Tarrant Texas is a city located in Tarrant County, Texas, United States. It is home to a diverse population and is known for its vibrant community, rich history, and numerous attractions. When it comes to the issuance of common stock in connection with acquisitions, Tarrant Texas has seen various types of transactions. Some key types include: 1. Merger Acquisitions: In a merger acquisition, two companies combine their operations to form a single entity. This can involve the issuance of common stock to the shareholders of the acquired company as part of the deal. It allows the acquiring company to gain control over the operations and assets of the target company. 2. Asset Acquisitions: In an asset acquisition, a company acquires selected assets of another company rather than the entire entity. This can involve the issuance of common stock to the selling company's shareholders as a consideration for the assets being acquired. This type of acquisition allows the acquiring company to acquire specific assets, such as technology, intellectual property, or customer relationships. 3. Stock-for-Stock Acquisitions: In a stock-for-stock acquisition, the acquiring company issues its own common stock to the shareholders of the target company as consideration for the acquisition. This exchange of stocks allows the shareholders of the target company to become shareholders of the acquiring company, often on a prorated basis. This type of acquisition can result in a more equitable distribution of ownership in the merged entity. 4. Reverse Acquisitions: In a reverse acquisition, a privately-held company acquires a publicly-traded company, resulting in the privately-held company becoming a public entity. This type of acquisition often involves the issuance of common stock to the shareholders of the publicly-traded company. The aim is to provide the privately-held company access to the public market and its associated benefits, such as increased liquidity and capital-raising opportunities. Regardless of the type of acquisition, the issuance of common stock plays a pivotal role in facilitating the transaction. It allows companies involved to exchange ownership and leverage the potential synergies and benefits of combining their operations. The terms of the stock issuance, such as the exchange ratio or price, are typically determined through negotiations between the acquiring and target companies. Tarrant Texas has witnessed several instances of issuance of common stock in connection with different types of acquisitions, contributing to the growth and development of the local economy. These transactions have brought together companies from various industries, fostering innovation, creating new opportunities, and strengthening Tarrant Texas' position as a business hub.

Tarrant Texas Issuance of Common Stock in Connection with Acquisition

Description

How to fill out Tarrant Texas Issuance Of Common Stock In Connection With Acquisition?

