Hillsborough Florida is a county located on the western coast of Florida, encompassing areas such as Tampa, Plant City, and Temple Terrace. With a population of over 1.5 million residents, Hillsborough is a vibrant and diverse community known for its rich history, stunning natural beauty, and thriving economy. One aspect of Hillsborough Florida's economic landscape involves the issuance of common stock in connection with acquisitions. When companies in Hillsborough engage in mergers or acquisitions, they may choose to utilize the issuance of common stock as a means of financing the deal. This strategic move involves offering shares of their stock to the shareholders of the acquired company as part of the transaction. The issuance of common stock in connection with acquisitions serves several purposes. Firstly, it allows the acquiring company to provide a form of compensation to the shareholders of the acquired company, ensuring their continued support and alignment with the future goals of the combined entity. Secondly, it can help the acquiring company leverage its existing capital structure by decreasing the need for excessive cash outlays or accumulating additional debt. There are different types of Hillsborough Florida issuance of common stock in connection with acquisitions that vary based on the specific circumstances of the transaction. These types include: 1. Straight Acquisition: In this type of acquisition, the acquiring company offers its common stock to the shareholders of the acquired company as the primary consideration for the deal. The value of the shares is determined based on the negotiated terms and the prevailing market conditions. 2. Stock-for-Stock Acquisition: Often, acquisitions involve exchanging common stock of the acquiring company with the common stock of the acquired company. This approach allows the acquiring company to issue its own shares to the shareholders of the acquired company, resulting in a combined entity with shared ownership. 3. Stock and Cash Acquisition: In some cases, a combination of common stock and cash may be used for the acquisition. This hybrid approach allows the acquiring company to offer a certain amount of cash along with common stock to compensate the shareholders of the acquired company. The issuance of common stock in connection with acquisitions is a complex process that requires careful evaluation and negotiation. Both the acquiring and acquired companies need to assess the financial implications and potential benefits of such a transaction, considering factors such as market conditions, regulatory requirements, and the long-term strategic goals of the combined entity. Overall, Hillsborough Florida's issuance of common stock in connection with acquisitions plays a significant role in fueling the local economy and driving business growth. By utilizing this financing method, companies in Hillsborough can undertake mergers and acquisitions, fostering innovation, expanding market presence, and capitalizing on synergies to achieve their strategic objectives.

Hillsborough Florida Issuance of Common Stock in Connection with Acquisition

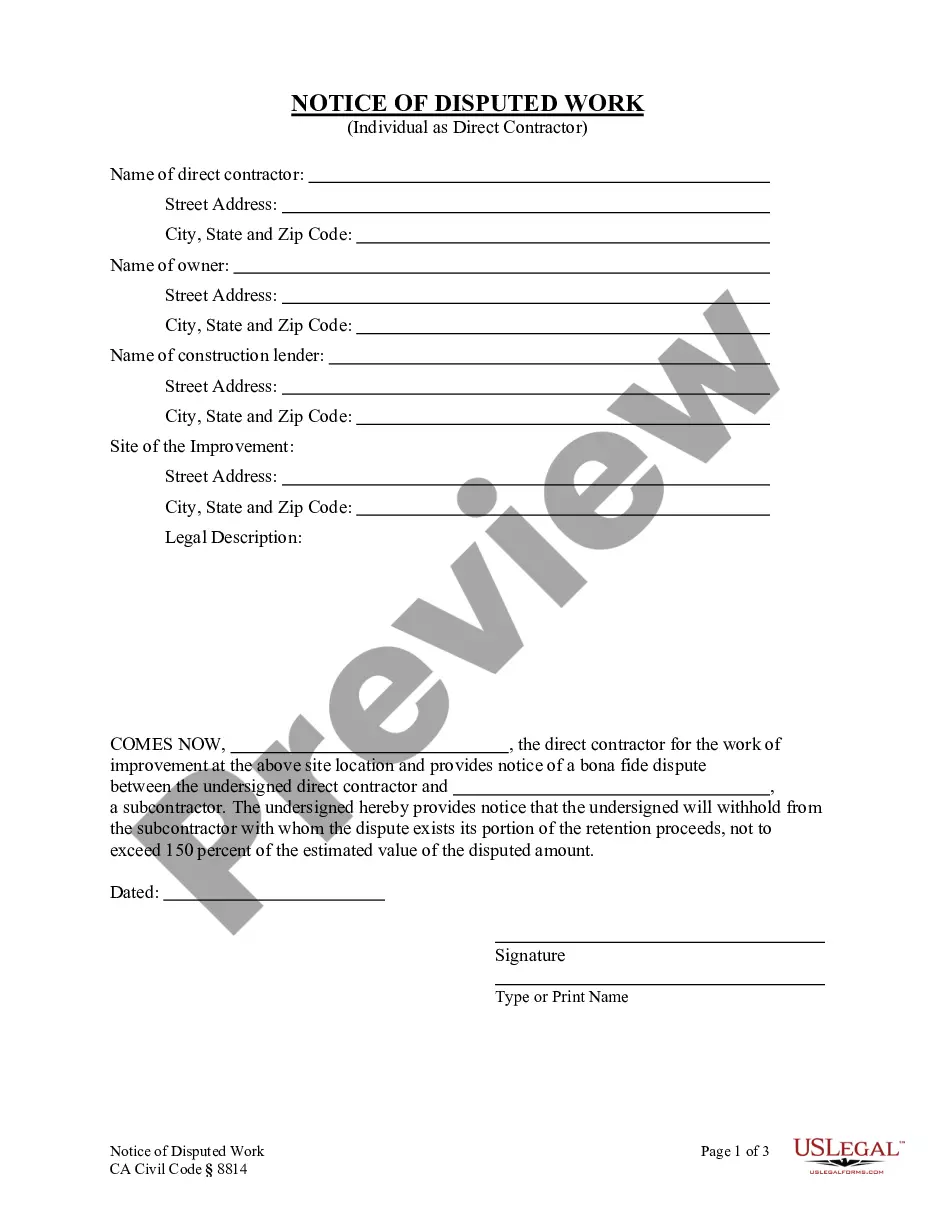

Description

How to fill out Hillsborough Florida Issuance Of Common Stock In Connection With Acquisition?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Hillsborough Issuance of Common Stock in Connection with Acquisition meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Aside from the Hillsborough Issuance of Common Stock in Connection with Acquisition, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Hillsborough Issuance of Common Stock in Connection with Acquisition:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Hillsborough Issuance of Common Stock in Connection with Acquisition.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!