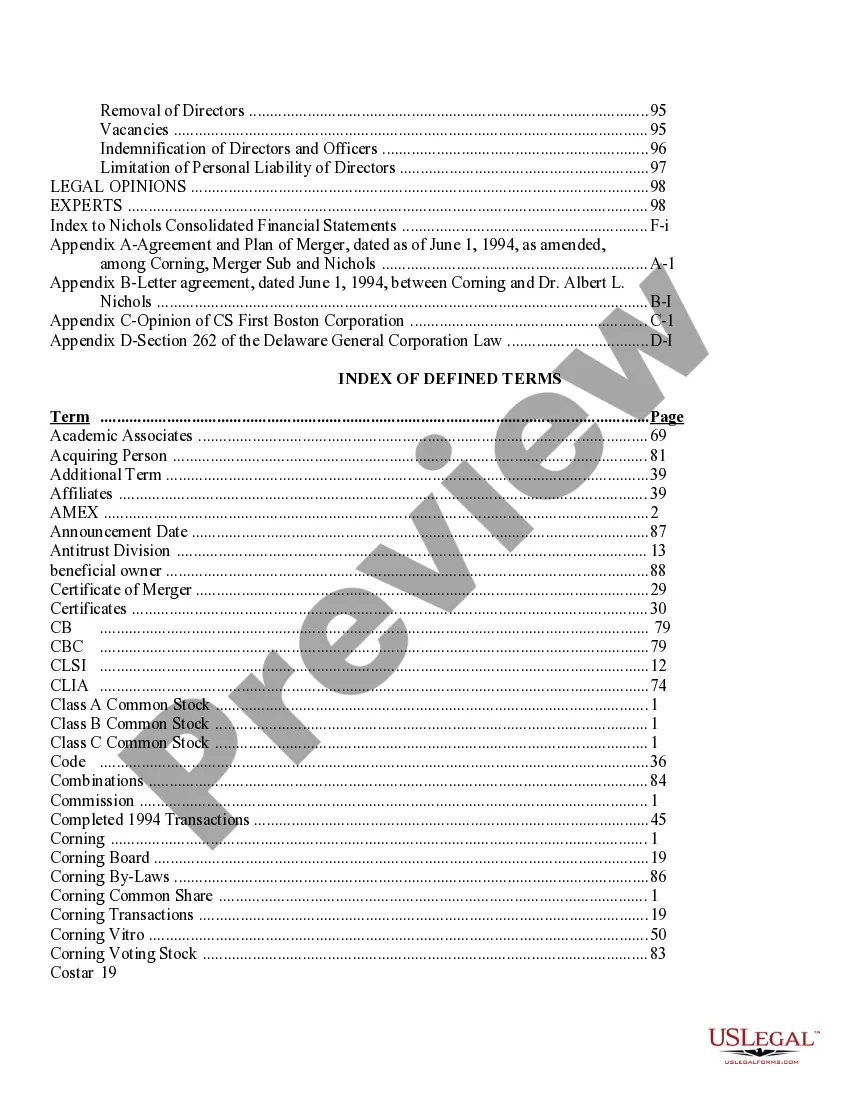

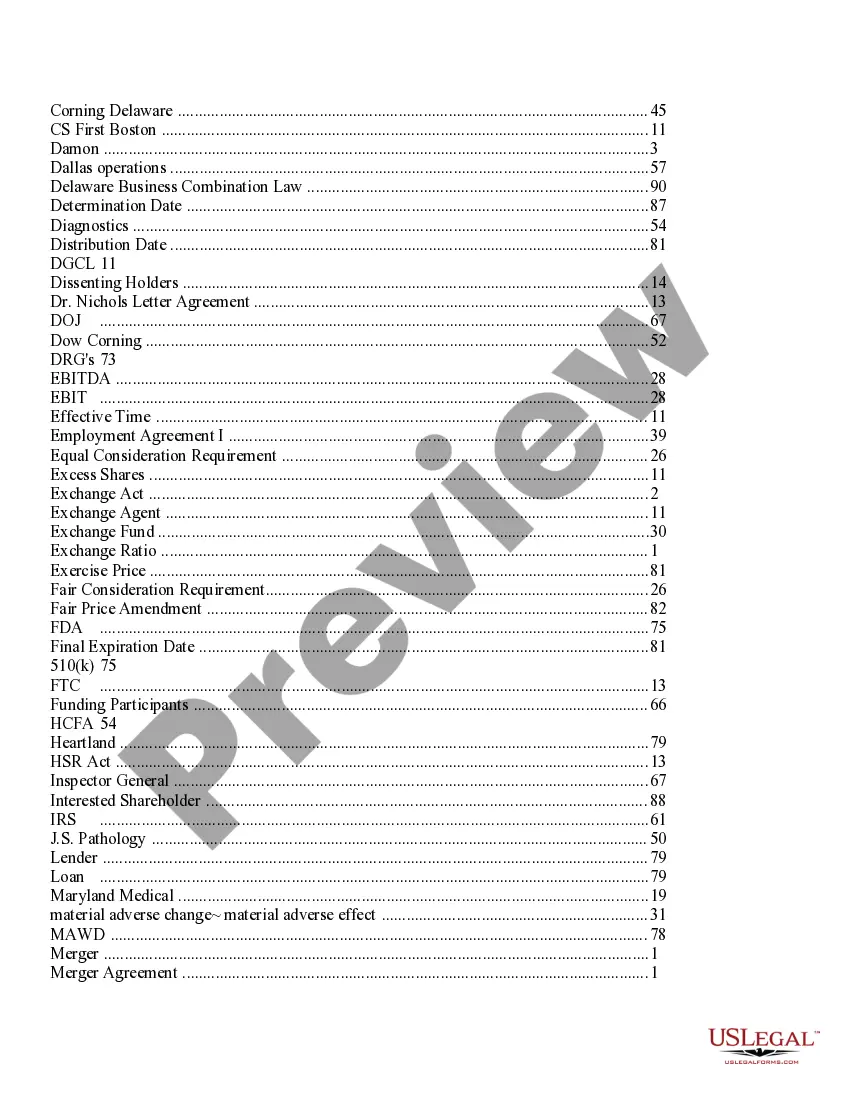

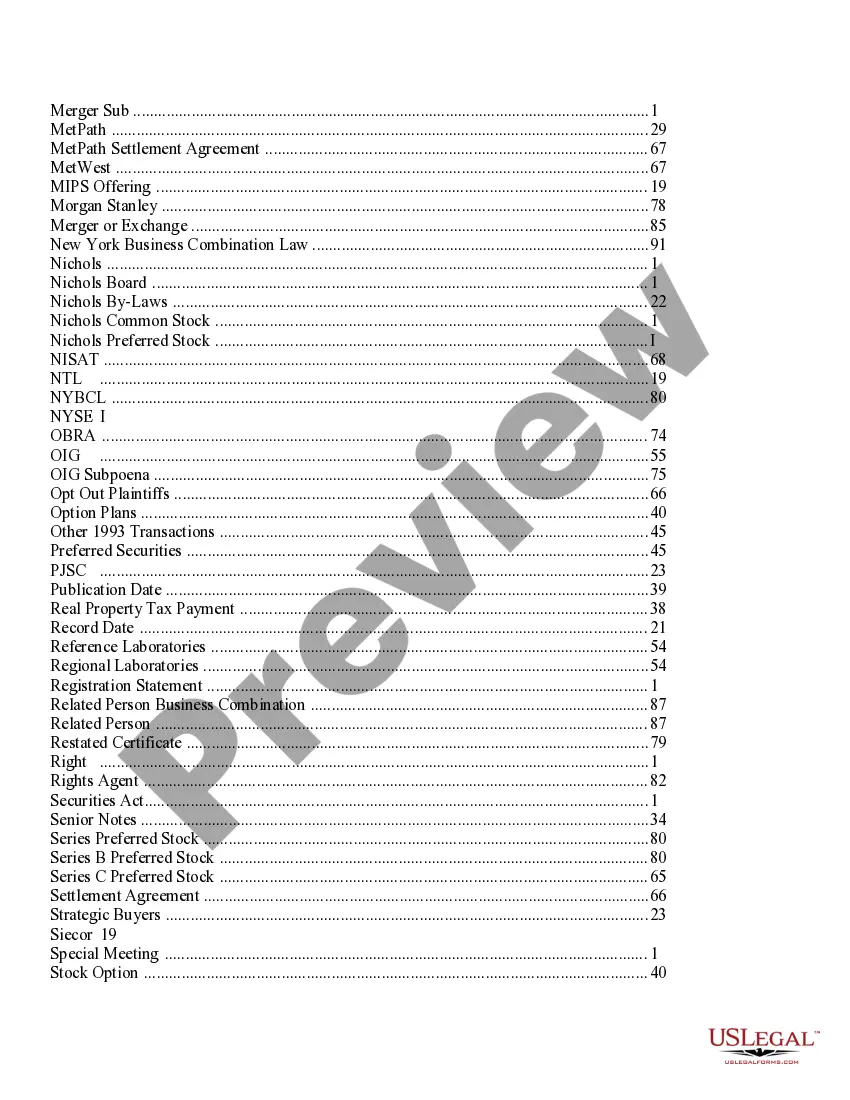

Harris Texas Proxy Statement — Prospectus of Corning Incorporated provides investors and shareholders with a comprehensive overview of Corning Incorporated's operations, financial performance, and future prospects, without including the appendices. This document serves as a vital tool for investors to make informed decisions about their investment in the company. The Harris Texas Proxy Statement — Prospectus outlines Corning Incorporated's corporate governance structure, executive compensation, and the procedures for proxy voting. It ensures transparency by detailing the composition and responsibilities of the Board of Directors, committees, and their functions in overseeing the company's operations. Additionally, it highlights any changes or updates in the executive compensation plans and policies. This Proxy Statement — Prospectus also examines Corning Incorporated's financial highlights, focusing on revenue growth, profitability, and cash flow analysis. It provides a breakdown of the company's segment-wise performance, giving investors insights into the