Fairfax Virginia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and New co Merger Co is a legally binding document that outlines the terms and conditions of a merger between these two entities. This agreement aims to combine the resources, assets, and operations of CNL Financial Corp and New co Merger Co into a single, unified entity. As per this agreement, the merger will be carried out following a series of steps, including a thorough evaluation of the financial, legal, and operational aspects of both companies. It specifies the exchange ratio or consideration to be provided to the shareholders of each company, ensuring a fair and equitable distribution of ownership in the newly formed entity. The Fairfax Virginia Amended and Restated Agreement and Plan of Merger also includes various provisions for governance, management, and decision-making within the new entity. It outlines the composition of the board of directors, their powers, and responsibilities, as well as the procedure for appointment and removal of directors. Additionally, this agreement addresses potential legal and financial contingencies that may arise during the merger process. It contains provisions related to tax matters, regulatory compliance, intellectual property rights, confidentiality, and dispute resolution mechanisms, among others. These provisions help ensure that the merger is conducted smoothly and mitigate any potential risks or conflicts. It is worth noting that there can be different types of Fairfax Virginia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and New co Merger Co. These variations may arise due to specific industry considerations, size of involved companies, geographical factors, or other unique circumstances. However, regardless of the specific type, the purpose of these agreements remains the same — to facilitate a merger between CNL Financial Corp and New co Merger Co while safeguarding the interests of all stakeholders involved.

Fairfax Virginia Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

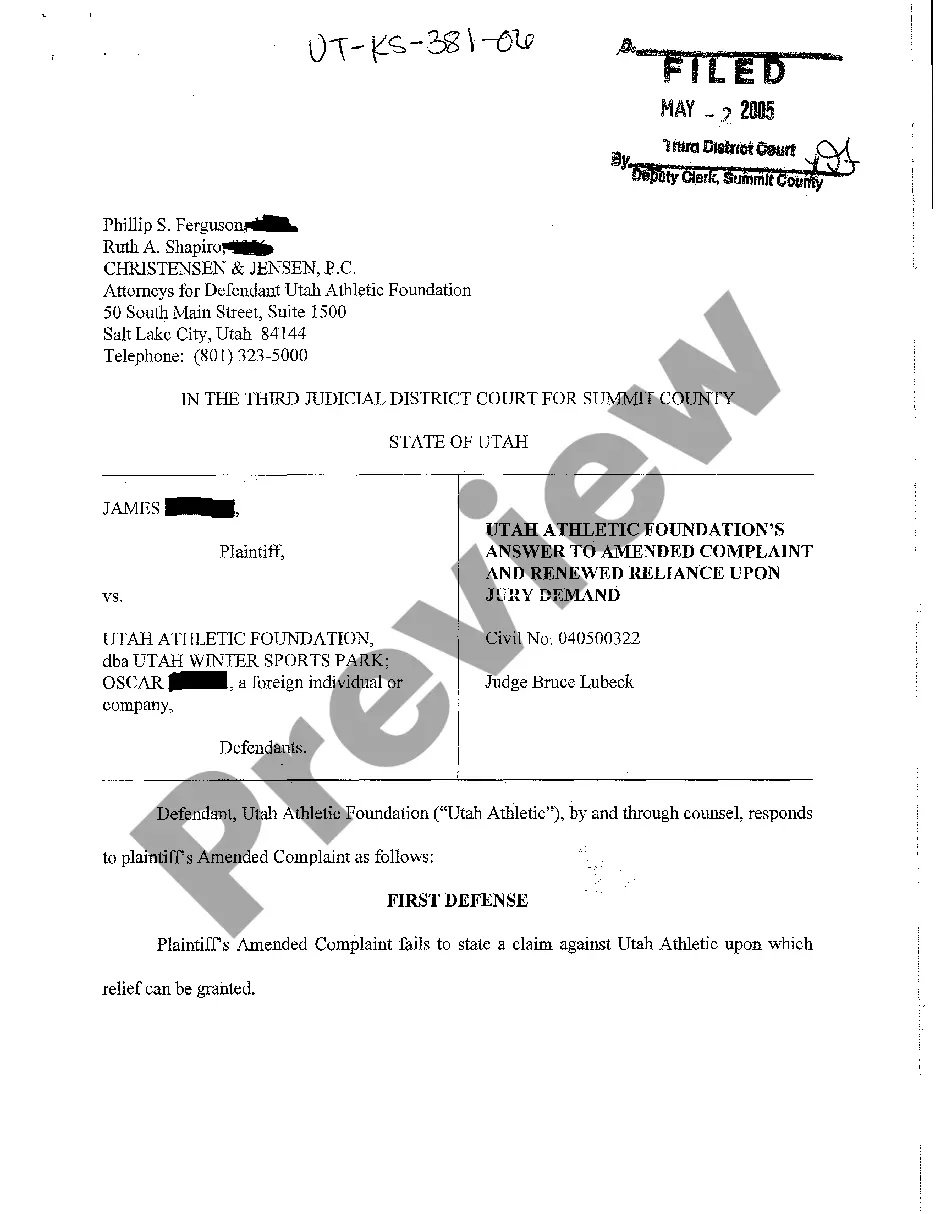

How to fill out Fairfax Virginia Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fairfax Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Fairfax Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fairfax Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

If the company changes owners in whole or in part, it is still the same company and this will not terminate any contracts. If, instead, the company sells its business (which is an asset of the company that it can sell like a car or a building), then the contracts are transferred as part of that sale.

A merger happens when two companies combine to form a single entity. Public companies often merge with the declared goal of increasing shareholder value, by gaining market share or from entering new business segments. Unlike an acquisition, a merger can result in a brand new entity formed from the two merging firms.

Neither party may assign this Agreement or any of its rights or obligations hereunder without the other's express written consent, except that either party may assign this Agreement to the surviving party in a merger of that party into another entity or in an acquisition of all or substantially all its assets.

A contract amendment allows the parties to make a mutually agreed-upon change to an existing contract. An amendment can add to an existing contract, delete from it, or change parts of it. The original contract remains in place, only with some terms altered by way of the amendment.

Unfortunately for most parties involved, no. A contract cannot survive the death of either party unless it's assigned under a corporate agreement (such as stock purchase agreements)--which has its own set of issues--or if the contract is supported by consideration produced before the termination.

Amending and Restating a Contract When Amendments Become Unwieldy.Review All Existing Documents.Fully Merge All Existing Terms Into the New Contract.Add New Terms.Add an Integration Clause.Finalizing the A&R Agreement.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Updated October 14, 2020: If a company changes its name, a contract will still be valid.

The term "amended and restated" is used in corporate law to refer to an agreement or other document that has been amended one or more times in the past and is presented in its entirety (restated) including all amendments to date.

Amended and Restated What Amended means changed, i.e., that someone has revised the document. Restated means presented in its entirety, i.e., as a single, complete document. Accordingly, amended and restated means a complete document into which one or more changes have been incorporated.