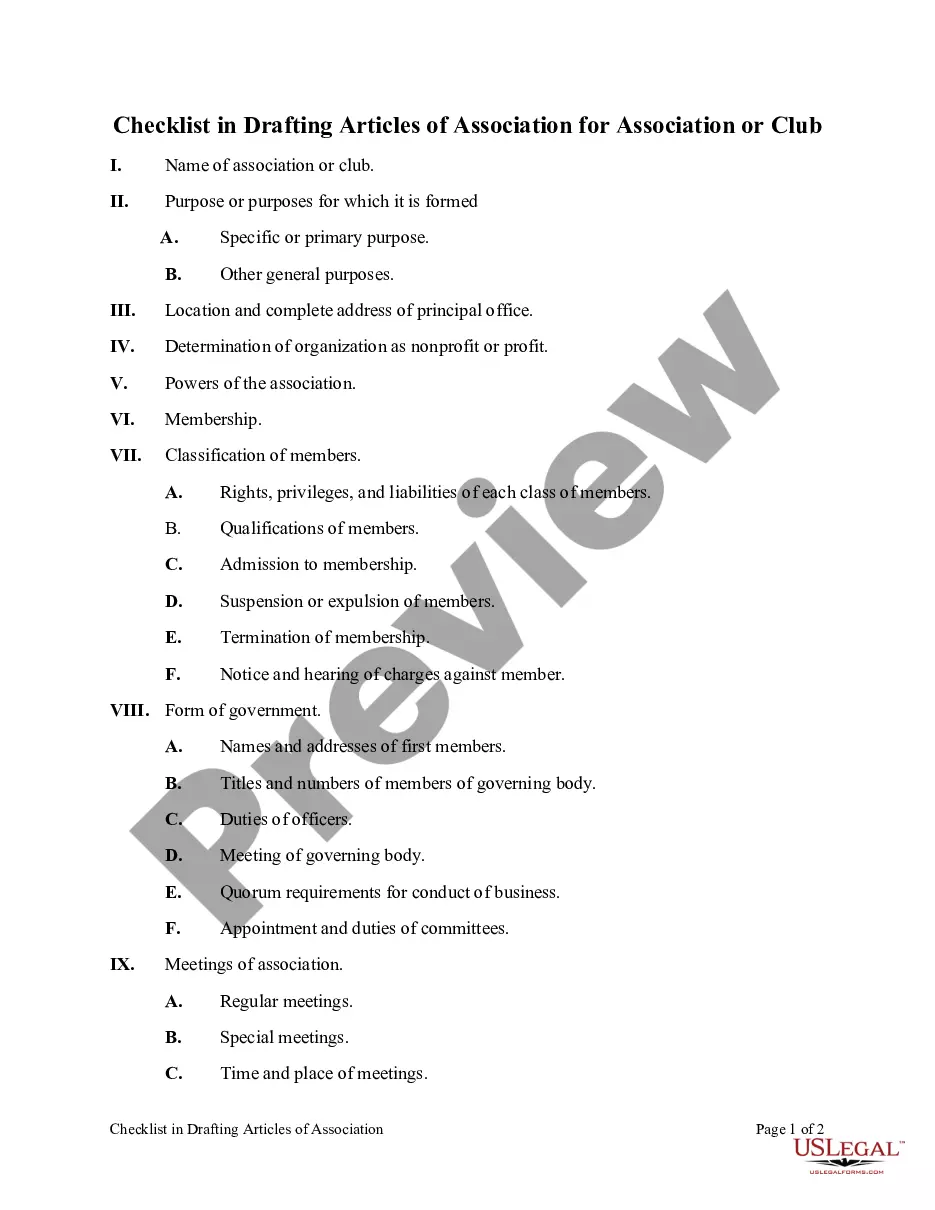

Draftwing documents, like Tarrant Issuance of Common Stock in Connection with Acquisition, to manage your legal affairs is a tough and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for a variety of scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Tarrant Issuance of Common Stock in Connection with Acquisition template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Tarrant Issuance of Common Stock in Connection with Acquisition:

- Ensure that your document is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Tarrant Issuance of Common Stock in Connection with Acquisition isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

When one company acquires another, the stock price of the acquiring company tends to dip temporarily, while the stock price of the target company tends to spike. The acquiring company's share price drops because it often pays a premium for the target company, or incurs debt to finance the acquisition.

If a publicly traded company is acquired by a private company, its share prices will typically rise to the takeover price. When the deal is closed, existing shareholders will receive cash in return for their stock (i.e., their shares will be sold to the acquiring company).

When the deal is closed, existing shareholders will receive cash in return for their stock (i.e., their shares will be sold to the acquiring company). If a public company takes over a private firm, the acquirer's share price may fall a bit to reflect the cost of the deal.

The main distinction between cash and stock transactions is this: In cash transactions, acquiring shareholders take on the entire risk that the expected synergy value embedded in the acquisition premium will not materialize. In stock transactions, that risk is shared with selling shareholders.

forstock merger occurs when shares of one company are traded for another during an acquisition. When, and if, the transaction is approved, shareholders can trade the shares of the target company for shares in the acquiring firm's company.

Mergers and Acquisitions (M&A), in simple terms, is when a company merges with another company or acquires a company for several purposes. An M&A can take place for several reasons such as: Expansion of Market share Merging and acquiring companies saves time and helps in increasing the market share.

When one company acquires another, the stock price of the acquiring company tends to dip temporarily, while the stock price of the target company tends to spike. The acquiring company's share price drops because it often pays a premium for the target company, or incurs debt to finance the acquisition.

If a publicly traded company is acquired by a private company, its share prices will typically rise to the takeover price. When the deal is closed, existing shareholders will receive cash in return for their stock (i.e., their shares will be sold to the acquiring company).

forstock merger occurs when shares of one company are traded for another during an acquisition. When, and if, the transaction is approved, shareholders can trade the shares of the target company for shares in the acquiring firm's company.

If the buyout is an all-cash deal, shares of your stock will disappear from your portfolio at some point following the deal's official closing date and be replaced by the cash value of the shares specified in the buyout. If it is an all-stock deal, the shares will be replaced by shares of the company doing the buying.