contributions of various business divisions. The prospectus further elaborates on factors influencing Corning Incorporated's financial performance, including market trends, competition, and industry-specific risks. Furthermore, the document delves into Corning Incorporated's strategic initiatives, including research and development efforts, technological advancements, and expansion plans. It details the company's focus on innovation and investment in cutting-edge technologies to maintain a competitive edge in numerous industries, such as telecommunications, automotive, and life sciences. The Harris Texas Proxy Statement — Prospectus also highlights any pending litigation, regulatory compliance matters, and potential risk factors that could impact Corning Incorporated's financial position or reputation. It provides an overview of the company's risk management practices, emphasizing its commitment to mitigate and manage various risks associated with its operations. While there may not be different types of Harris Texas Proxy Statement — Prospectus without appendices, Corning Incorporated updates this document annually or whenever necessary to reflect the most accurate and up-to-date information relevant to its shareholders and potential investors. In conclusion, the Harris Texas Proxy Statement — Prospectus of Corning Incorporated without appendices is an essential document that provides comprehensive insights into the company's governance practices, financial performance, strategic initiatives, and potential risks. It enables investors to make informed decisions about investing in Corning Incorporated and assists them in understanding the company's long-term growth opportunities and its ability to navigate market challenges.

Harris Texas Proxy Statement - Prospectus of Corning Incorporated without appendices

Description

How to fill out Harris Texas Proxy Statement - Prospectus Of Corning Incorporated Without Appendices?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Harris Proxy Statement - Prospectus of Corning Incorporated without appendices is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Harris Proxy Statement - Prospectus of Corning Incorporated without appendices. Follow the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Proxy Statement - Prospectus of Corning Incorporated without appendices in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!