Collin Texas Issuance of Common Stock in Connection with Acquisition Collin County, Texas is known for its vibrant business community and numerous corporate activities. One such business activity is the issuance of common stock in connection with acquisitions. This process involves a company issuing shares of their common stock to finance or facilitate an acquisition or merger with another company. The issuance of common stock in connection with an acquisition is a strategic move by a company to fund the purchase of another business entity. By issuing shares, the acquiring company utilizes its stock as a form of currency to compensate the existing shareholders of the target company. This allows the acquiring company to gain ownership and control over the target company by exchanging their shares for those of the target company's shareholders. There are several types of Collin Texas Issuance of Common Stock in Connection with Acquisition: 1. Stock-for-Stock Acquisition: In this type of acquisition, the acquiring company offers its stock to the shareholders of the target company in exchange for their shares. The value of the acquiring company's stock is often determined based on market conditions and negotiations between the two parties. 2. Cash-and-Stock Acquisition: This type of acquisition involves a combination of cash and stock offered by the acquiring company. The cash component provides immediate liquidity to the target company's shareholders, while the stock component enables them to participate in the future growth potential of the combined entity. 3. Reverse Merger: In a reverse merger, the target company is typically larger and more established than the acquiring company. The target company merges with the acquiring company, and as a result, the shareholders of the target company receive common stock of the acquiring company. This allows the acquiring company to gain instant access to the target company's assets, market presence, and expertise. 4. Friendly Acquisition: A friendly acquisition refers to a situation where both the acquiring and target companies mutually agree to the terms of the merger or acquisition. The issuance of common stock in this type of acquisition is often well-received by both companies' shareholders, as it provides them with a stake in the new combined entity. 5. Hostile Takeover: In some cases, the target company may resist the acquisition attempts by the acquiring company. However, if the acquiring company is determined to proceed with the acquisition, they may issue common stock to the target company's shareholders against their will. This type of issuance is generally met with resistance and legal complications. Overall, the Collin Texas issuance of common stock in connection with acquisitions plays a crucial role in the dynamic business environment of the area. It serves as a means for companies to expand their operations, enhance their market presence, and create value for their shareholders.

Collin Texas Issuance of Common Stock in Connection with Acquisition

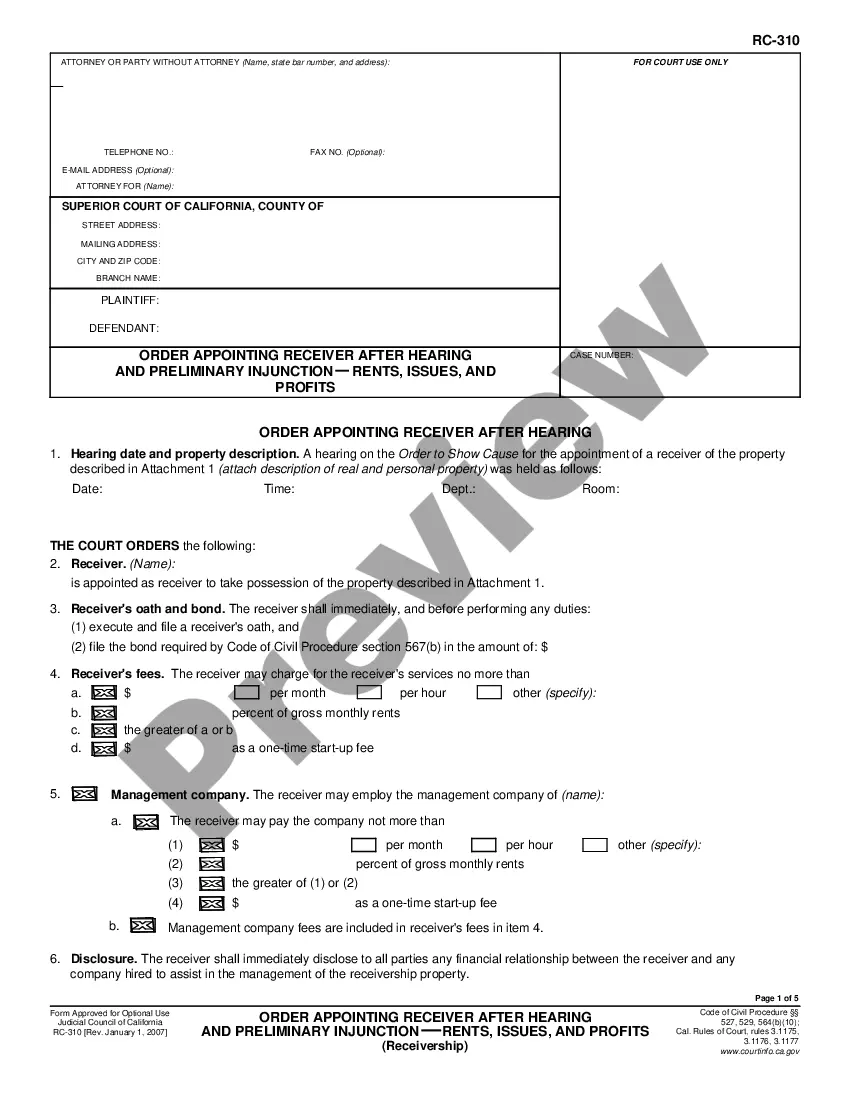

Description

How to fill out Collin Texas Issuance Of Common Stock In Connection With Acquisition?

Draftwing paperwork, like Collin Issuance of Common Stock in Connection with Acquisition, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for different cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Collin Issuance of Common Stock in Connection with Acquisition template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Collin Issuance of Common Stock in Connection with Acquisition:

- Make sure that your template is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Collin Issuance of Common Stock in Connection with Acquisition isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin using our service and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!