Los Angeles California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and New co Merger Co is a legal document that outlines the terms, conditions, and procedures involved in the merger between these two entities. This contractual agreement is designed to provide a comprehensive framework for the merger process and ensures a smooth transition of ownership and operation. Keywords: Los Angeles California, Amended and Restated Agreement, Plan of Merger, CNL Financial Corp, New co Merger Co, merger process, terms and conditions, legal document, ownership, operation, contractual agreement, smooth transition. Different types of Los Angeles California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and New co Merger Co may include: 1. Asset Merger Agreement: This type of agreement specifically focuses on the consolidation of assets involved in the merger. It outlines the assets contributing to the merged entity and the distribution of shares or ownership stakes accordingly. 2. Stock-for-Stock Merger Agreement: In this type of agreement, the merger is achieved by exchanging the stock of one corporation for the stock of another. The document defines the terms of the exchange ratio and the allocation of shares, ensuring fair treatment for both companies' shareholders. 3. Cash Merger Agreement: A cash merger agreement involves one corporation being acquired by another for a predetermined cash amount. This type of agreement states the terms of the cash consideration, the payment schedule, and any other financial arrangements. 4. Triangular Merger Agreement: In a triangular merger, an acquiring company forms a subsidiary that is merged with the target company. Subsequently, the subsidiary is dissolved, and the acquiring company assumes control. This agreement outlines the steps involved in this complex merger structure, preserving the interests and rights of all parties involved. 5. Reverse Merger Agreement: A reverse merger agreement involves a private company acquiring a publicly-traded company, allowing the private company to become a publicly-listed entity without the need for an initial public offering (IPO). This type of agreement outlines the terms of the reverse merger, including the exchange of shares and any financial considerations. These different types of Los Angeles California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and New co Merger Co provide flexibility to accommodate various merger scenarios and ensure the specific needs of both companies are addressed.

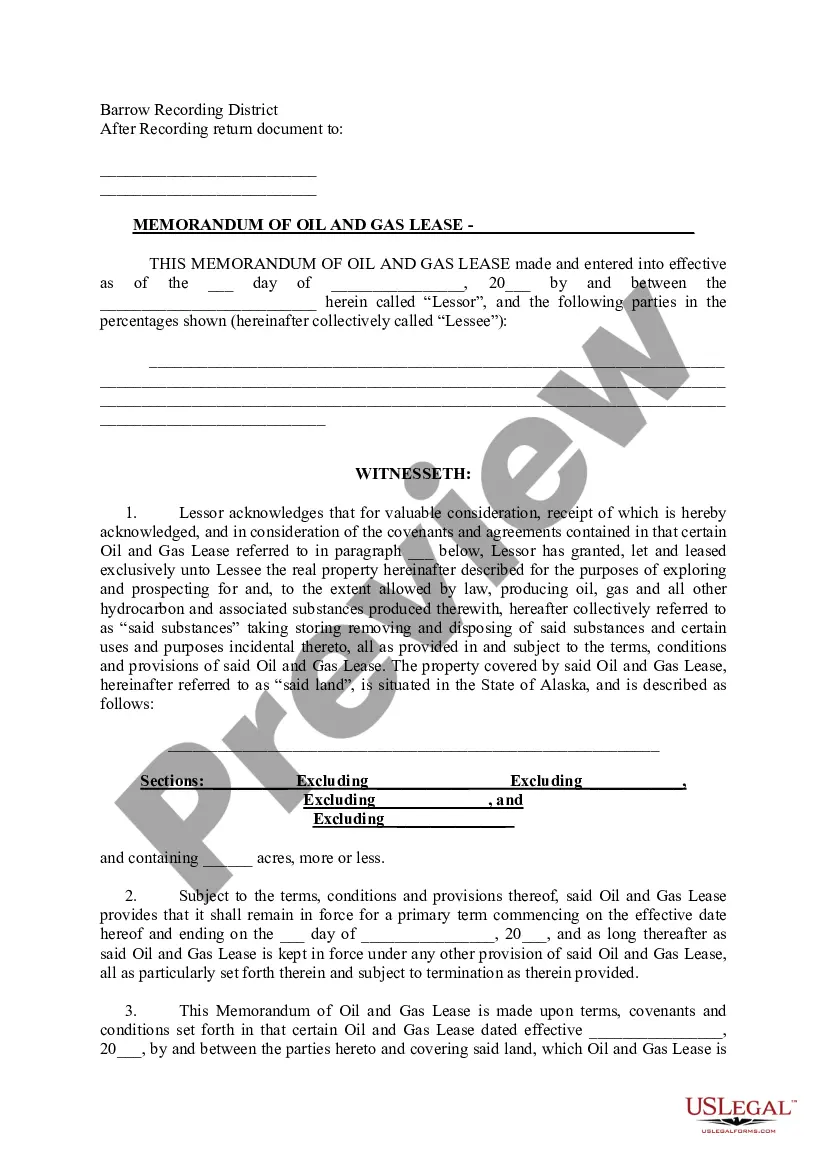

Los Angeles California Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

How to fill out Los Angeles California Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Los Angeles Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Los Angeles Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Los Angeles Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Los Angeles Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!