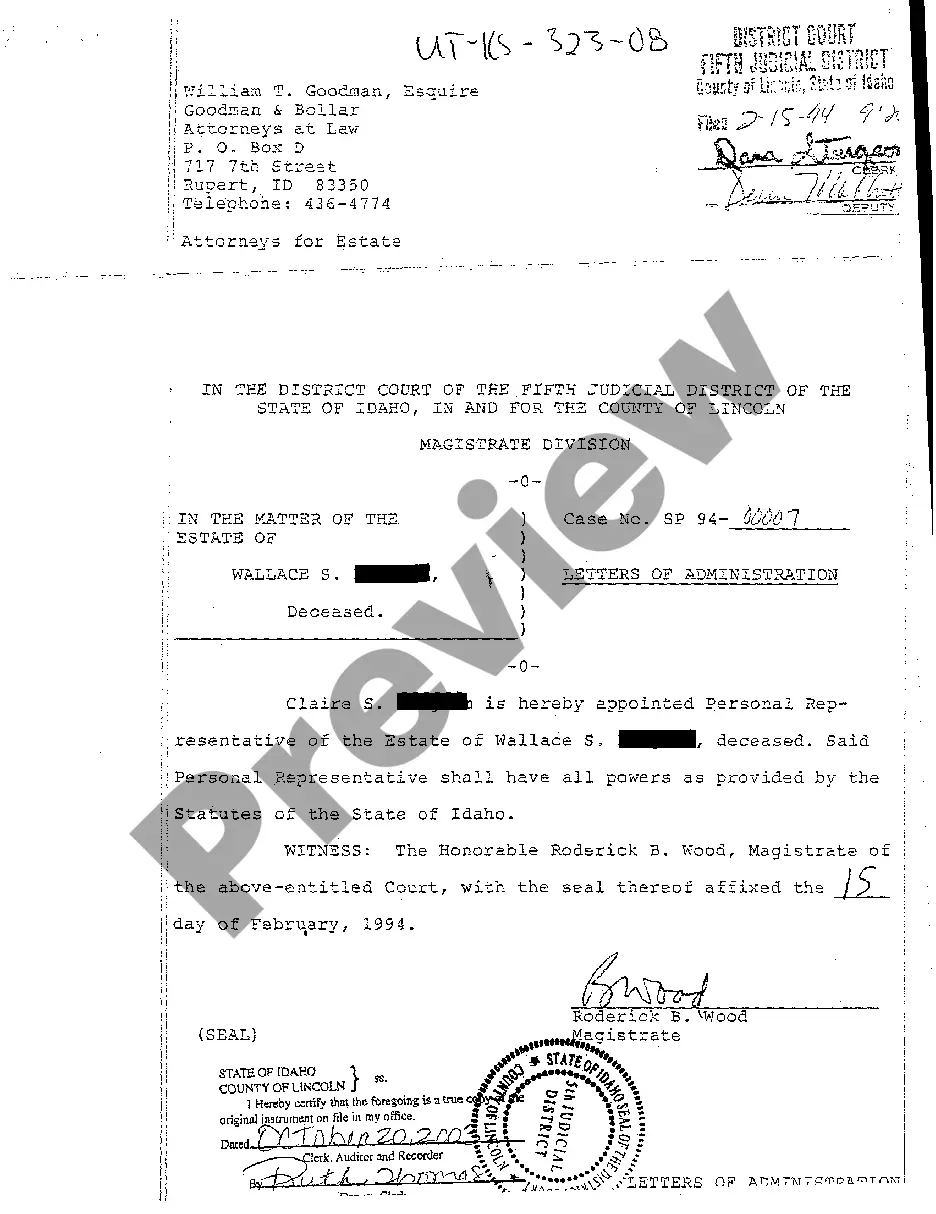

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!