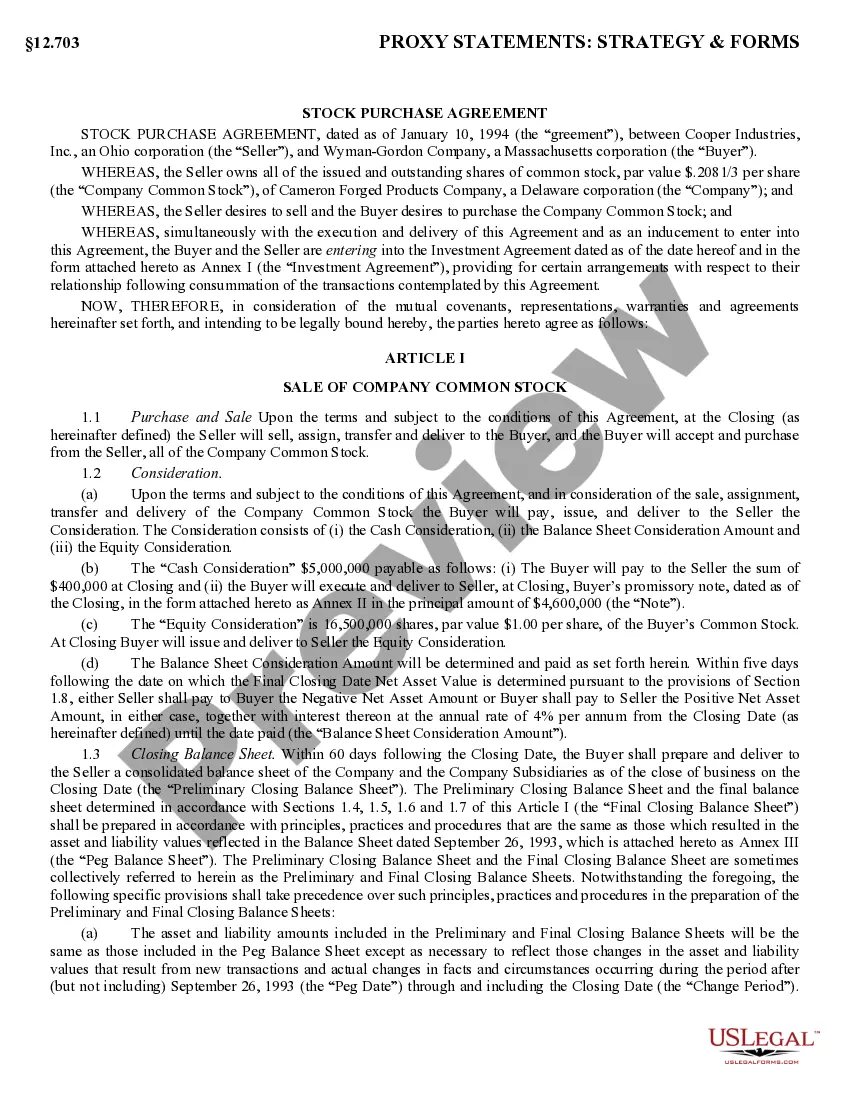

Title: Harris Texas Sample Stock Purchase Agreement: A Comprehensive Overview for All States Introduction: In the United States, the Harris Texas Sample Stock Purchase Agreement serves as a generalized form used across the nation. This document entails the terms and conditions involved in the acquisition of stocks in a company by an individual or entity. Designed to protect the interests of both the buyer and the seller, this agreement outlines the various legal, financial, and procedural aspects essential to the stock purchase process. Key Keywords: — Harris Texas Sample Stock Purchase Agreement — General for— - United States - Stock purchase — Terms and condition— - Acquisition - Buyer — Seller - Lega— - Financial - Procedural aspects Types of Harris Texas Sample Stock Purchase Agreement general forms across the United States: 1. Harris Texas Sample Stock Purchase Agreement for Closely Held Corporations: Specifically tailored for closely held corporations, this agreement caters to the unique considerations and intricacies involved in purchasing stocks in such entities. It addresses issues like shareholder relationships, minority shareholder rights, and buy-sell provisions. 2. Harris Texas Sample Stock Purchase Agreement for Publicly Traded Companies: This form is specifically designed for stock purchases in publicly traded companies. It encompasses provisions to account for the extensive regulatory and compliance requirements associated with publicly traded stocks, including SEC filings, disclosures, and corporate governance considerations. 3. Harris Texas Sample Stock Purchase Agreement for Limited Liability Companies (LCS): This version of the agreement is customized to accommodate the specific characteristics of stock purchases in LCS. It considers the unique ownership structure, management agreements, and distribution of profits and losses typically associated with LCS. Content: 1. Parties Involved: Clearly identifies the buyer(s) and seller(s) involved in the stock purchase agreement, including their legal names, addresses, and relevant contact details. 2. Stock Description: Provides a comprehensive description of the stocks being sold, including the type of shares, quantity, class, and any outstanding options or rights pertaining to the shares. 3. Purchase Price and Payment Terms: Articulates the purchase price for the stocks and the agreed-upon payment terms. It may specify whether the payment will be made in cash, installments, or through the exchange of assets. 4. Representations and Warranties: Outlines the representations and warranties made by the seller regarding the stocks being sold, ensuring that the shares are free from encumbrances, accurately represented, and compliant with applicable laws. 5. Conditions Precedent: Encompasses the conditions that both parties must fulfill before the completion of the stock purchase agreement, such as regulatory approvals, third-party consents, and other necessary actions. 6. Indemnification: Governs the responsibilities and liabilities of both parties in case of breaches or inaccuracies in the representations and warranties made, providing safeguards and remedies for the injured party. 7. Closing and Post-Closing Obligations: Elaborates on the process, timing, and obligations related to the closing of the stock purchase, including the delivery of relevant documents, transfer of stock certificates, and any required post-closing actions. Conclusion: In summary, the Harris Texas Sample Stock Purchase Agreement general form is a versatile document suitable for stock purchases across the United States. Tailored variations exist to address specific circumstances related to closely held corporations, publicly traded companies, and limited liability companies. By utilizing this comprehensive agreement, buyers and sellers can confidently navigate the complexities of stock transactions while safeguarding their interests.

Harris Texas Sample Stock Purchase Agreement general form to be used across the United States

Description

How to fill out Harris Texas Sample Stock Purchase Agreement General Form To Be Used Across The United States?

Do you need to quickly create a legally-binding Harris Sample Stock Purchase Agreement general form to be used across the United States or probably any other document to handle your personal or business matters? You can select one of the two options: hire a legal advisor to draft a legal document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Harris Sample Stock Purchase Agreement general form to be used across the United States and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Harris Sample Stock Purchase Agreement general form to be used across the United States is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Harris Sample Stock Purchase Agreement general form to be used across the United States template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!