Mecklenburg County, located in the state of North Carolina, is known for its business-friendly environment and robust economic growth. One of the common practices in this region is the issuance of common stock in connection with acquisitions. This process involves acquiring another company or a significant portion of its assets by offering shares of common stock to the target company's shareholders. The issuance of common stock in connection with an acquisition can take various forms, including: 1. Stock-for-Stock Acquisition: In this scenario, the acquiring company offers its own common stock to the target company's shareholders in exchange for their shares. The value of the acquiring company's stock determines the overall valuation of the deal, and the target company's shareholders become shareholders of the acquiring company post-acquisition. 2. Cash and Stock Acquisition: In some cases, the acquisition deal may involve a combination of cash and common stock. The acquiring company offers a portion of the deal value in cash, while the rest is covered through the issuance of its common stock. This structure allows the acquiring company to provide immediate liquidity to the target company's shareholders while benefiting from the potential future growth of its stock. 3. Reverse Stock Split for Acquisition: In certain situations, an acquiring company may decide to consolidate its outstanding shares through a reverse stock split before proceeding with an acquisition. This strategy aims to increase the stock's per-share value, making it more attractive to the target company's shareholders. By reducing the number of outstanding shares, the acquiring company can simplify the transaction process and potentially enhance the value proposition for the acquired company. The issuance of common stock in connection with acquisitions provides numerous benefits for both the acquiring and acquired companies. For the acquiring company, this financing method can help facilitate growth, access new markets, acquire valuable assets, and gain competitive advantages. On the other hand, the target company's shareholders have the opportunity to become owners of the acquiring company, potentially benefiting from its future success and growth. In summary, Mecklenburg, North Carolina, exhibits a thriving business ecosystem where the issuance of common stock in connection with acquisitions plays a crucial role in driving economic activity. Depending on the specifics of the deal, various types of acquisitions may occur, including stock-for-stock acquisitions, cash and stock acquisitions, and acquisitions following reverse stock splits. These strategies enable companies to achieve their growth objectives, expand their market presence, and create synergies through M&A activities.

Mecklenburg North Carolina Issuance of Common Stock in Connection with Acquisition

Description

How to fill out Mecklenburg North Carolina Issuance Of Common Stock In Connection With Acquisition?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Mecklenburg Issuance of Common Stock in Connection with Acquisition meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Mecklenburg Issuance of Common Stock in Connection with Acquisition, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Mecklenburg Issuance of Common Stock in Connection with Acquisition:

- Examine the content of the page you’re on.

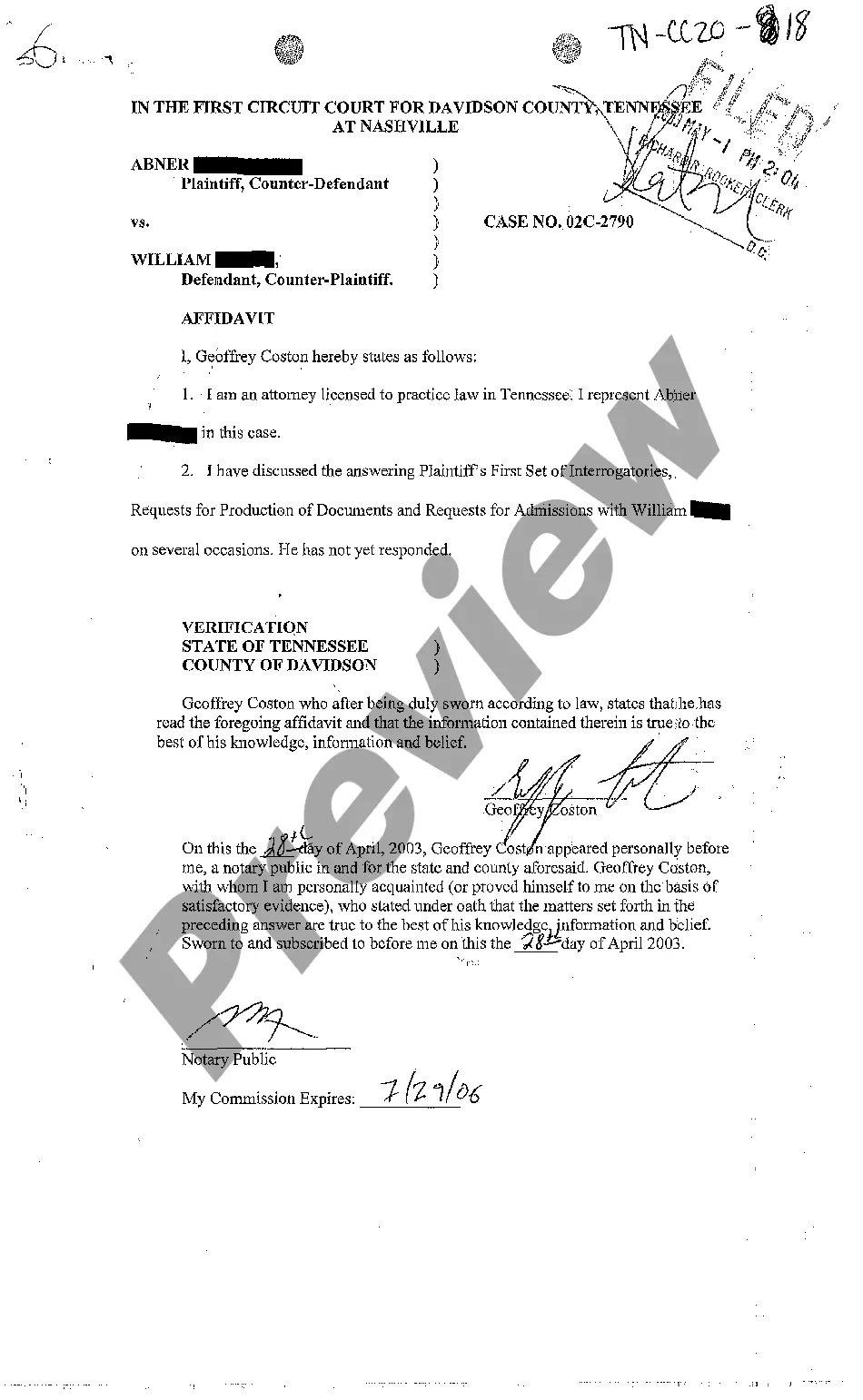

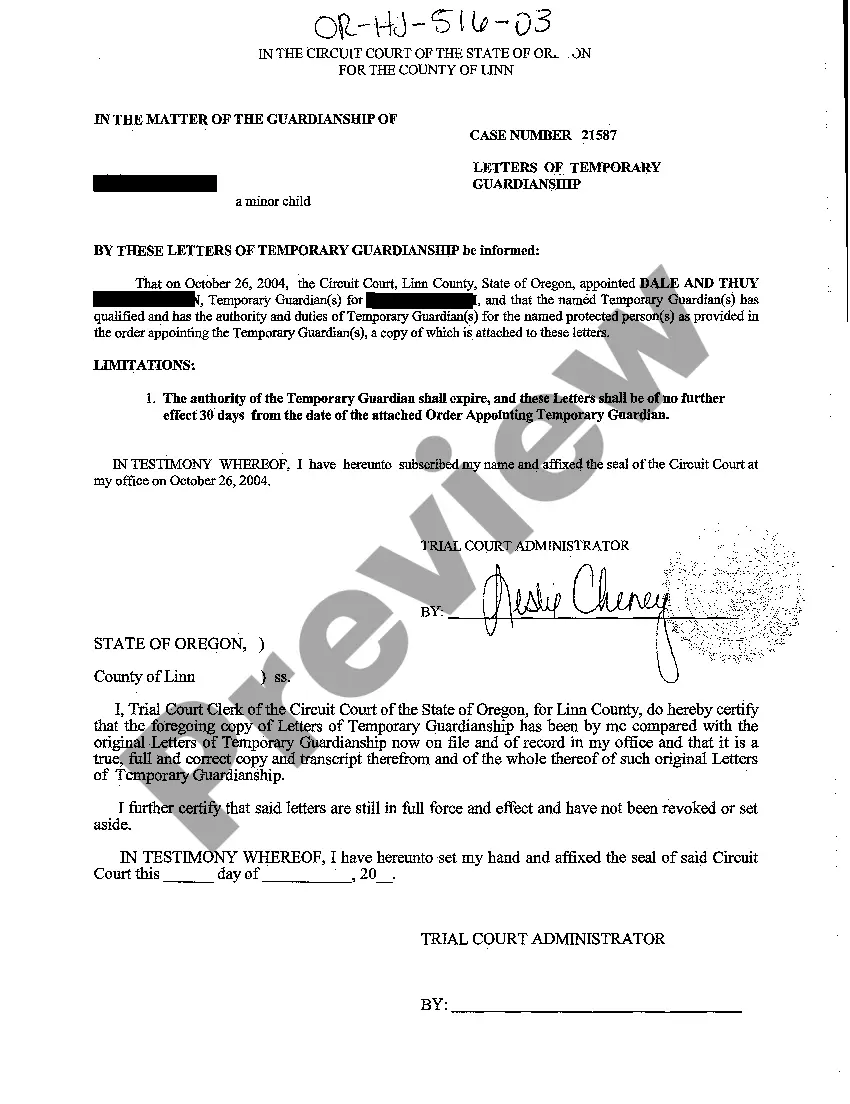

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Mecklenburg Issuance of Common Stock in Connection with Acquisition.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Corporations issue stock to raise money for growth and expansion. To raise money, corporations will issue stock by selling off a percentage of profits in a company.

Common stocks are shares issued by a company to raise money instead of selling debt or issuing preferred stock. Common stocks are essentially ordinary shares. When the company issues common stock for the first time, they do so via an initial public offering or an IPO.

The effect on the Stockholder's Equity account from the issuance of shares is also an increase. Money you receive from issuing stock increases the equity of the company's stockholders.

Common stocks are shares issued by a company to raise money instead of selling debt or issuing preferred stock. Common stocks are essentially ordinary shares. When the company issues common stock for the first time, they do so via an initial public offering or an IPO.

You can find the total number of shares in the shareholders' equity section of a company's balance sheet, which also summarizes the assets and liabilities. The numbers of authorized, issued and outstanding common shares are listed in this section, along with the number of preferred shares.

Figure 16.2 Issuance of a Share of Common Stock for Cash. On the balance sheet, within the stockholders' equity section, the amount that owners put into a corporation when they originally bought stock is the summation of the common stock and capital in excess of par value accounts.

It's easy to find the sum of common stock on a balance sheet -- if you know what all those terms and numbers mean. If you want to find out the total of common stock a company has, the information can be found right on the stockholder's equity section of its balance sheet.

When companies issue additional shares, it increases the number of common stock being traded in the stock market. For existing investors, too many shares being issued can lead to share dilution. Share dilution occurs because the additional shares reduce the value of the existing shares for investors.

It's rare that a company assigns par value to a stock, but if they are required to by state law, then you would calculate stock issuance by multiplying the par value by the number of shares issued. For example, if a company issues 100 common stocks for a par value of $1, the calculation is 100 x $1 = $100.